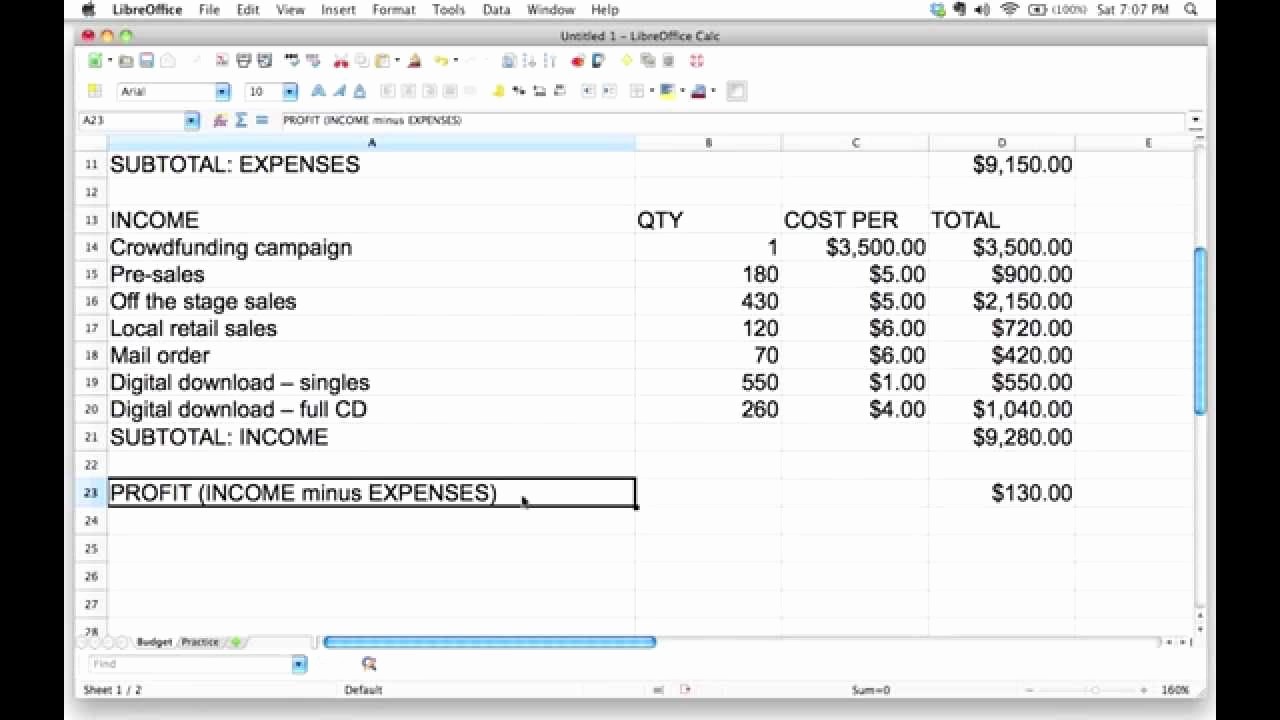

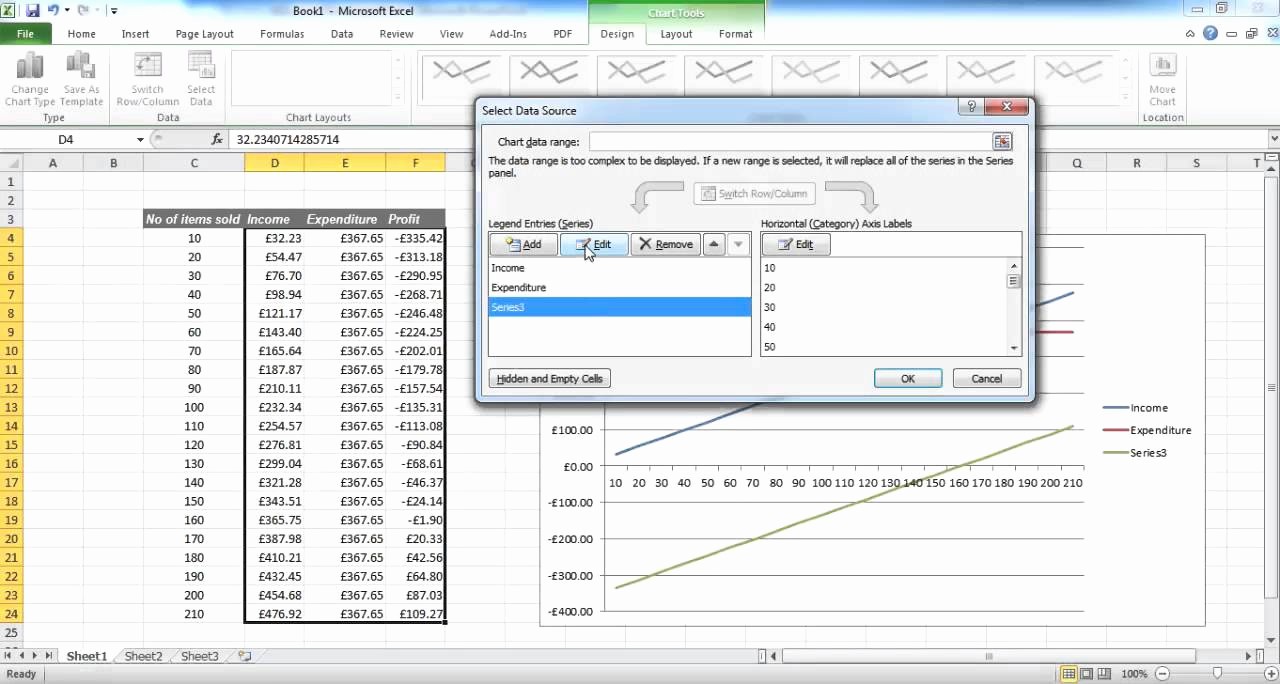

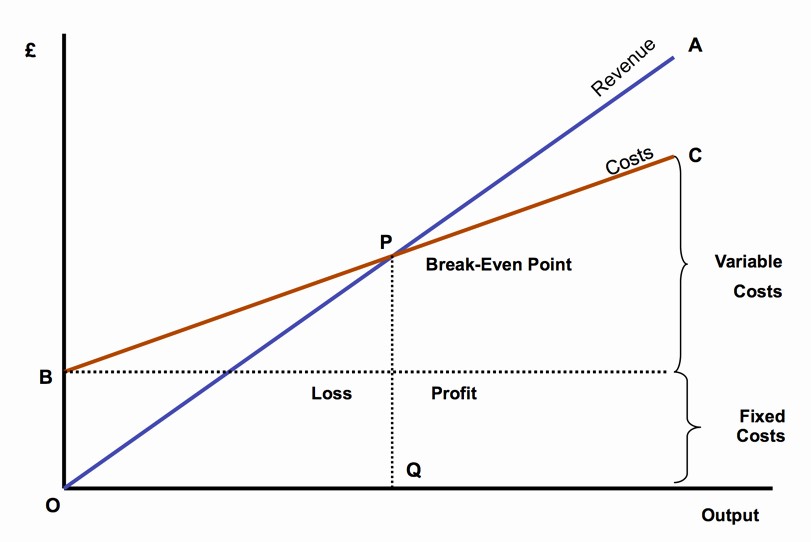

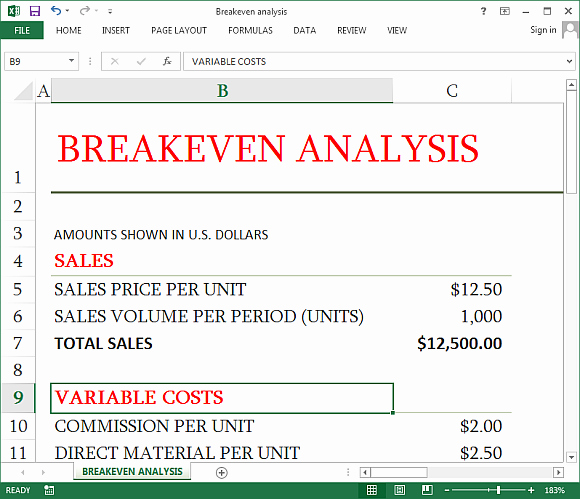

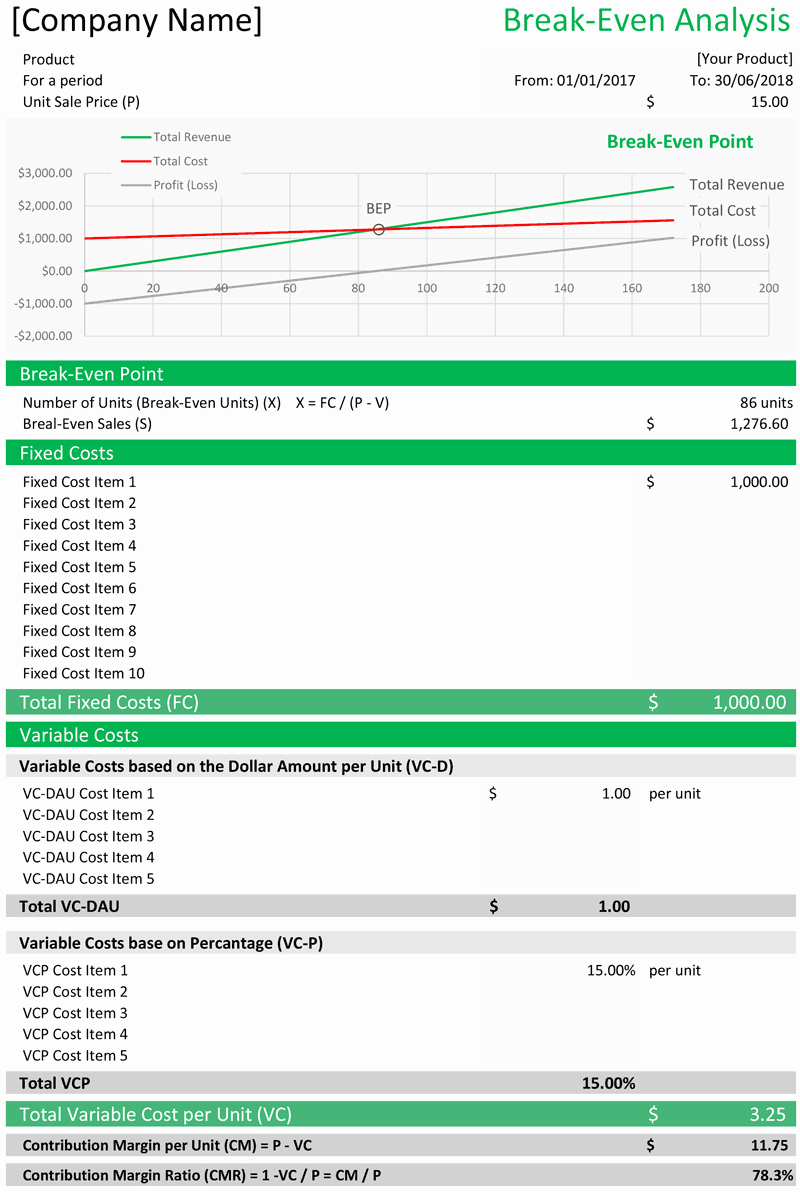

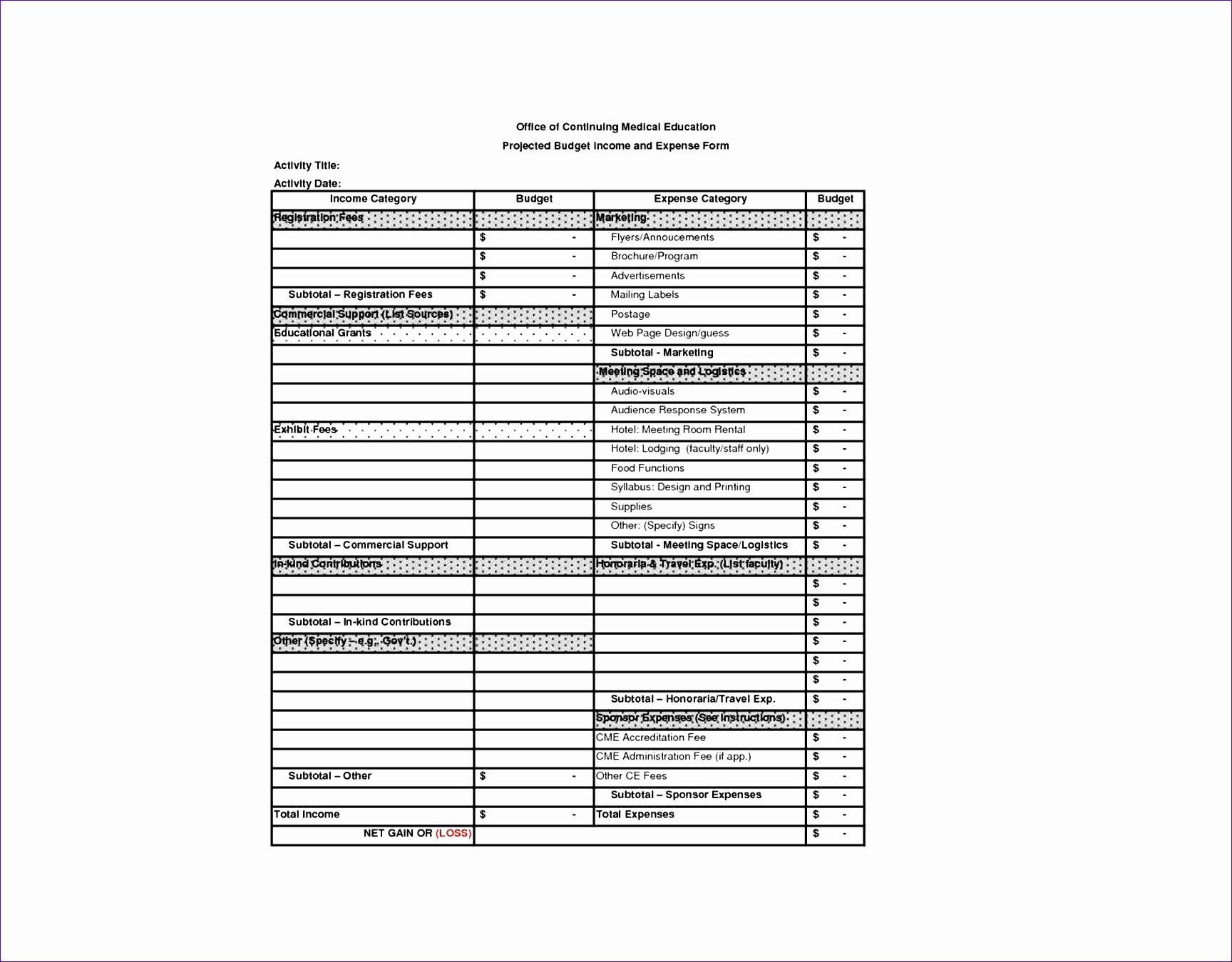

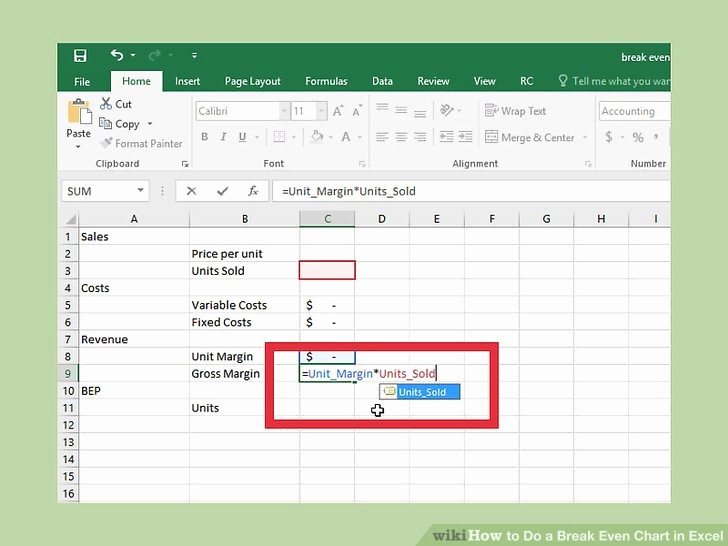

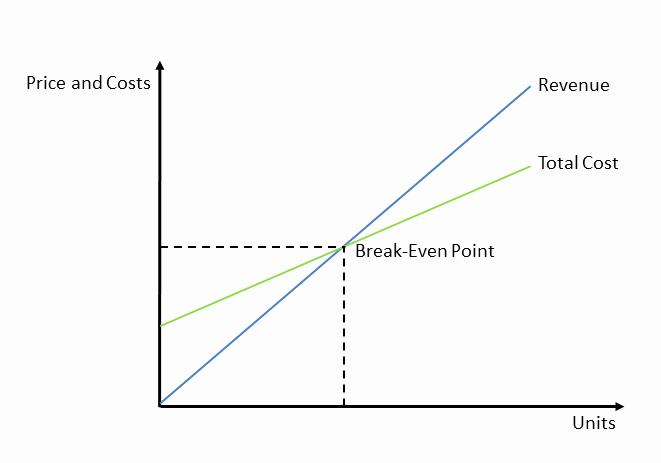

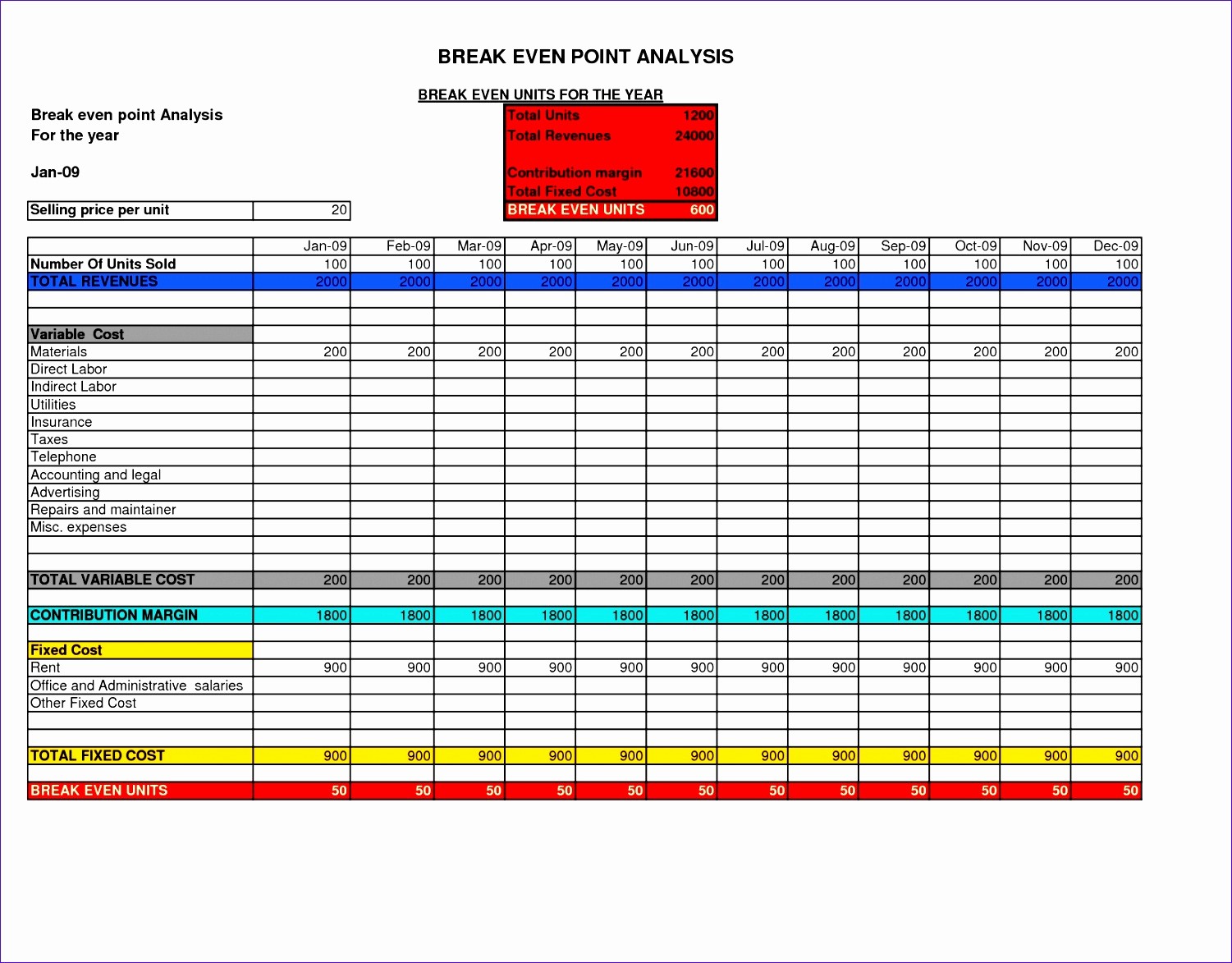

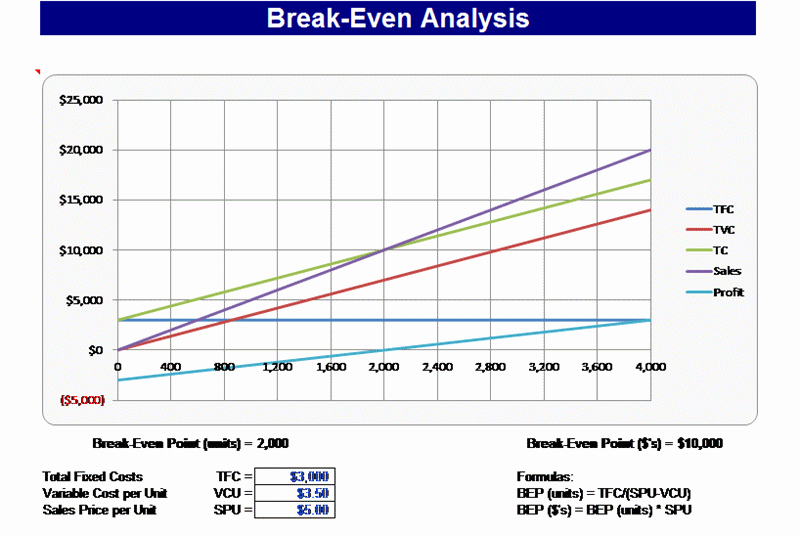

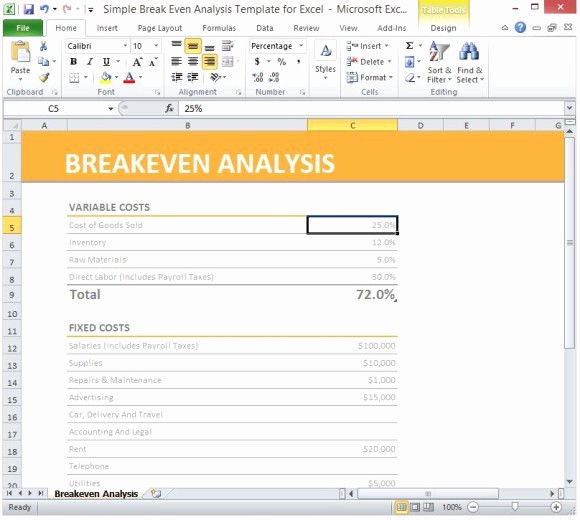

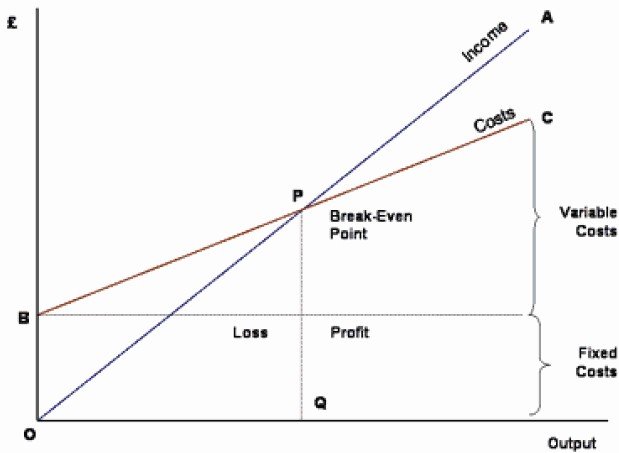

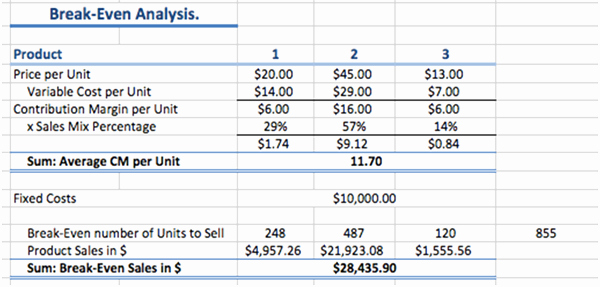

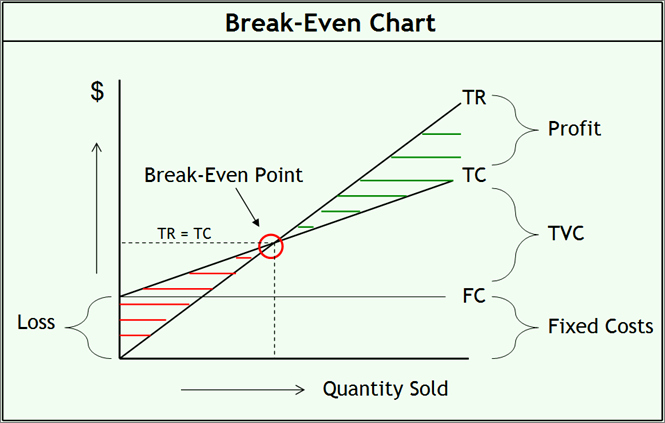

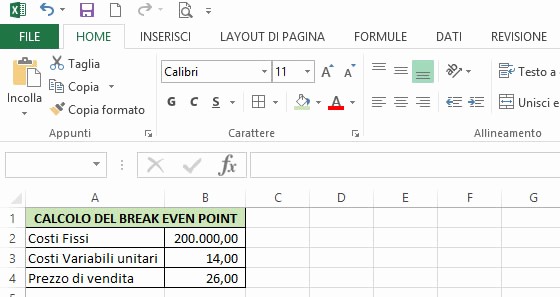

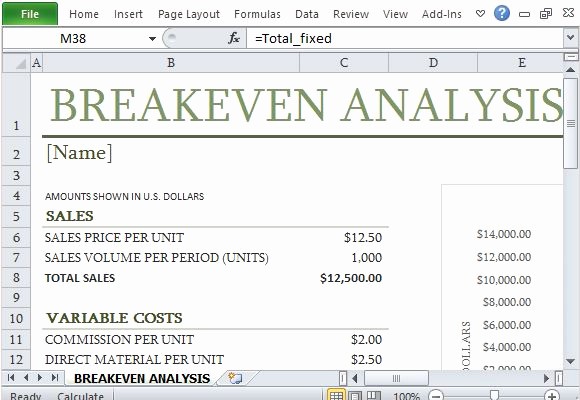

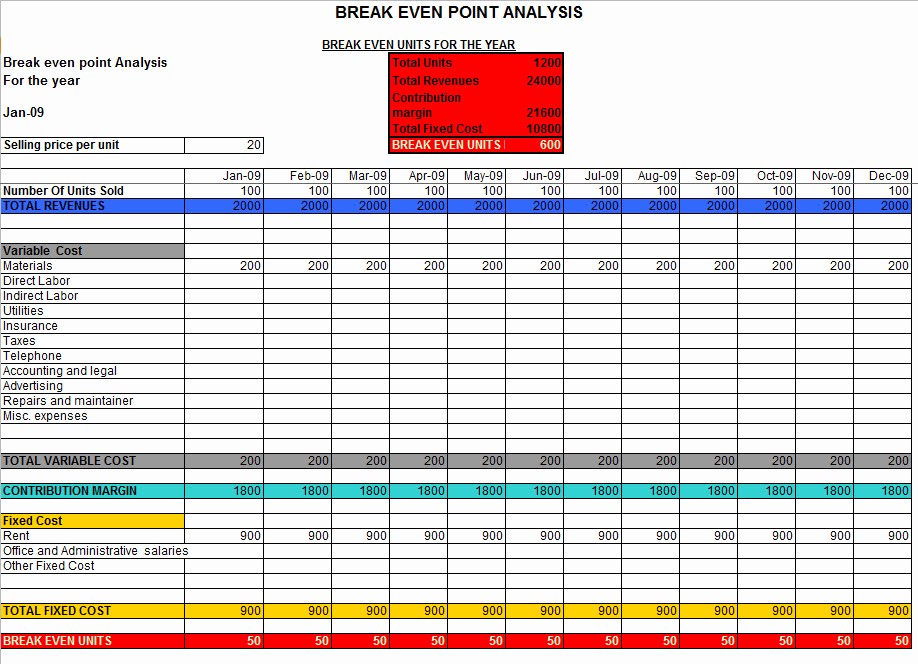

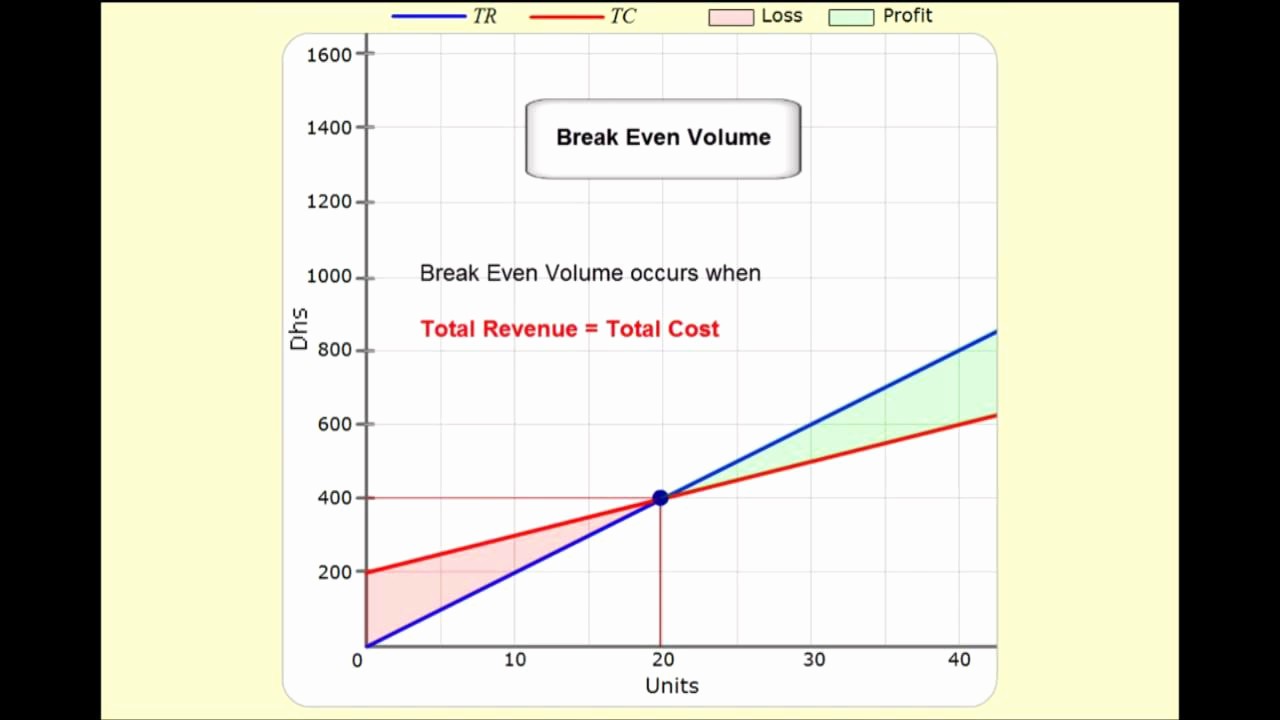

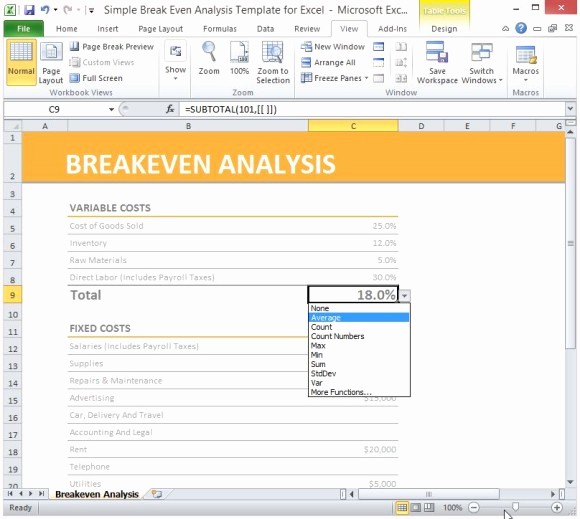

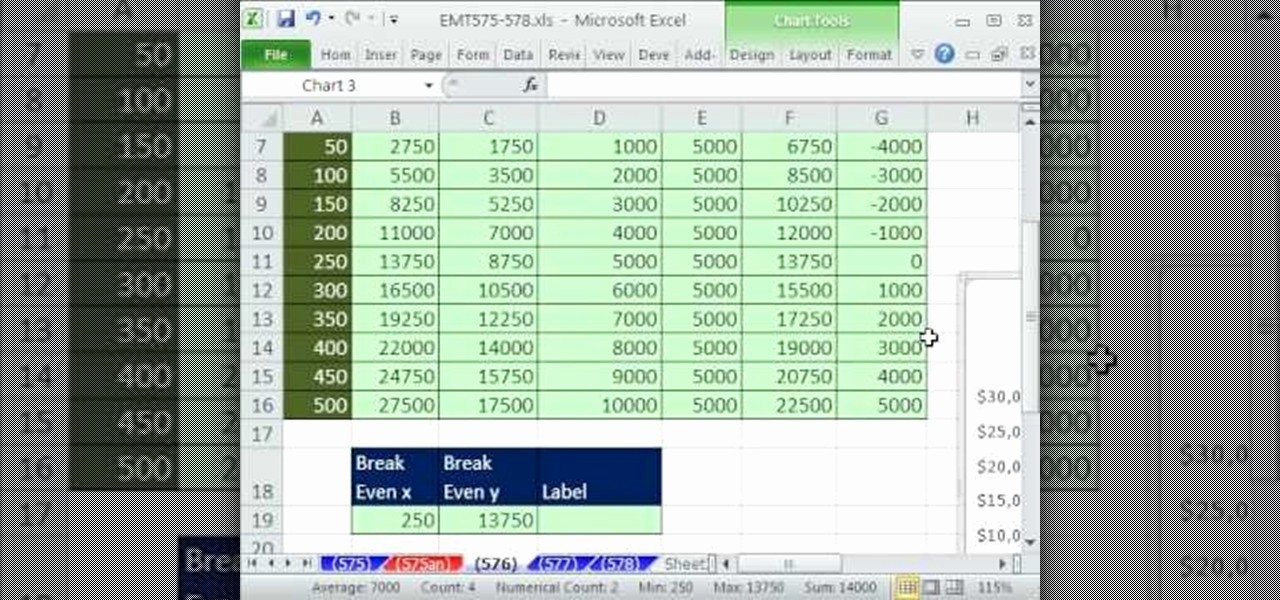

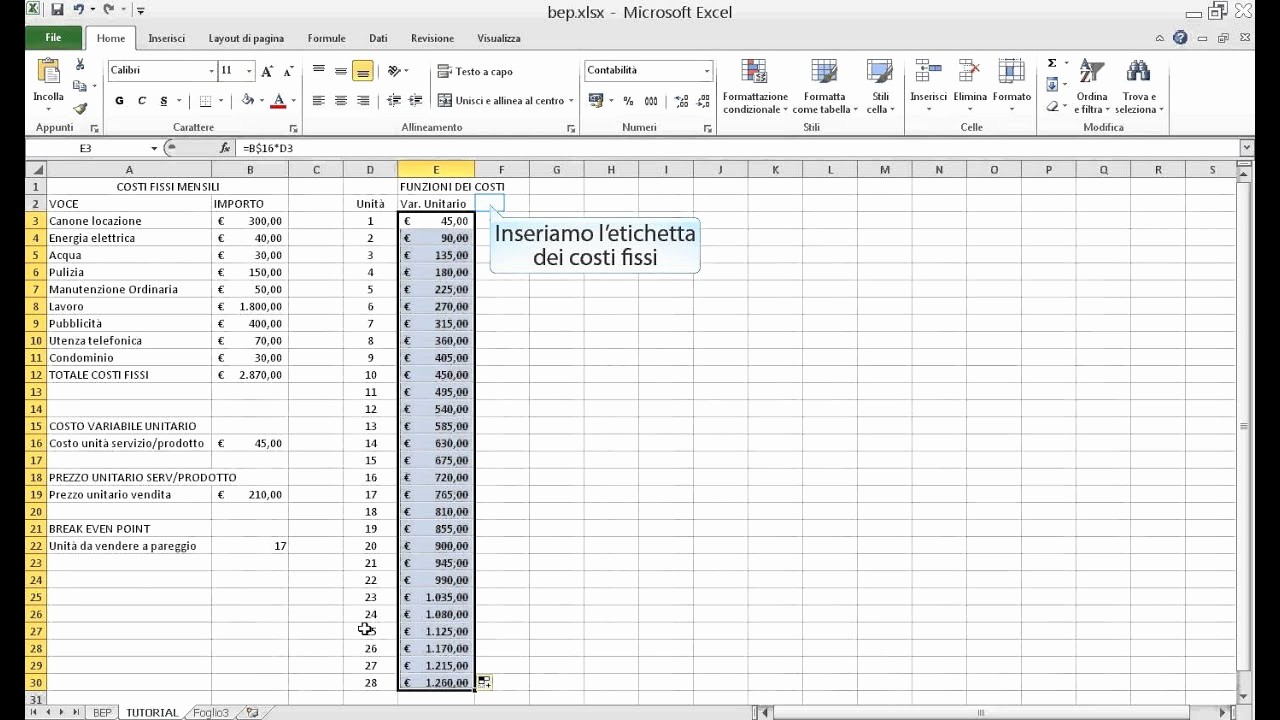

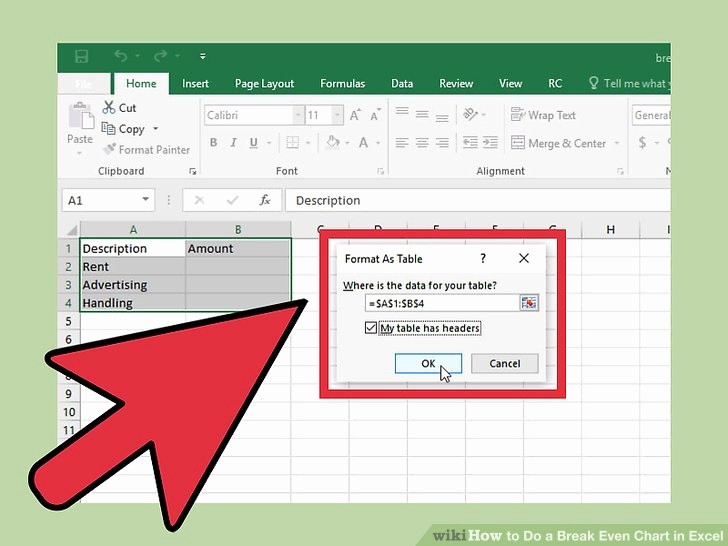

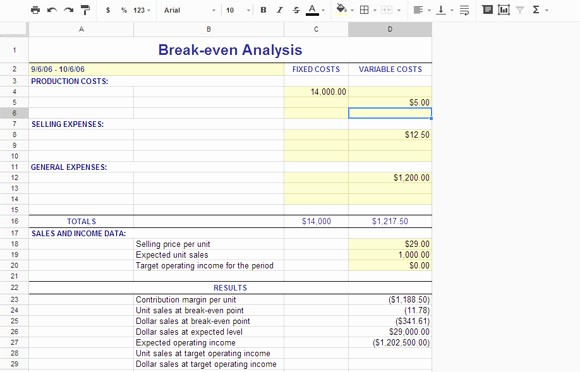

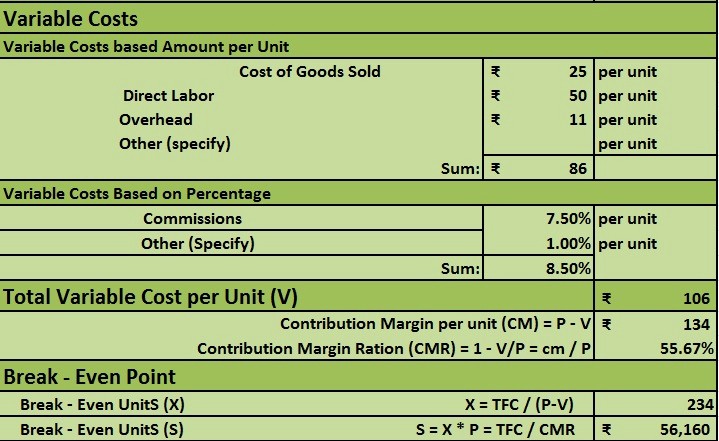

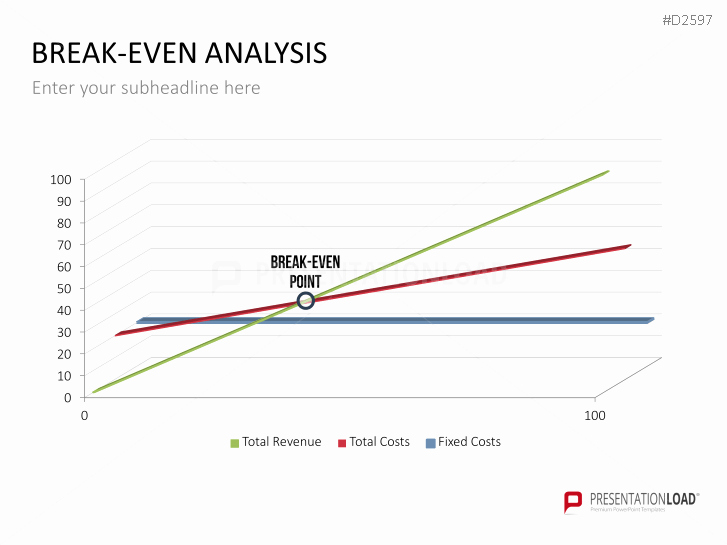

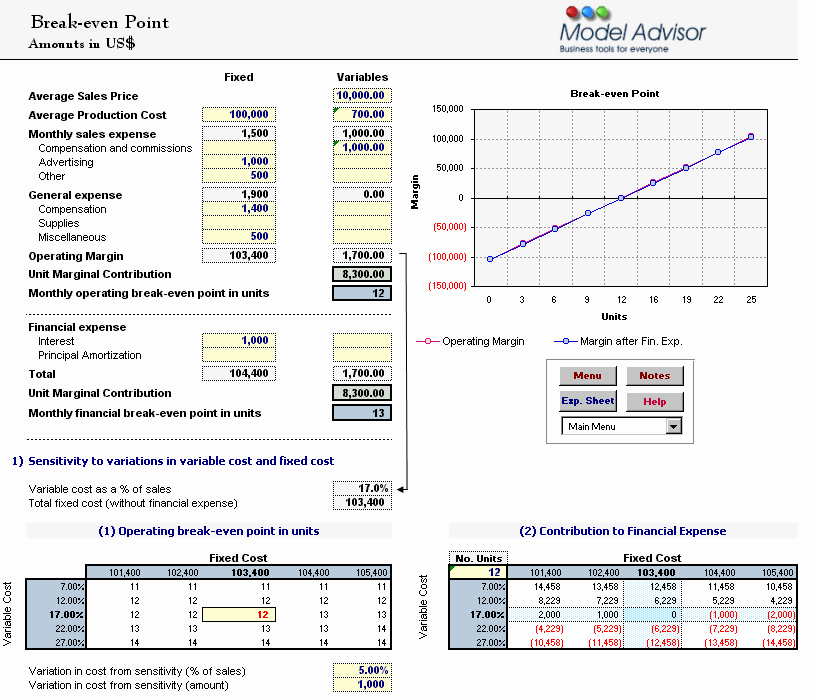

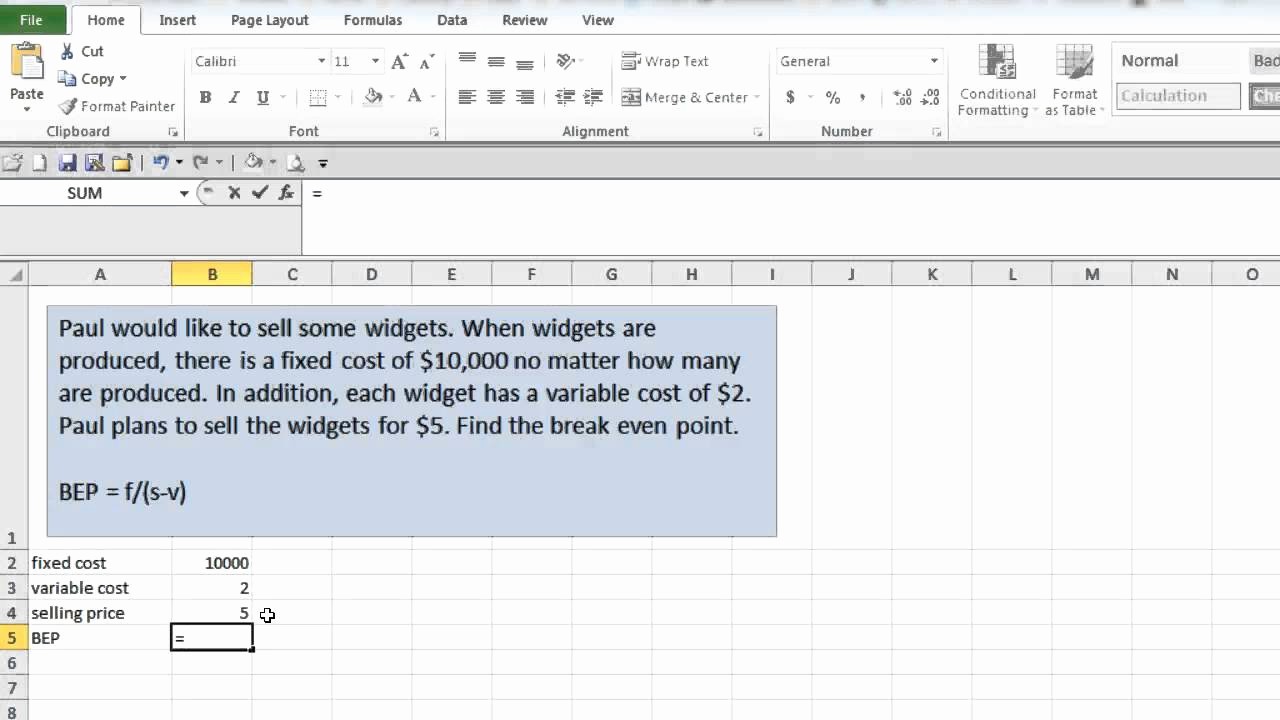

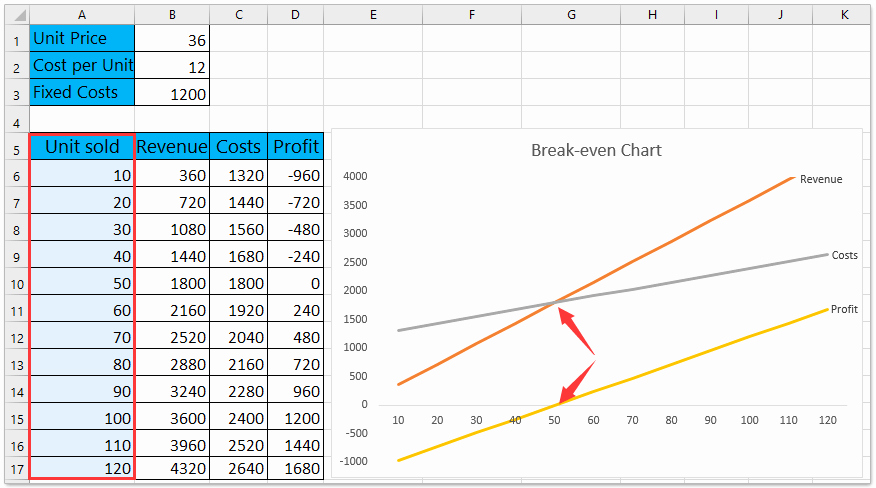

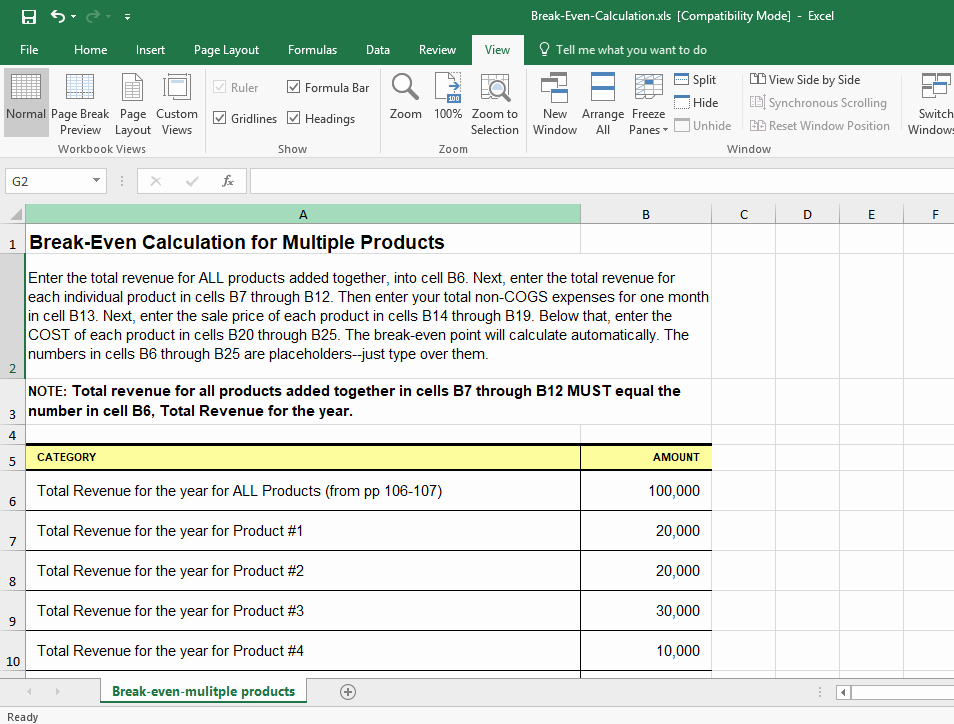

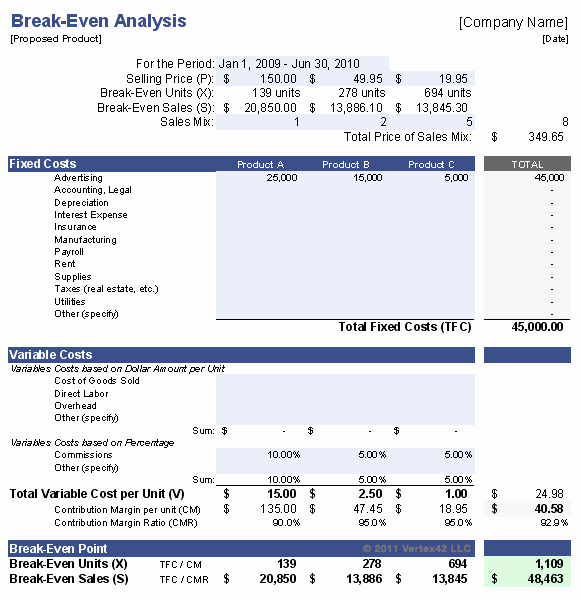

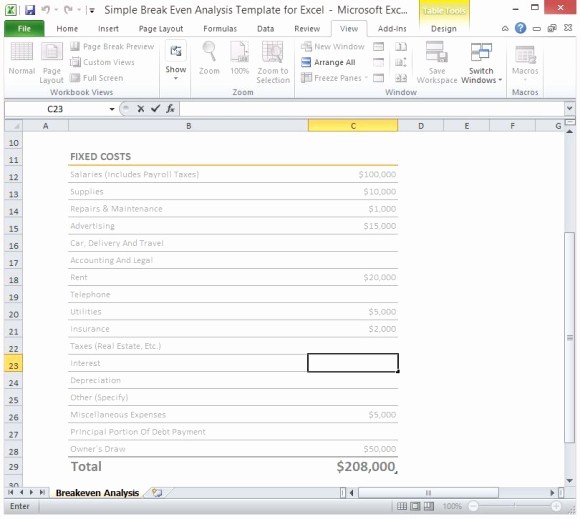

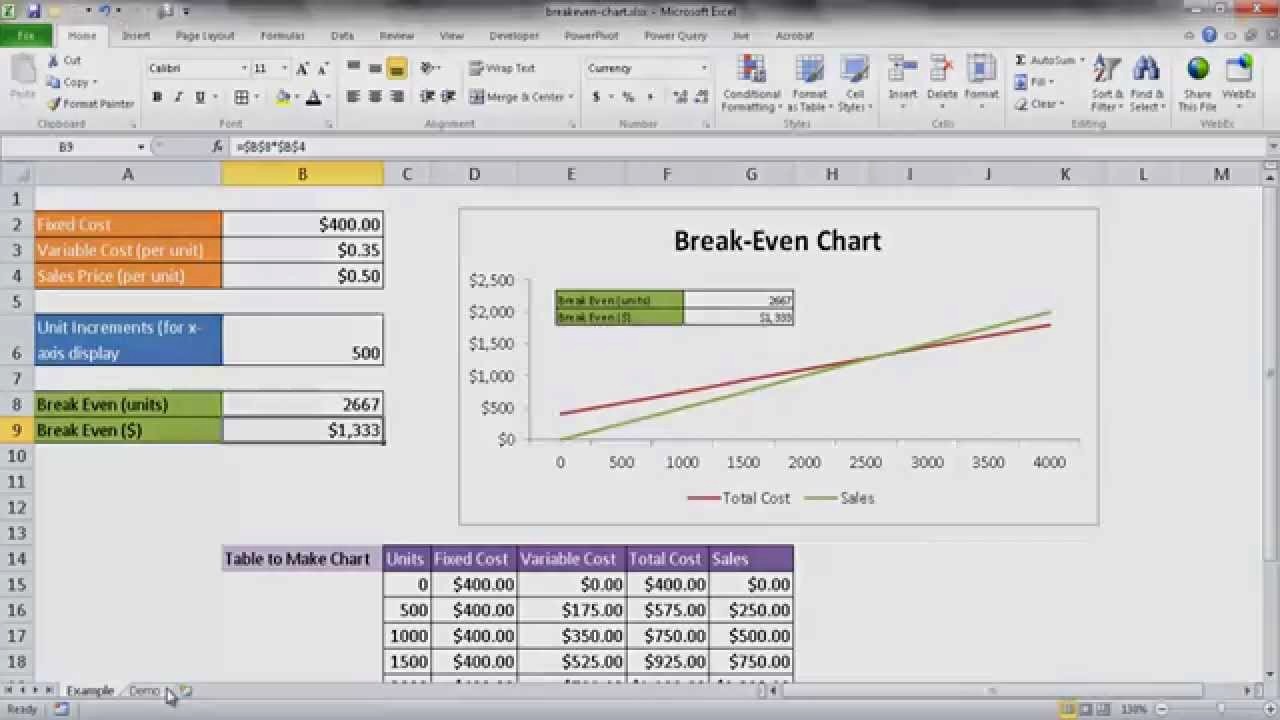

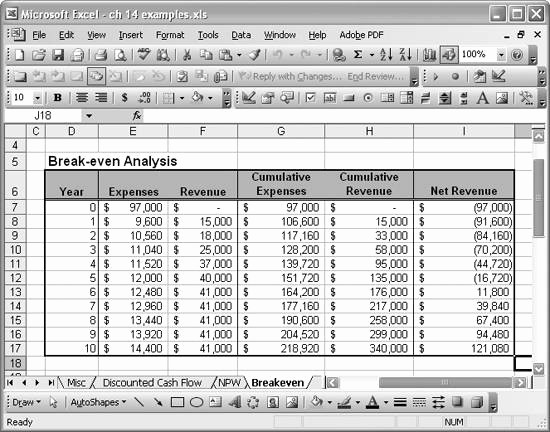

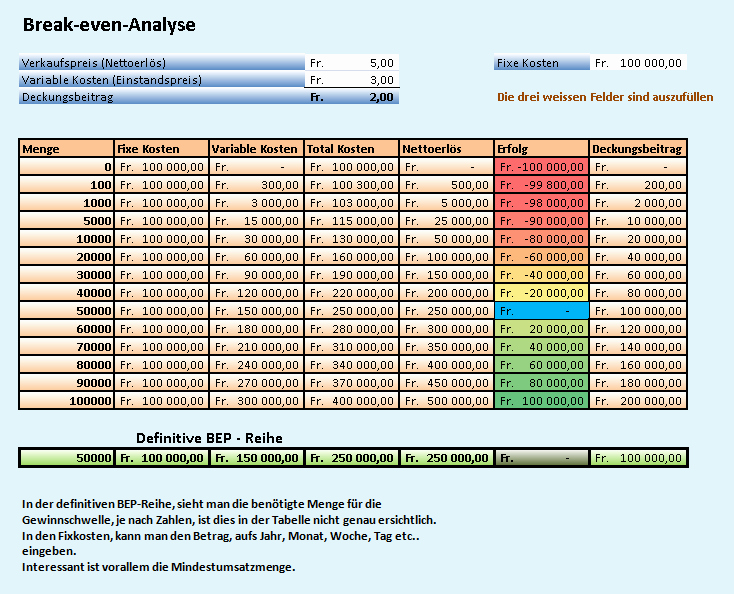

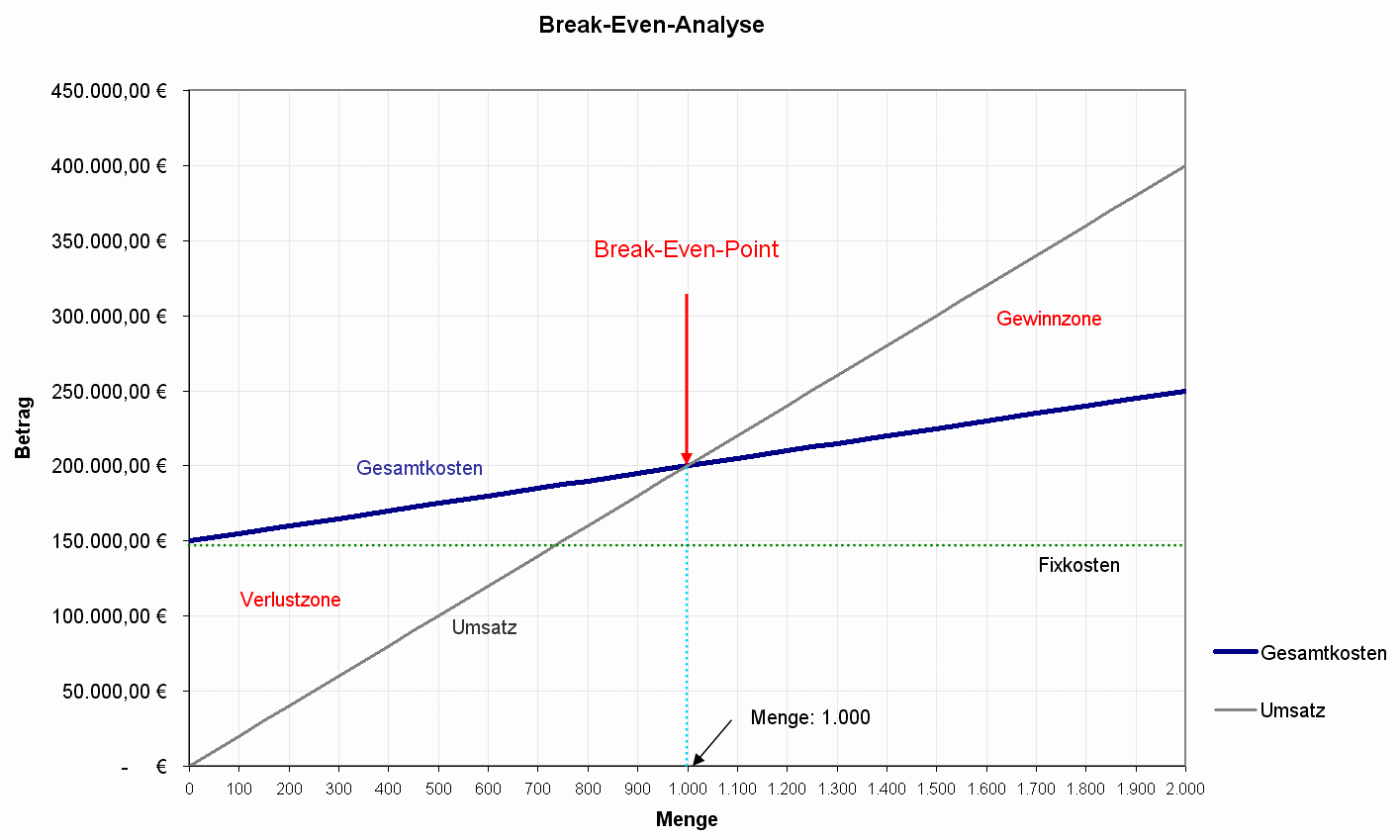

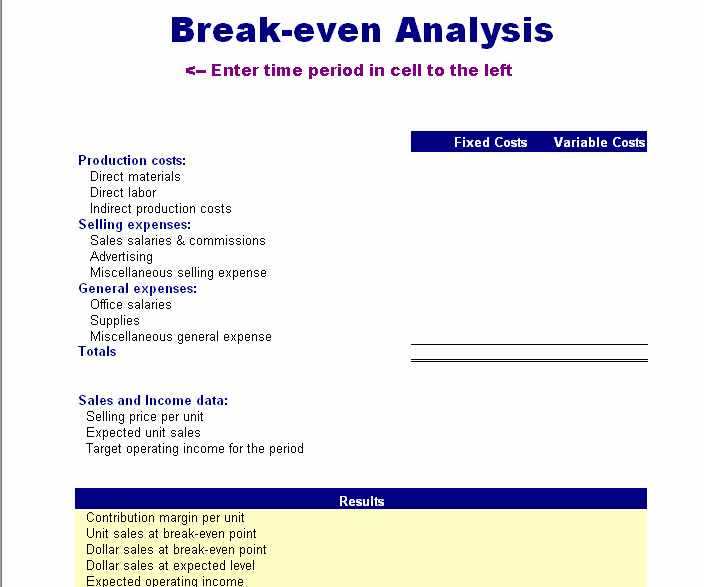

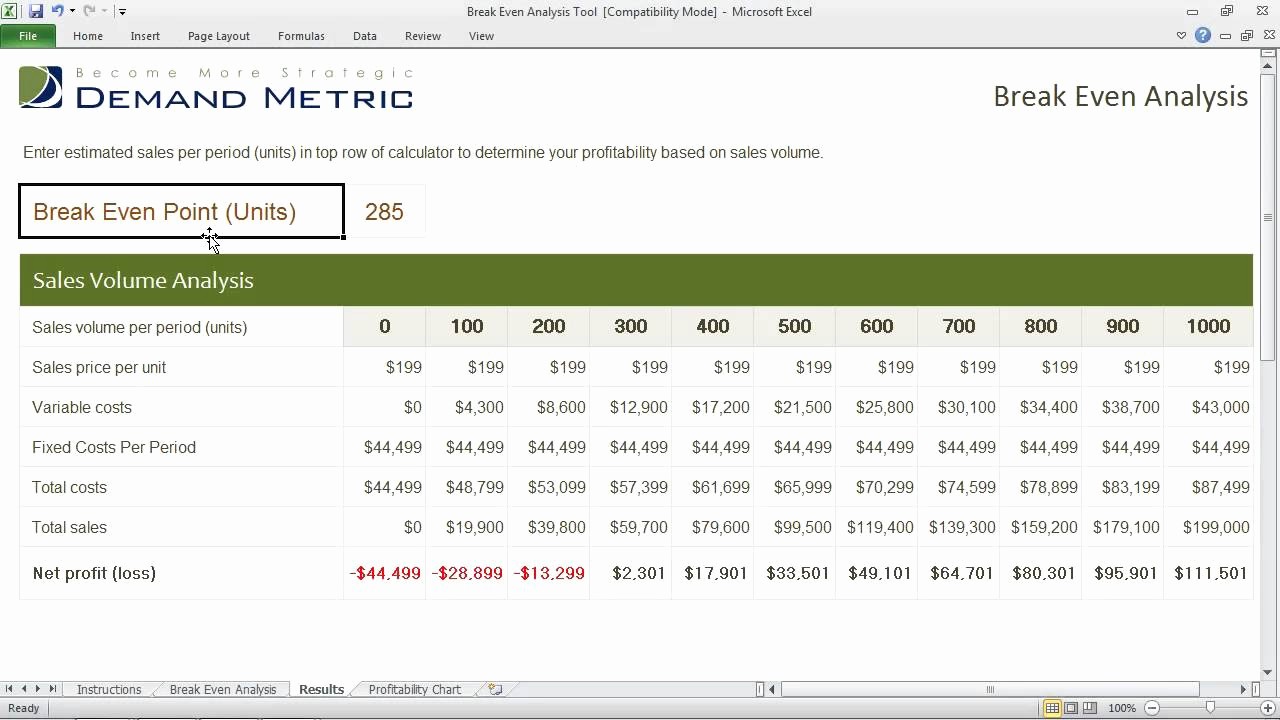

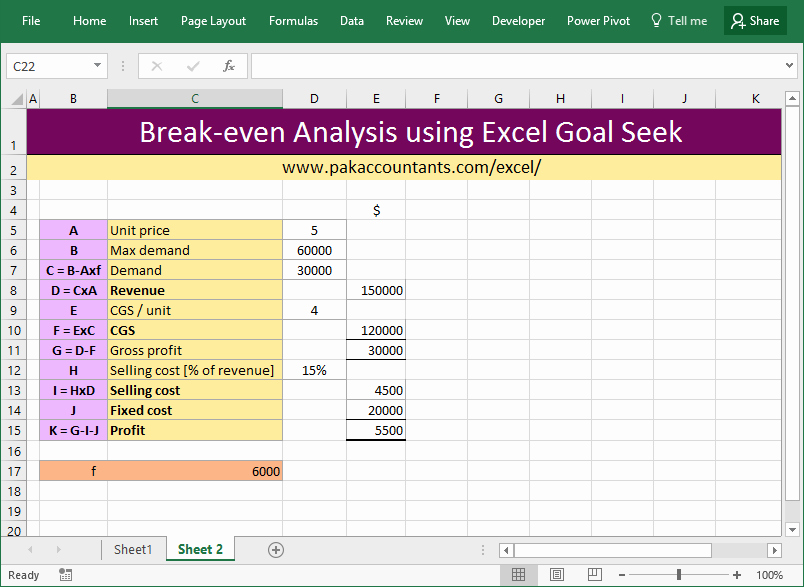

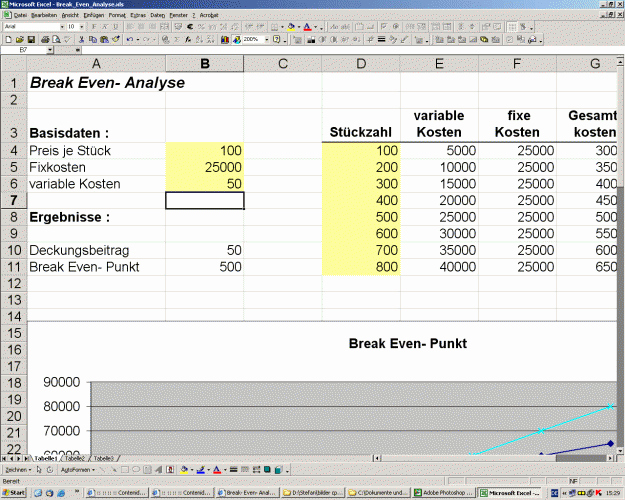

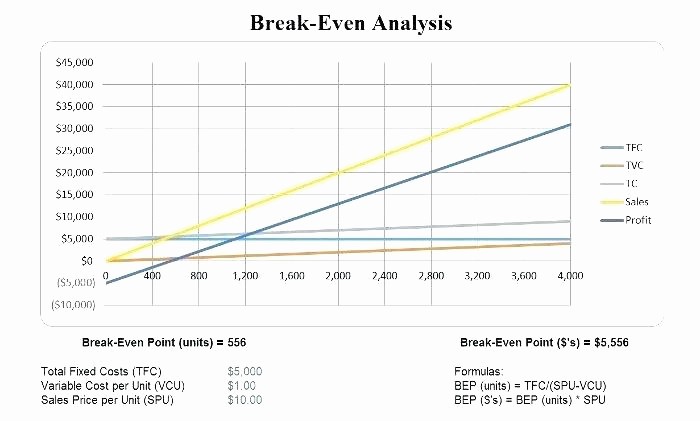

break even analysis learn how to calculate the break break even analysis in economics financial modeling and cost accounting refers to the point in which total cost and total revenue are equal it is used to determine the number of units or revenue needed to cover total costs fixed & variable costs break even economics the break even point bep in economics business—and specifically cost accounting—is the point at which total cost and total revenue are equal i e "even" break even point analysis in steps from fixed and break even point is the business volume that balances total costs with total gains at break even volume cash inflows equal cash outflows exactly and net cash flow equals zero examples show how to calculate break even from fixed and variable costs also with semivariable costs and revenues download break even analysis excel template exceldatapro a break even analysis is used to calculate financial feasibility for launching a new product or starting new ventures the formulas for calculating the break even point are relatively simple how to do a break even chart in excel with break even analysis is a tool for evaluating the profit potential of a business model and for evaluating various pricing strategies you can easily pile fixed costs variable costs and pricing options in excel to determine the break even point for your product

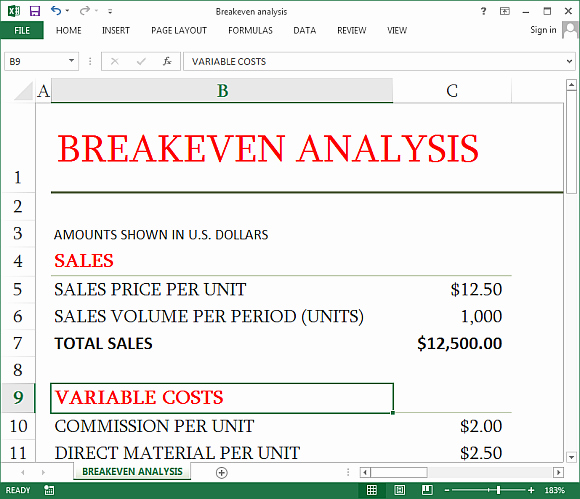

Excel 2010 break even point lez 2 from break even point in excel , image source: www.youtube.com

![Break even Point In Excel Beautiful Excel Tutorial Lemonade Stand [break even Point]](https://ufreeonline.net/wp-content/uploads/2019/04/break-even-point-in-excel-beautiful-excel-tutorial-lemonade-stand-break-even-point-of-break-even-point-in-excel.jpg)