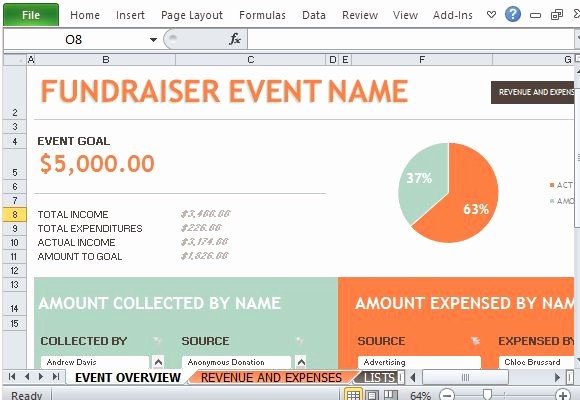

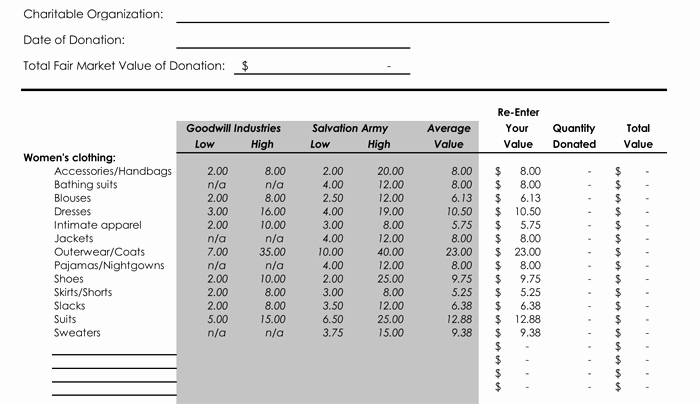

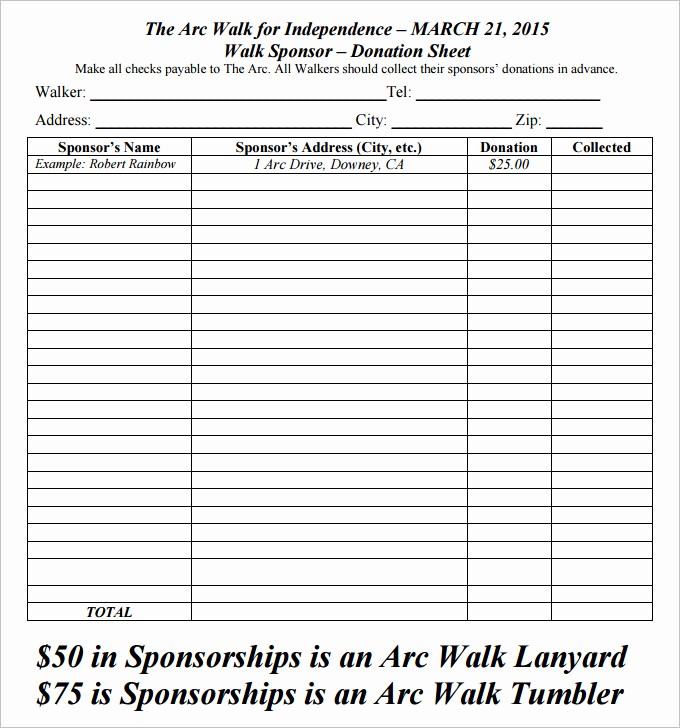

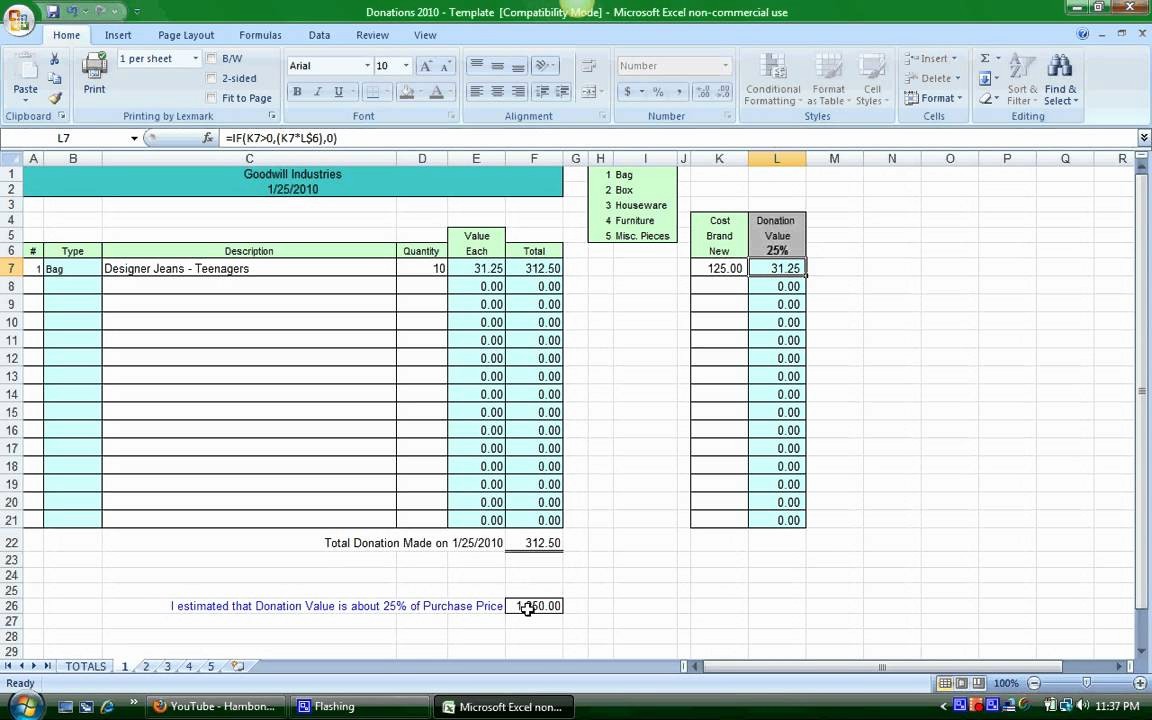

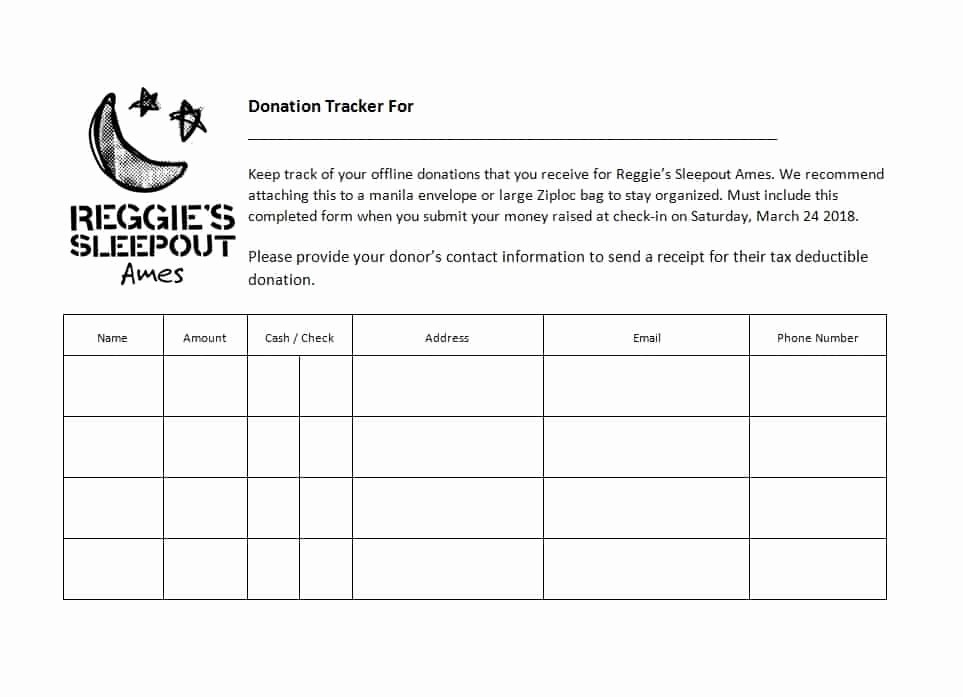

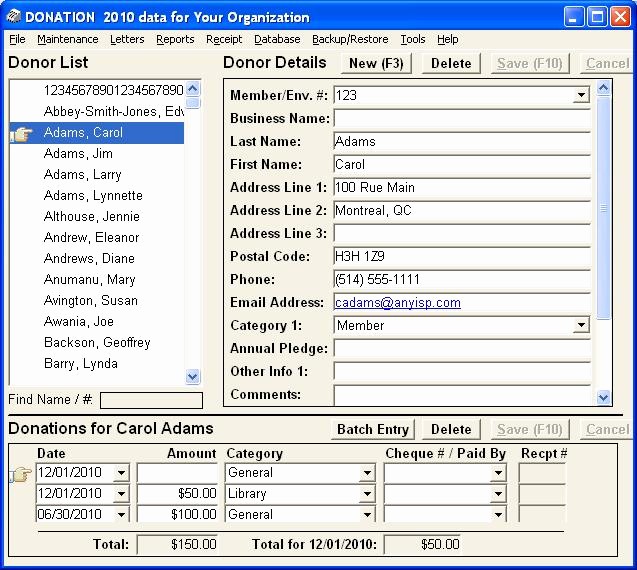

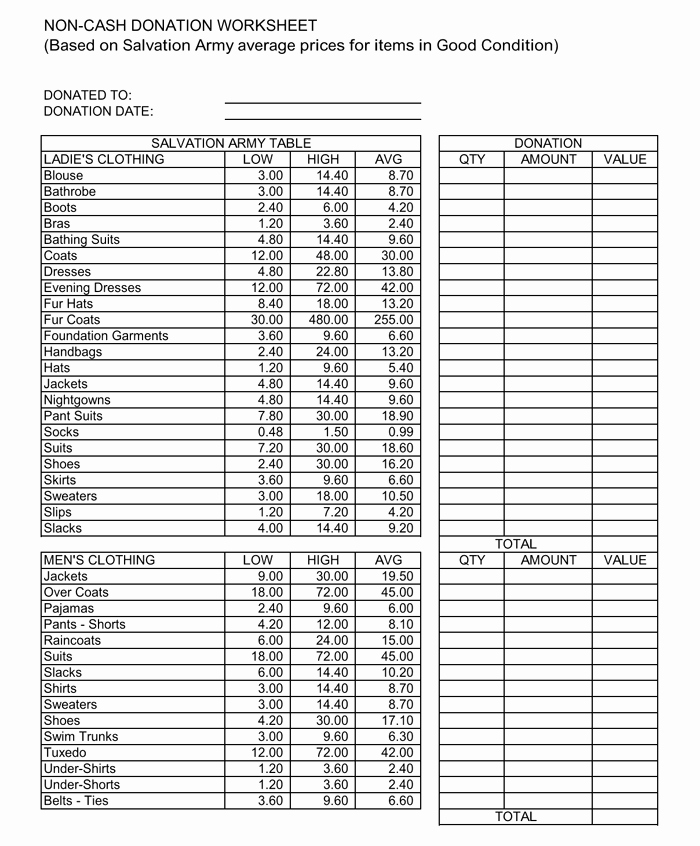

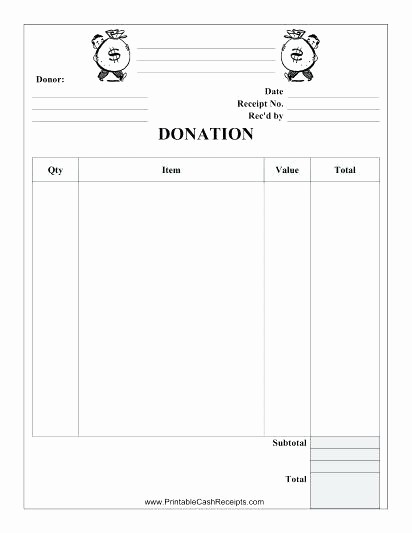

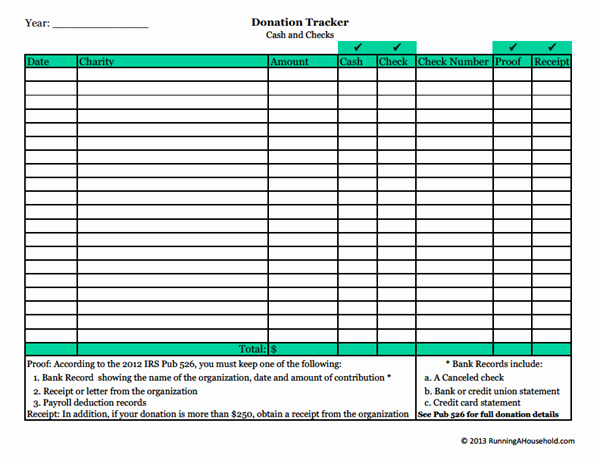

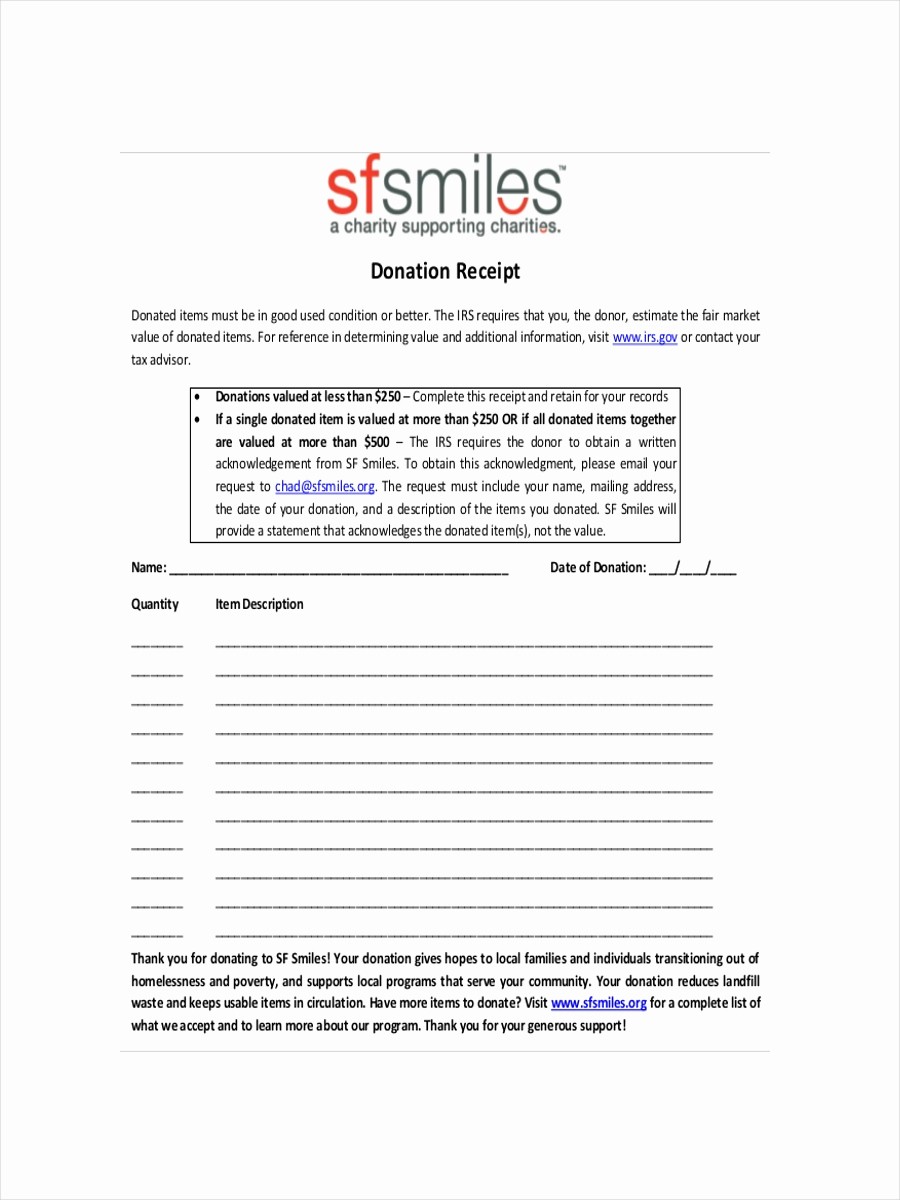

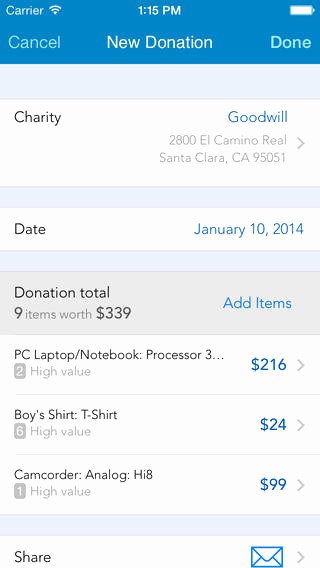

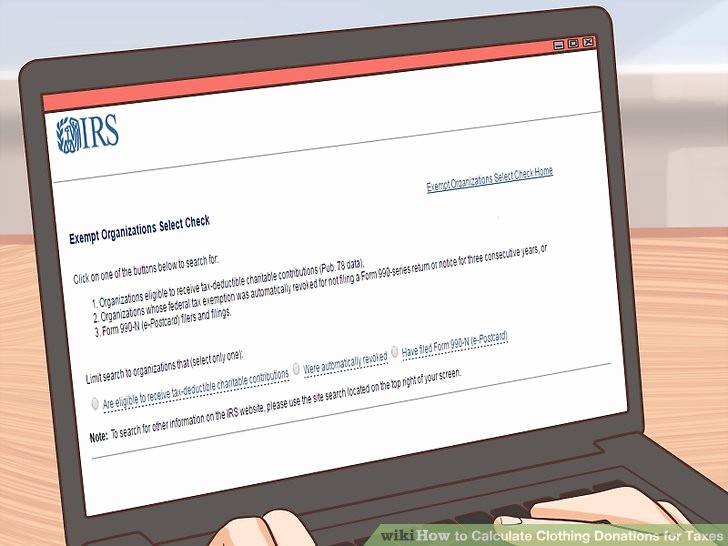

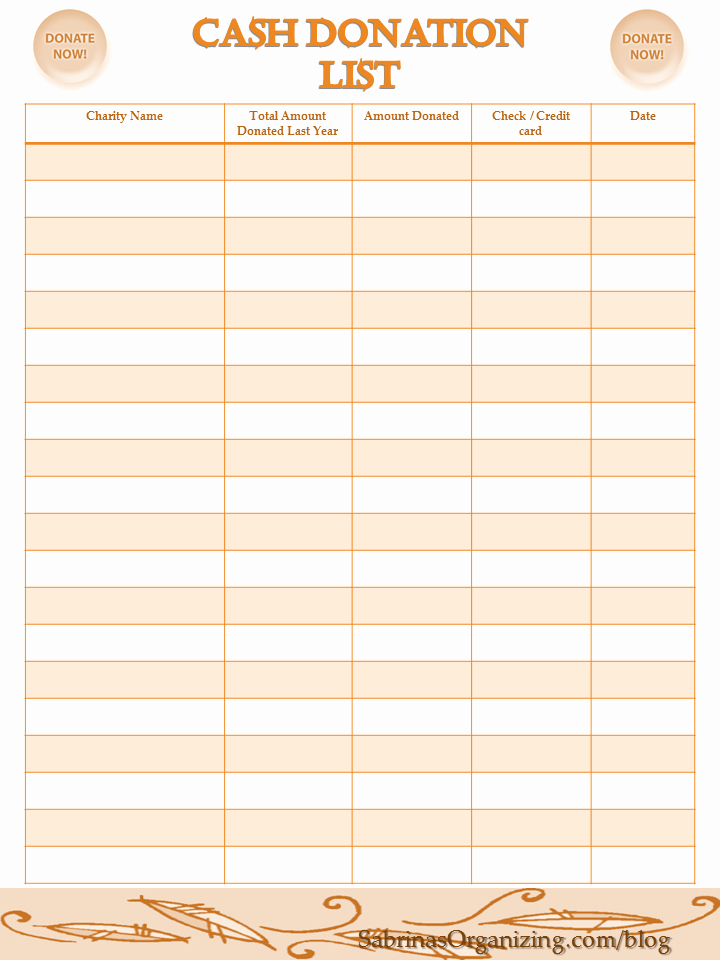

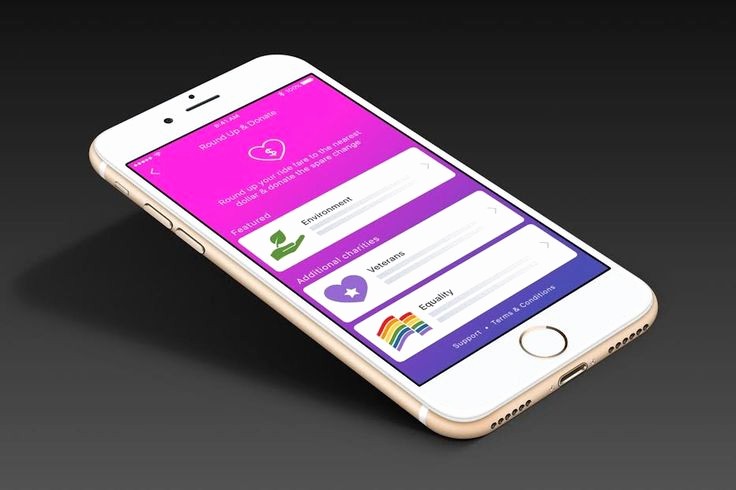

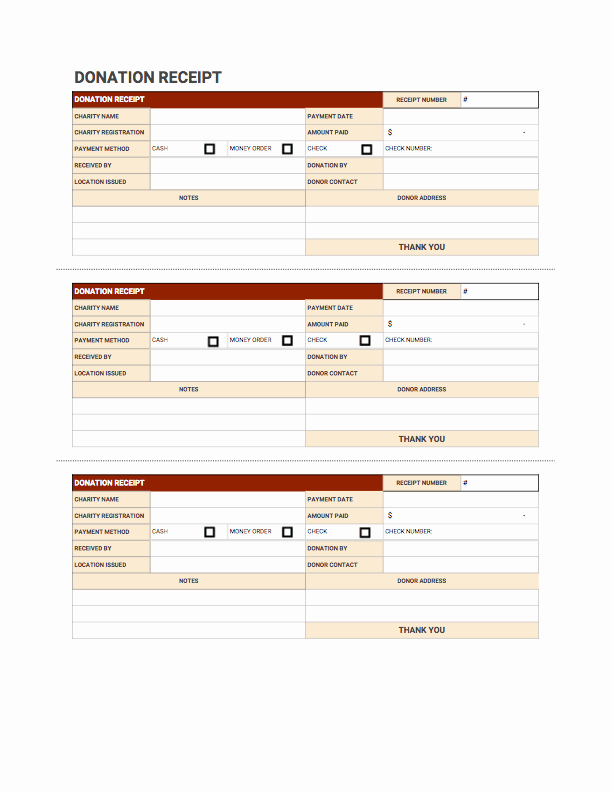

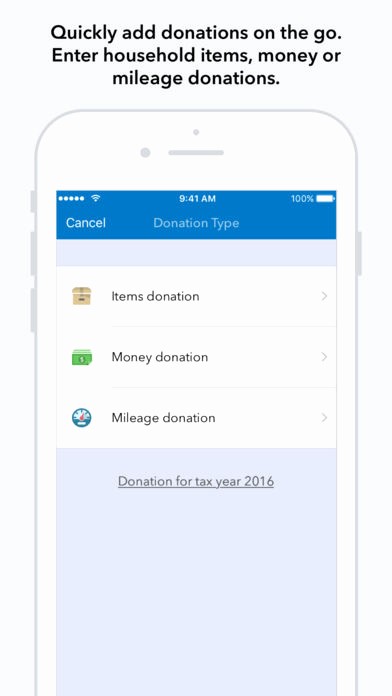

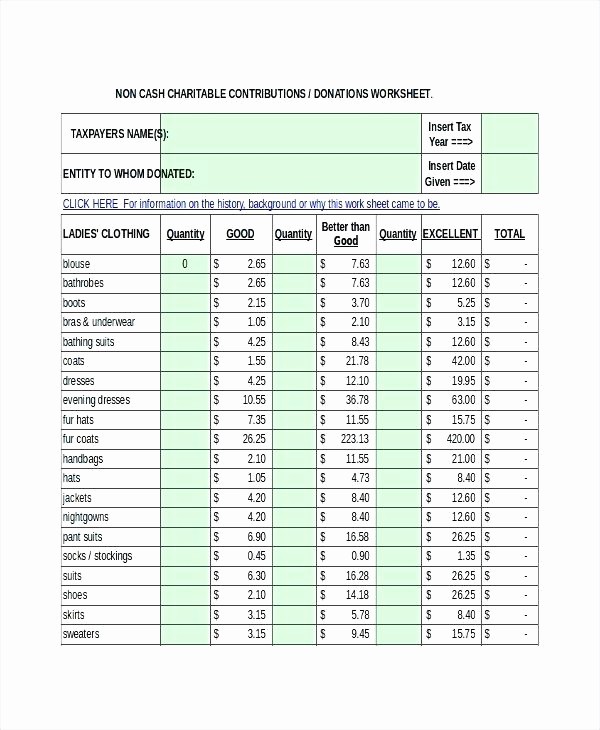

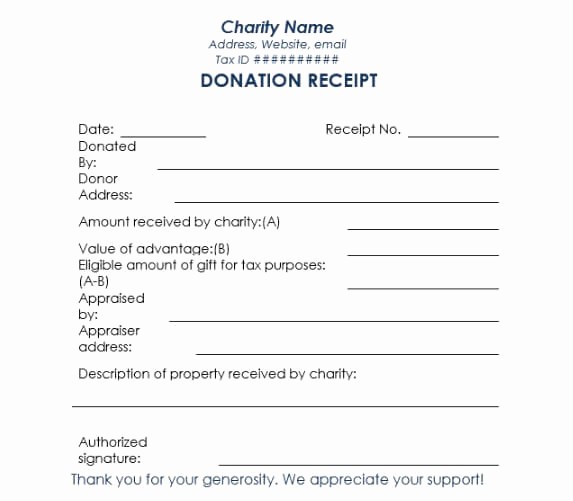

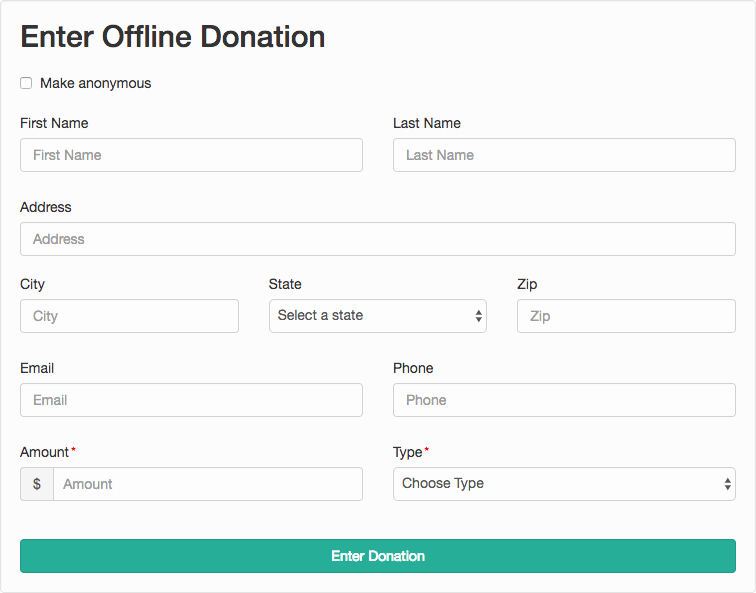

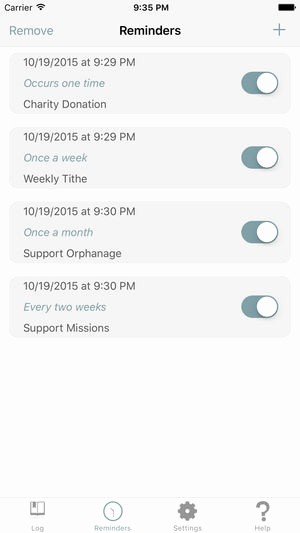

turbotax itsdeductible track charitable donations for turbotax itsdeductible makes it easy to track your charitable donations so you the biggest tax deduction possible get the most from your charitable contributions anytime available online on the web or the itsdeductible in the app store for on the go donation tracking publication 526 2017 charitable contributions introduction this publication explains how to claim a deduction for your charitable contributions it discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct 16 tips for making tax deductible charitable donations keeping track of receipts when making donations is a necessity says jacob dayan ceo and co founder of chicago based munity tax donations made in cash are included in this rule the average american s charitable donations how do you tis the season for charitable giving and for tallying up the tax break that es with it with that in mind you might be wondering how much money or property the average person of your in e 5 things to know about charitable donations and taxes 3 you need acknowledgment of ts of $250 or more most people give cash or checks as their charitable donations because it s simple however there are some requirements for ts of $250 or more

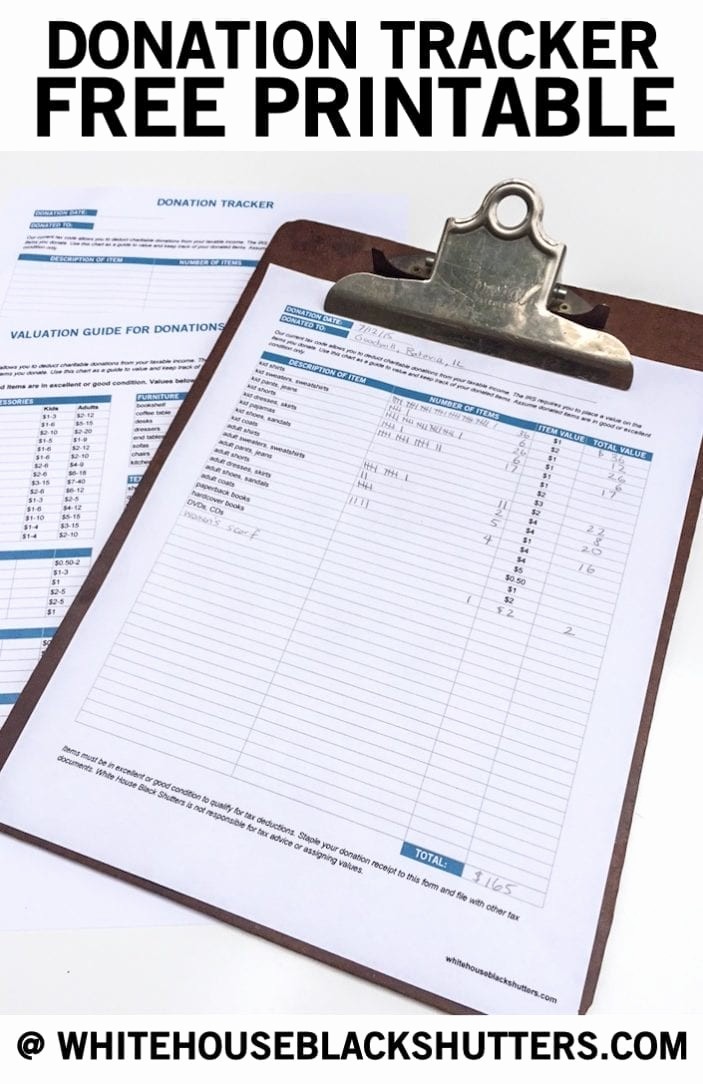

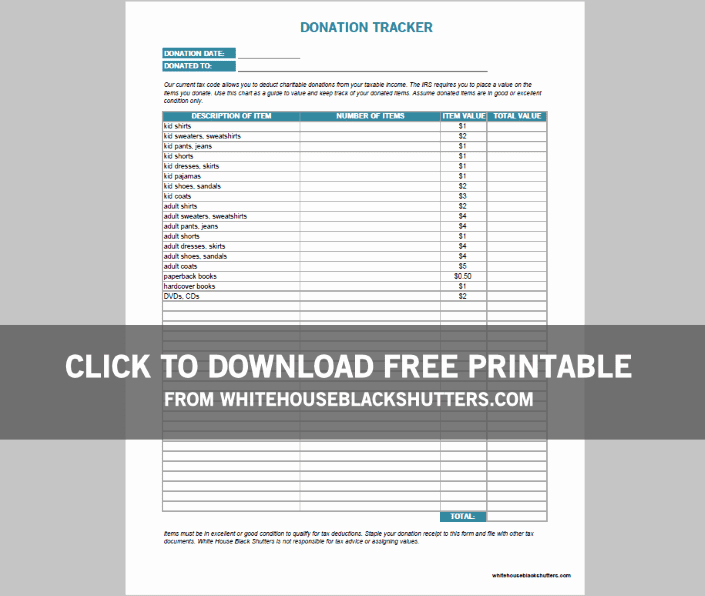

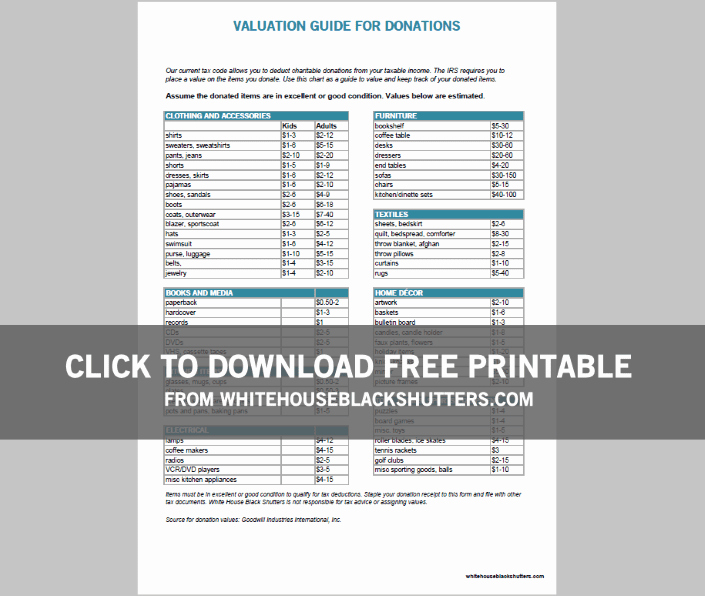

97 Itsdeductible Mobile Track Your Donations Explore The from keep track of charitable donations , image source: ffcomores.com