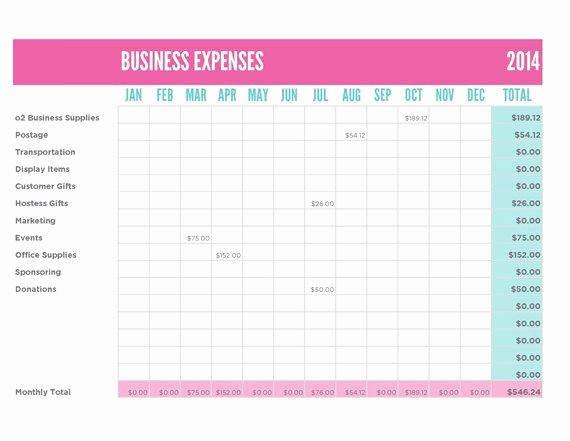

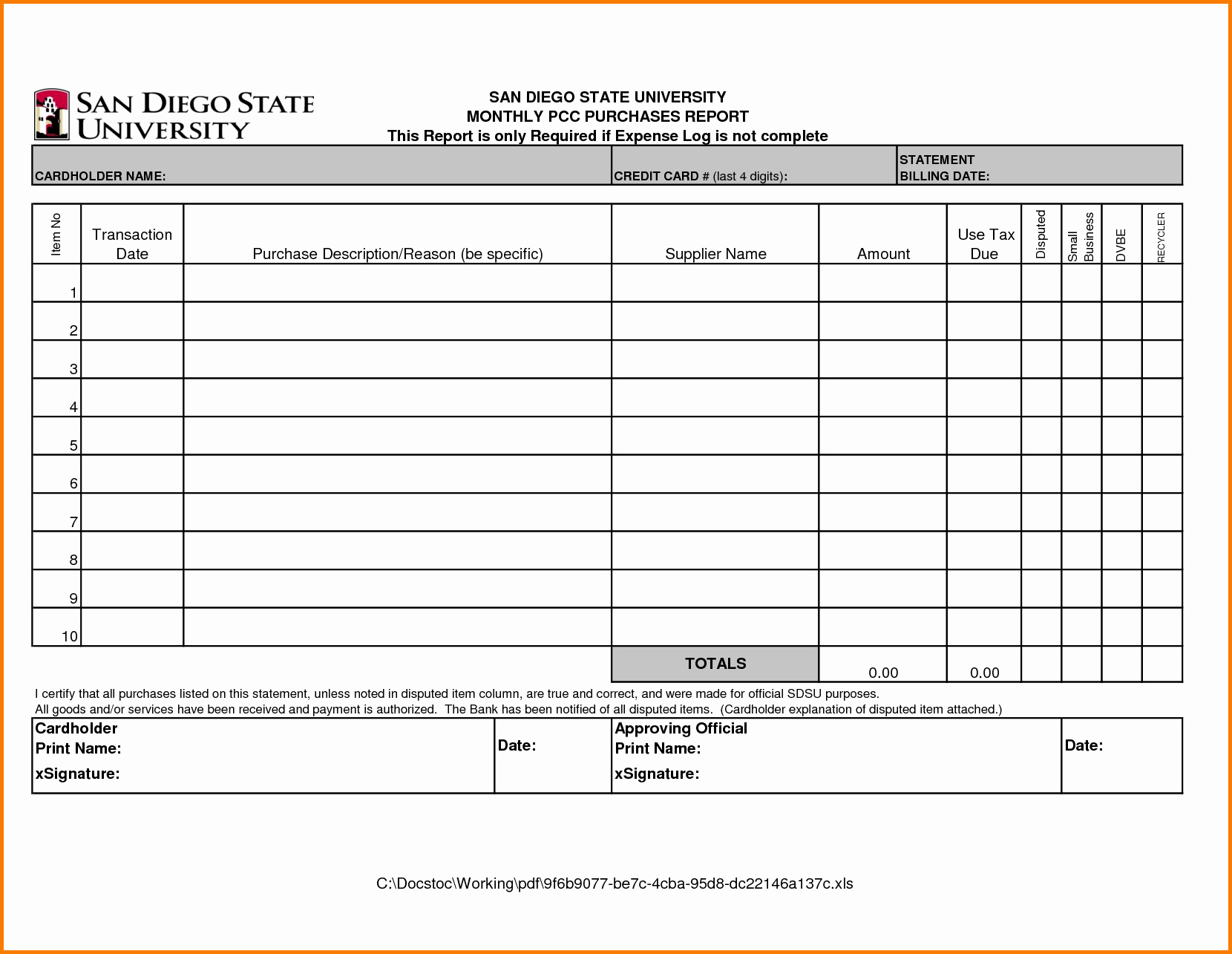

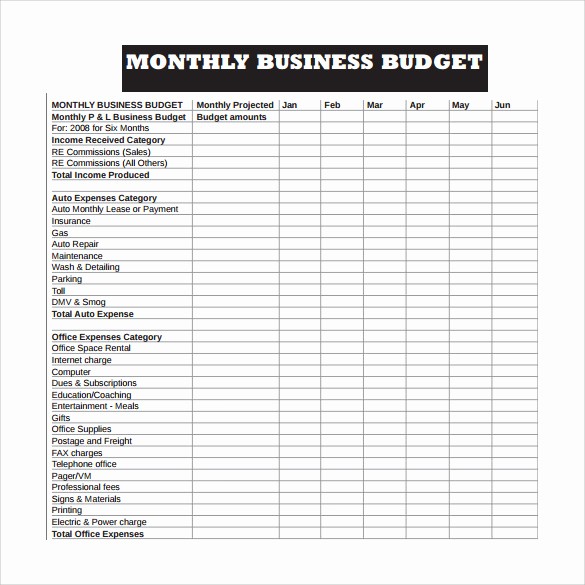

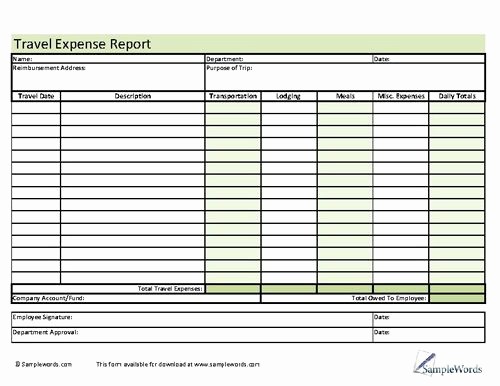

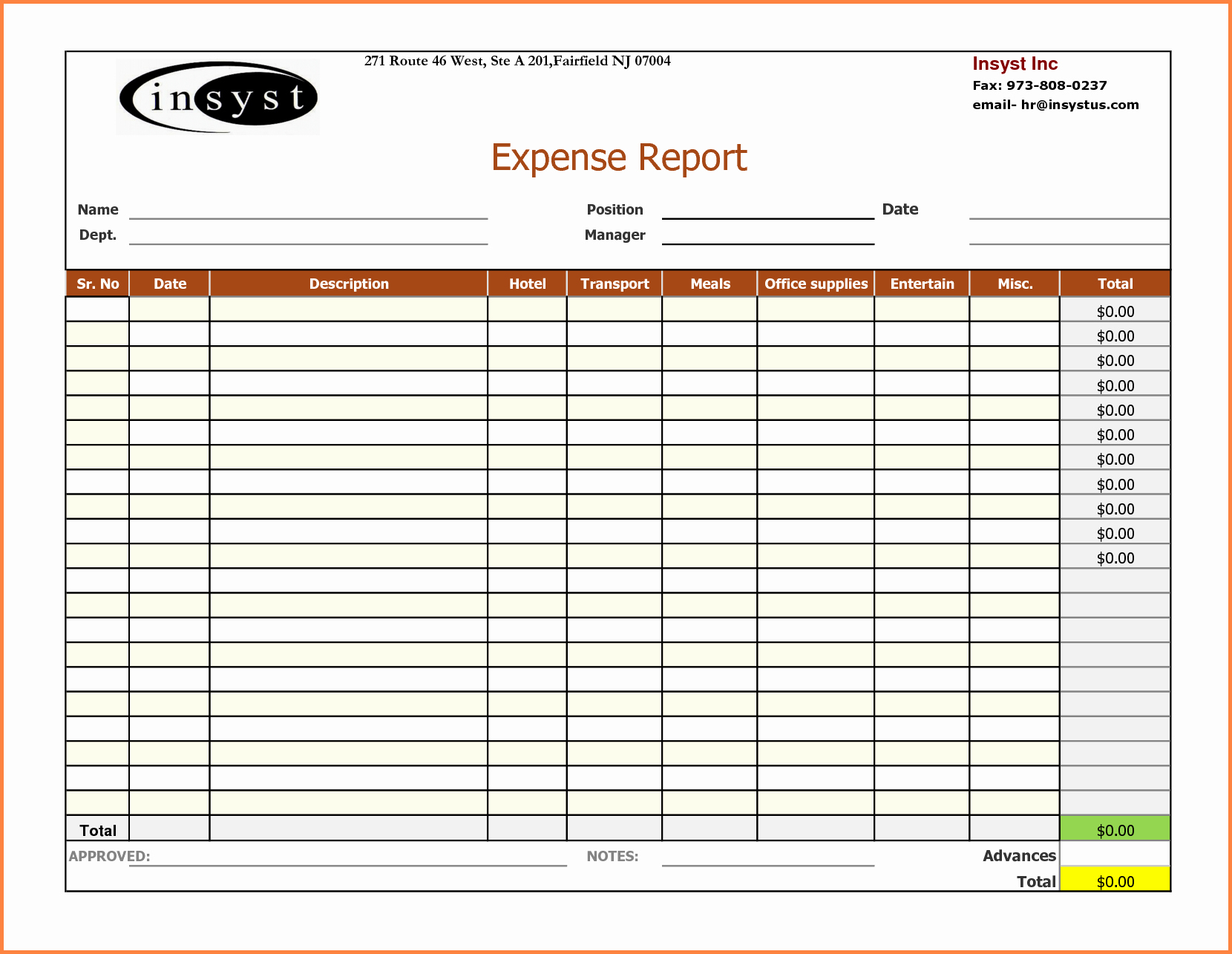

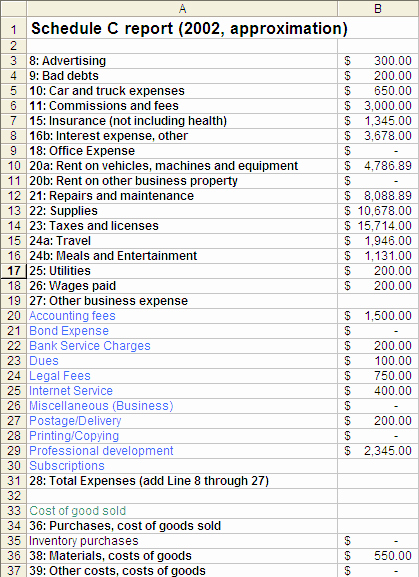

business expenses now you ve started what s next business expenses are day to day expenses for the running of your business like advertising or wages we call these revenue expenses and assets you purchase like plant or machinery we call these capital expenses tax deductible business expenses encyclopedia inc all of the basic expenses necessary to run a business are generally tax deductible including office rent salaries equipment and supplies telephone and utility costs legal and accounting the rules for deducting business expenses on federal taxes let s face it—it costs money to make money self employed individuals incur many mon expenses in the course of doing business but the internal revenue service allows you to deduct the costs of keeping your business up and running and in many cases these expenses are fully deductible reasonable relocation expenses many panies restrict relocation packages to £8k as this is the tax free limit for qualifying expenses however packages of £8k are not un mon for senior roles with the pany picking up the tax on any excess emburse business expenses for the modern age control employee office and travel expenses by using emburse s prepaid corporate debit cards to set spending limits category & time restrictions and more

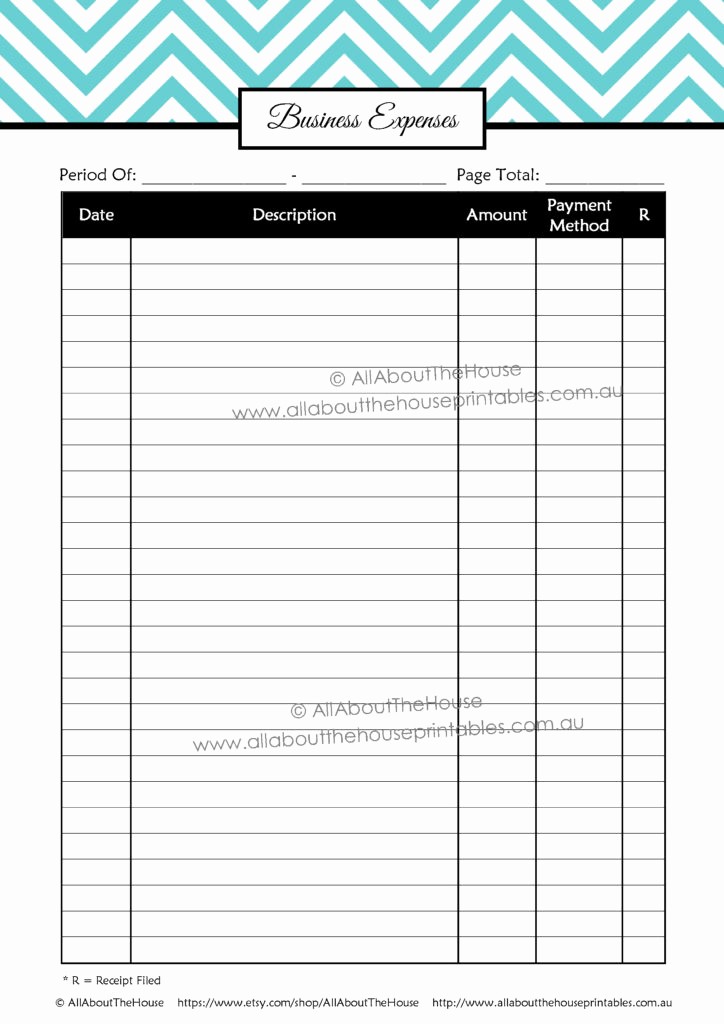

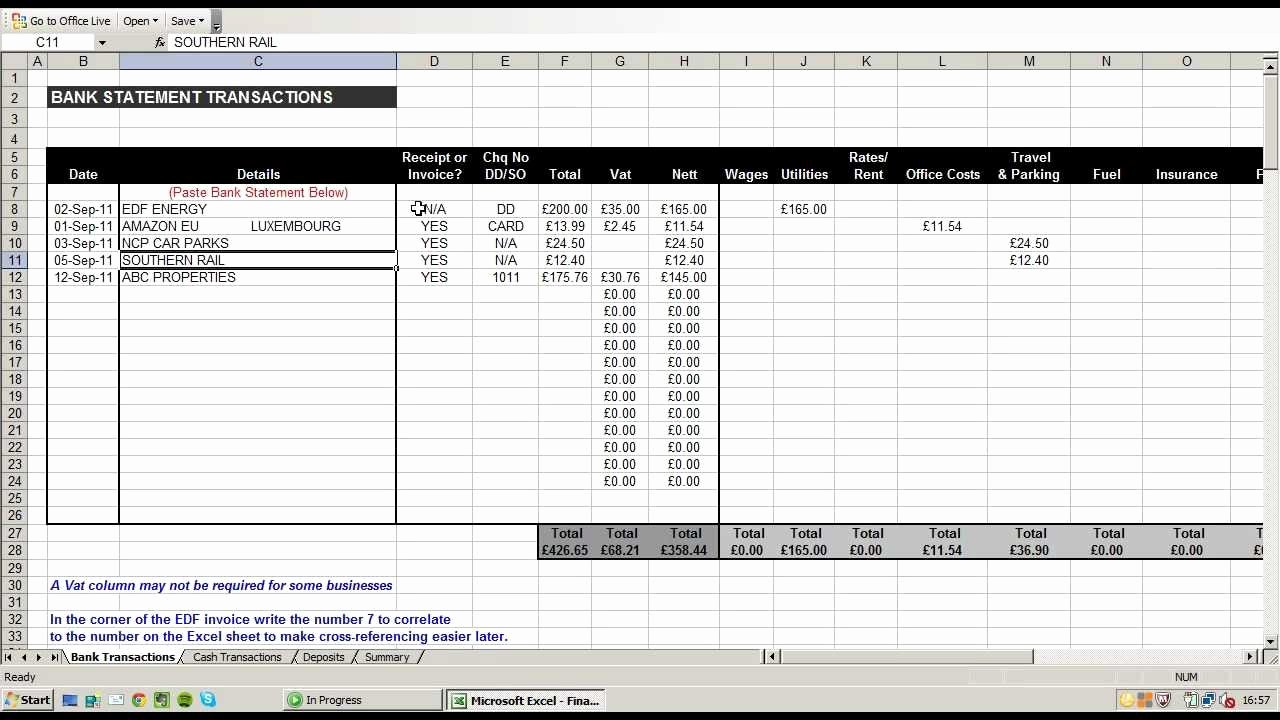

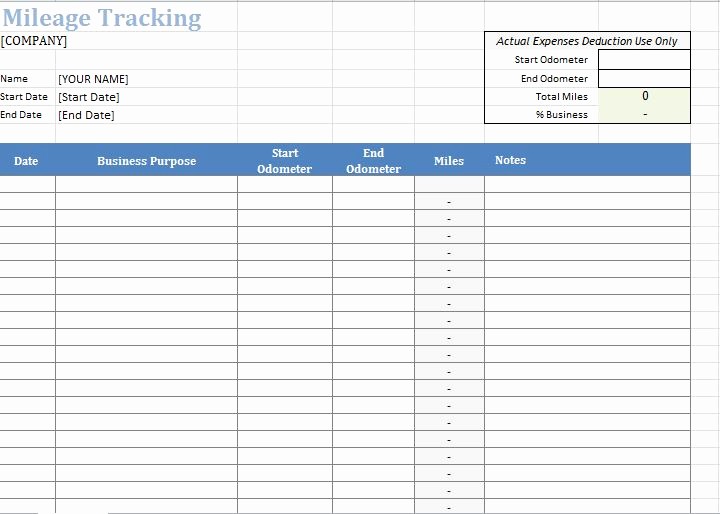

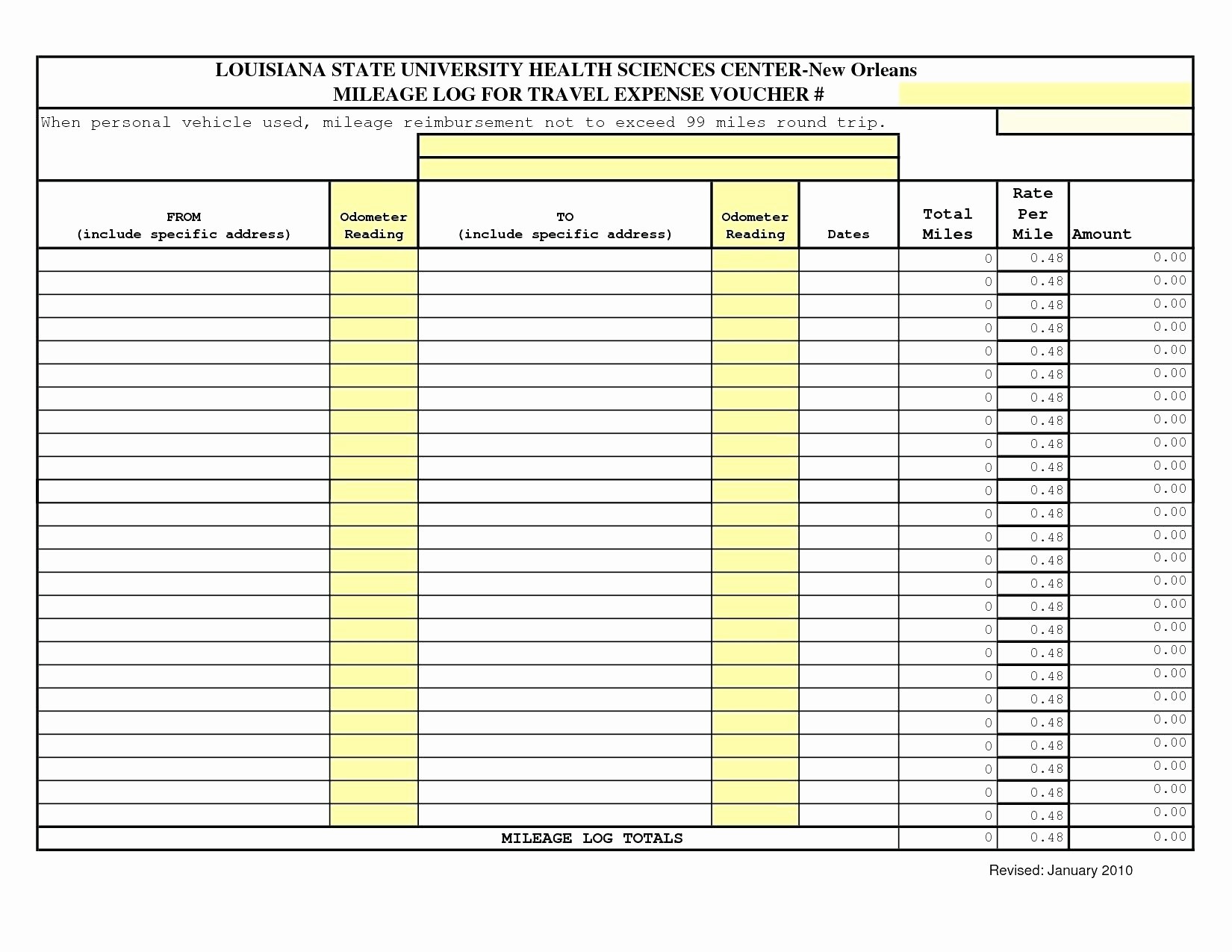

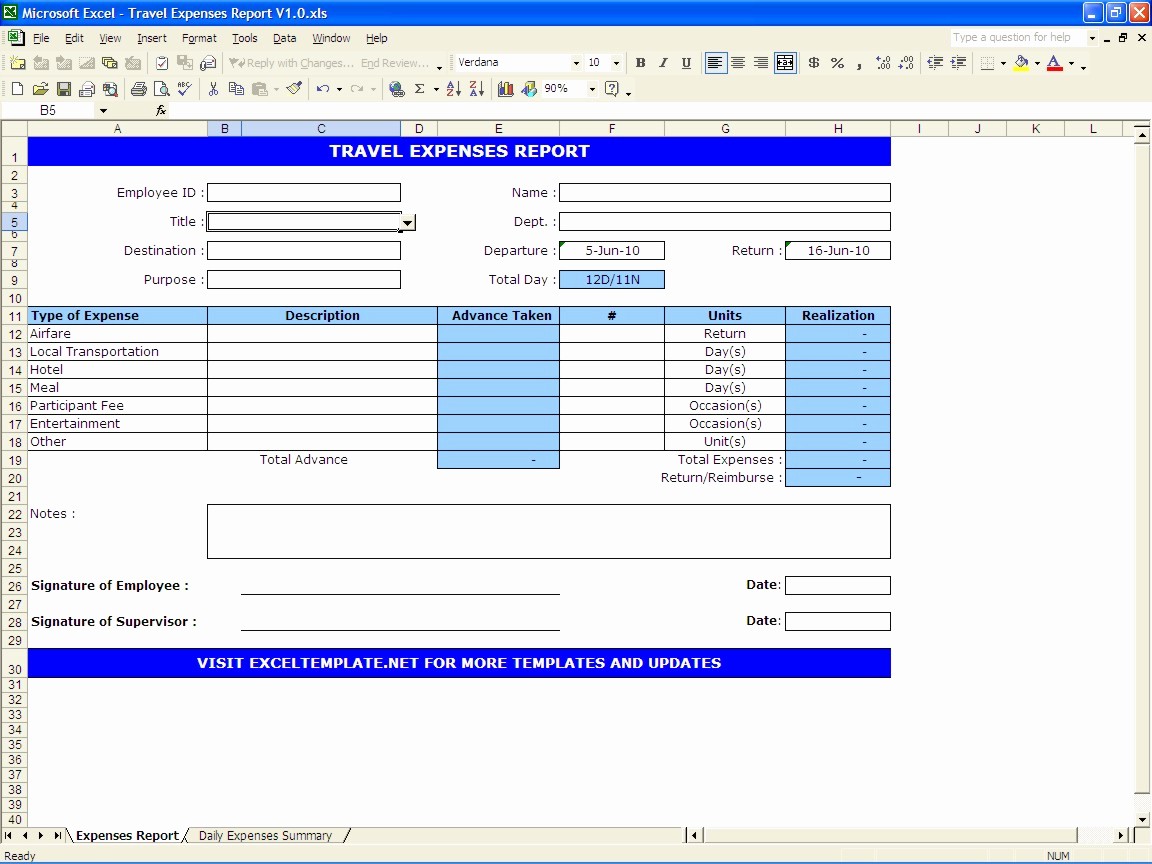

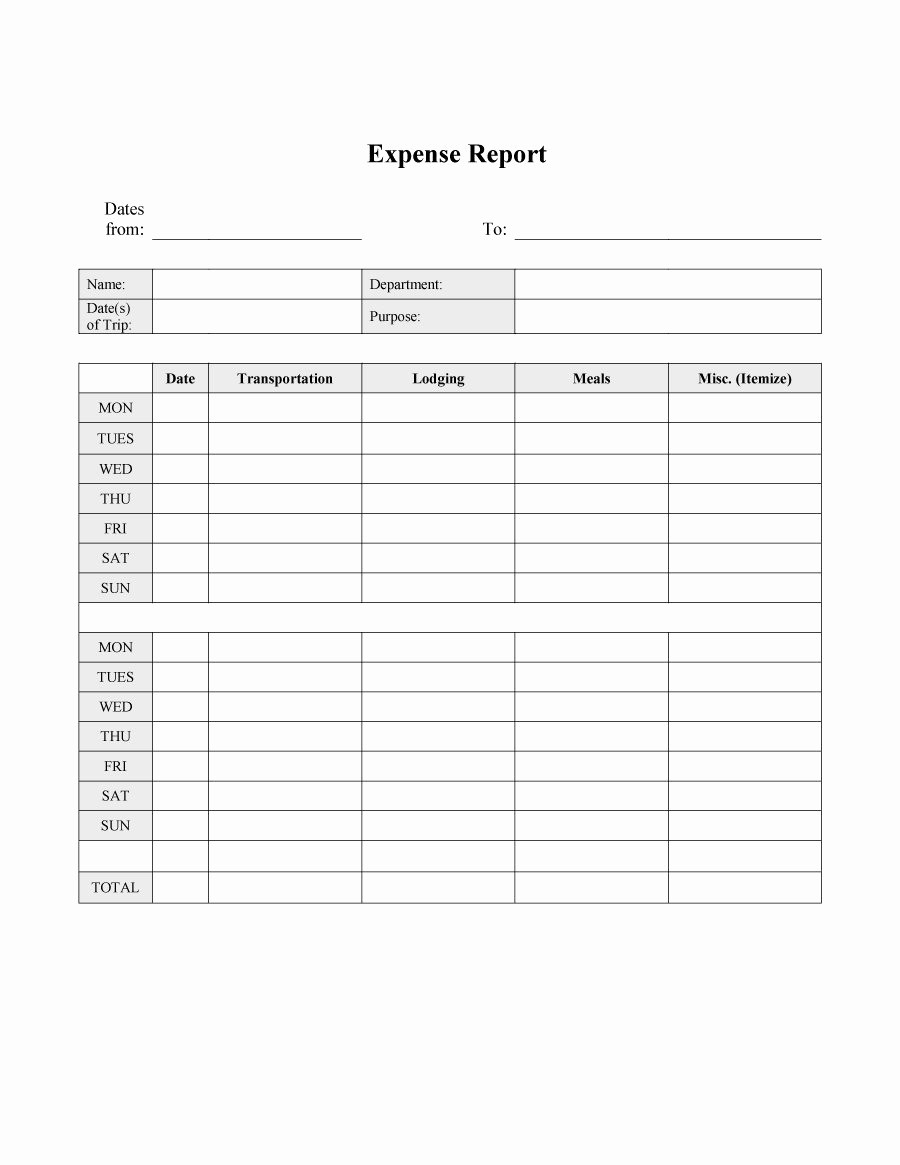

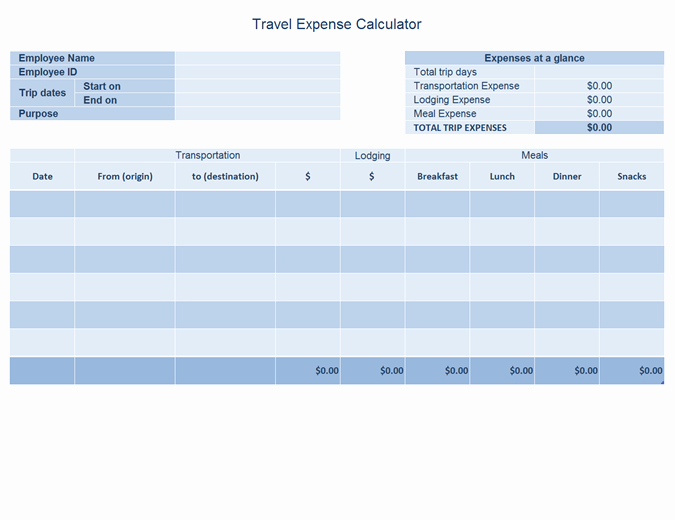

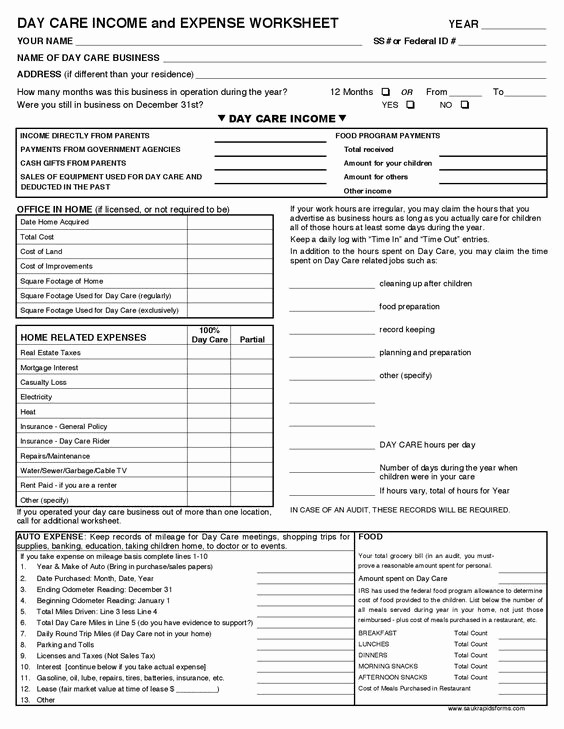

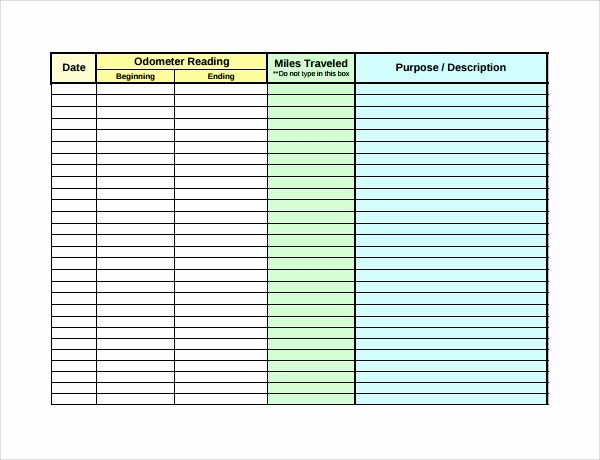

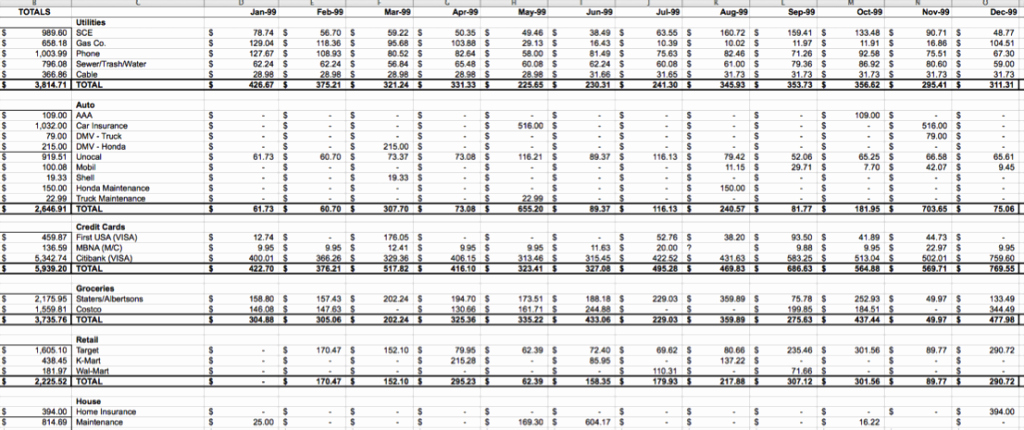

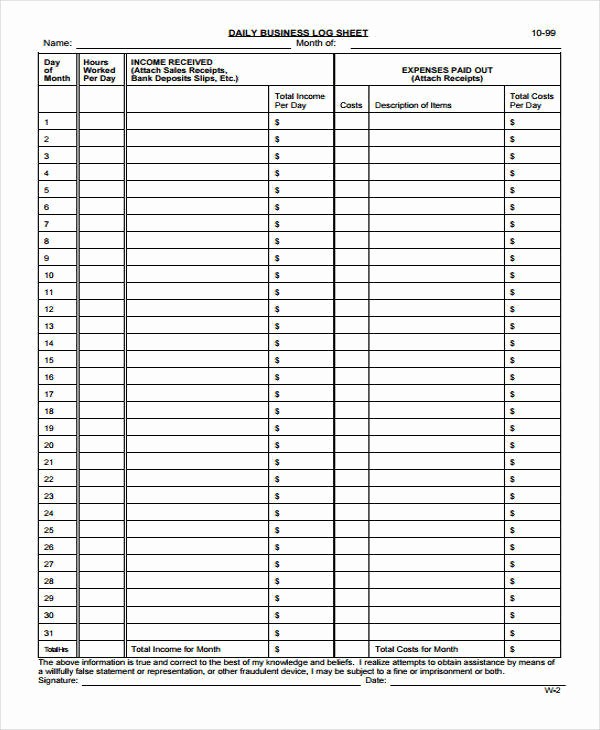

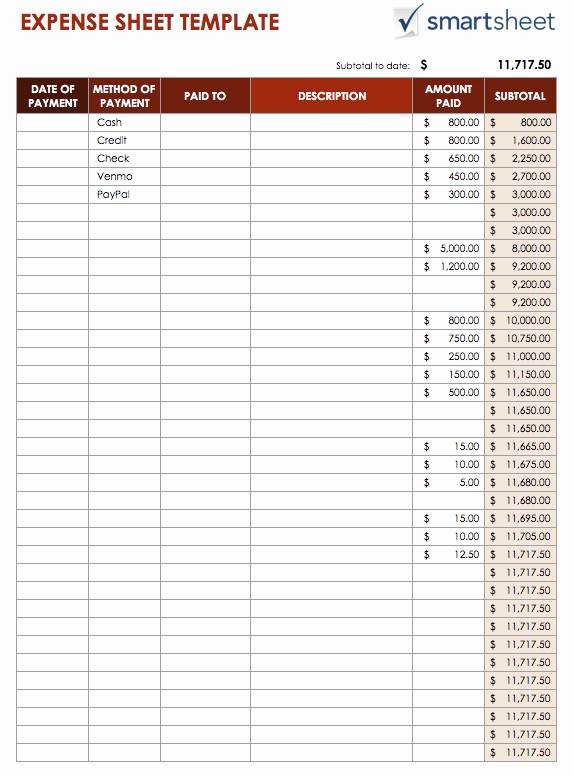

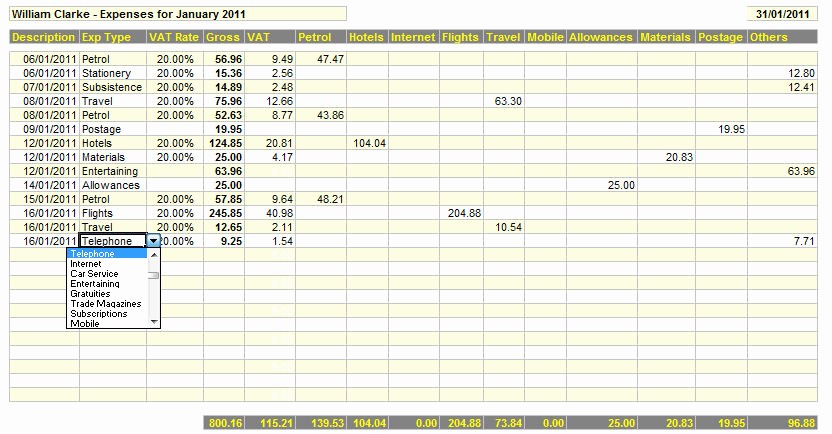

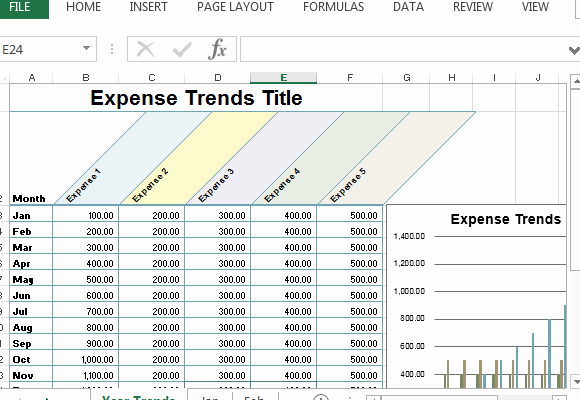

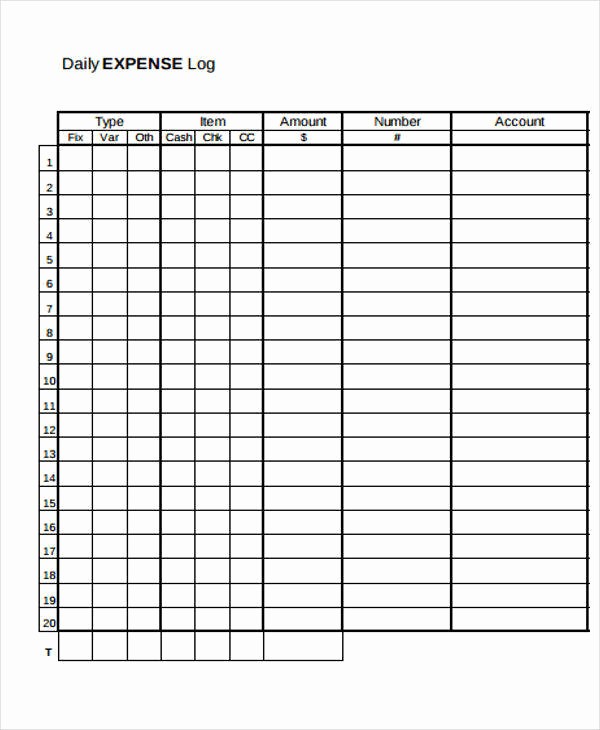

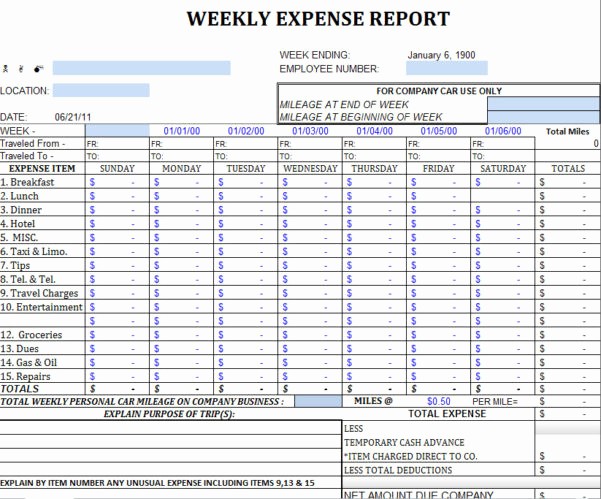

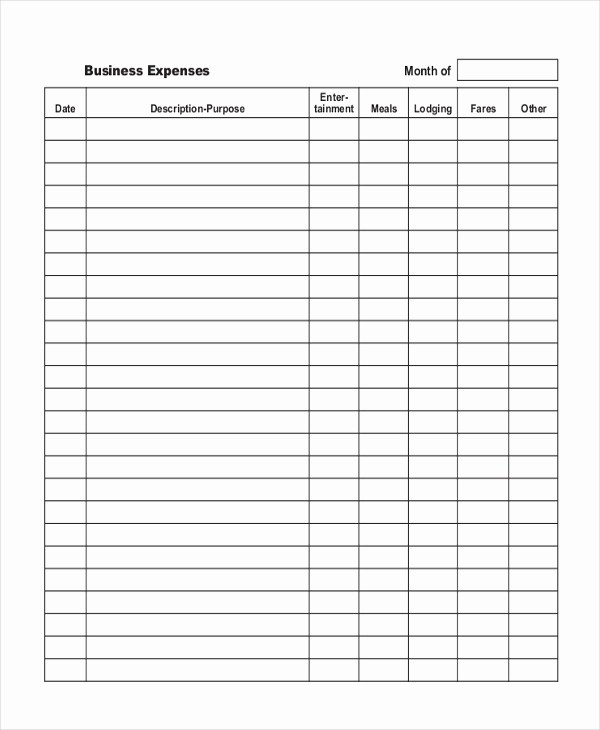

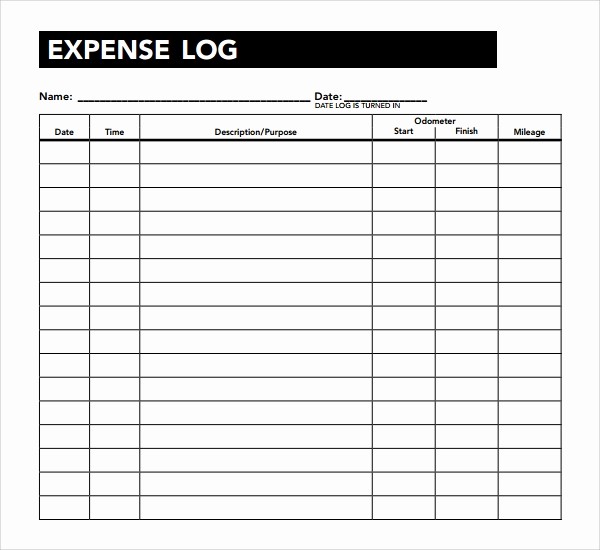

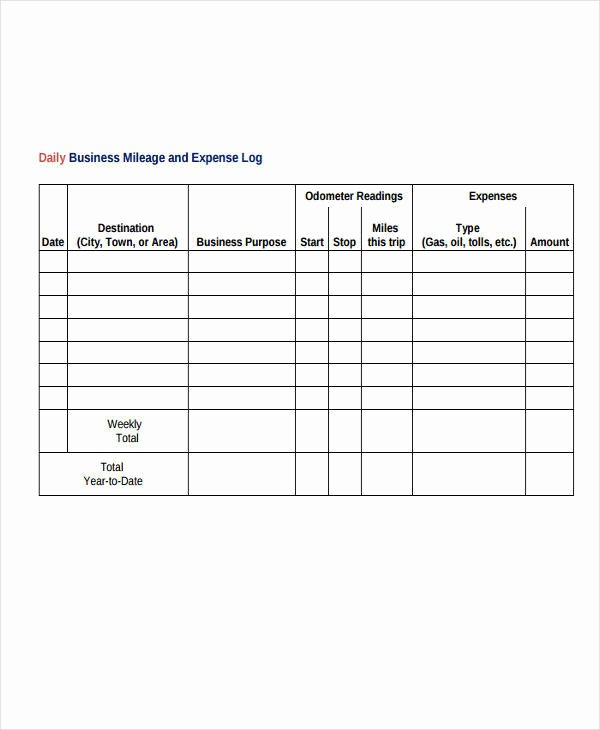

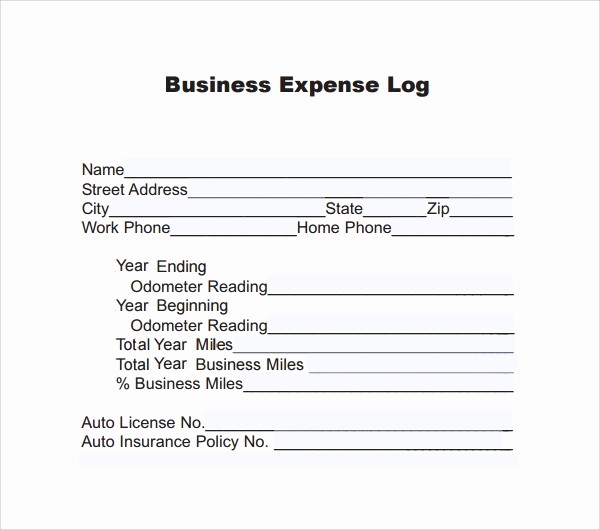

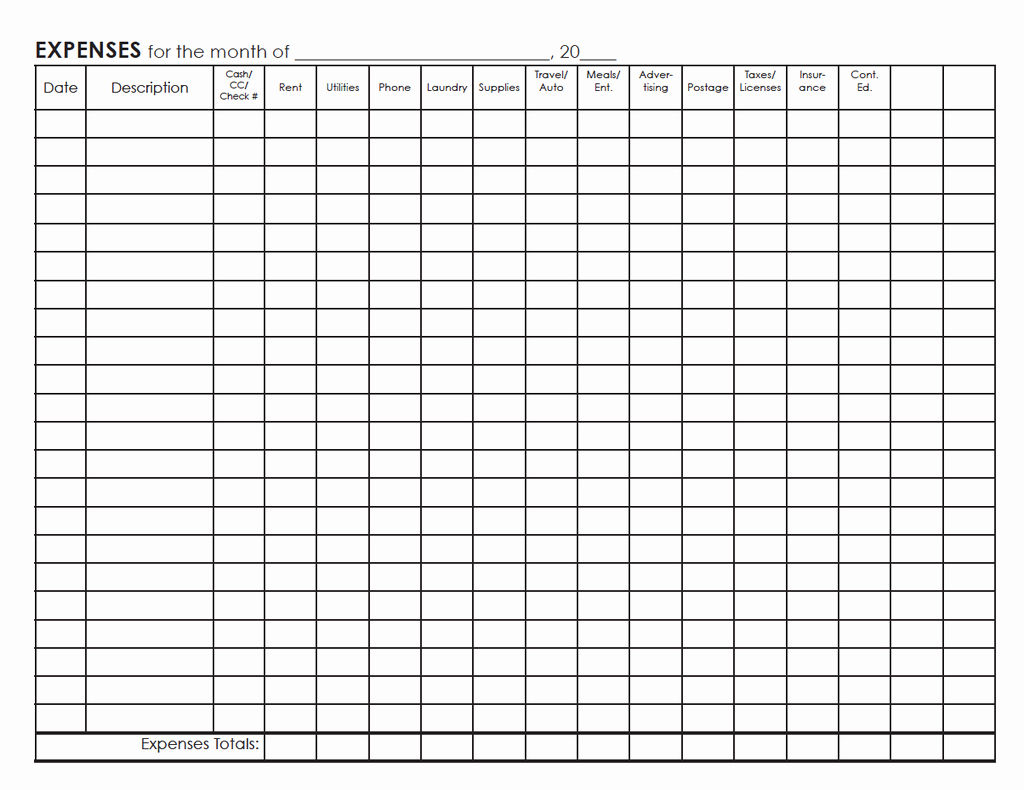

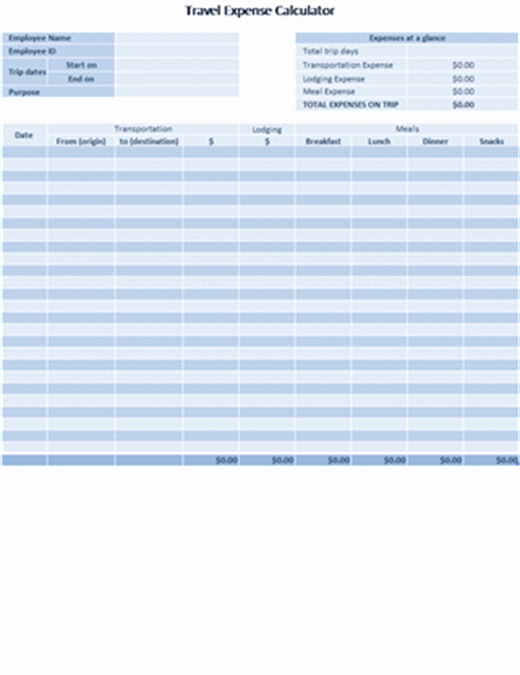

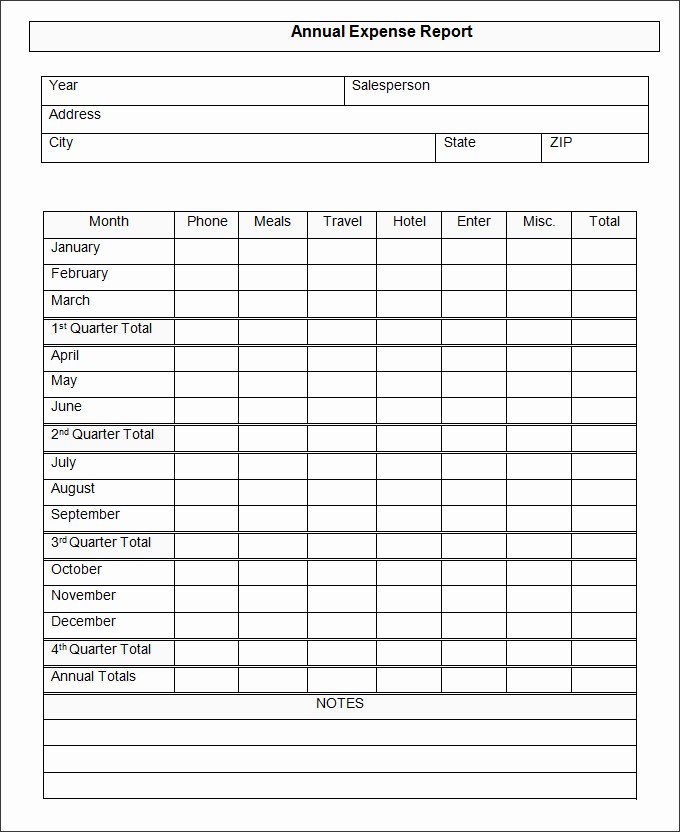

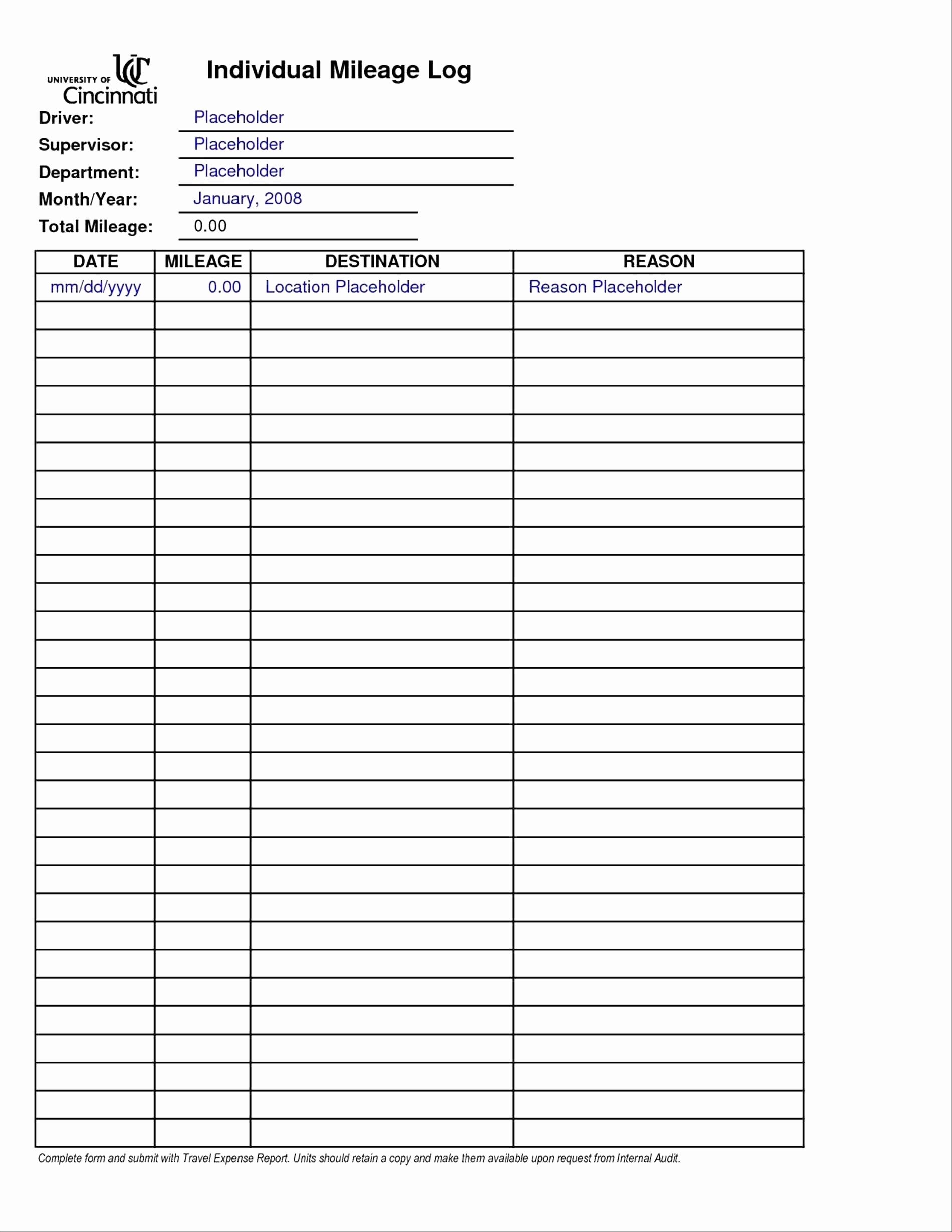

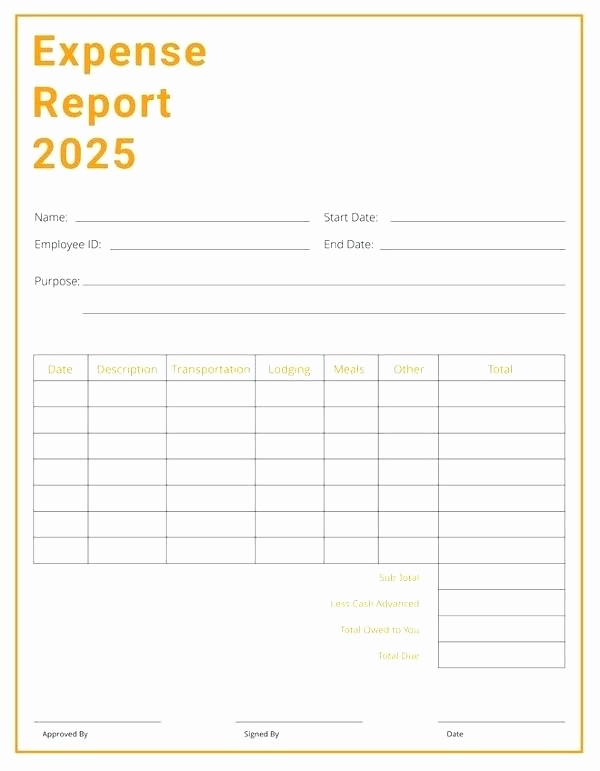

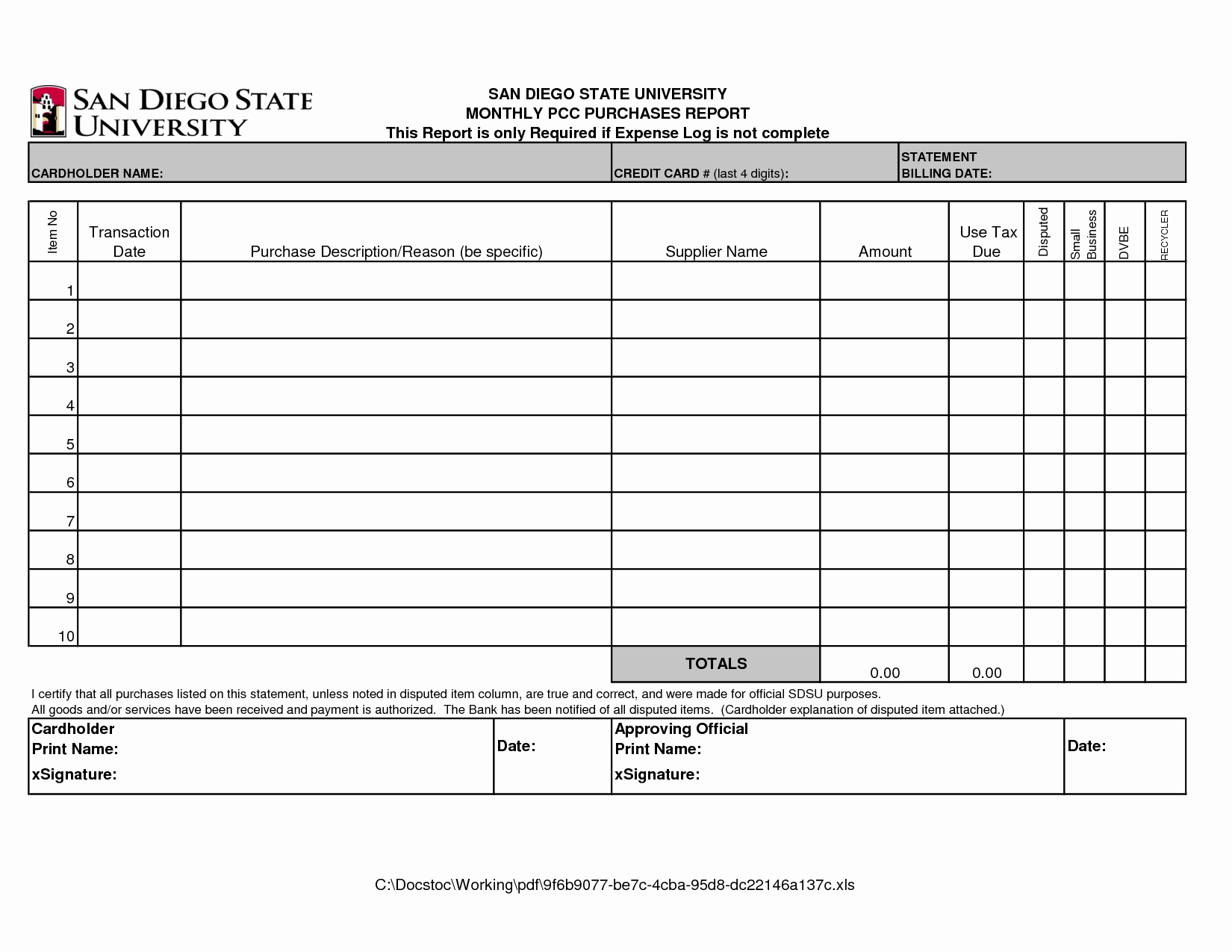

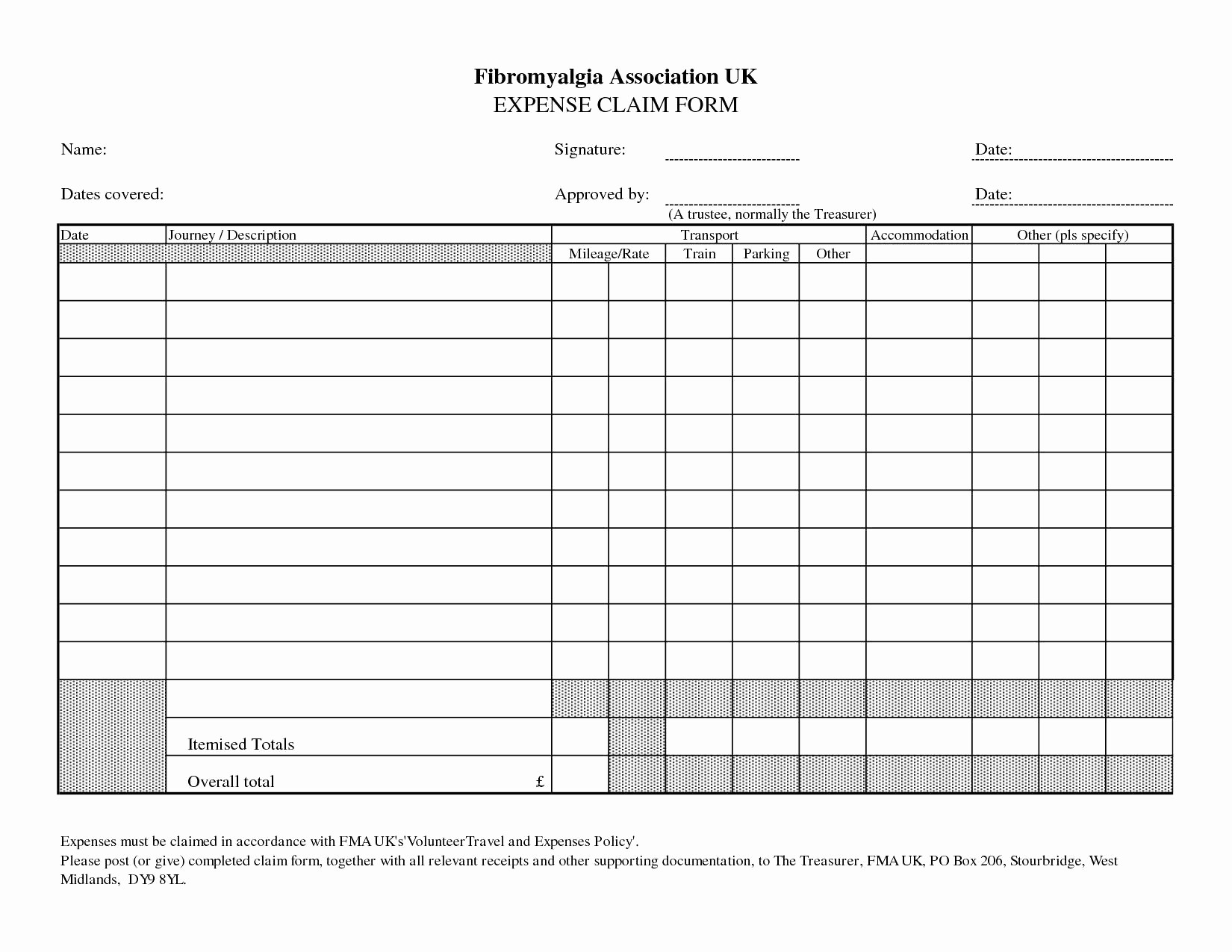

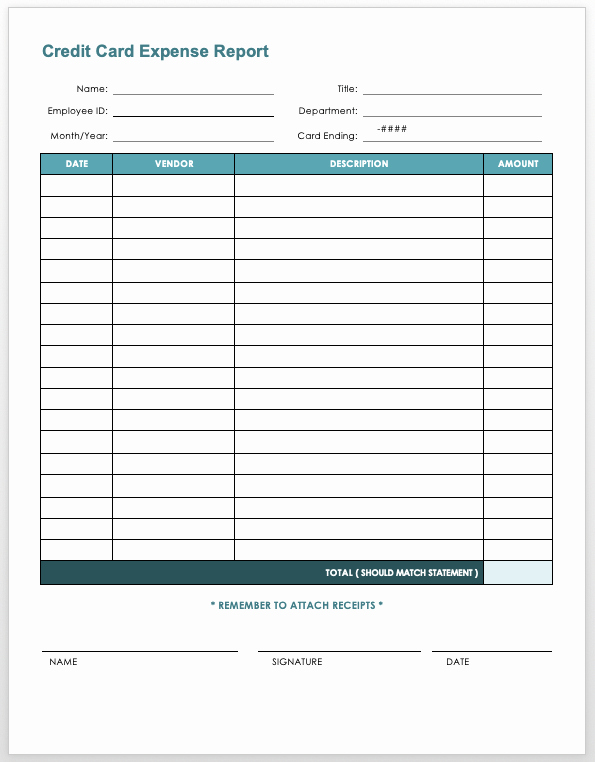

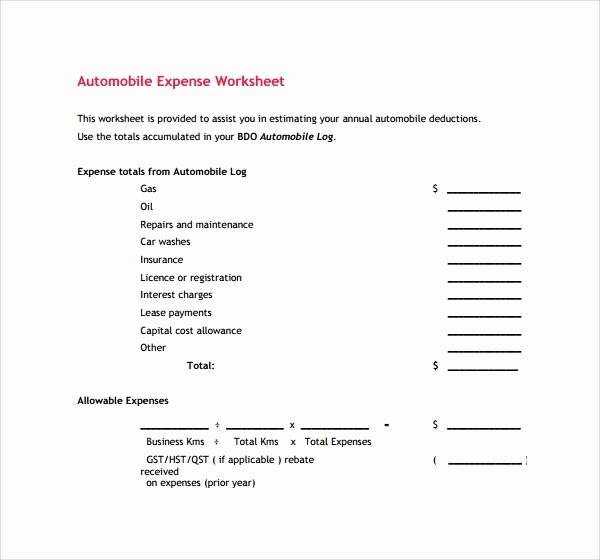

9 Expense Log Templates to Download from how to log business expenses , image source: www.sampletemplates.com