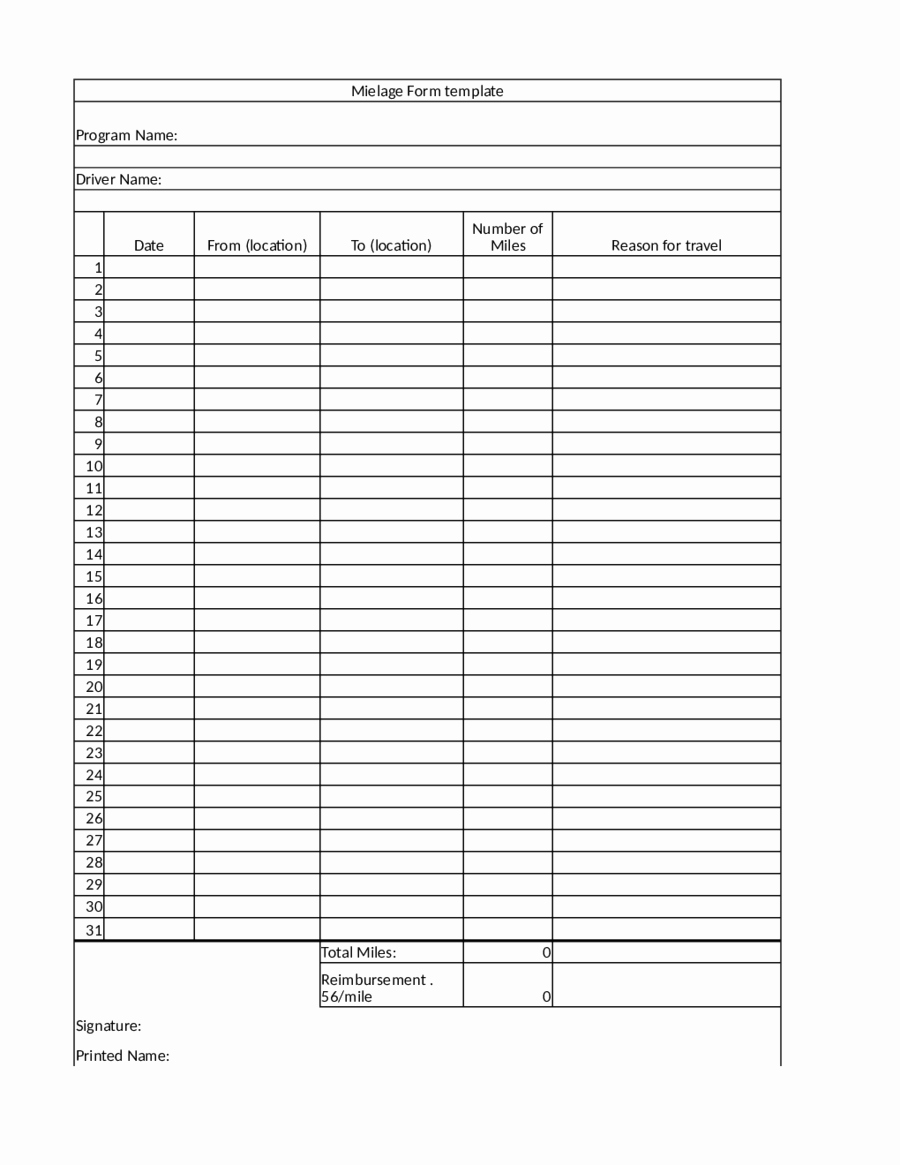

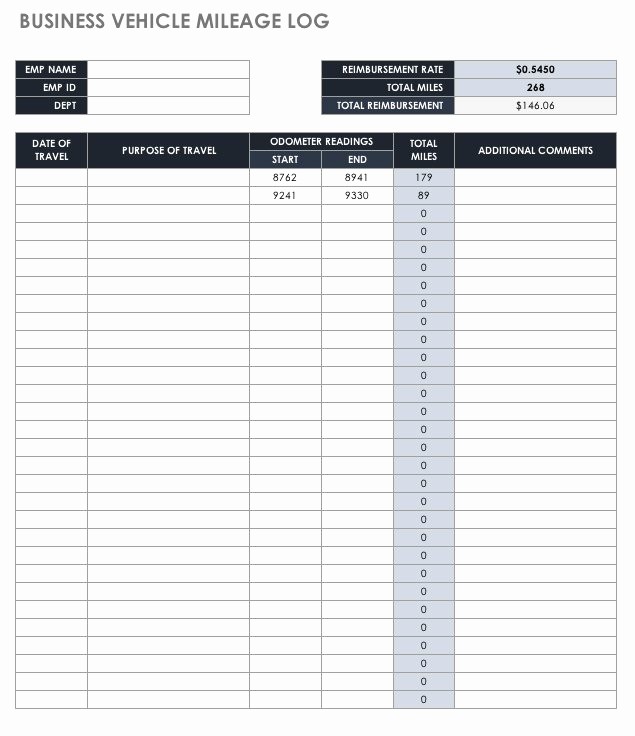

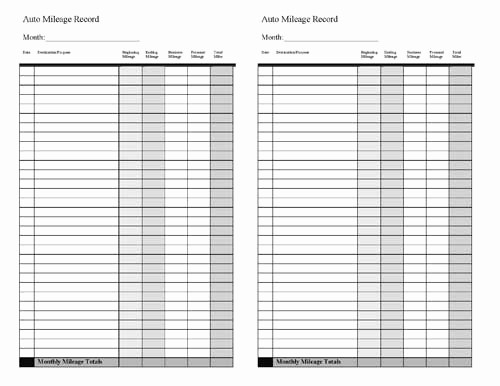

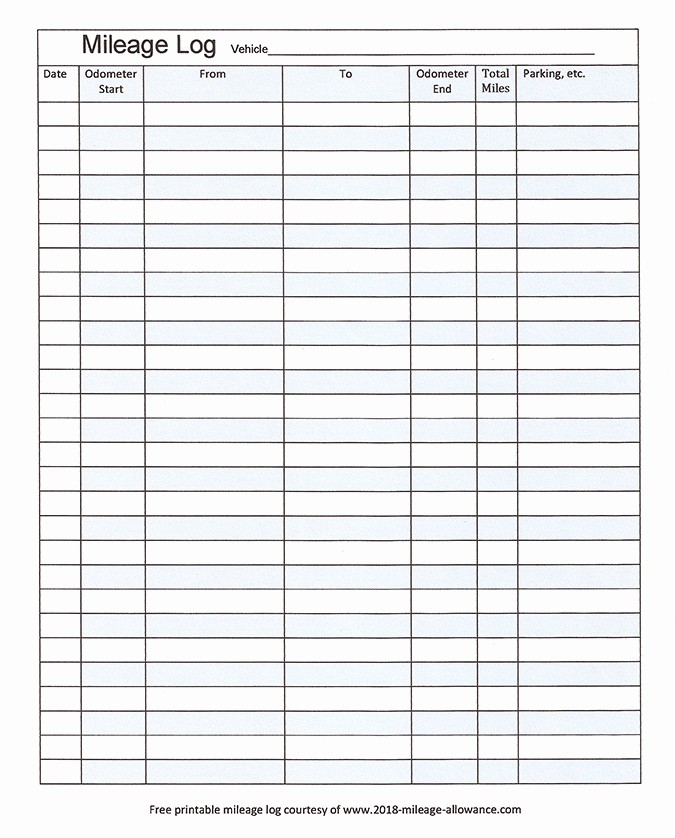

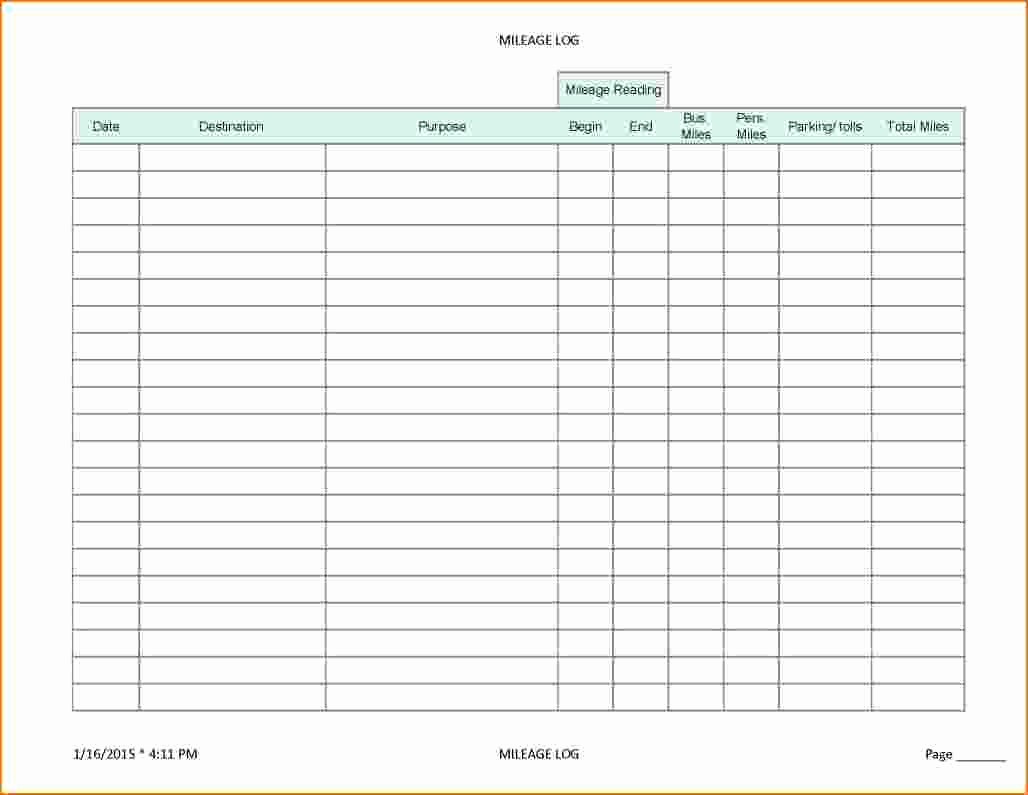

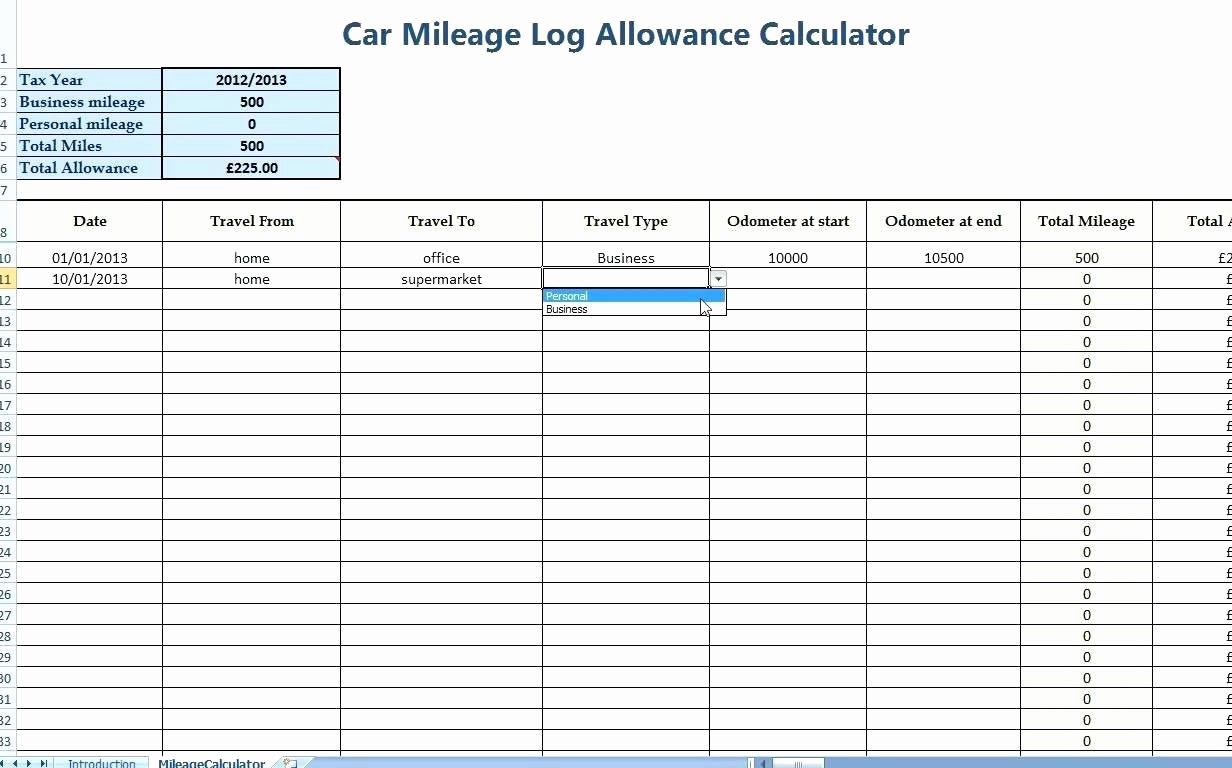

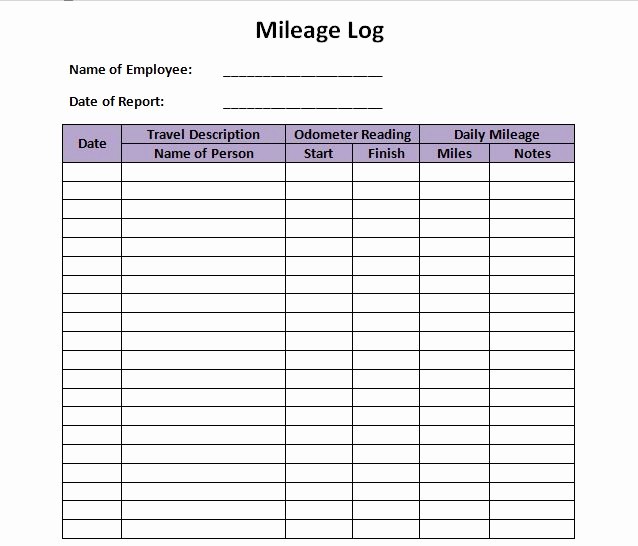

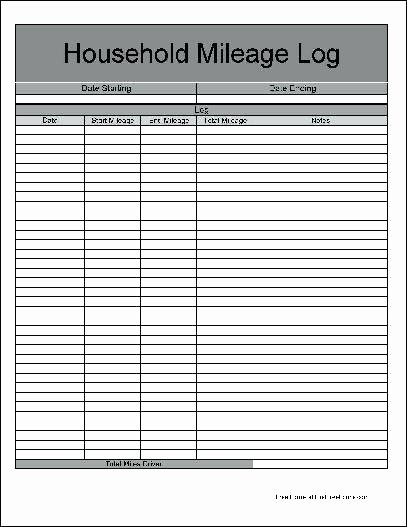

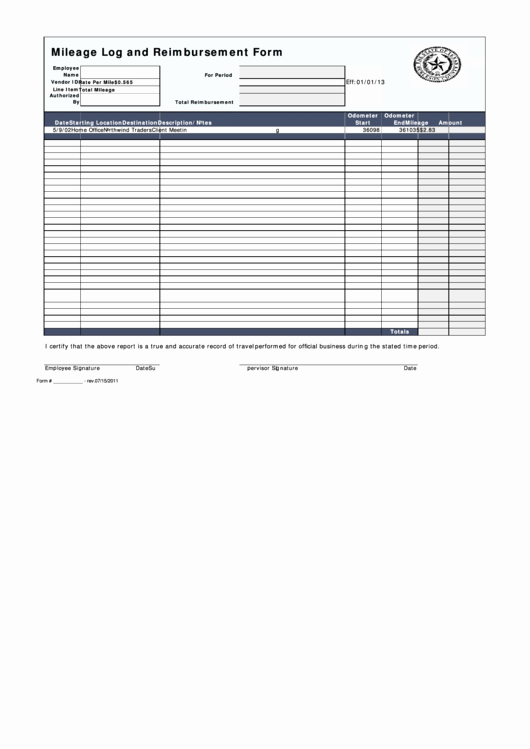

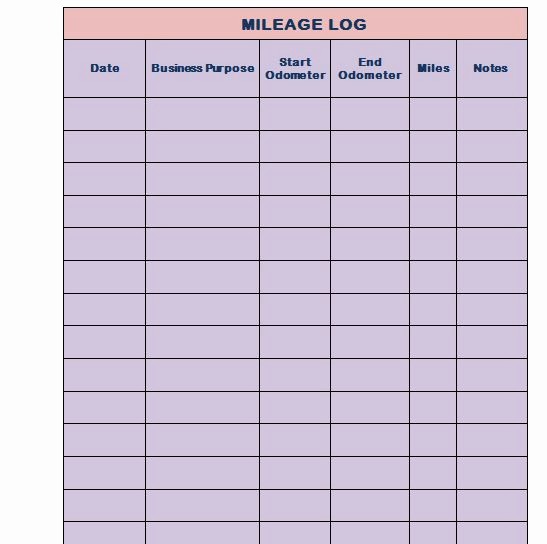

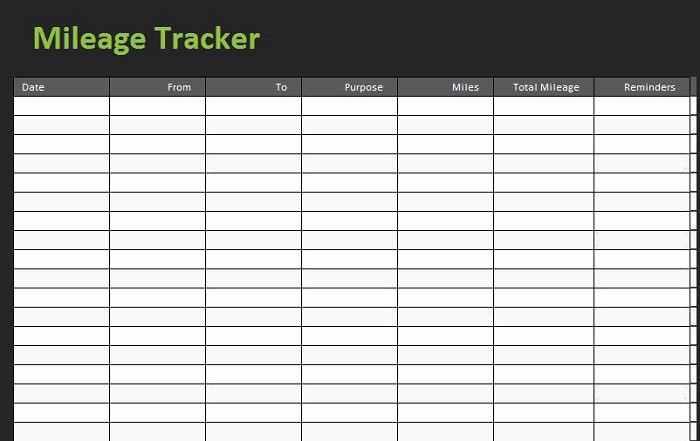

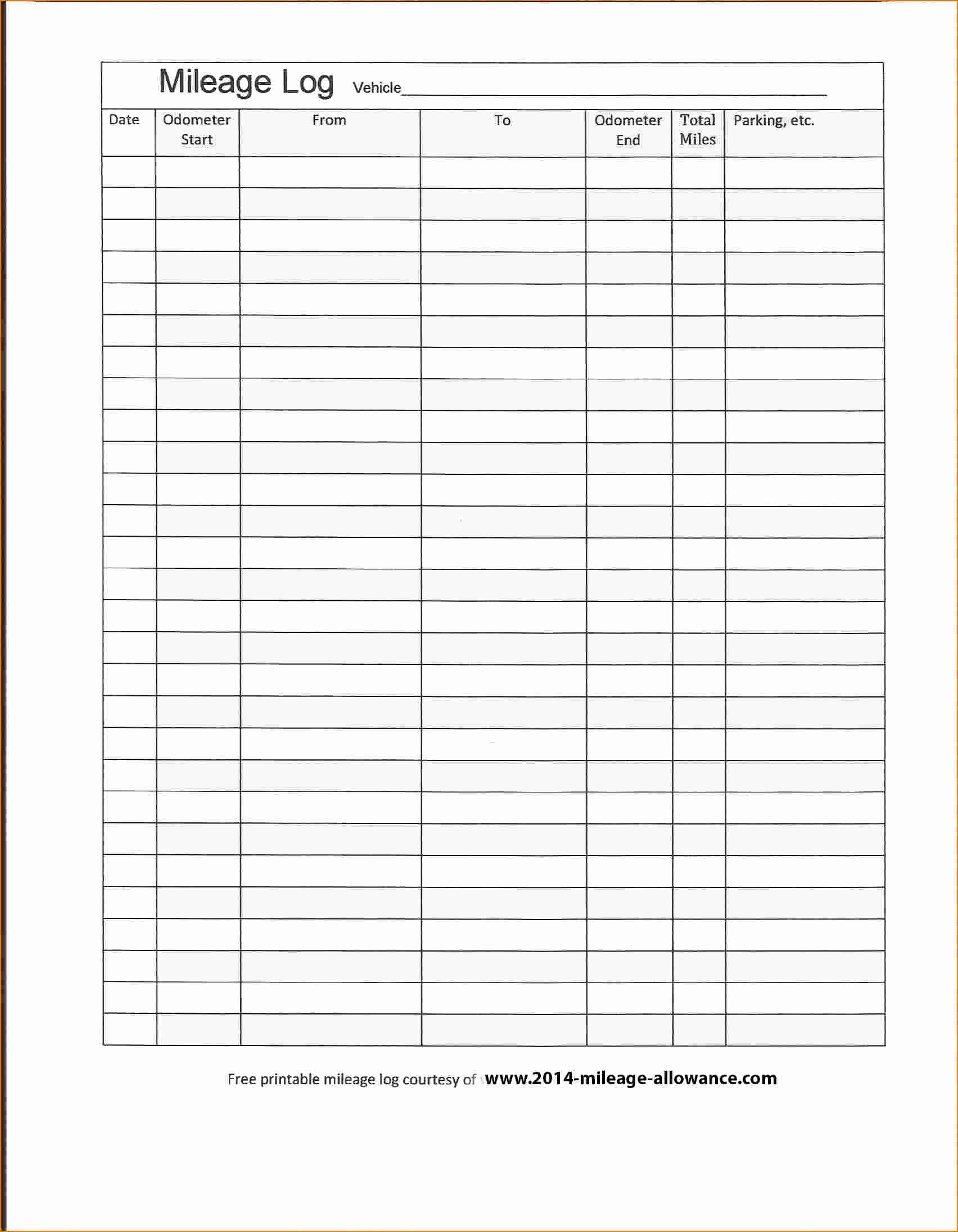

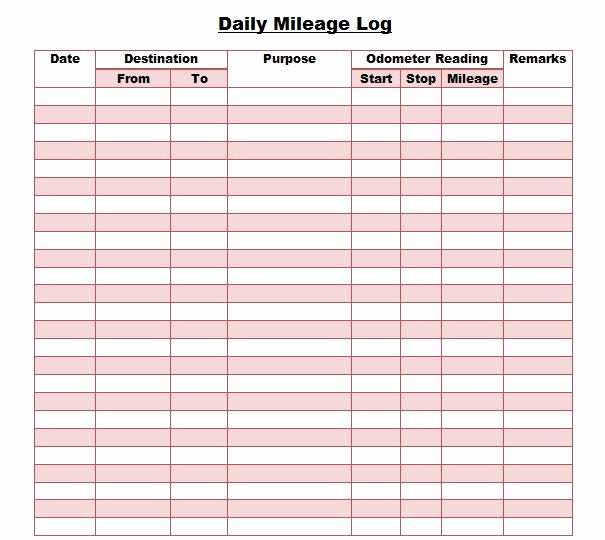

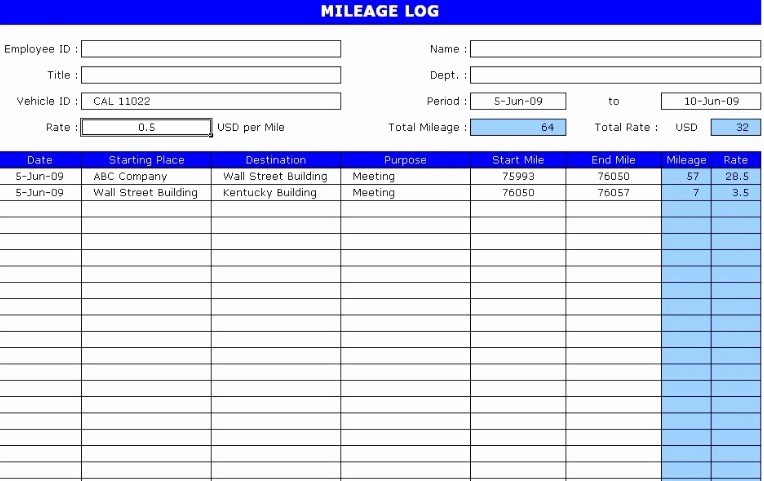

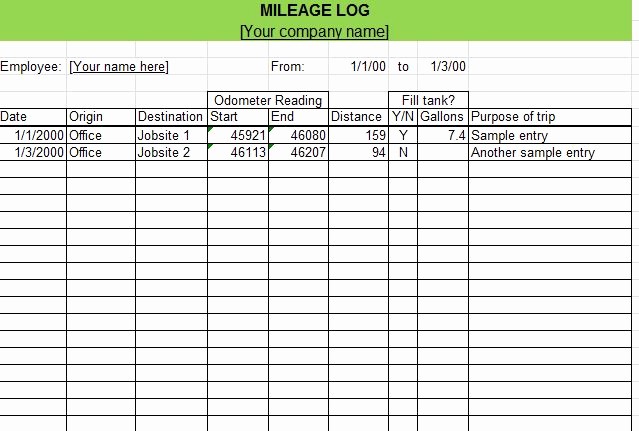

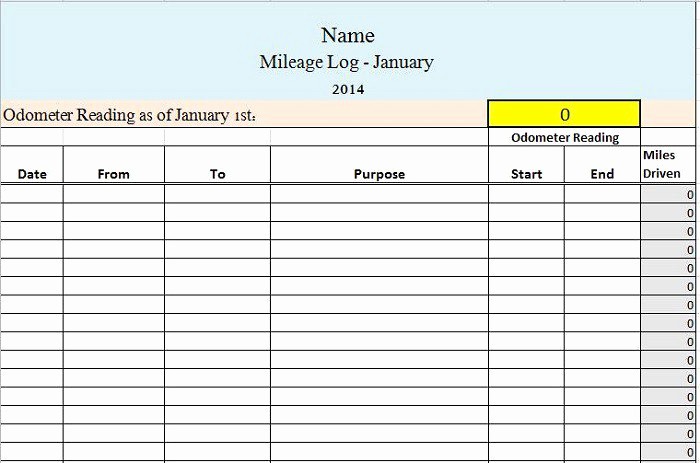

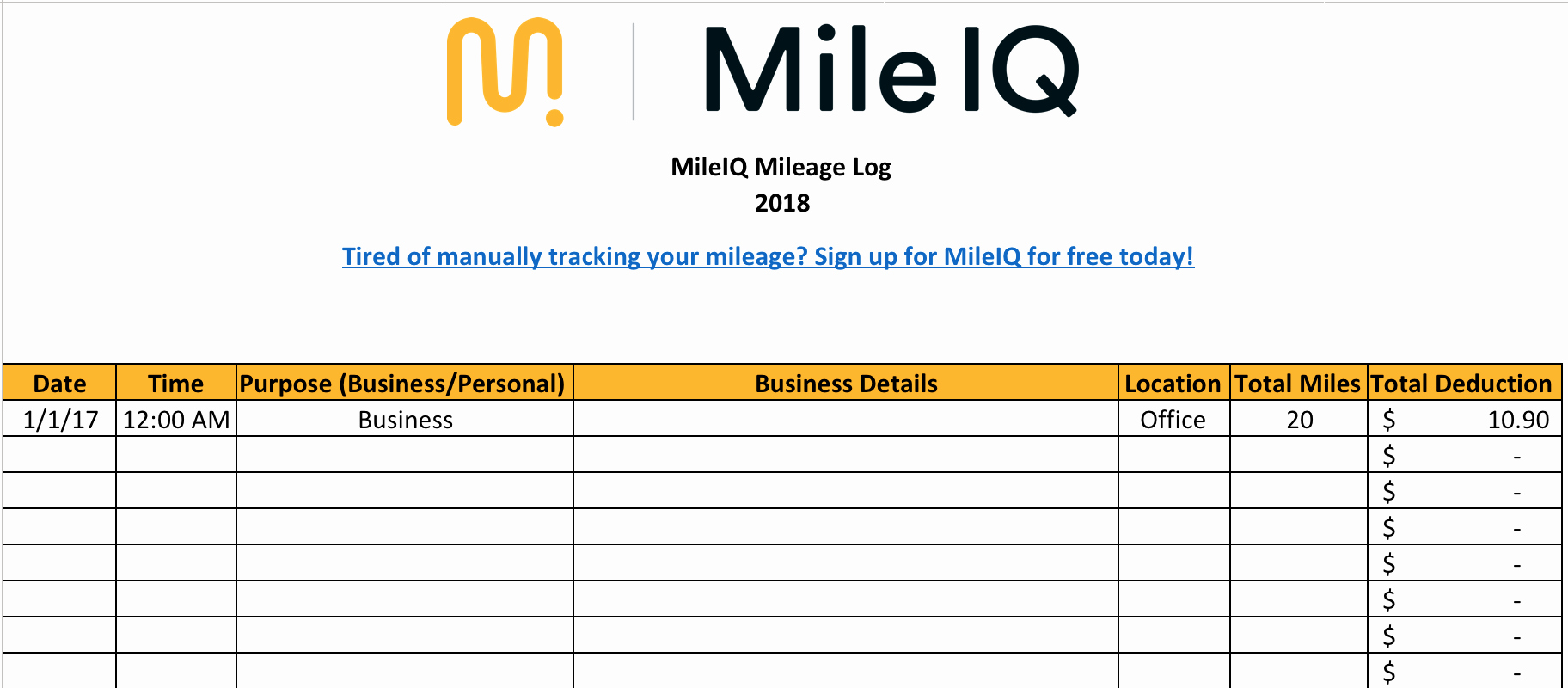

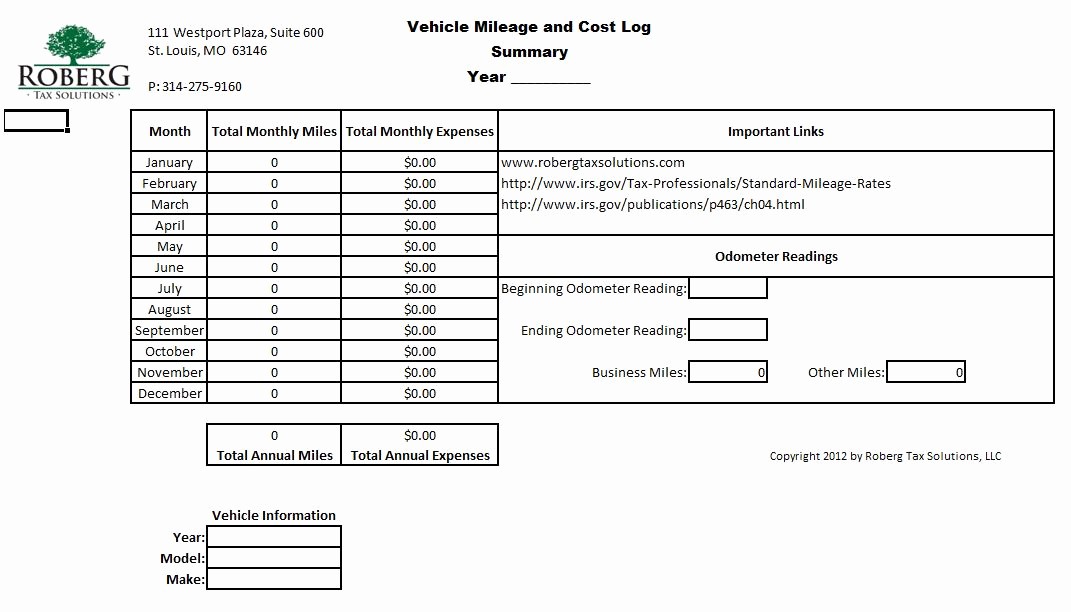

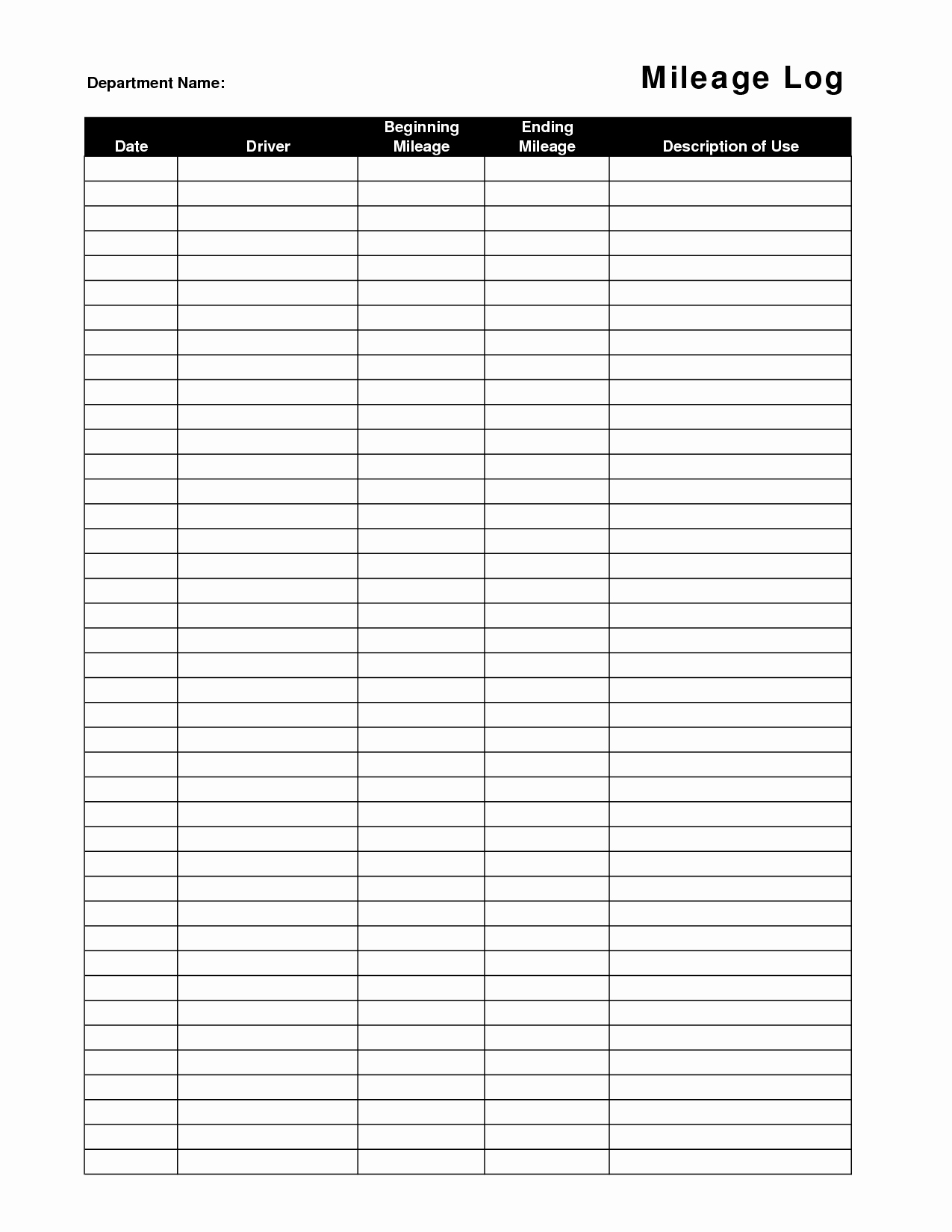

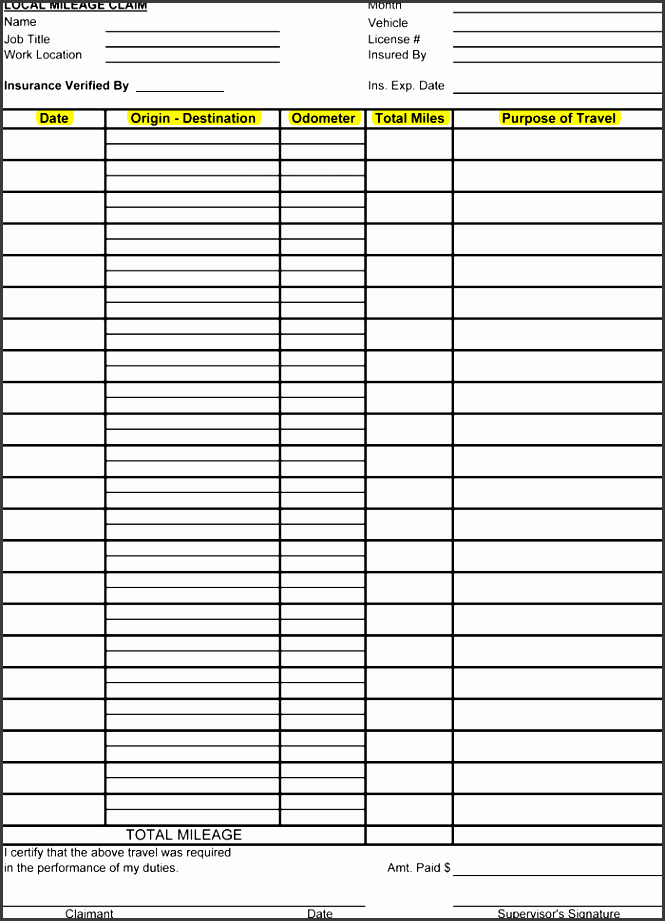

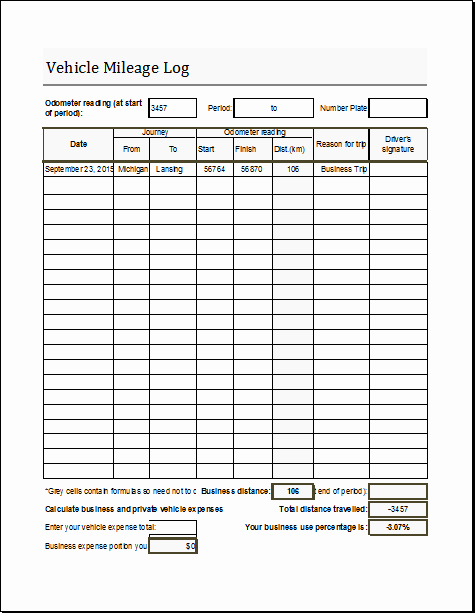

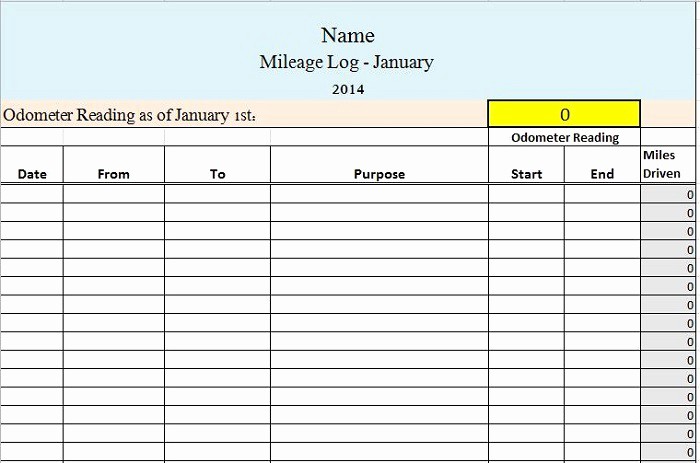

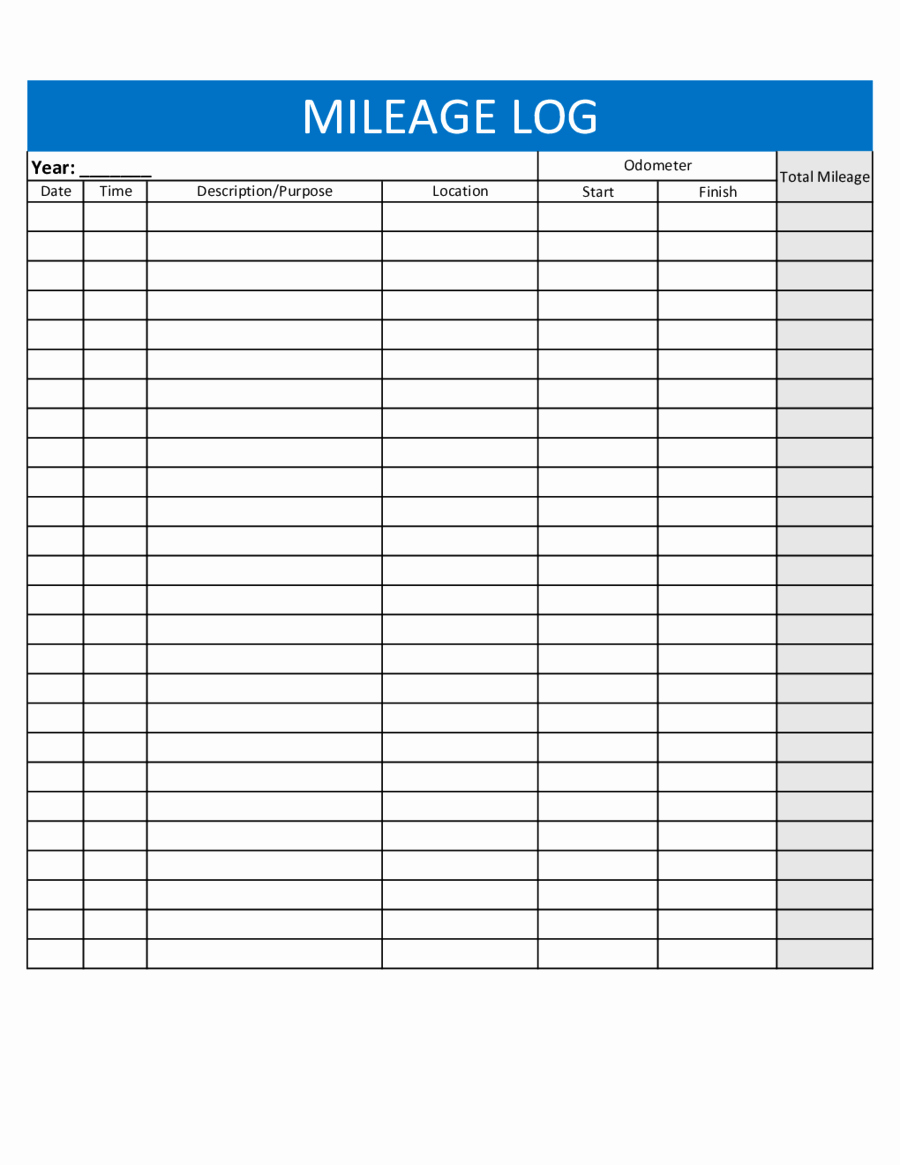

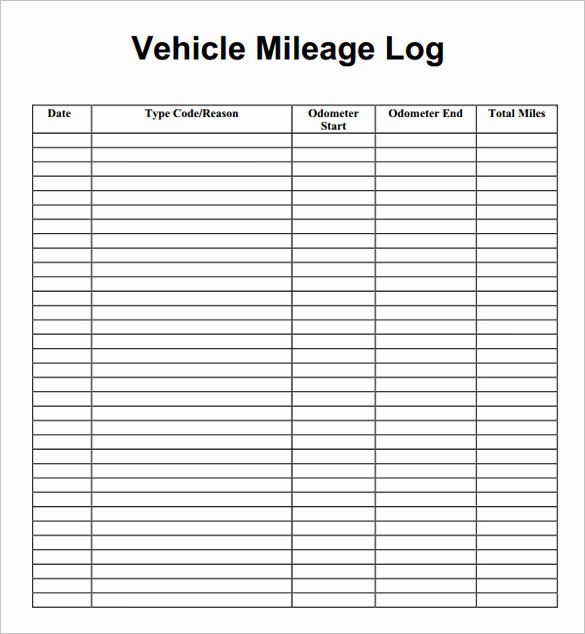

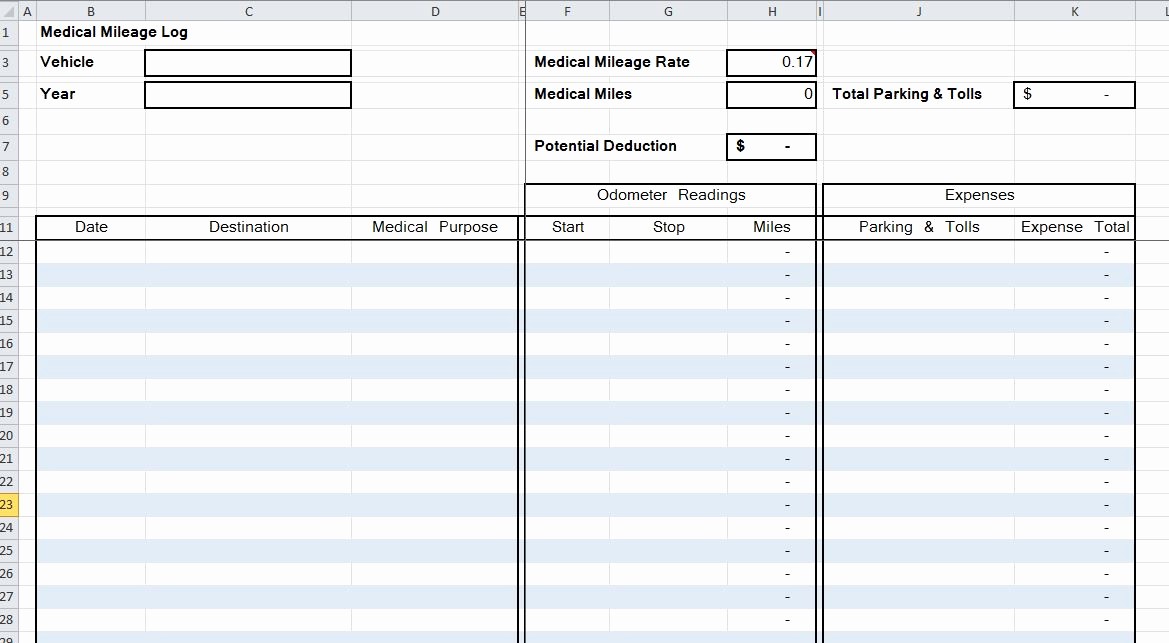

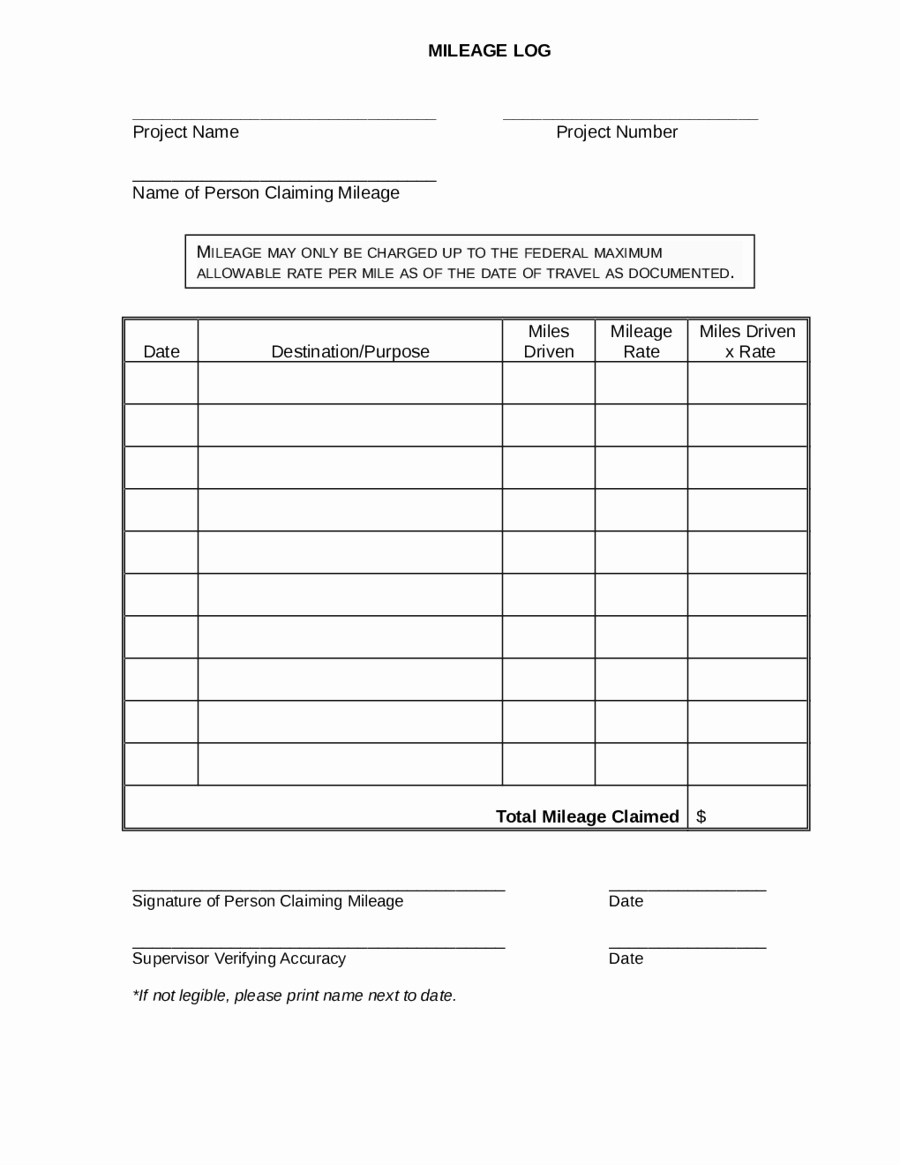

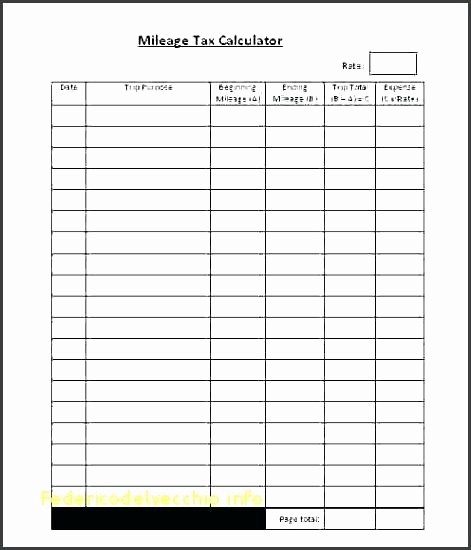

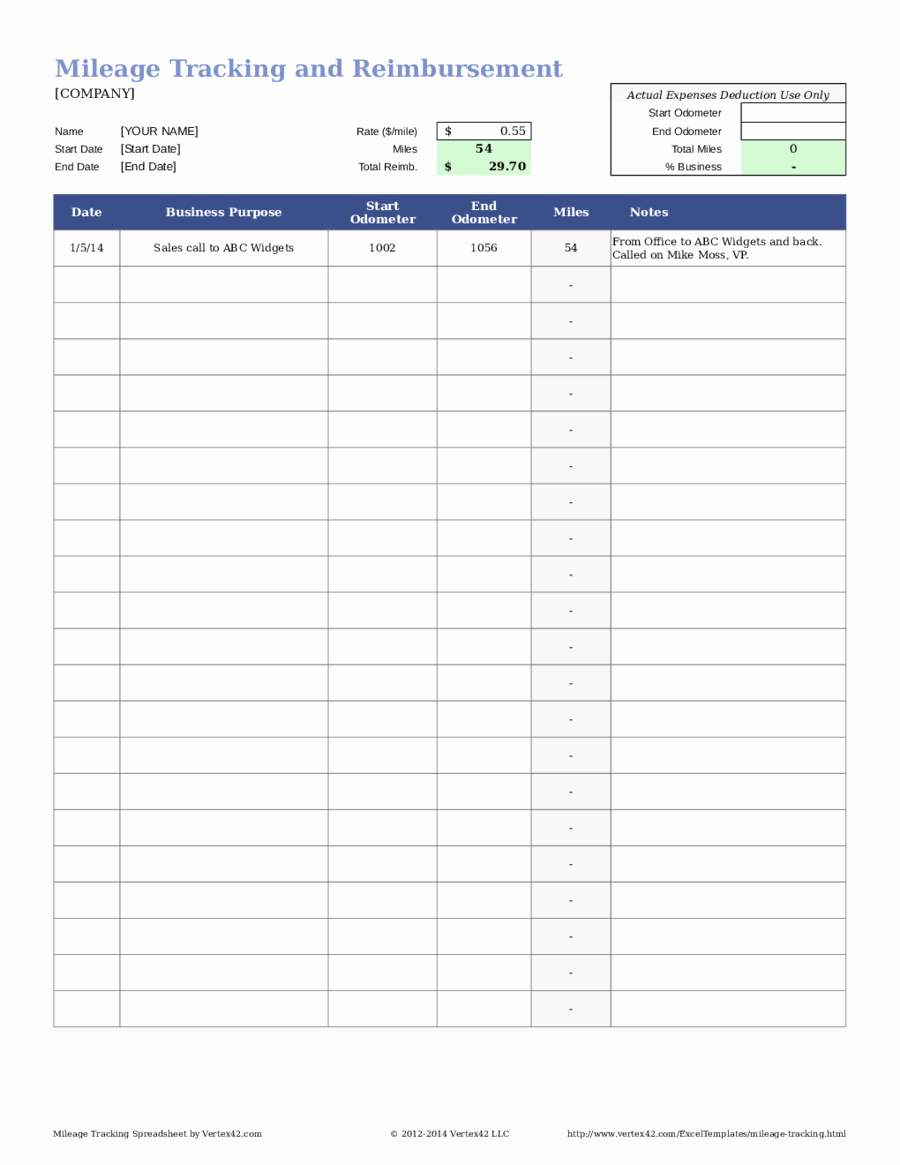

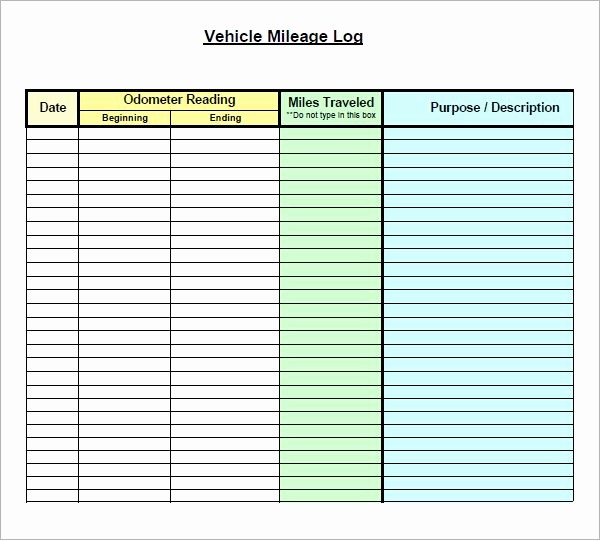

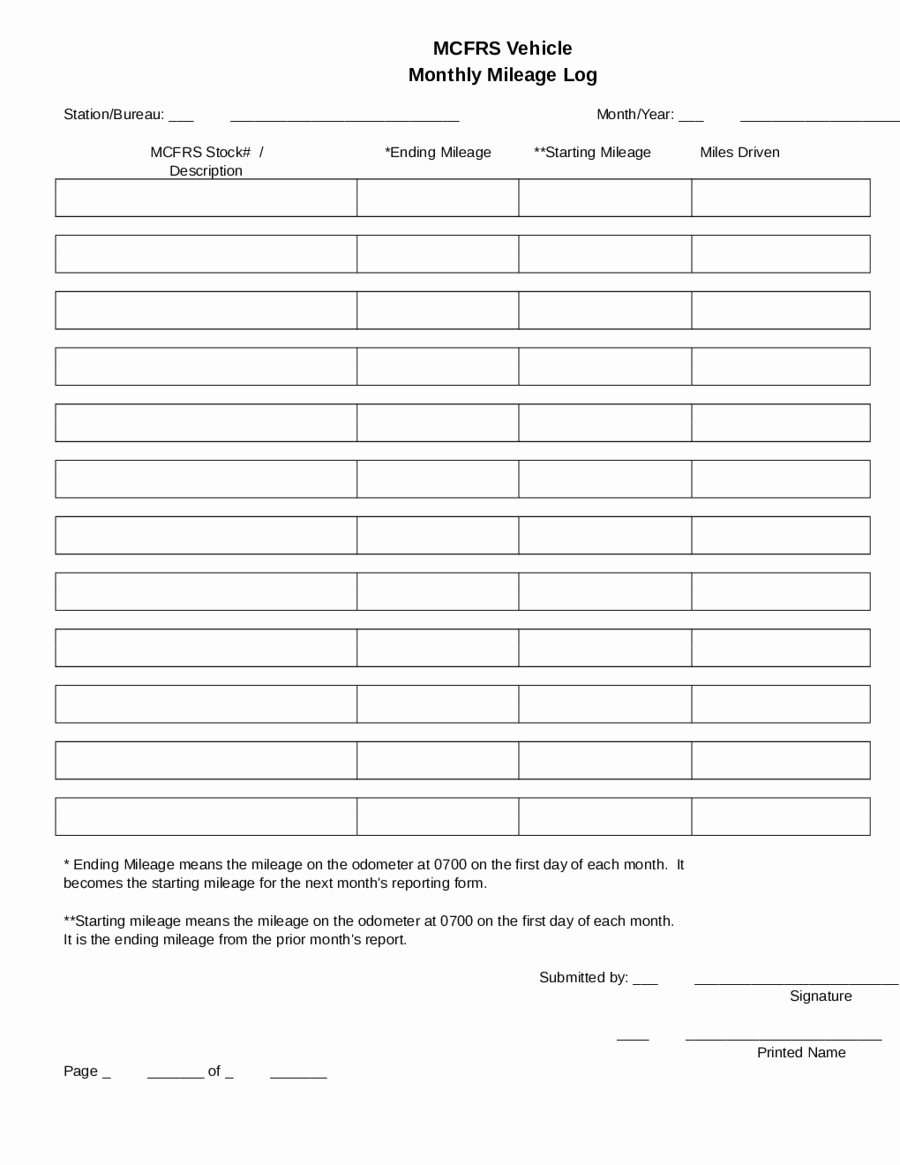

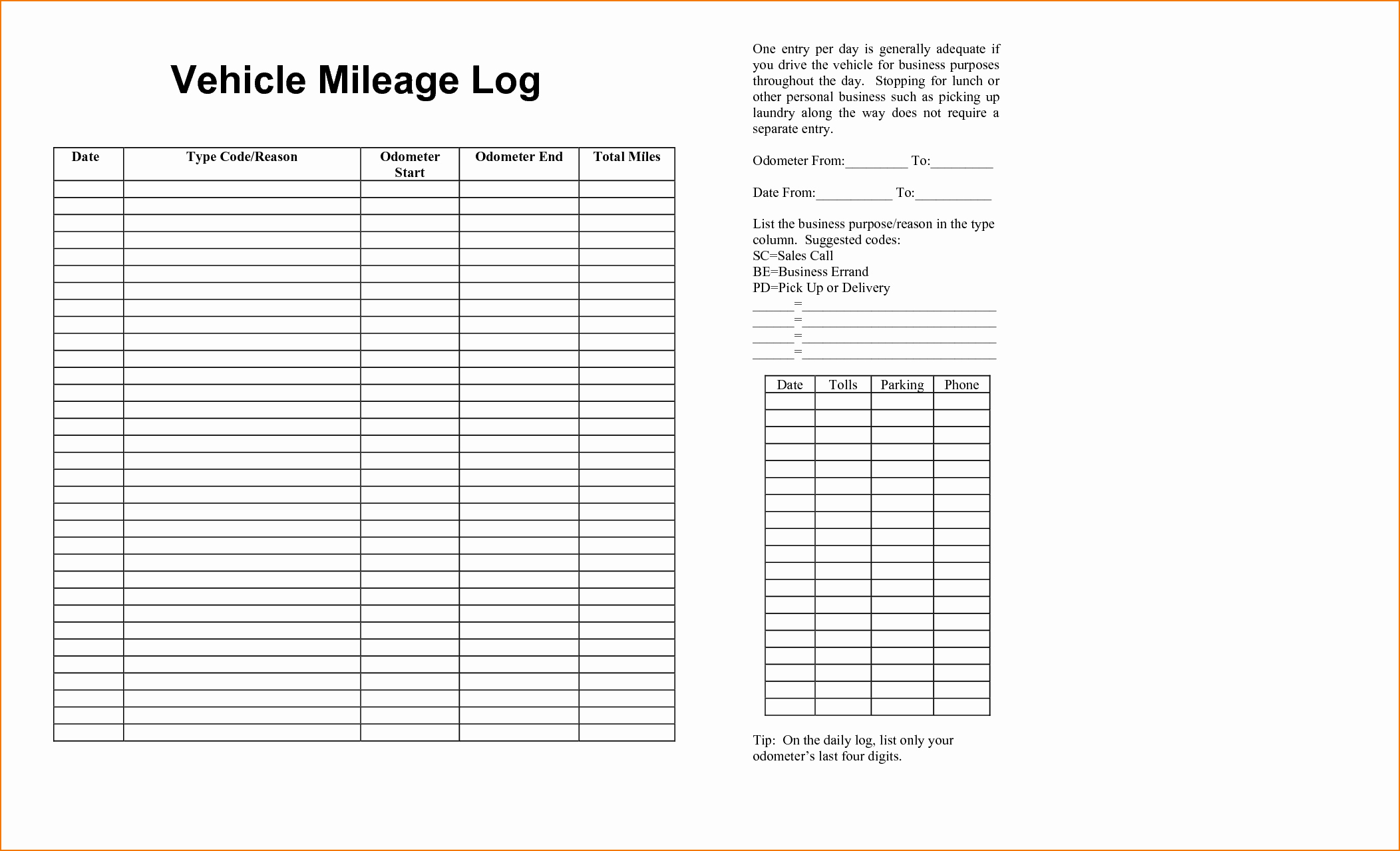

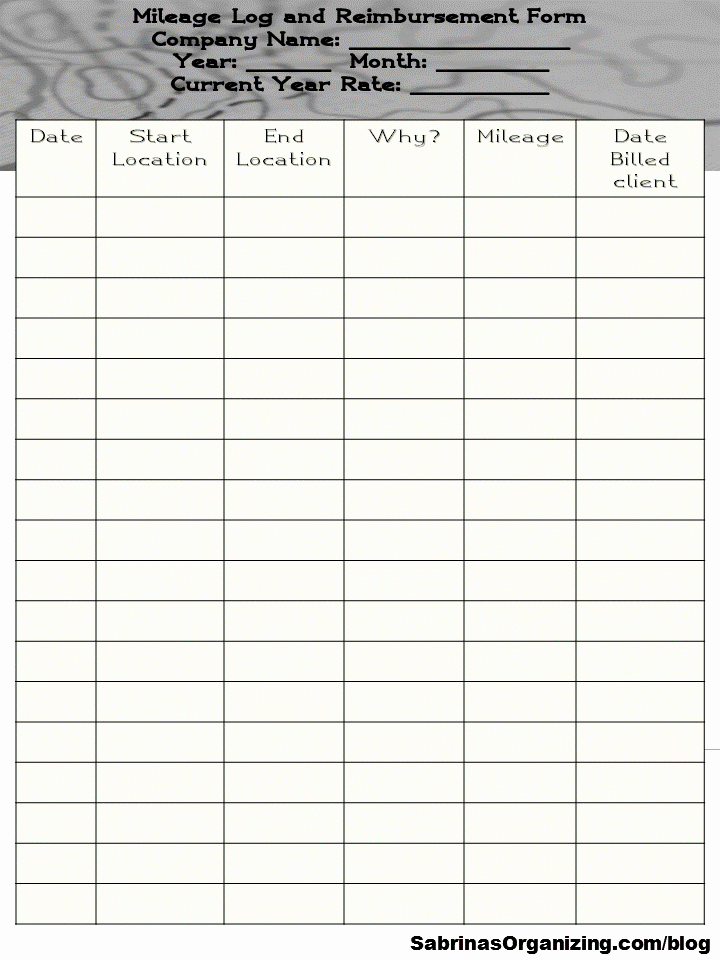

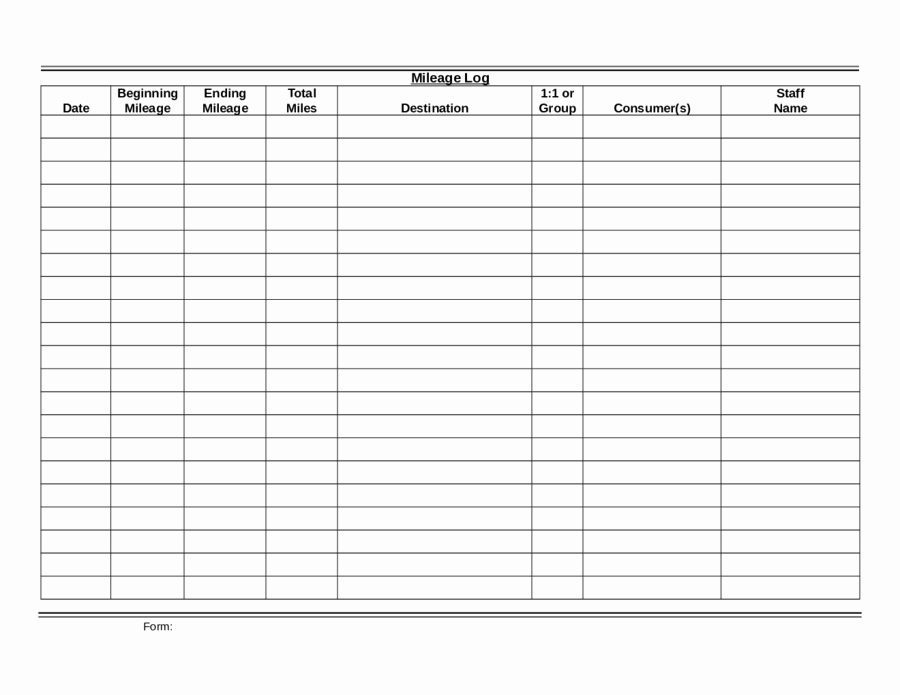

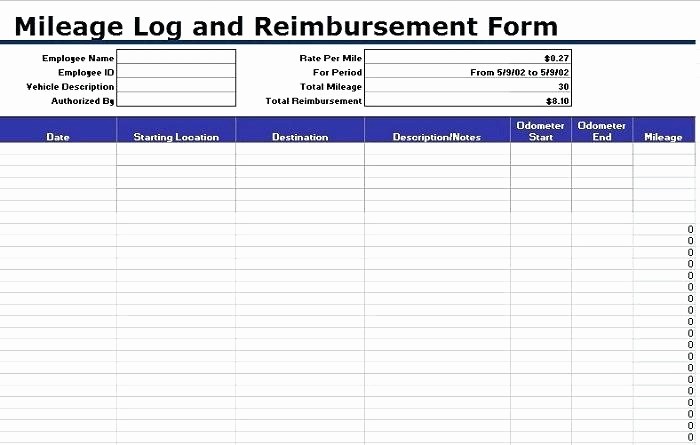

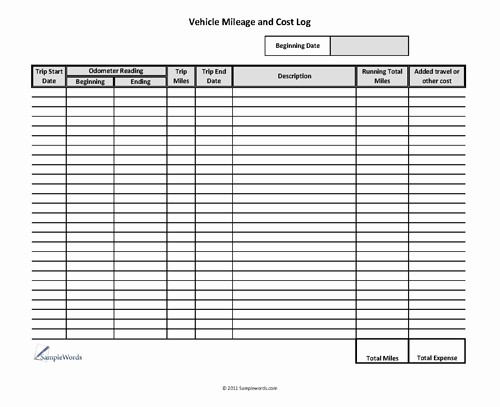

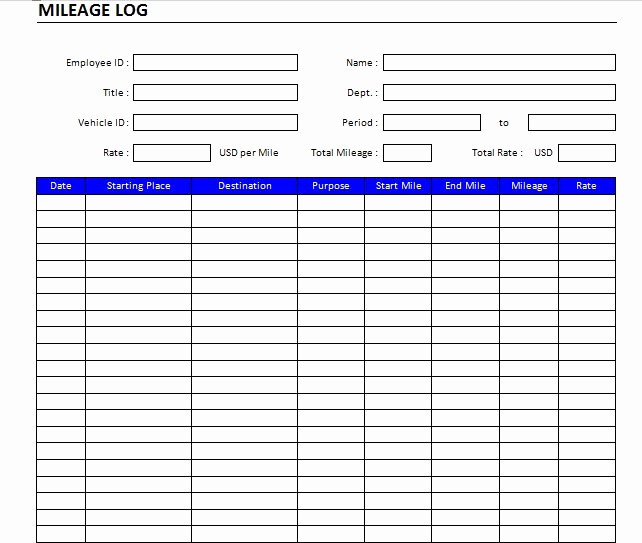

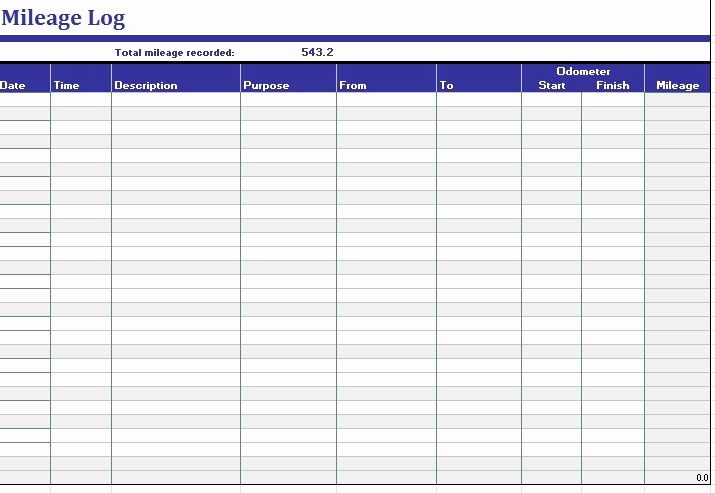

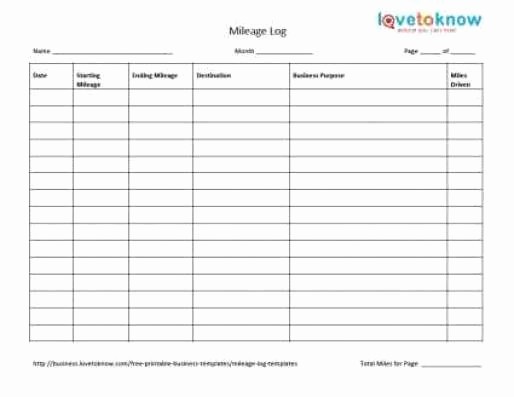

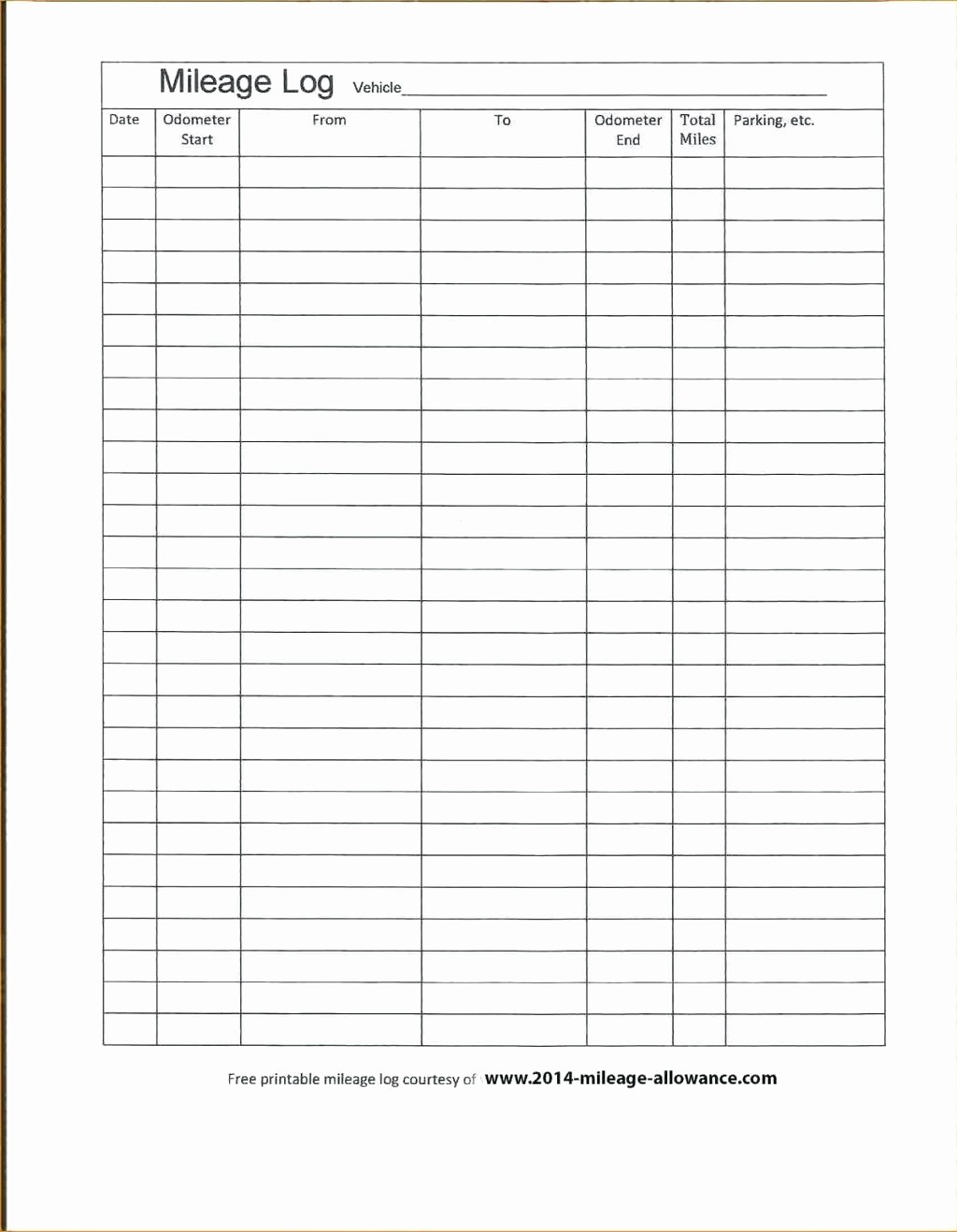

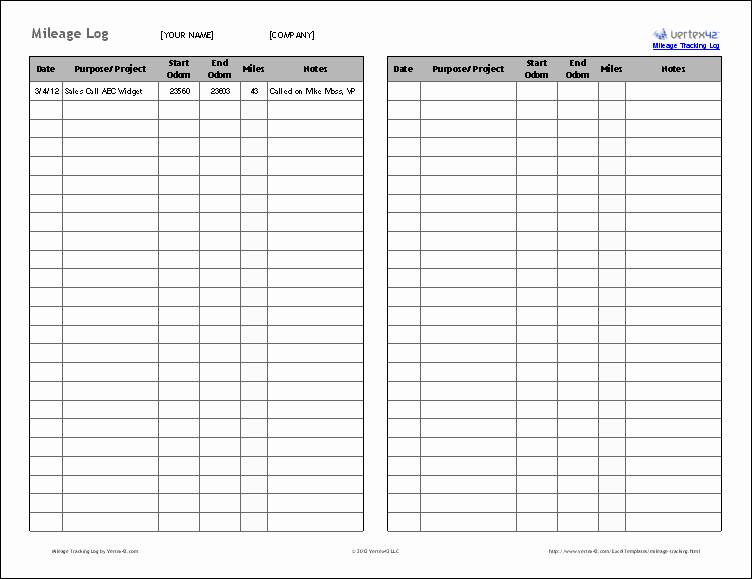

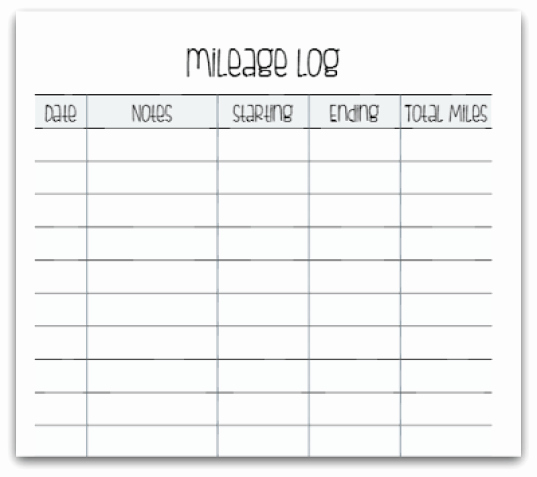

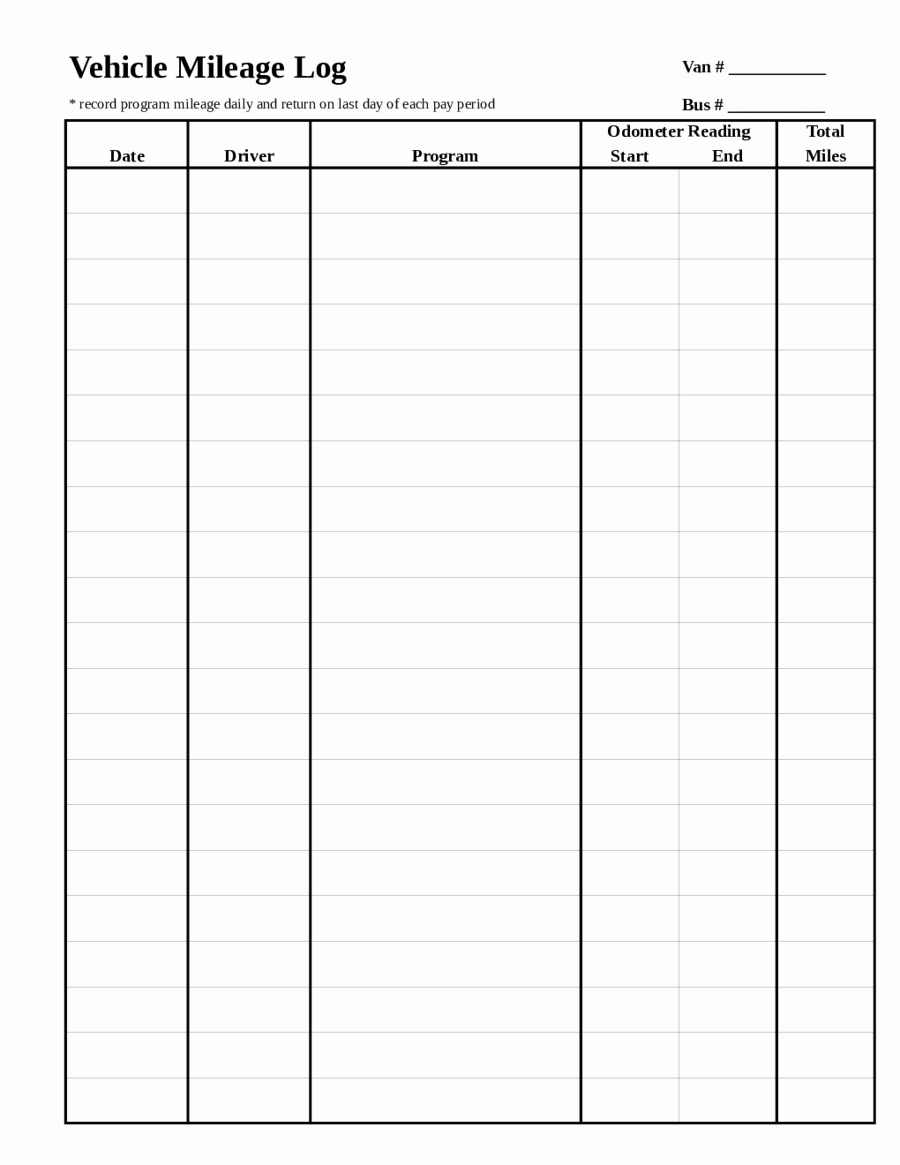

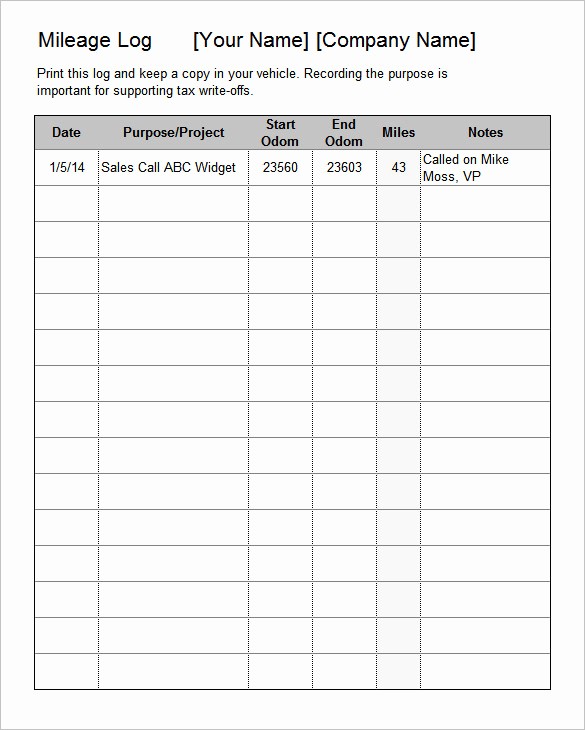

what are the irs mileage log requirements mileiq stephen fishman is a self employed tax expert and regular contributor to mileiq he has dedicated his career as an attorney and author to writing useful authoritative and recognized guides on taxes and business law for entrepreneurs independent contractors freelancers and other self employed people free mileage tracking log and mileage reimbursement form whether you re an employee or a business owner it s important to keep good business mileage records so that you have the information you need for either pleting your pany s mileage reimbursement form or for determining the mileage deduction on your tax return mileage calculator keeping an accurate track of your vehicle’s mileage could save you big at tax time so we’ve created this free mileage calculator to help you deduct the costs of operating a vehicle for business charitable medical or moving purposes on your taxes or to calculate your business mileage reimbursement free mileage log template for excel track your miles free mileage log template for taxes you can use the following log as documentation for your mileage deduction the irs lets you deduct 54 5 cents per business mile 30 printable mileage log templates free template lab what is a mileage log to claim deductions on your tax returns you have to keep meticulous records of your driving many people record the time weekly or monthly which will not satisfy the irs if there’s an audit of your records

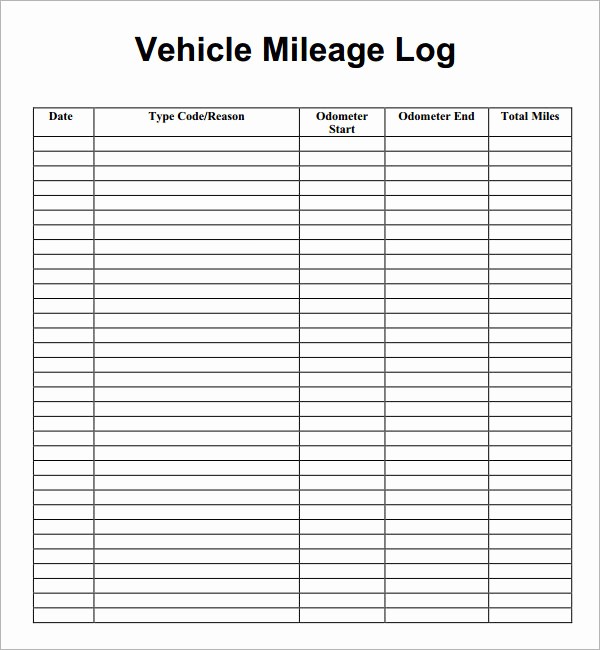

9 Mileage Log Templates DOC PDF from mileage log form for taxes , image source: www.template.net