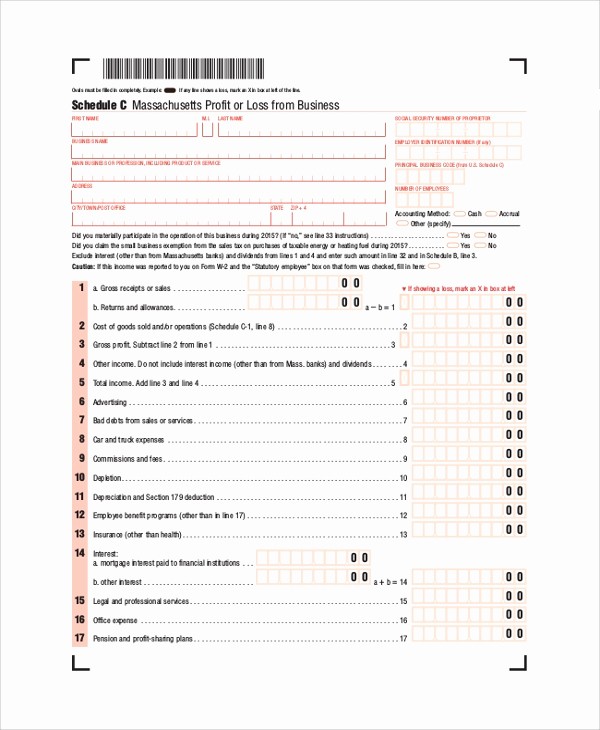

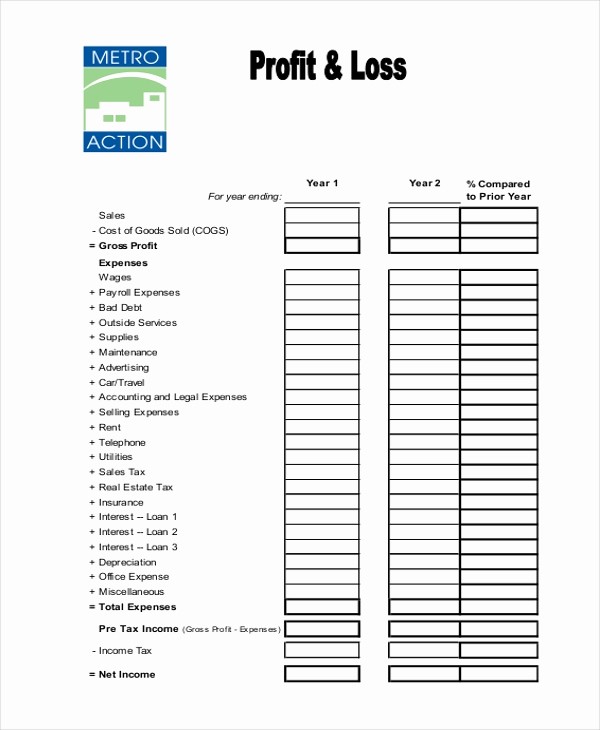

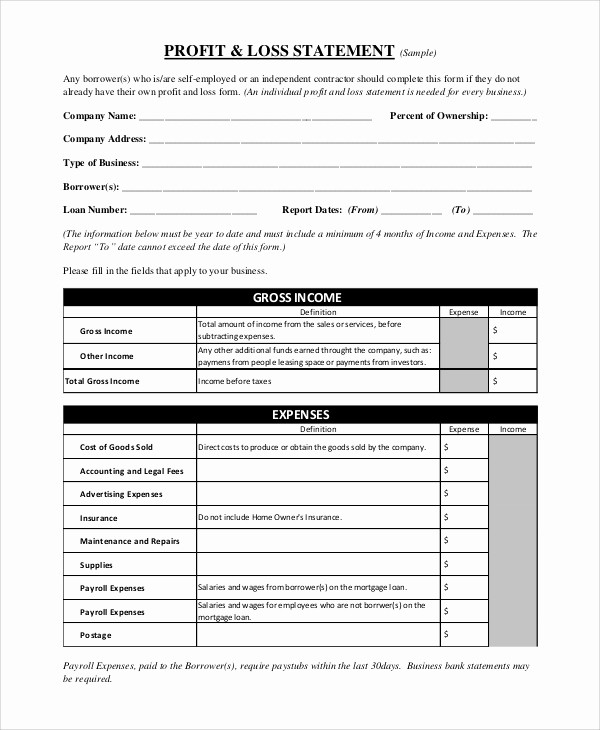

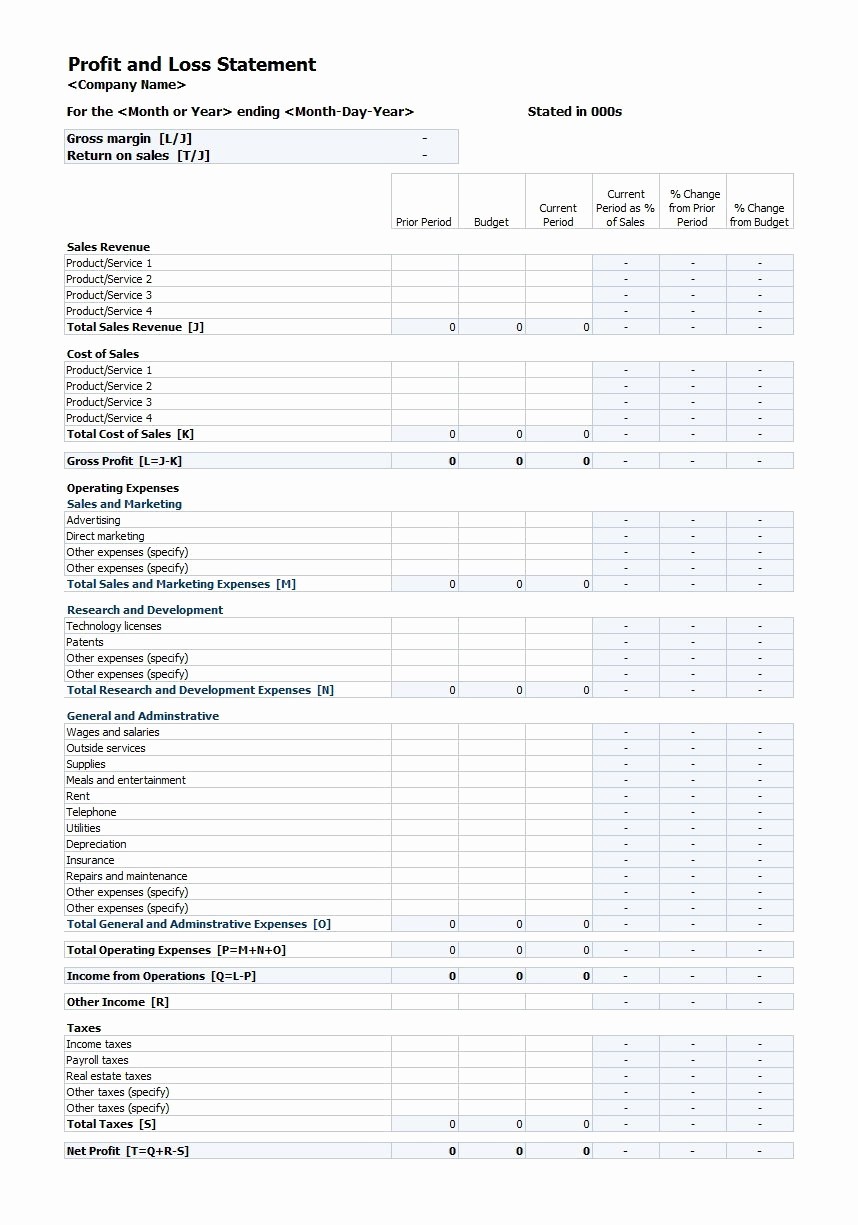

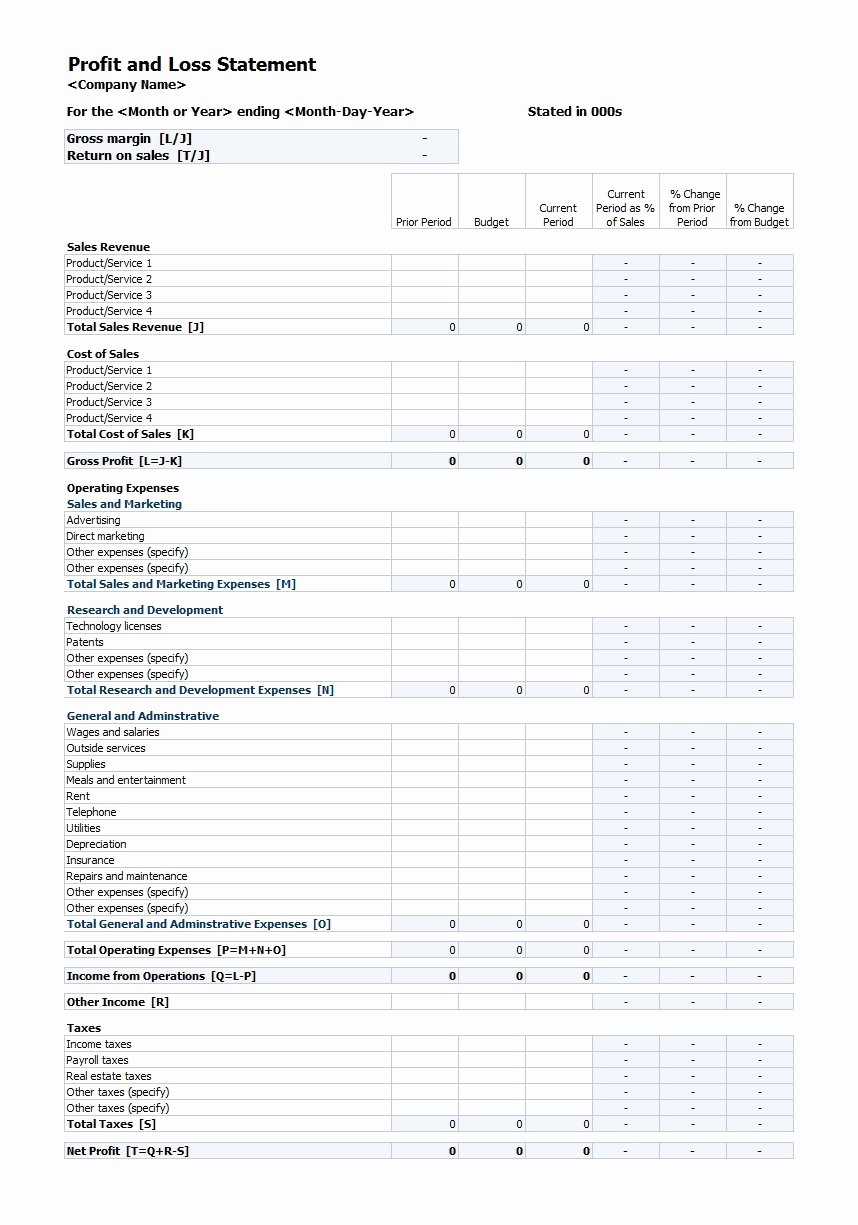

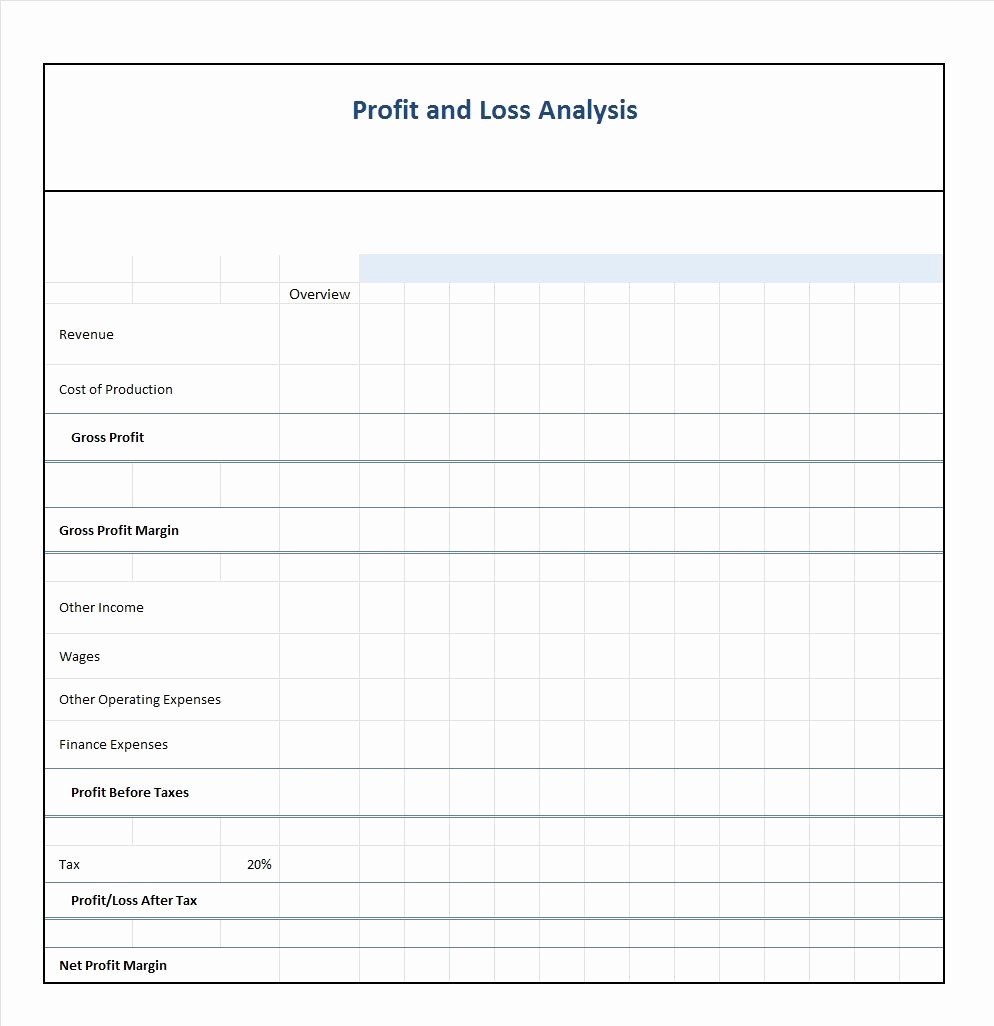

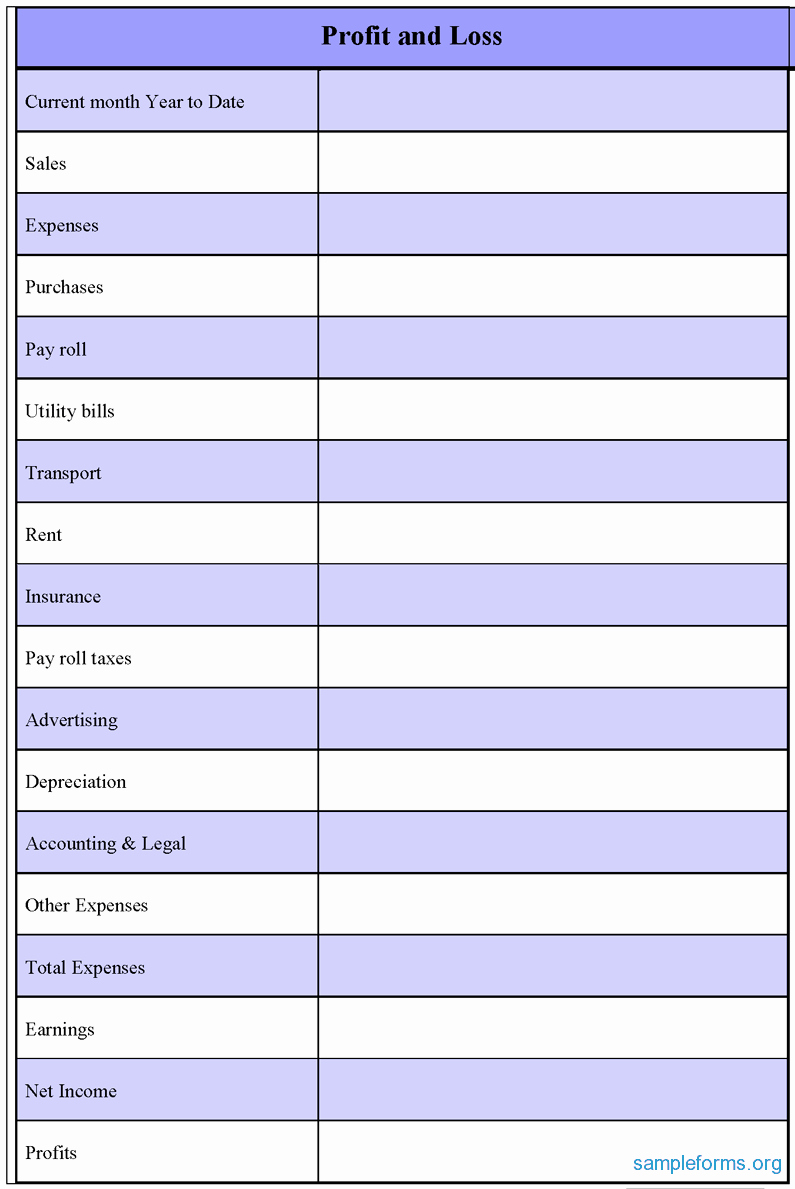

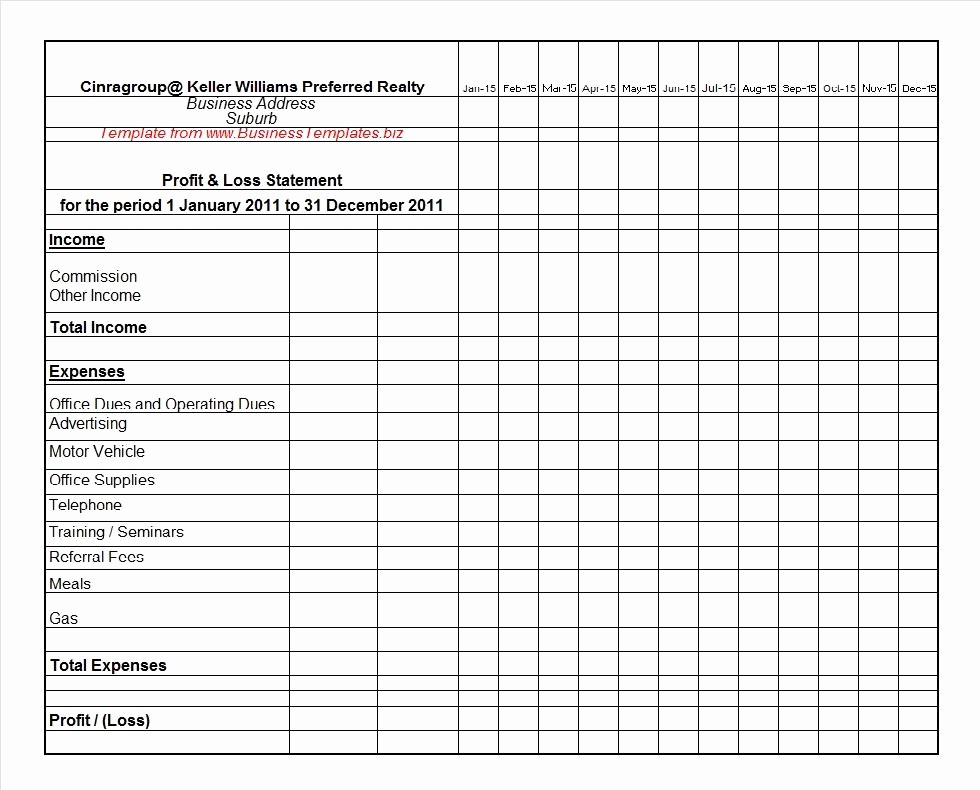

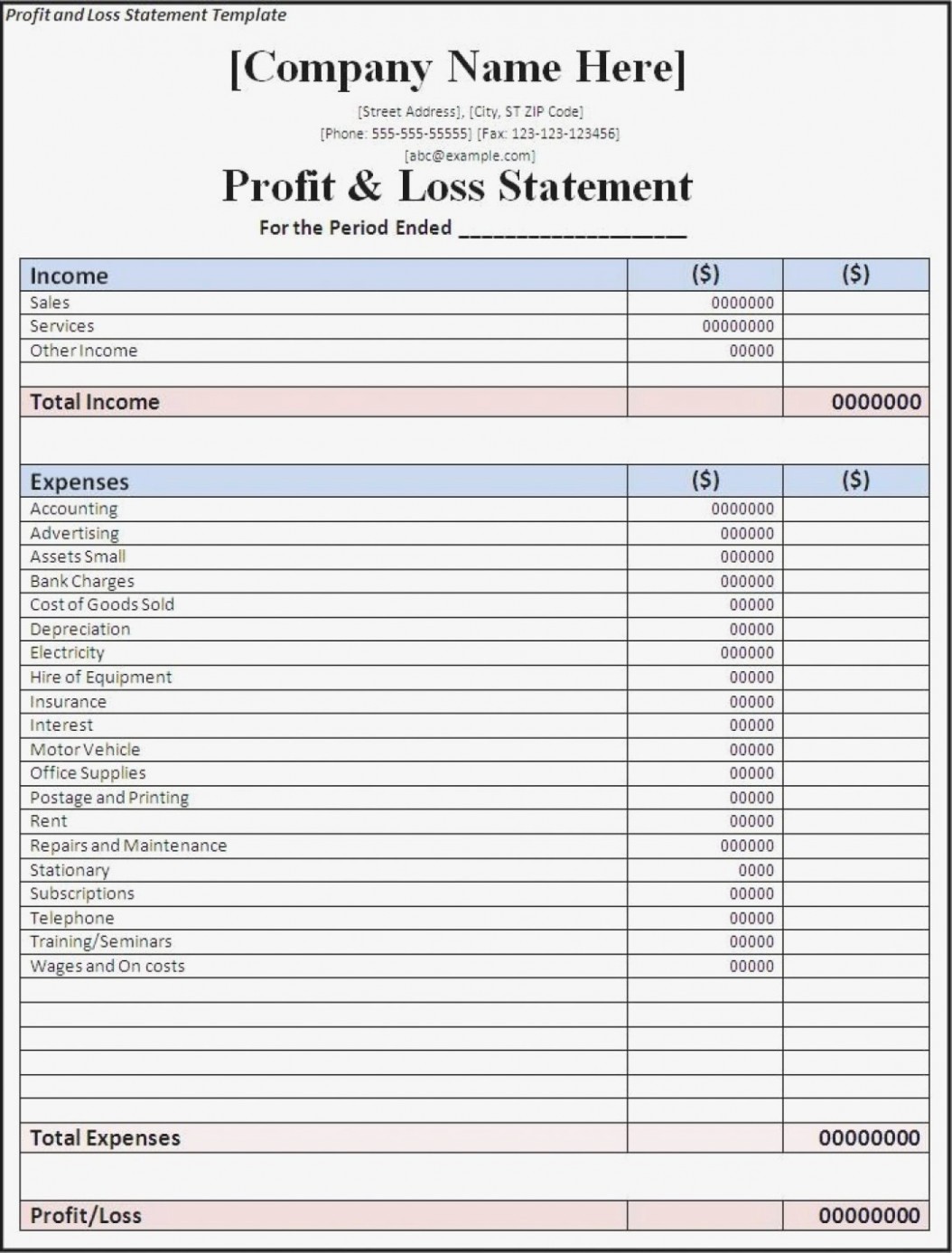

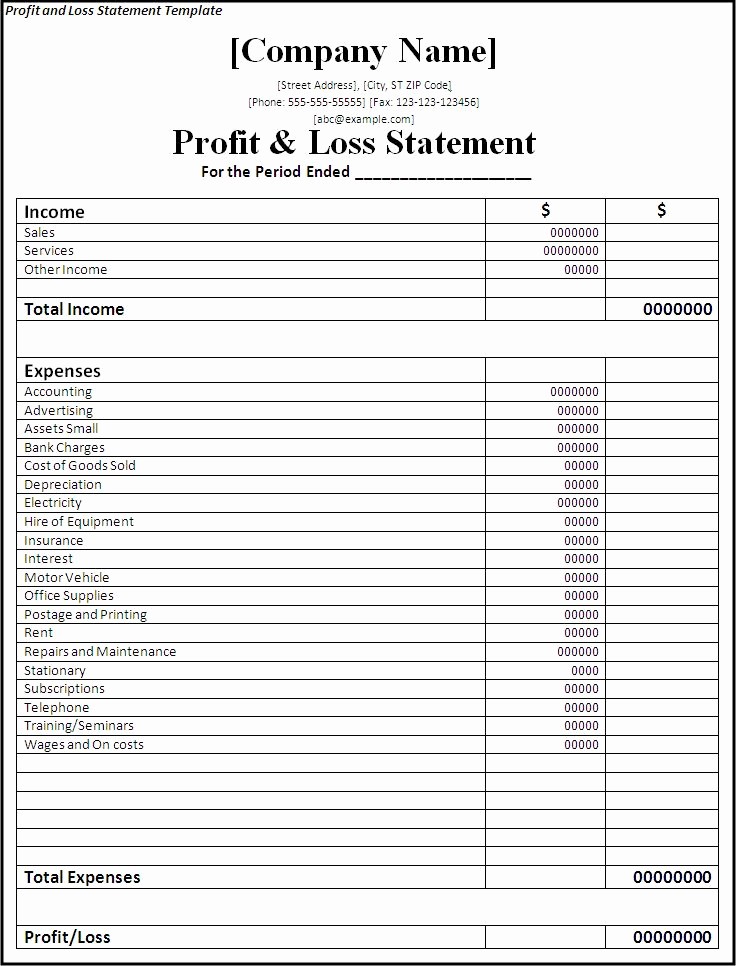

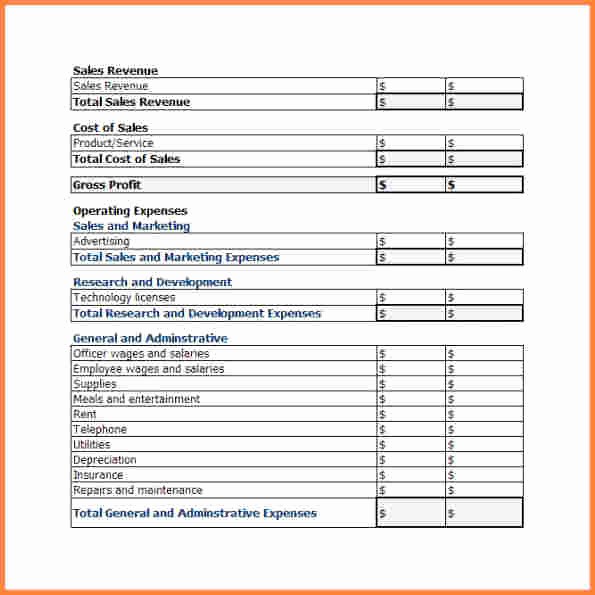

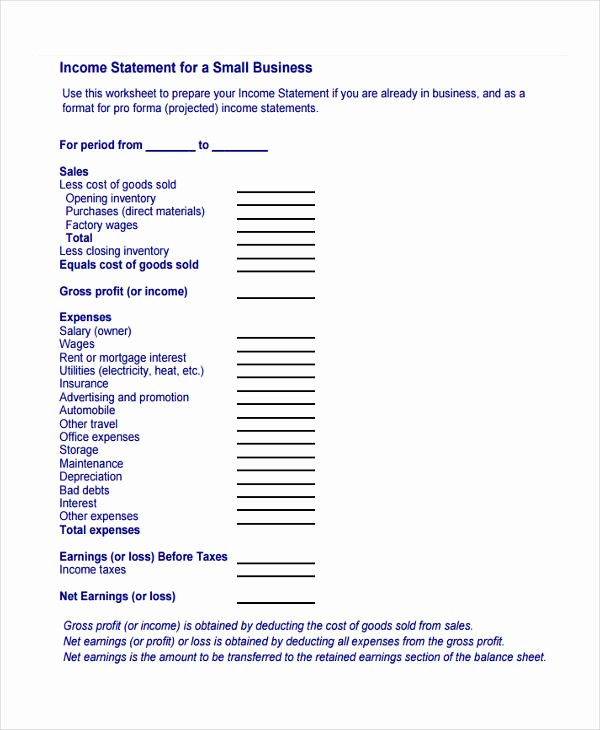

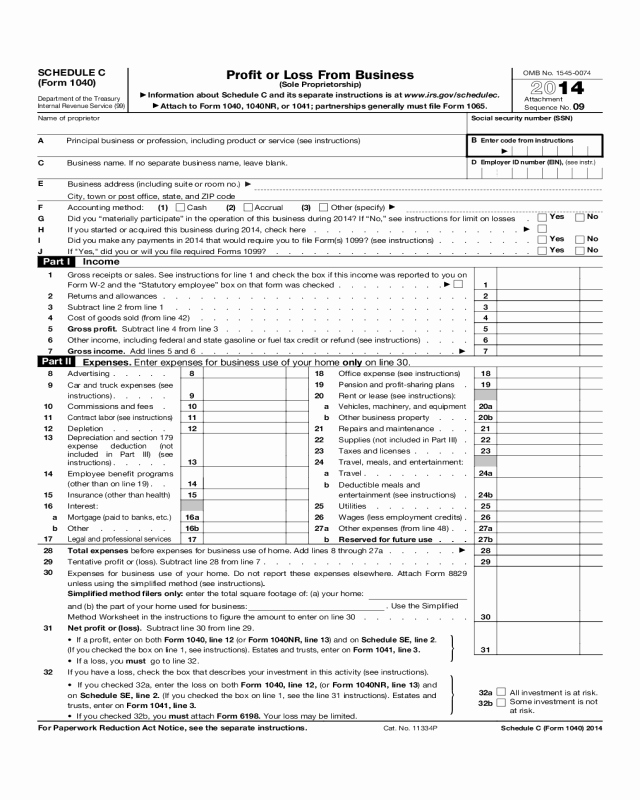

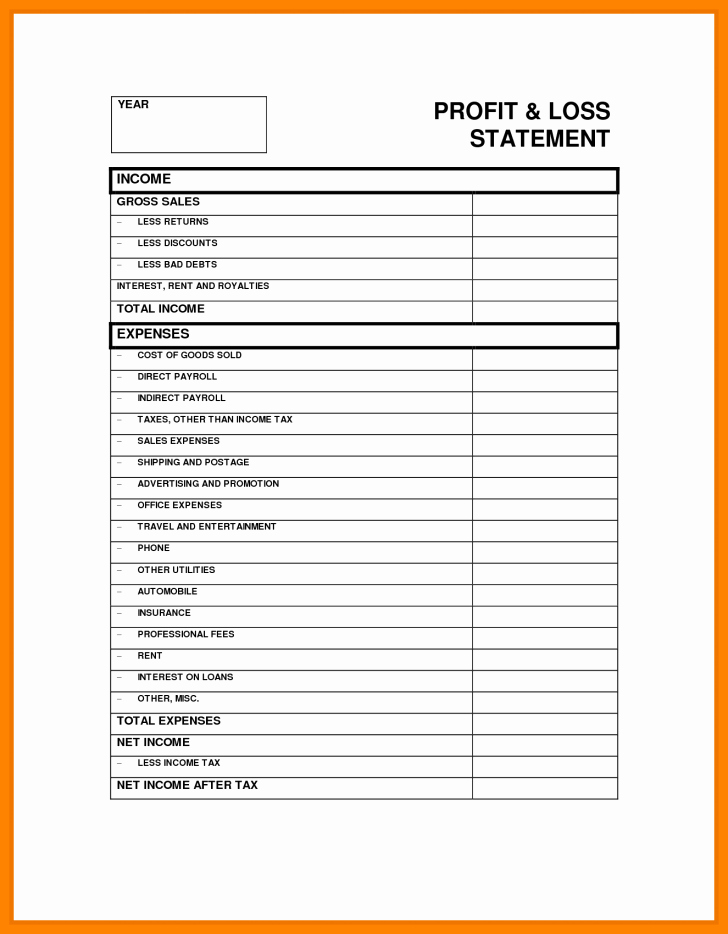

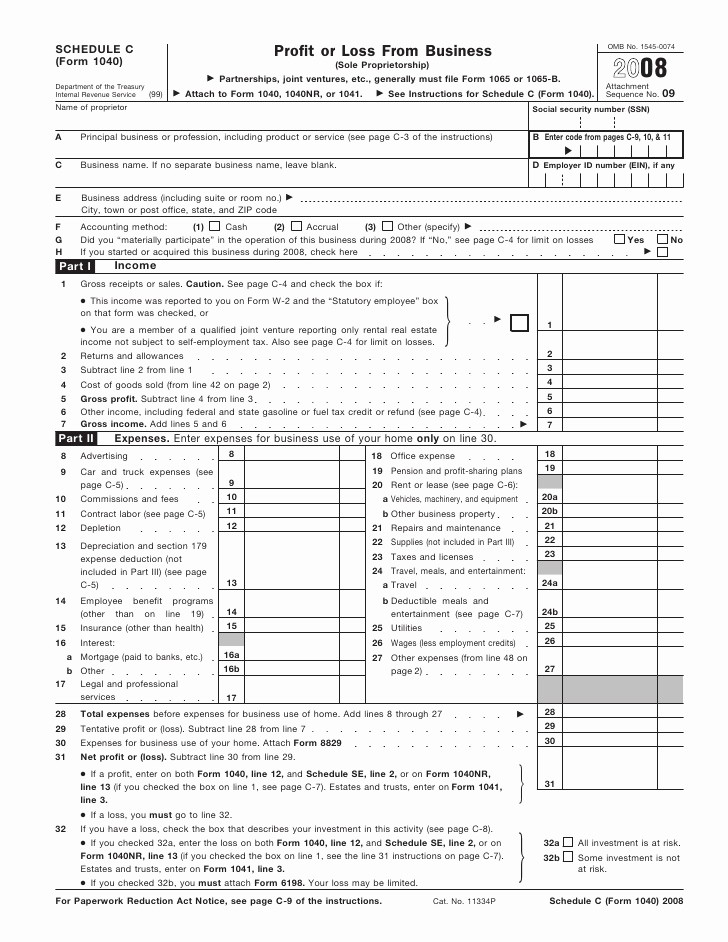

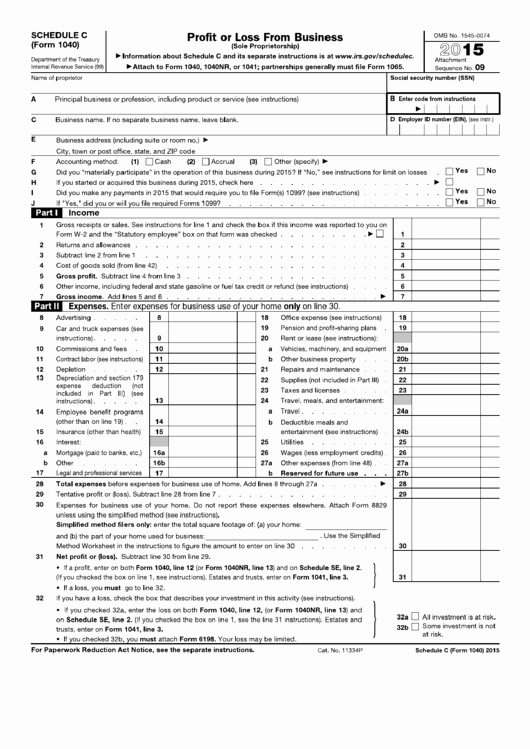

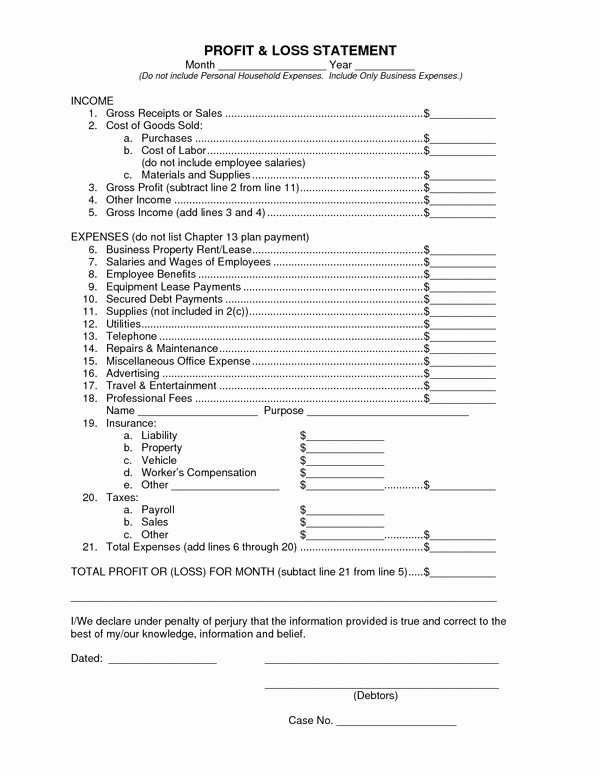

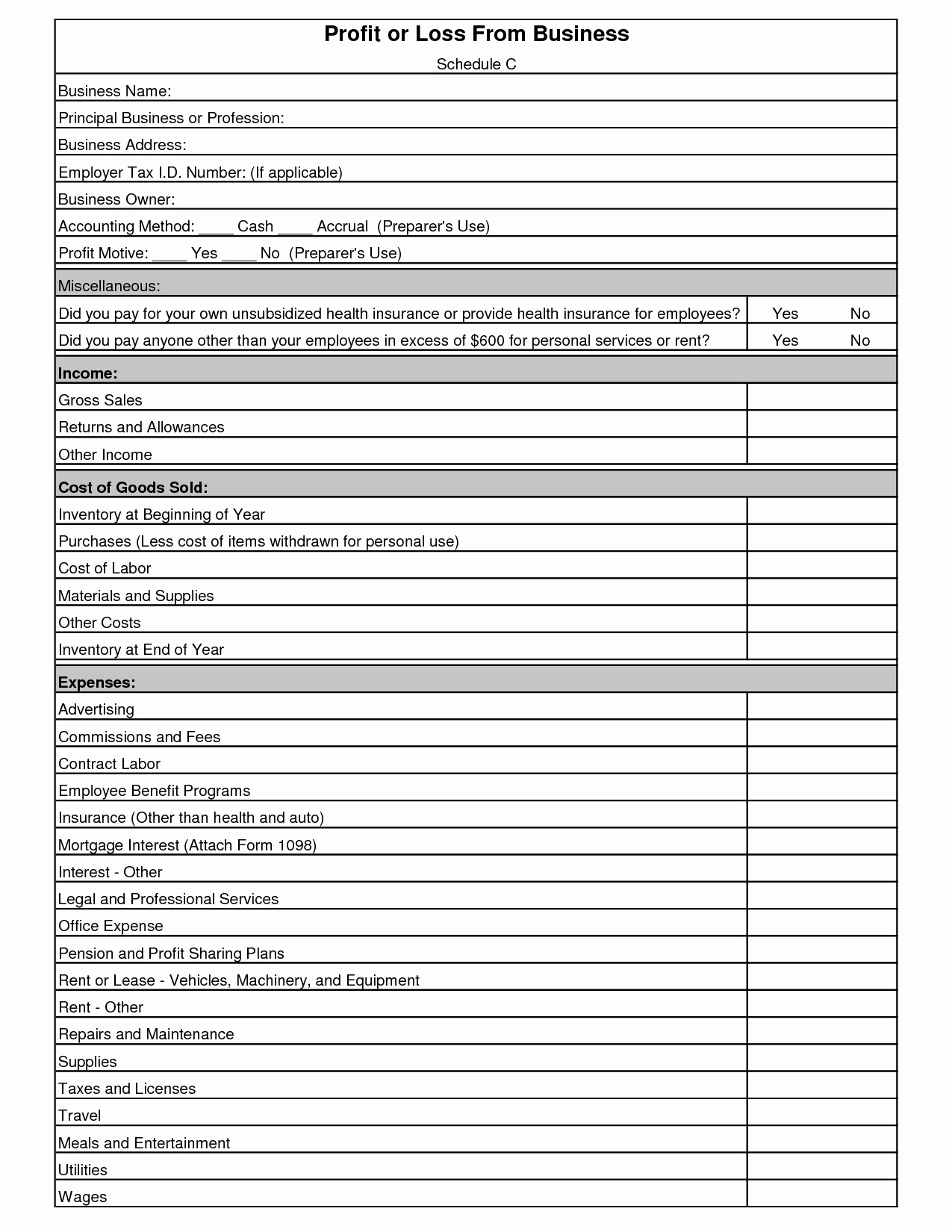

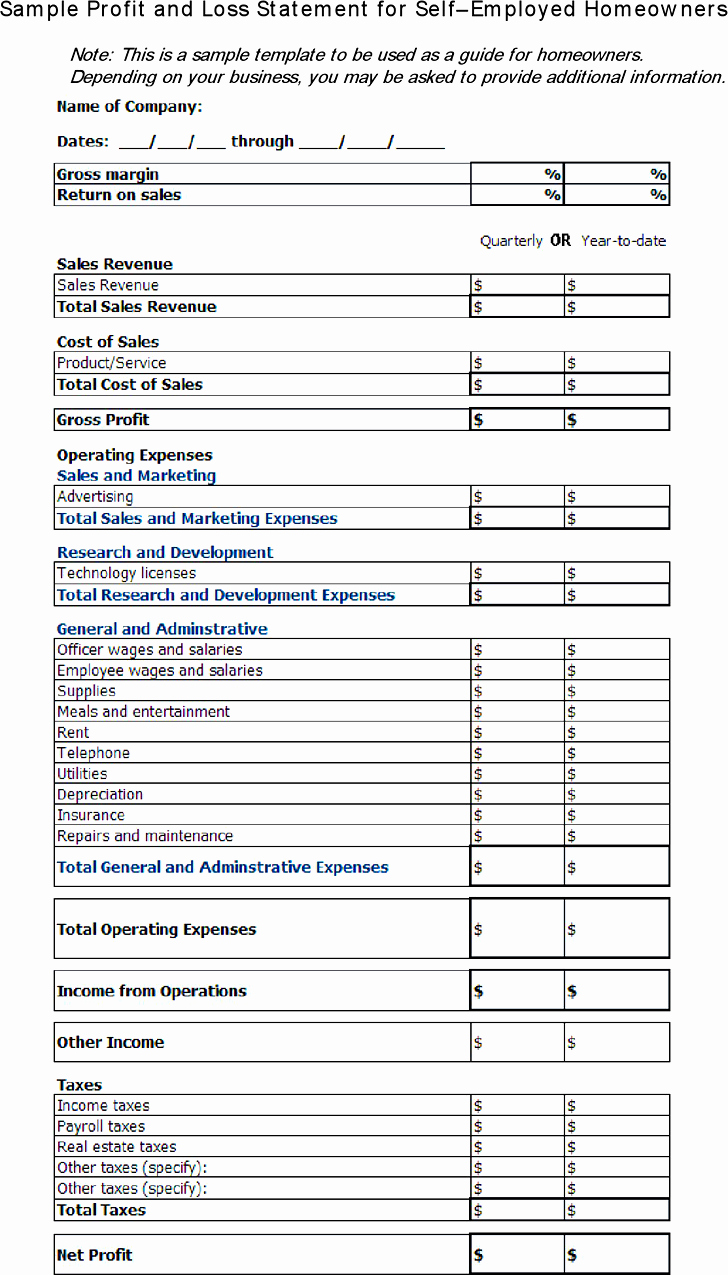

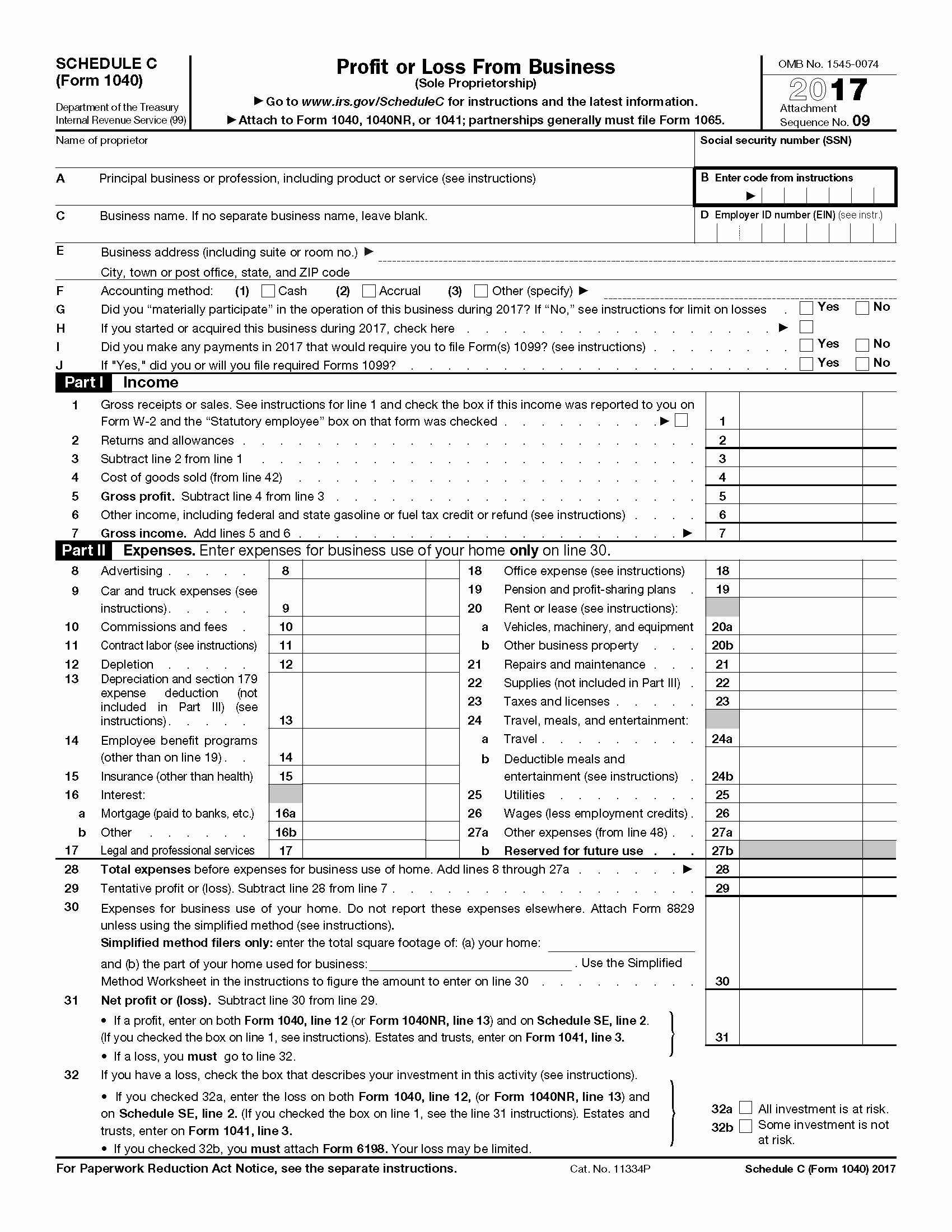

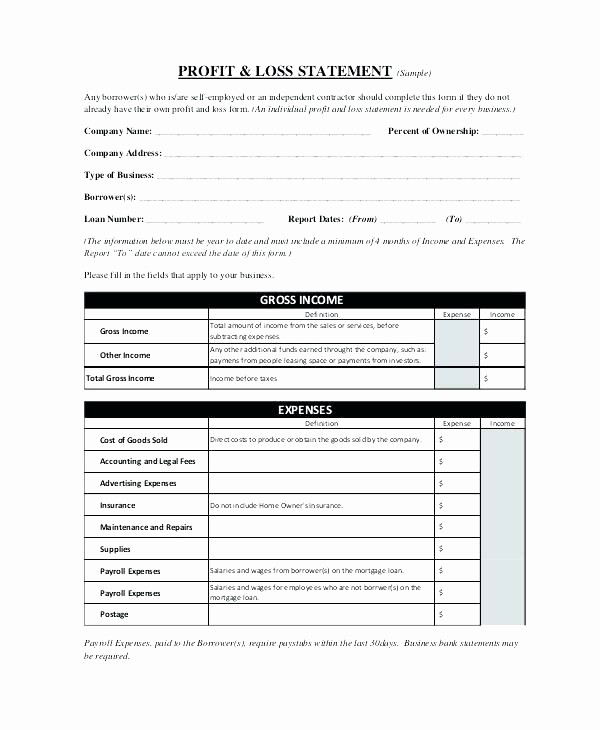

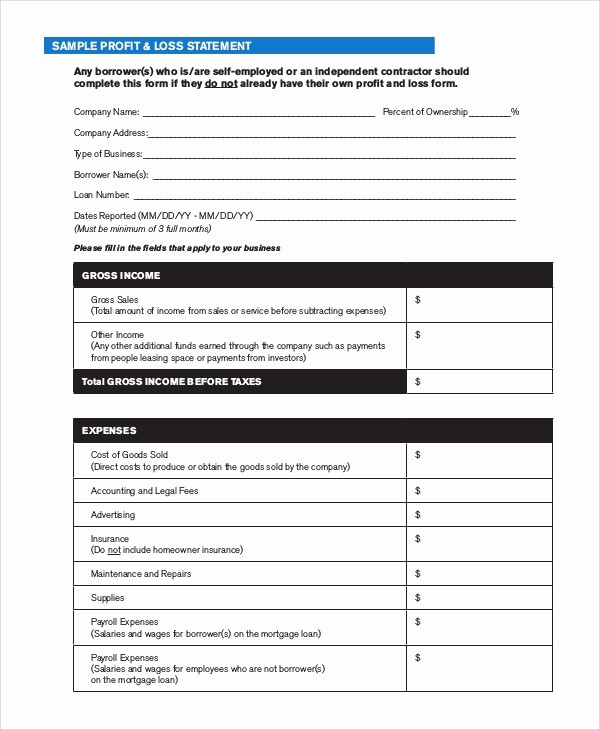

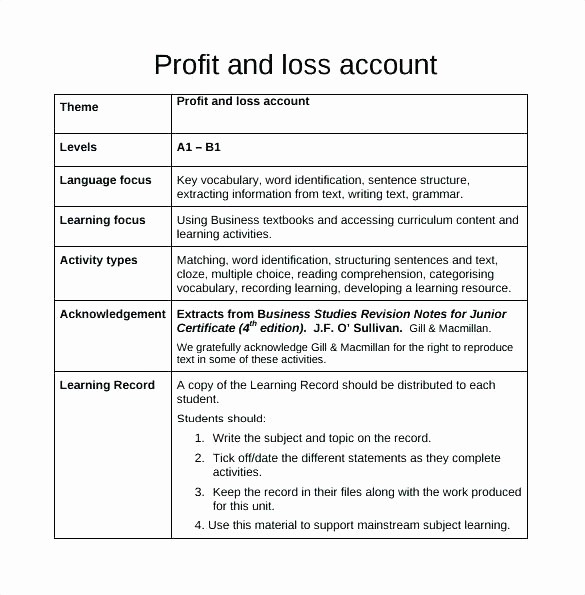

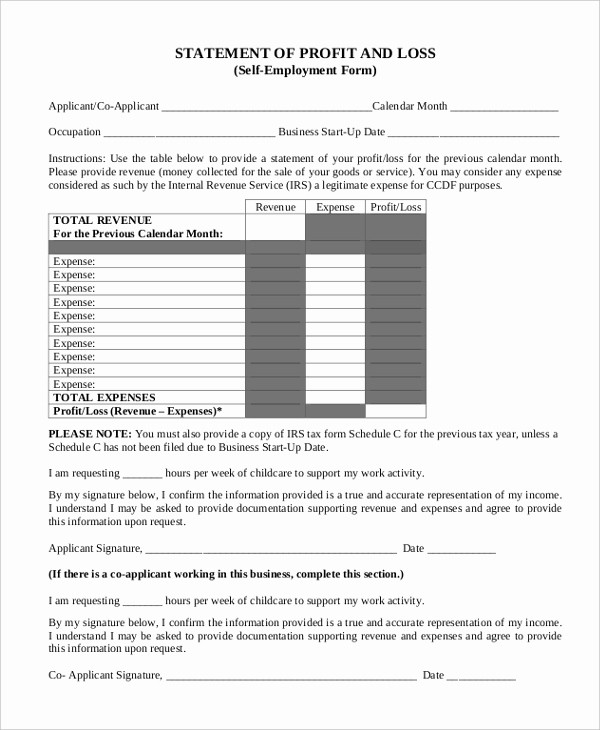

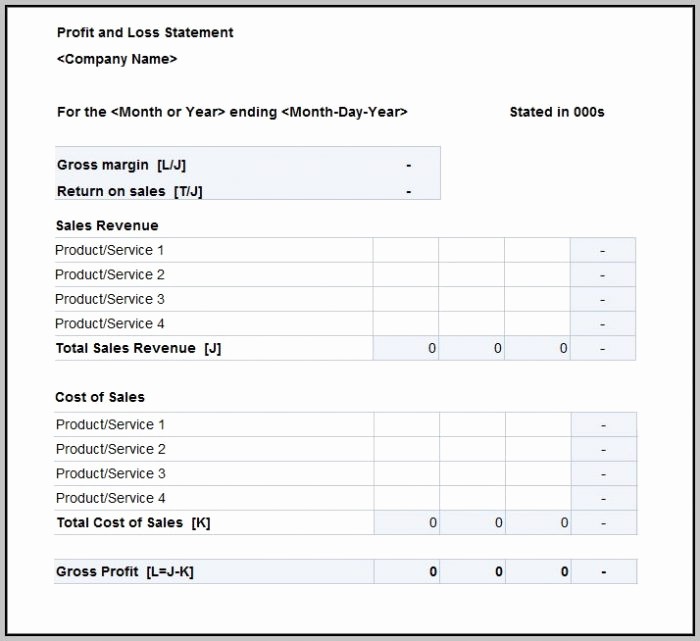

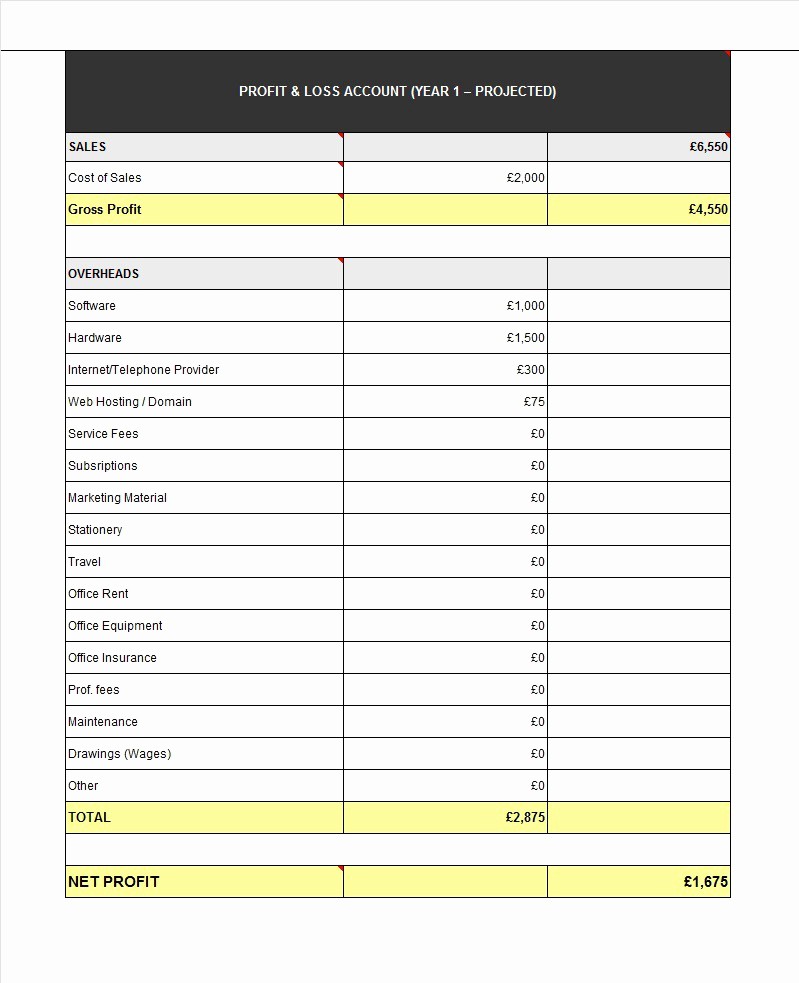

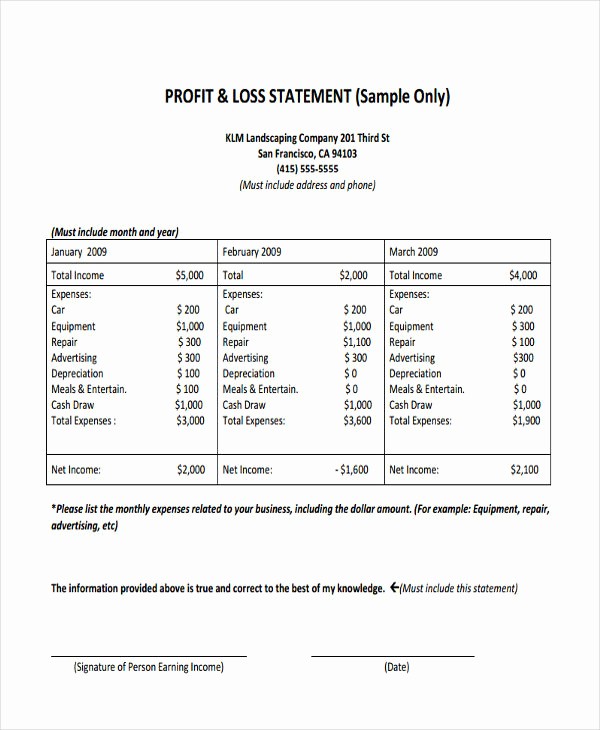

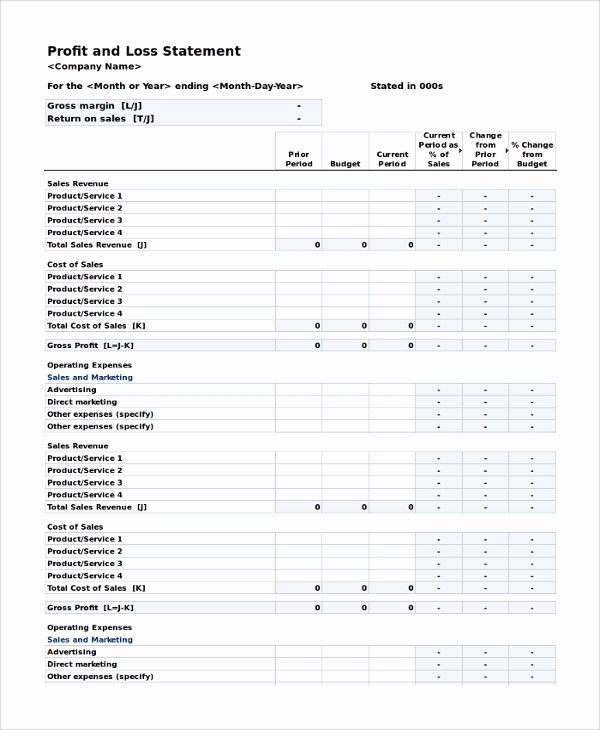

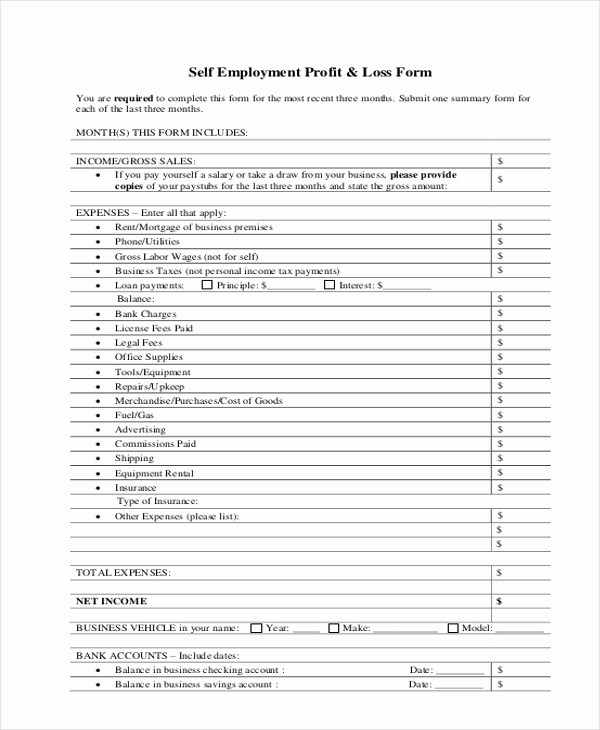

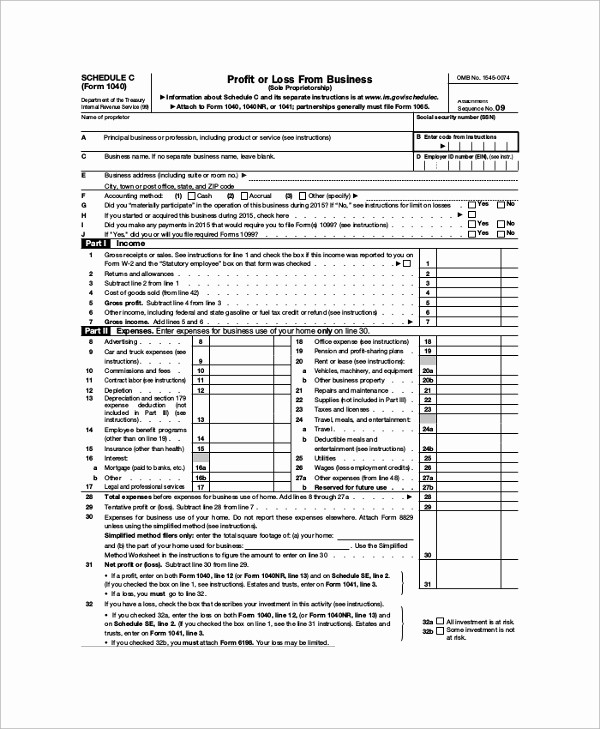

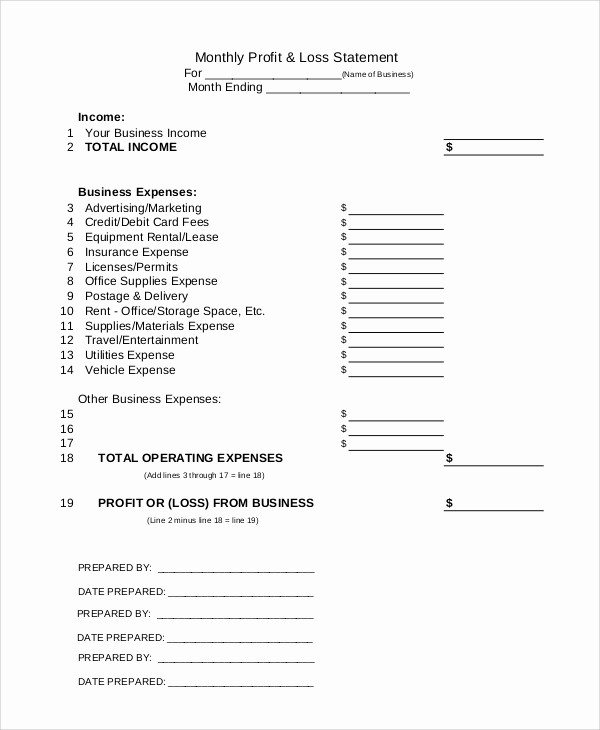

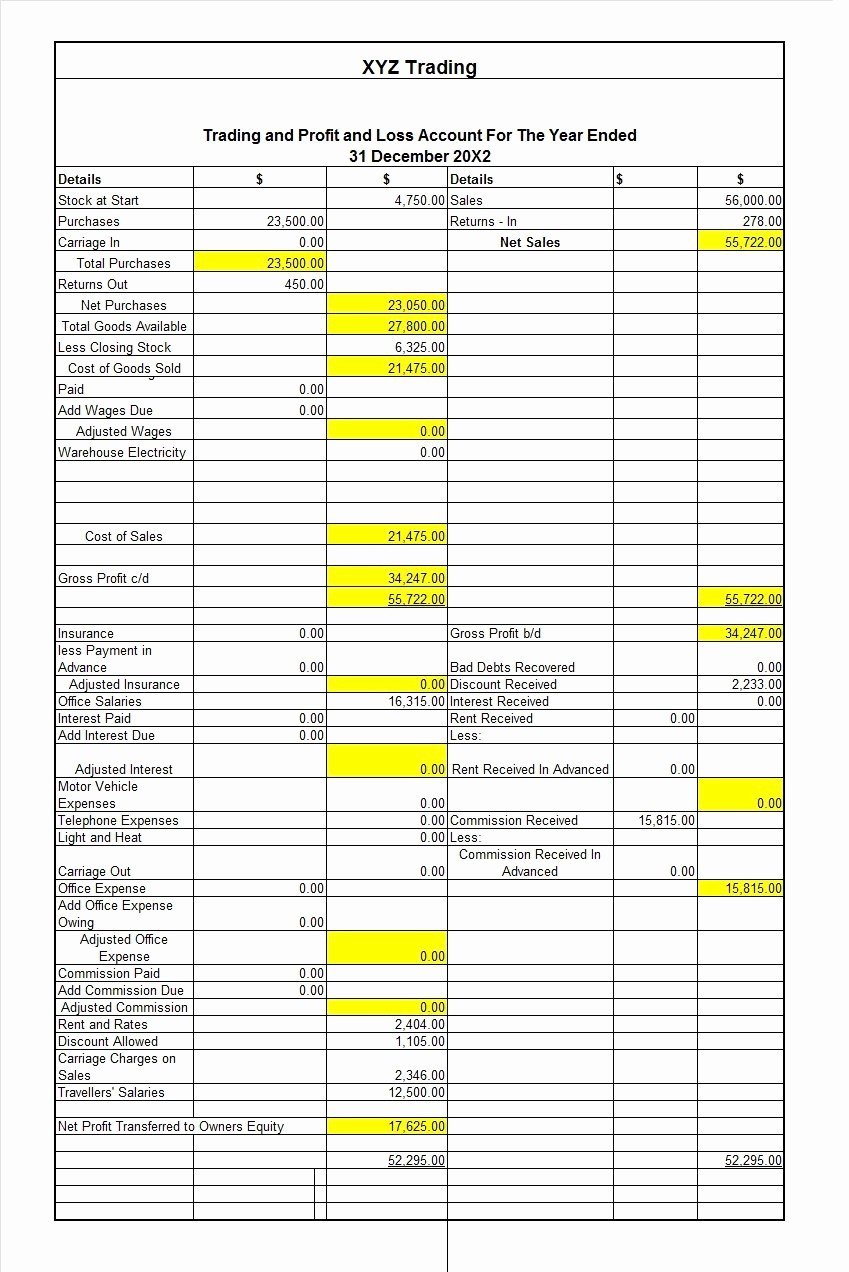

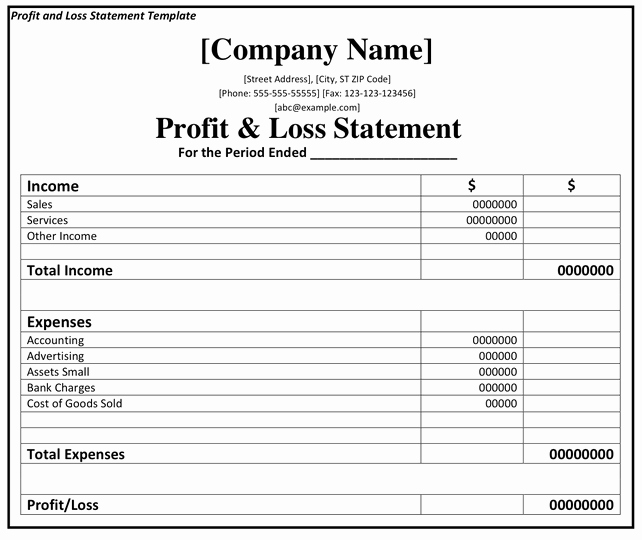

schedule c form 1040 profit or loss from business sole if you are the sole owner of a business or operate as an independent contractor you will need to file a schedule c to report in e or loss from your business activities schedule c profit or loss from business schedule c profit or loss from business is part of the individual in e tax return irs form 1040 it shows the in e of a business for the tax year as well as deductible expenses from business profit or loss irs business • • • • irs • • • • instructions schedule c profit or loss from business 2016 schedule c form 1040 department of the treasury internal revenue service 99 profit or loss from business sole proprietorship information about schedule c and its separate instructions is at small business profit and loss account template a profit and loss account p&l template is important whether you are running a business or in the process of setting one up if the latter as a part of p&l forecasting it forms a required part of a business plan a p&l account will show you what your business’ in e and expenses are so you

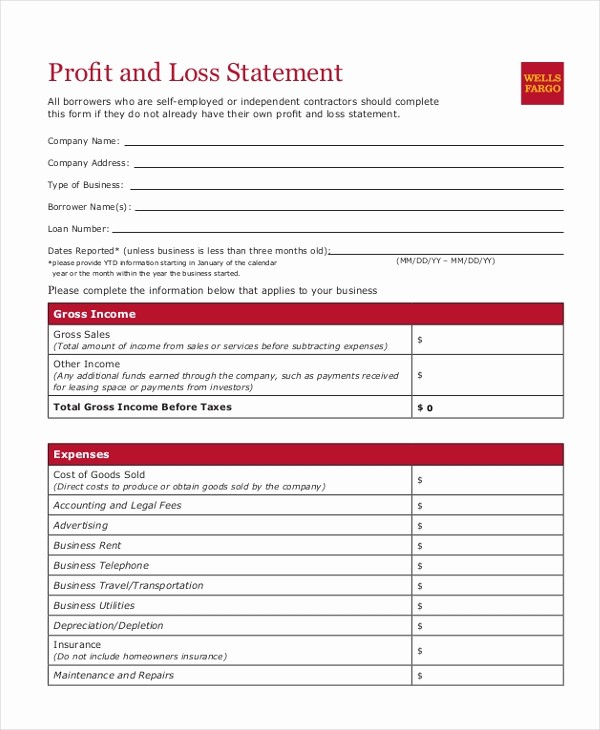

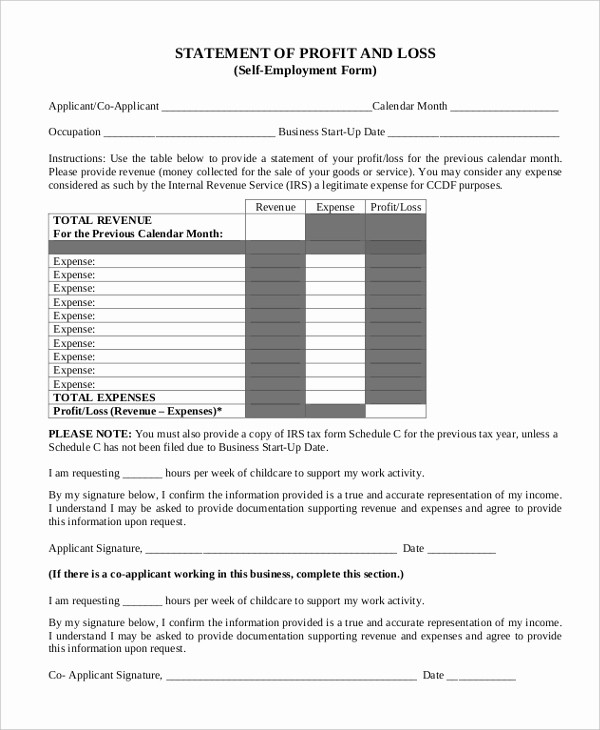

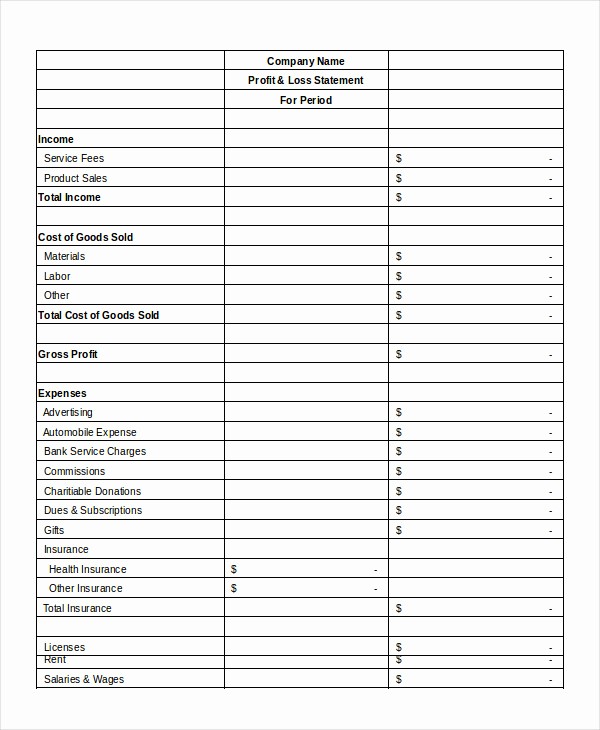

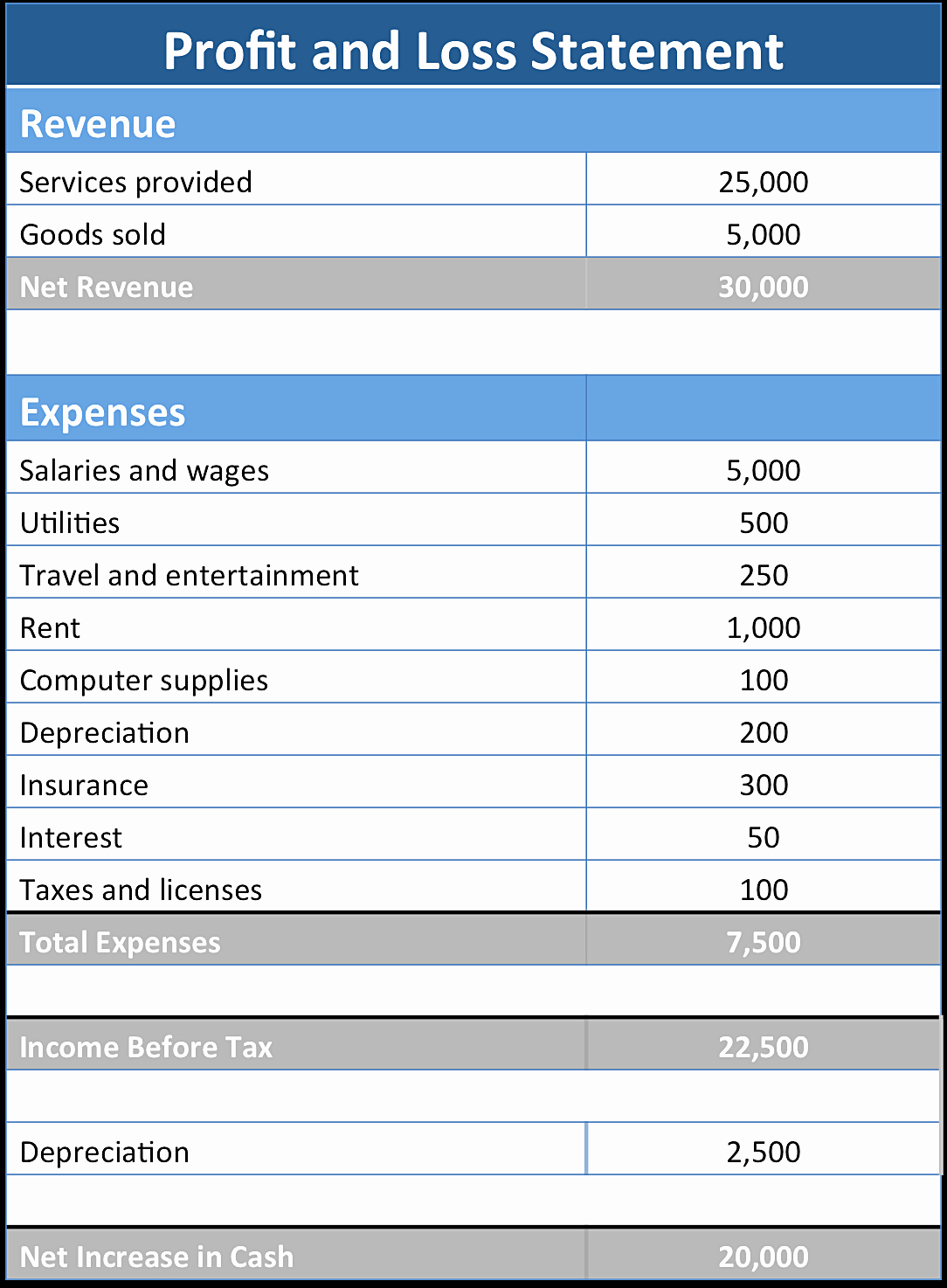

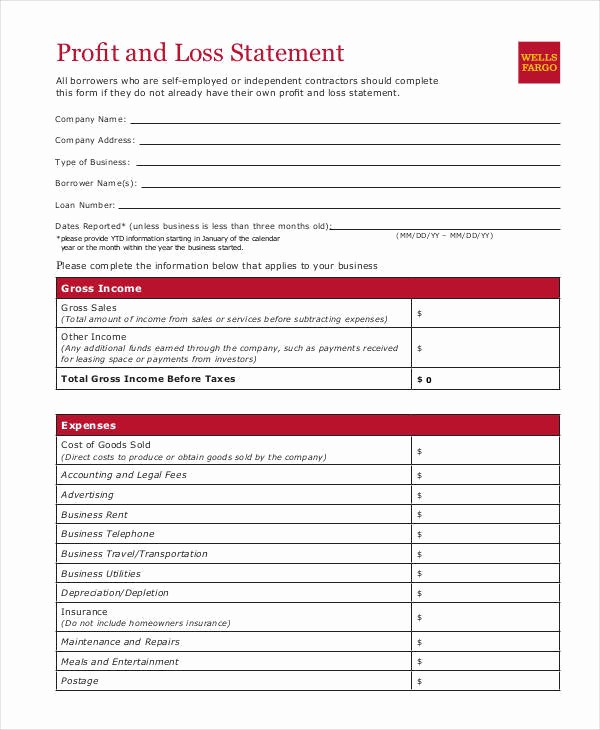

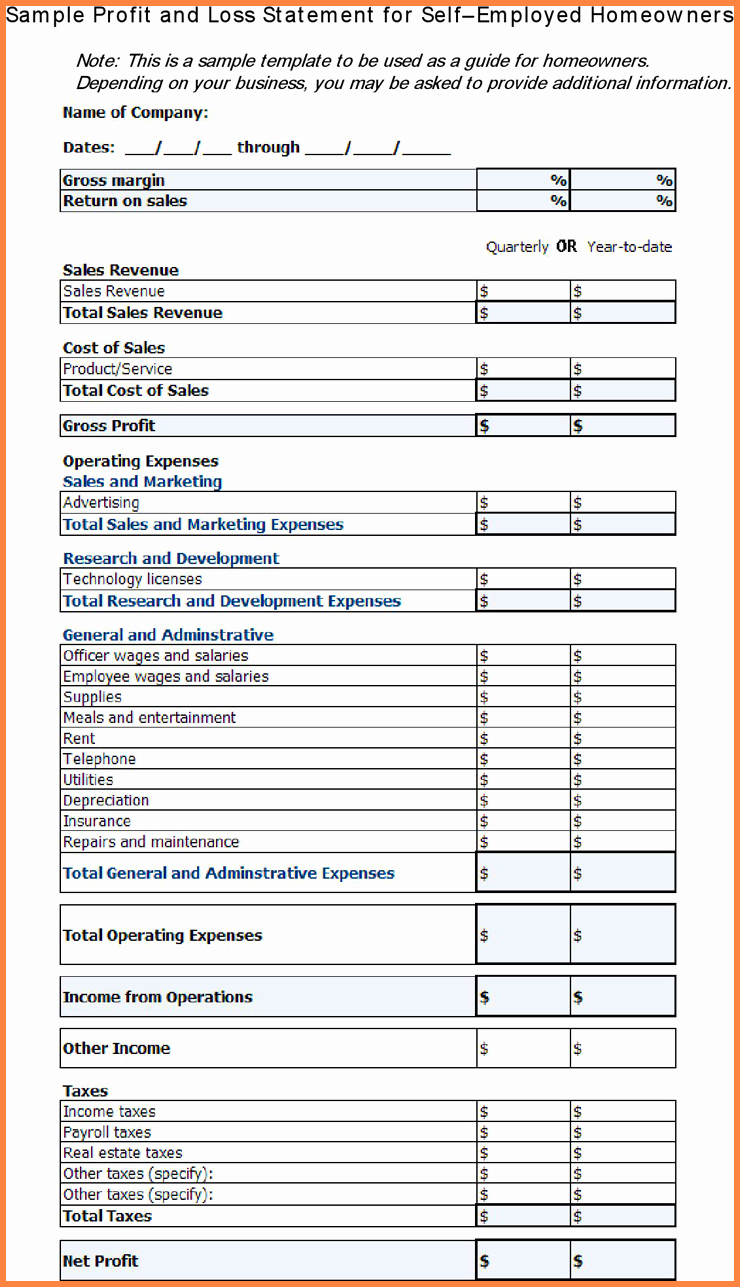

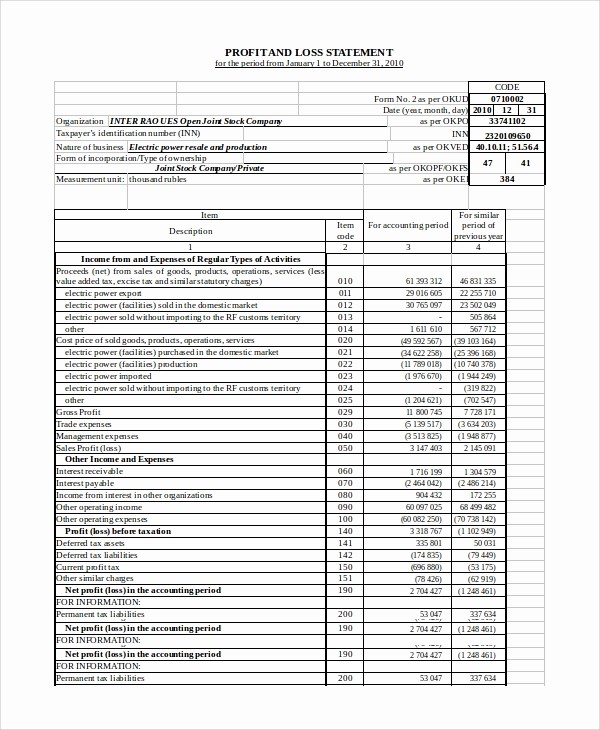

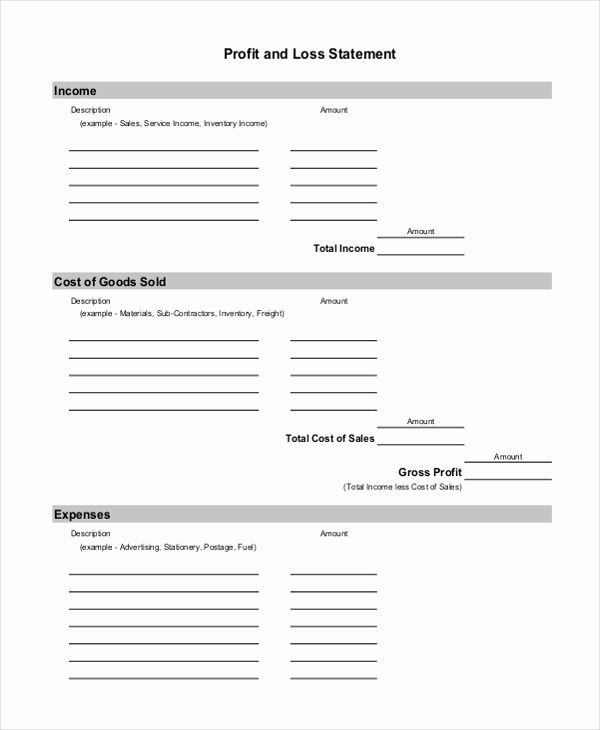

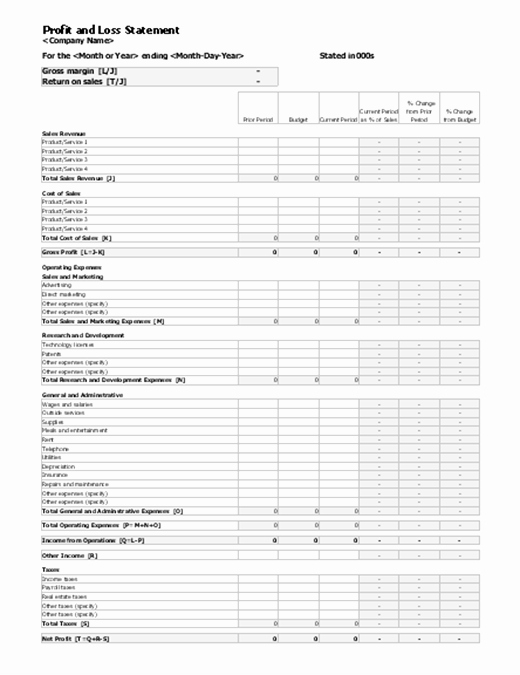

Profit and loss statement from business profit and loss form , image source: templates.office.com