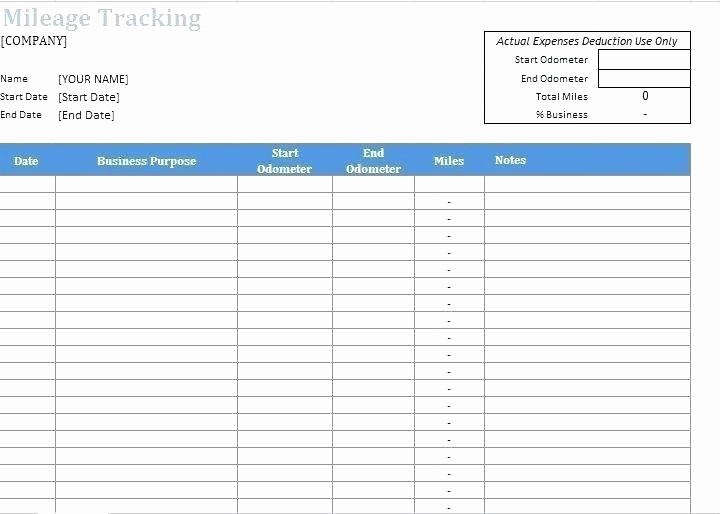

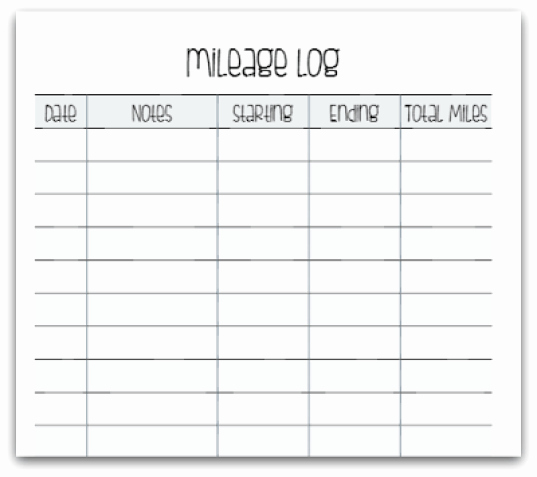

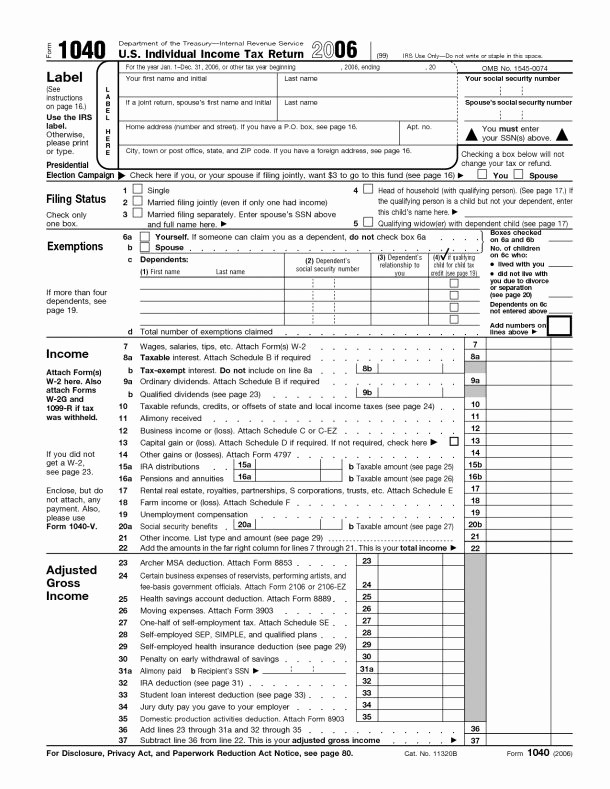

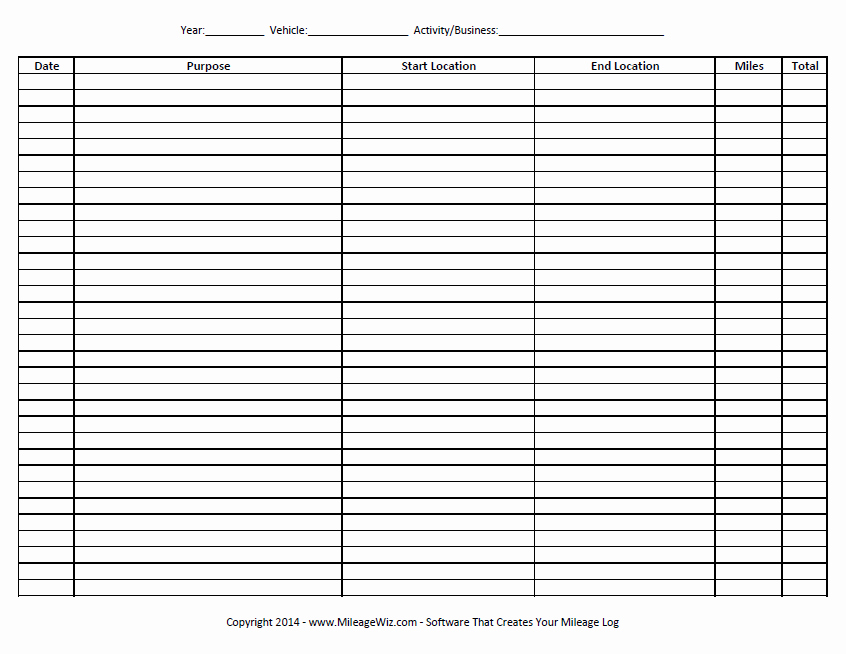

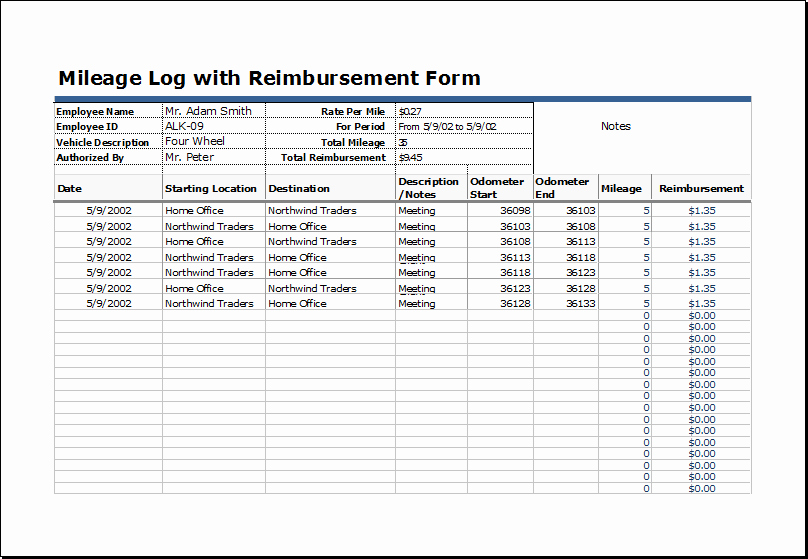

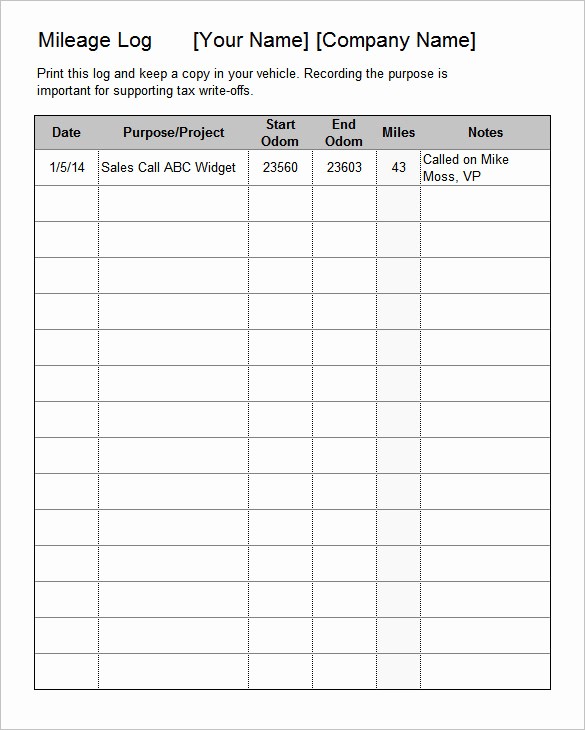

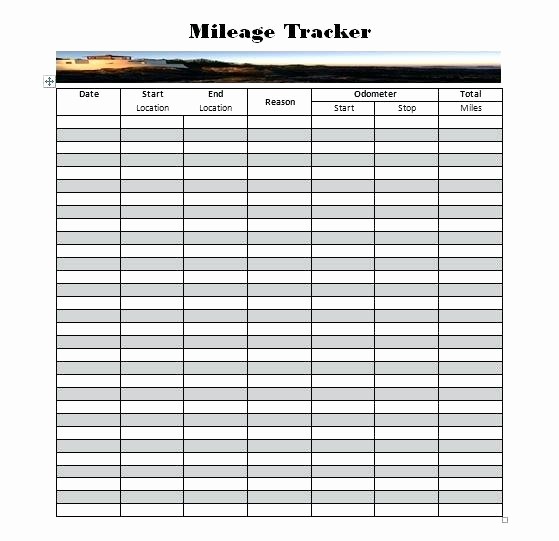

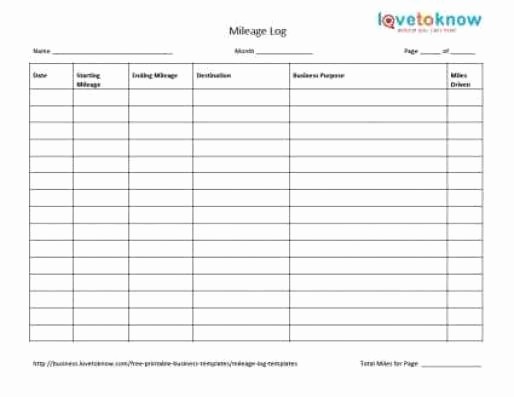

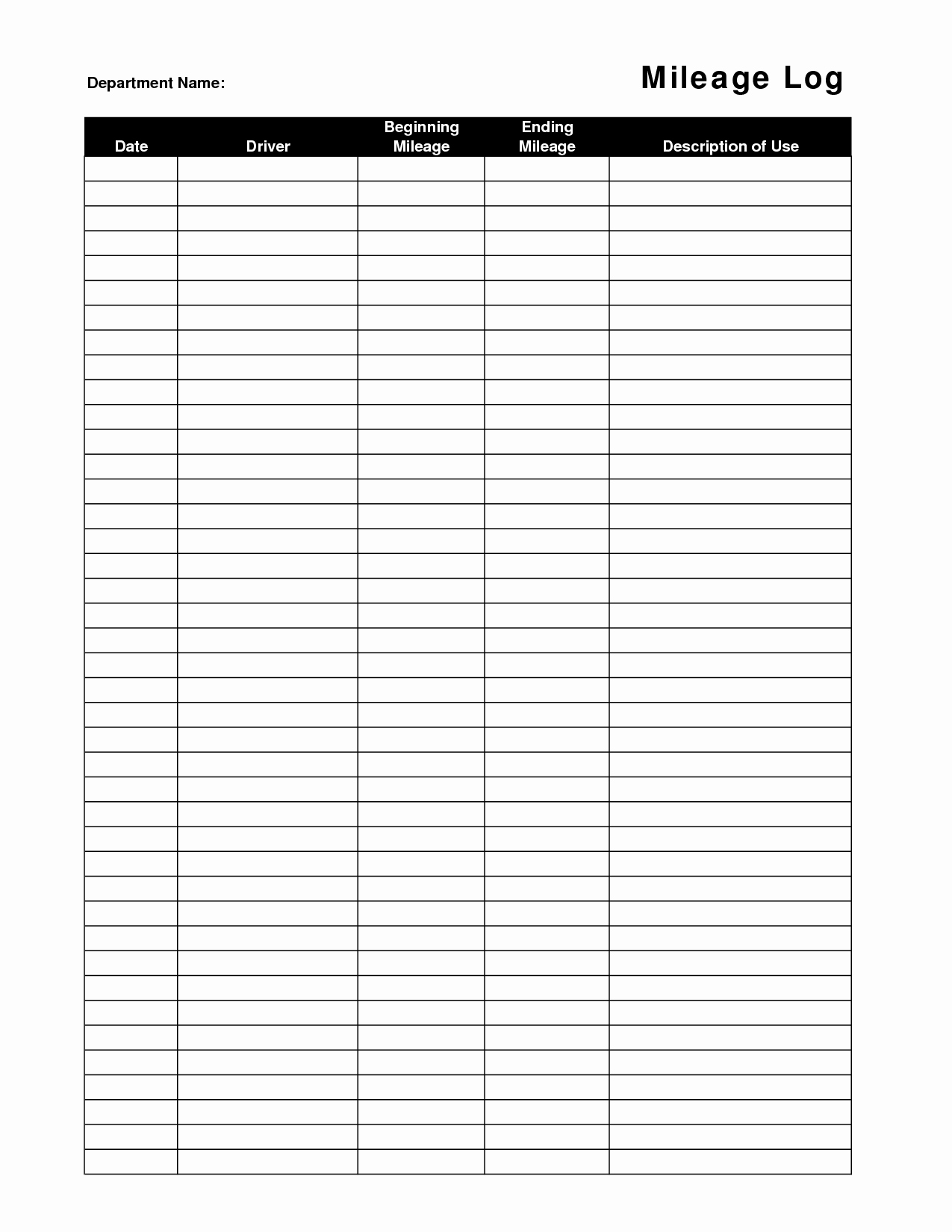

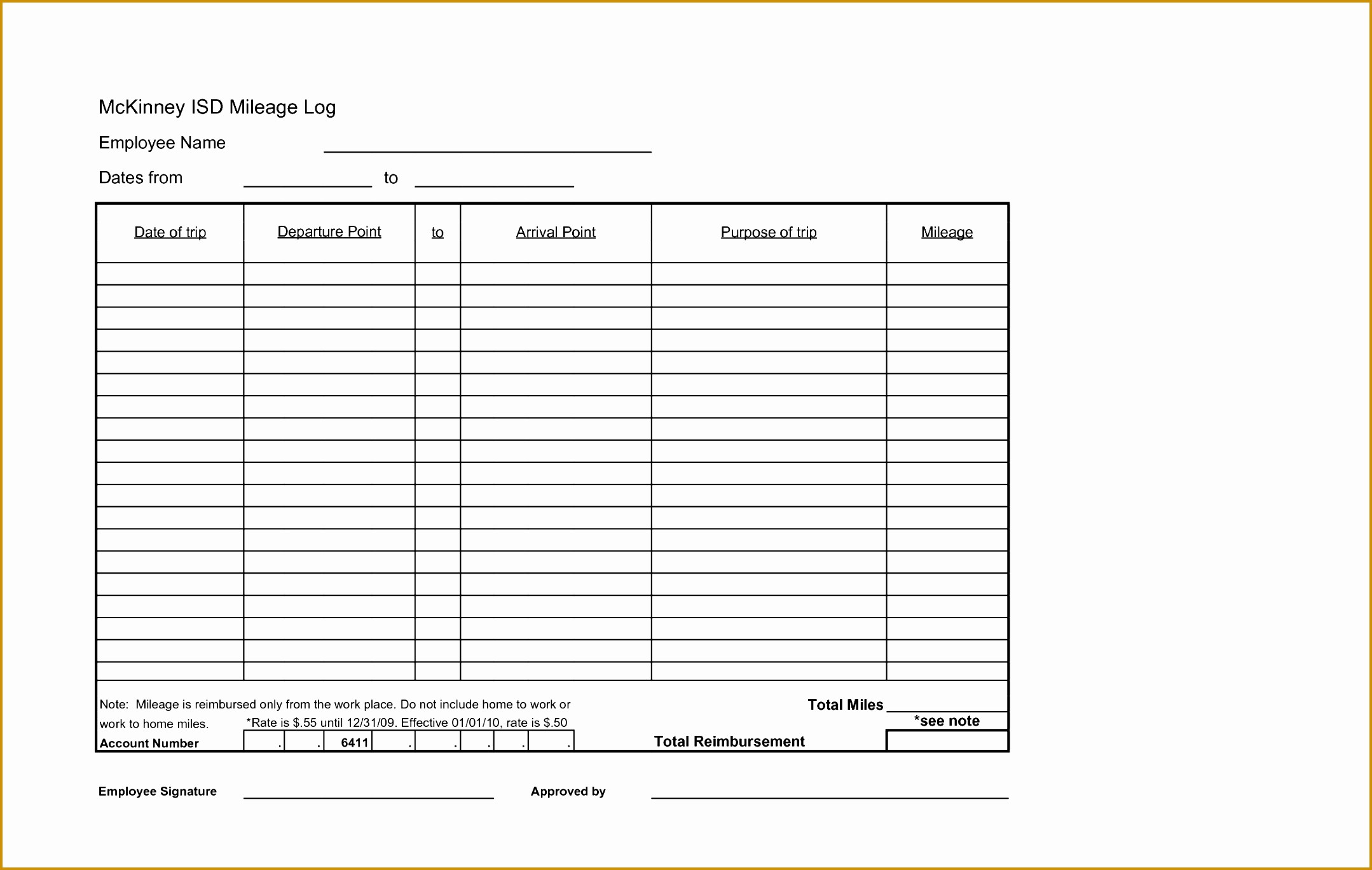

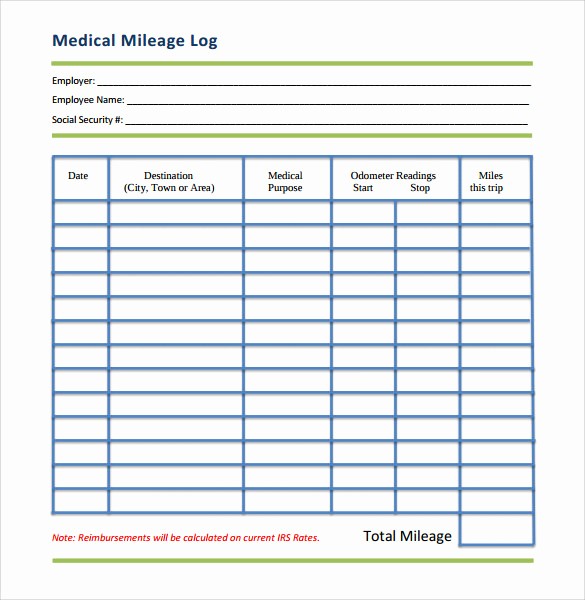

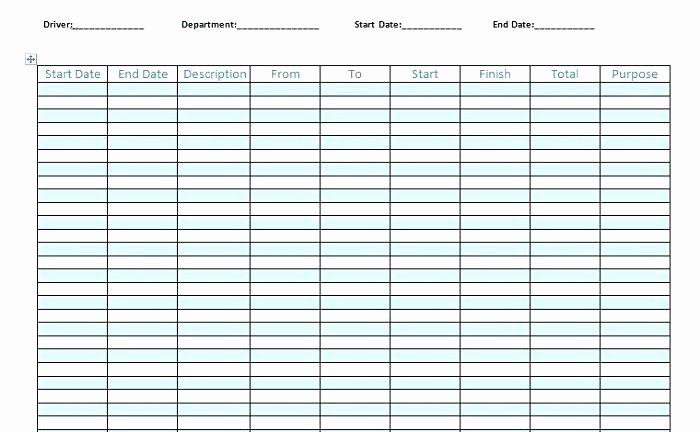

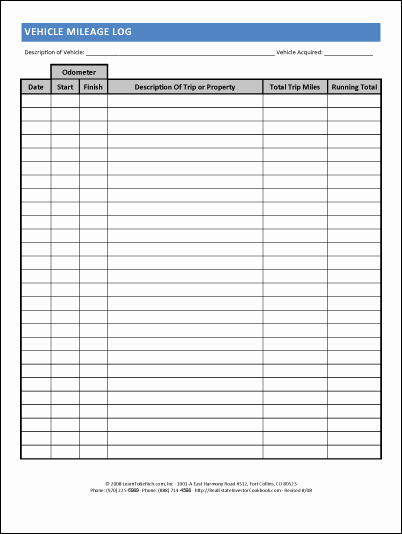

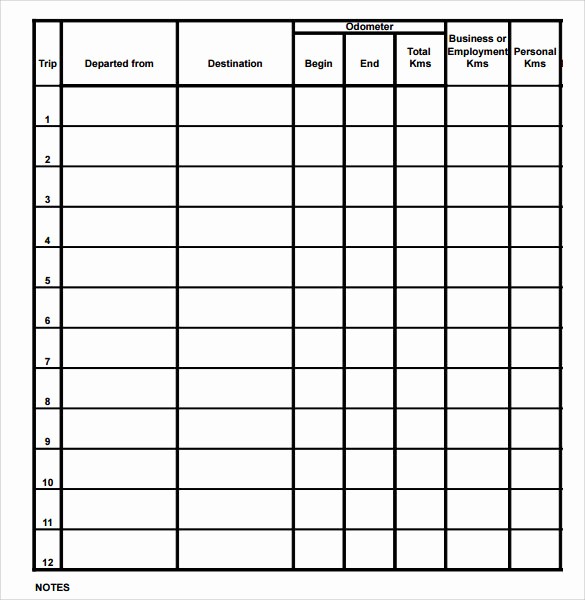

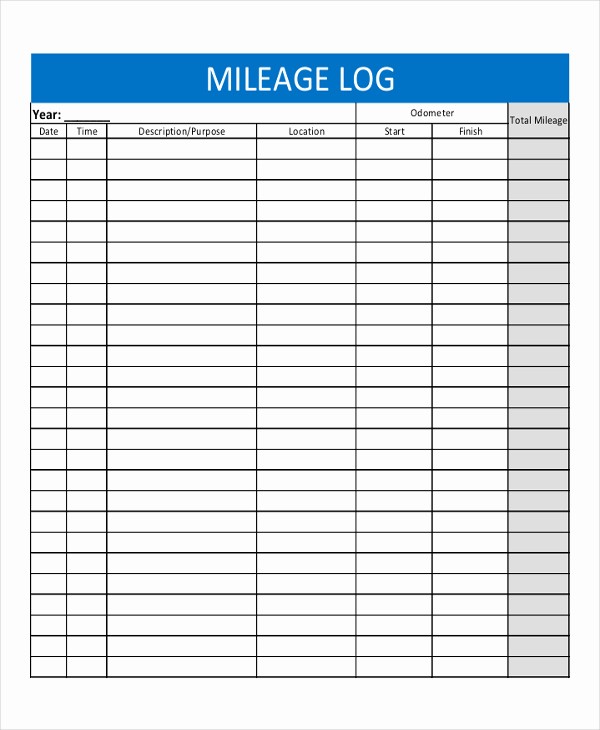

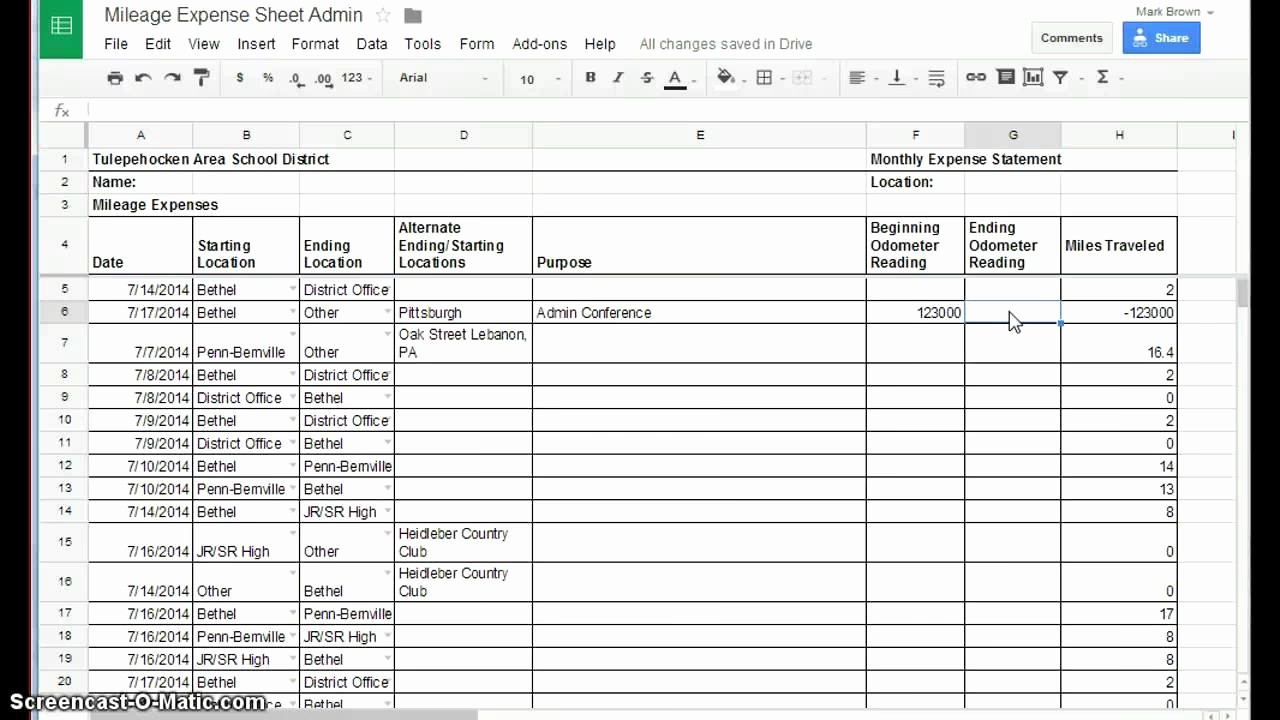

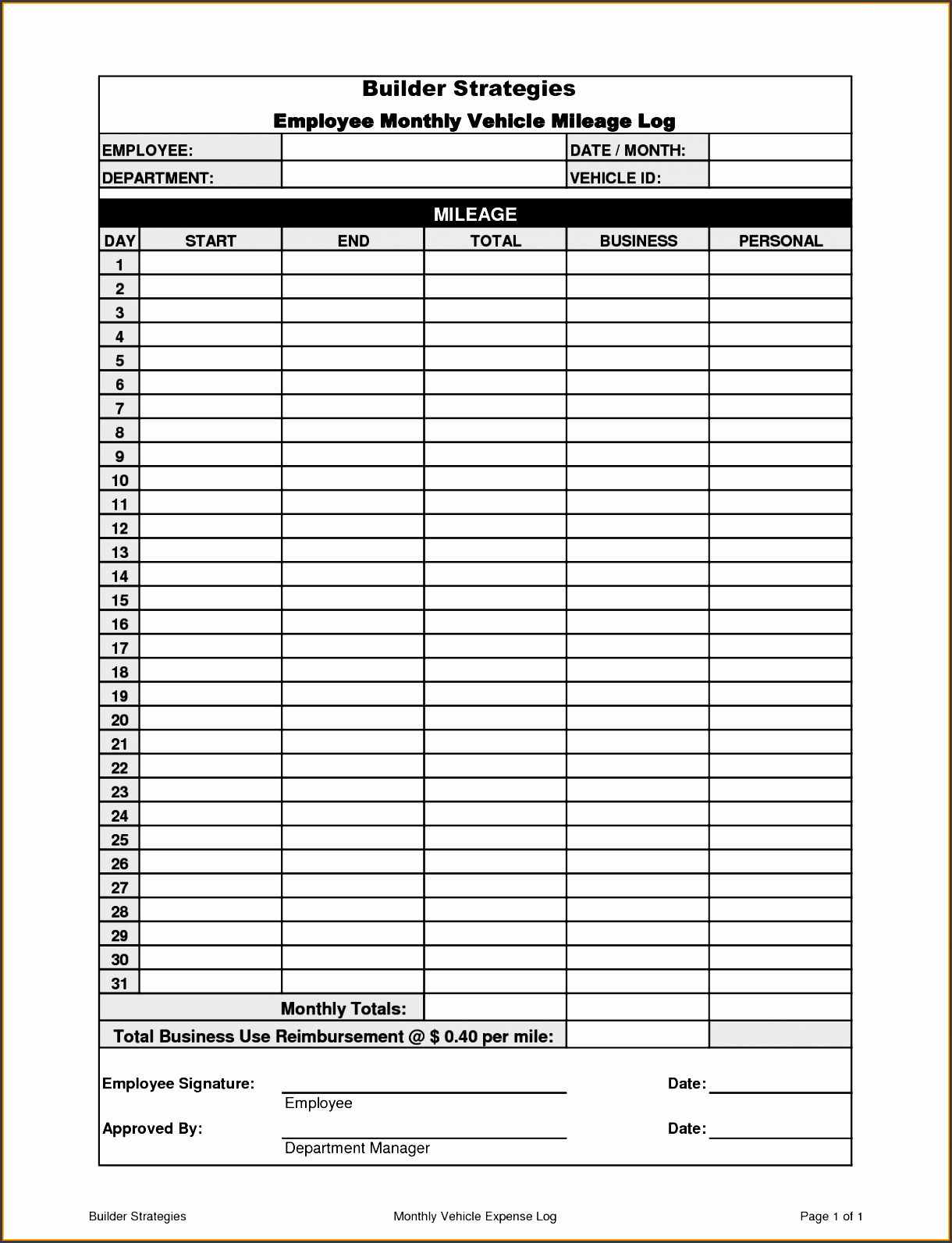

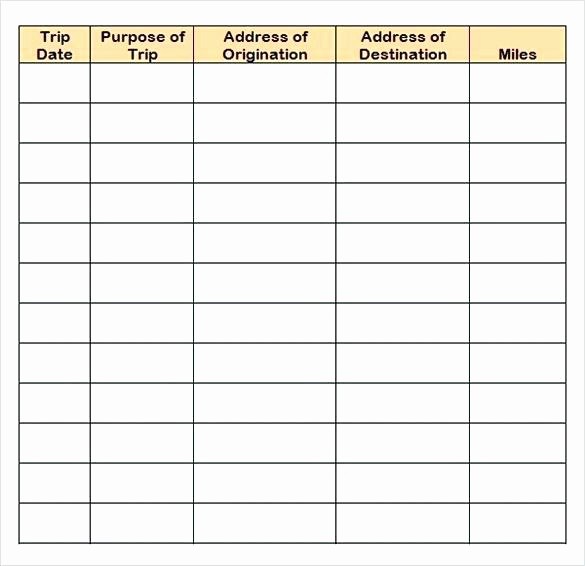

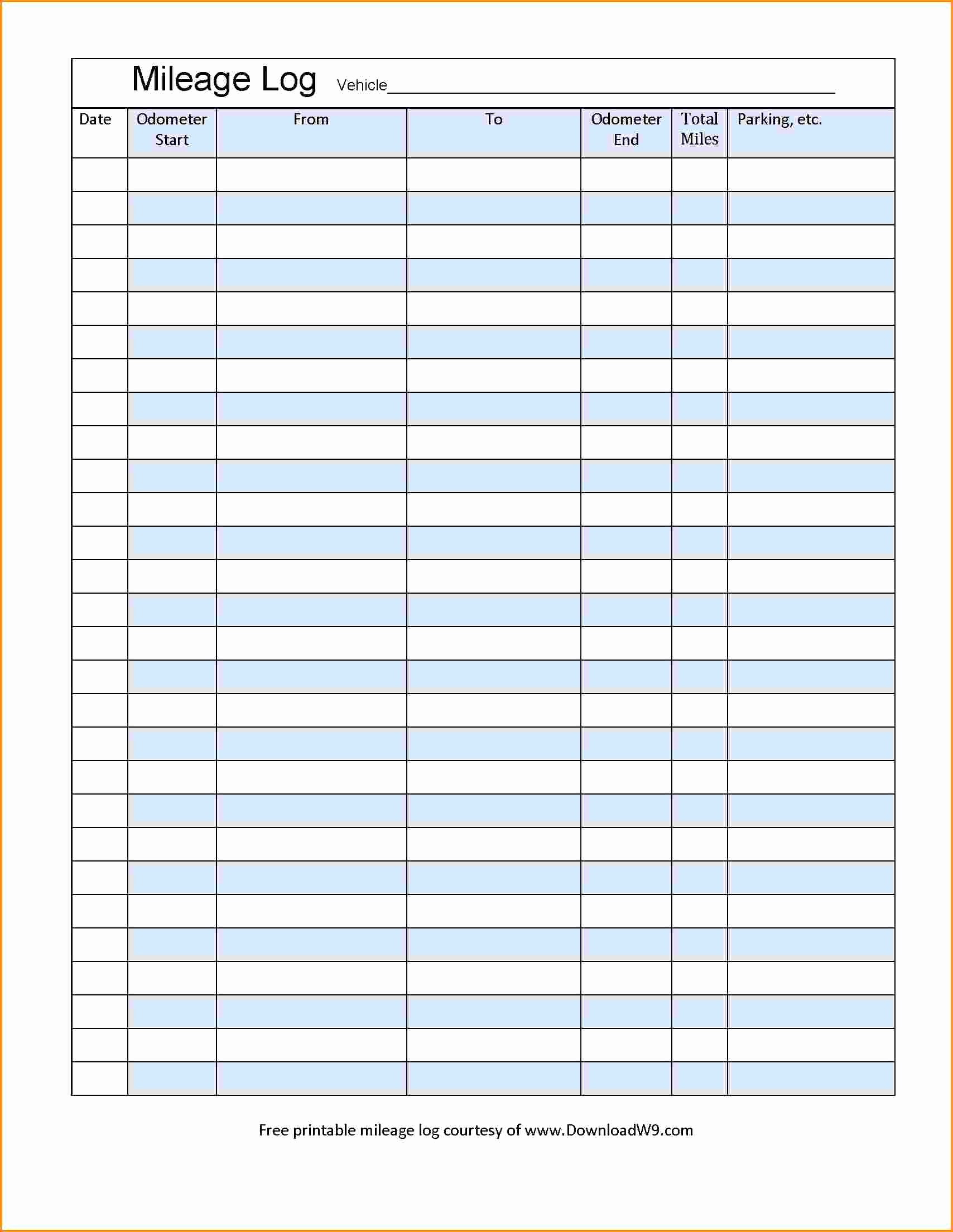

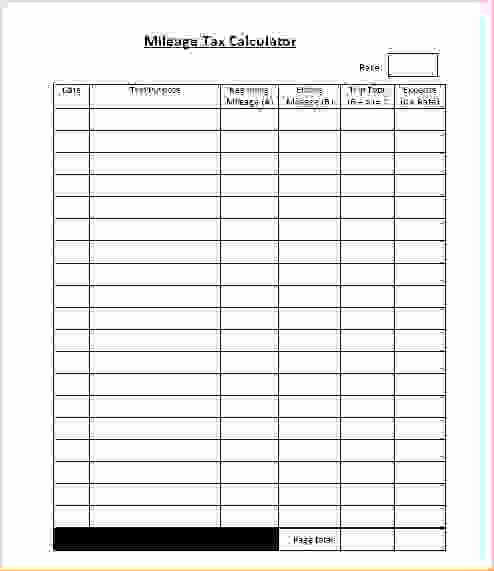

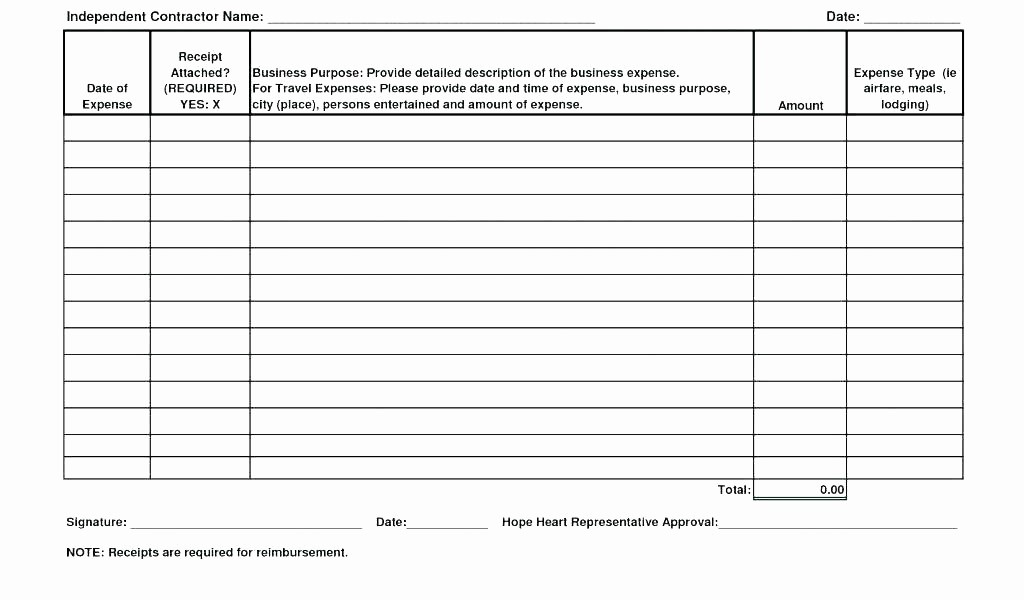

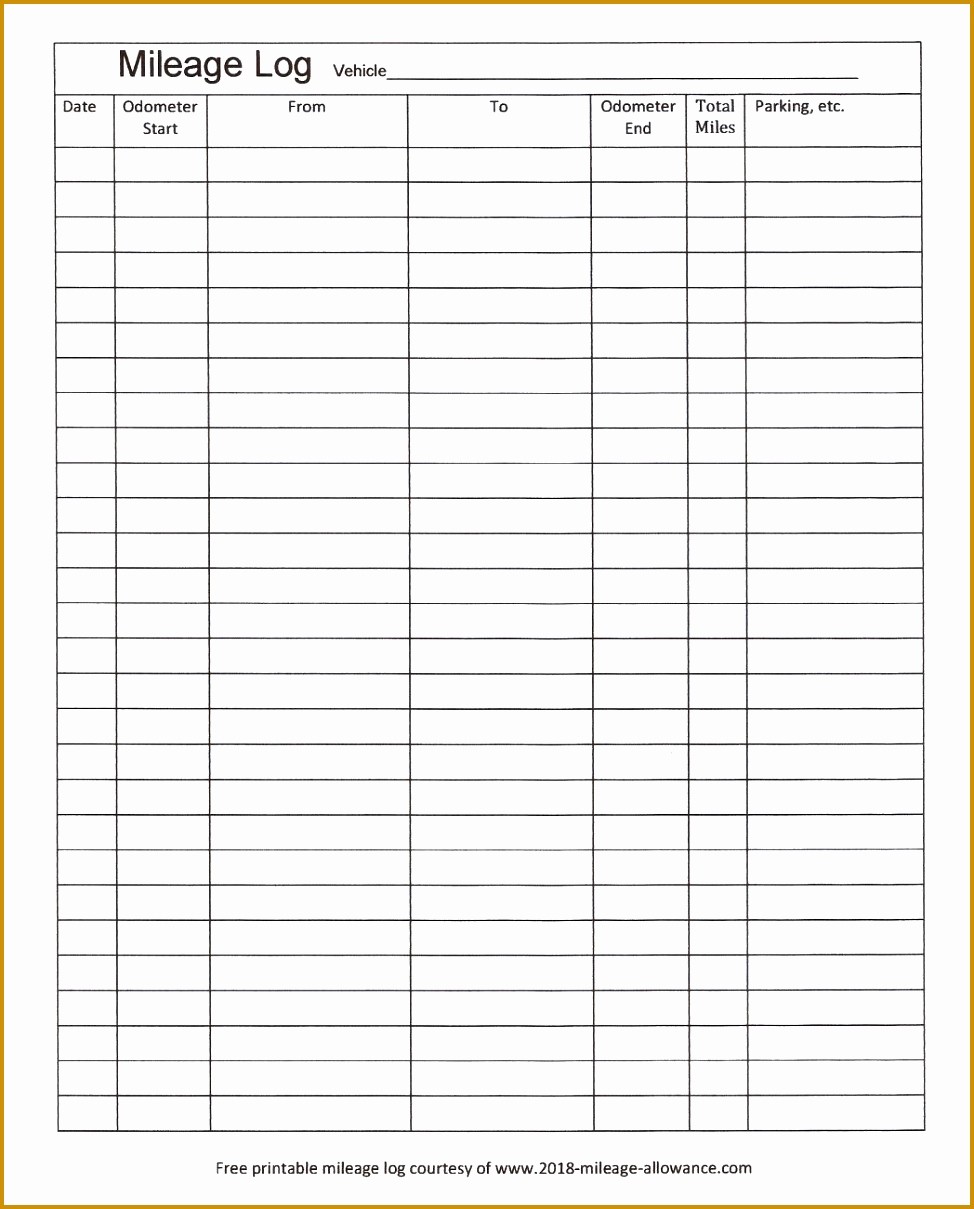

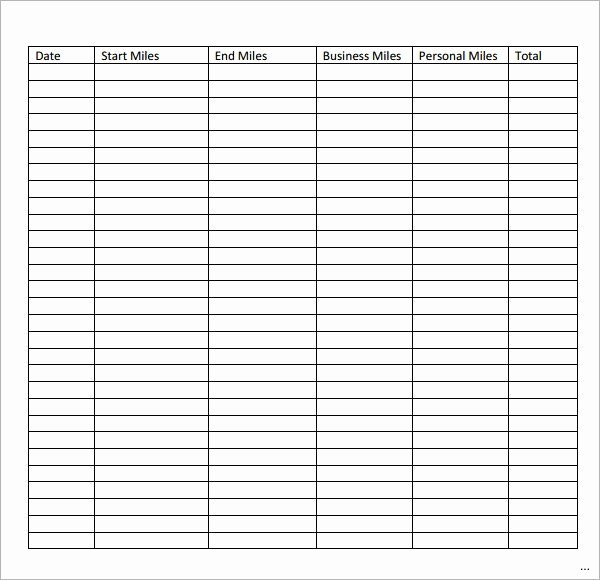

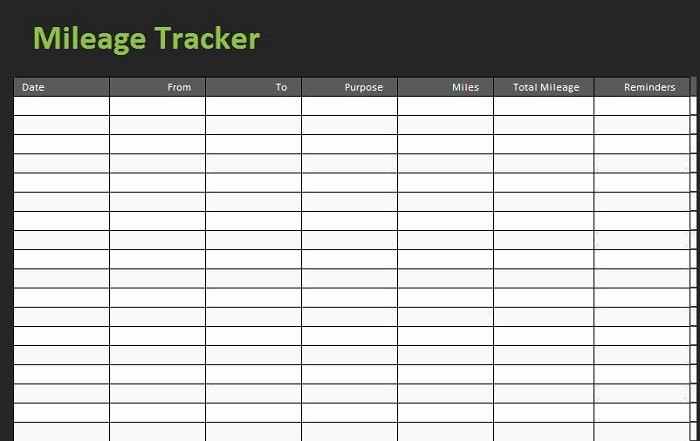

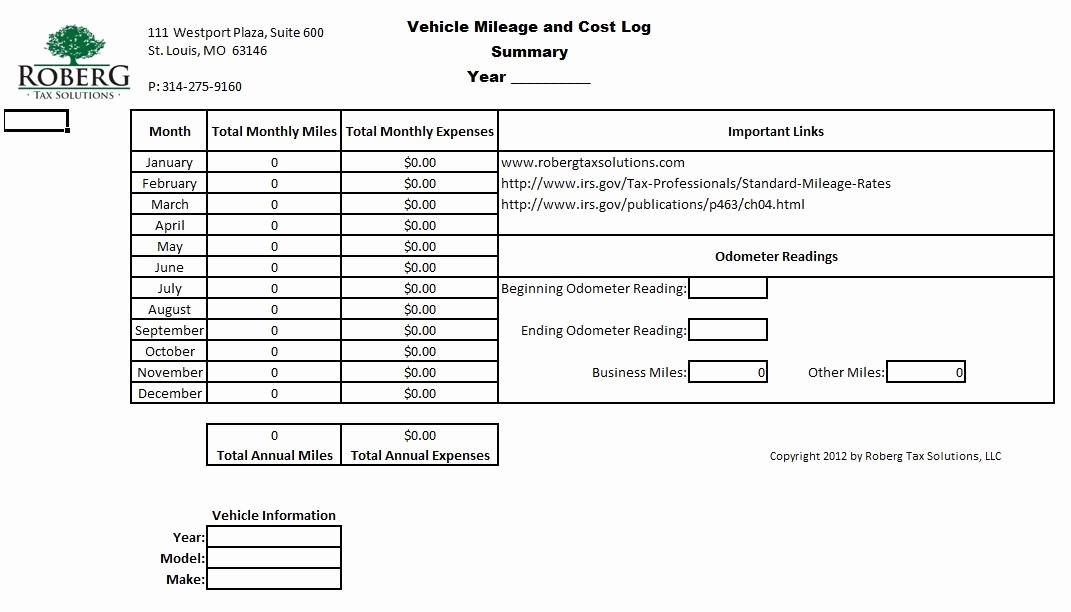

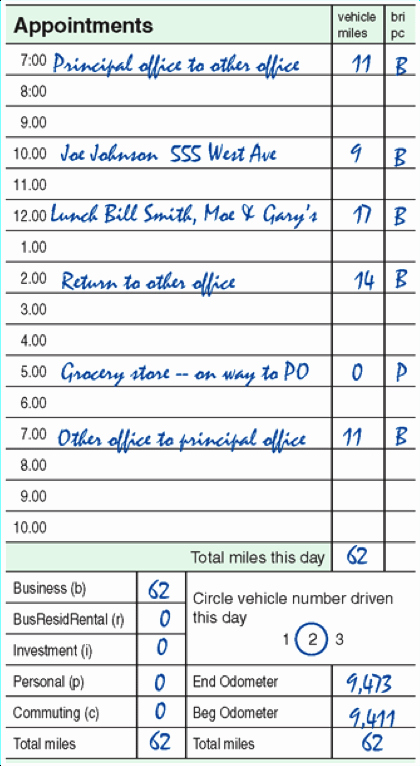

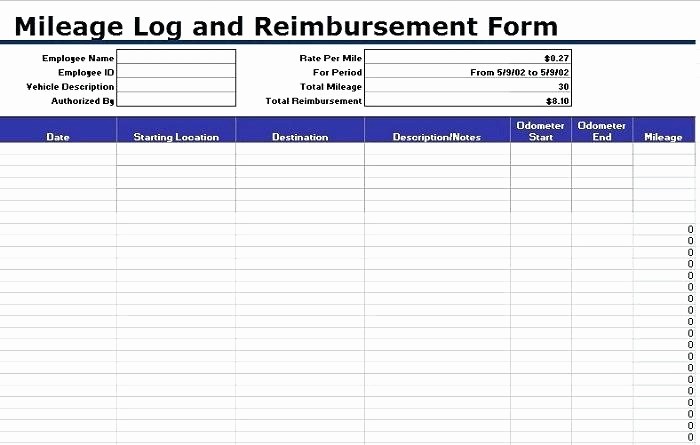

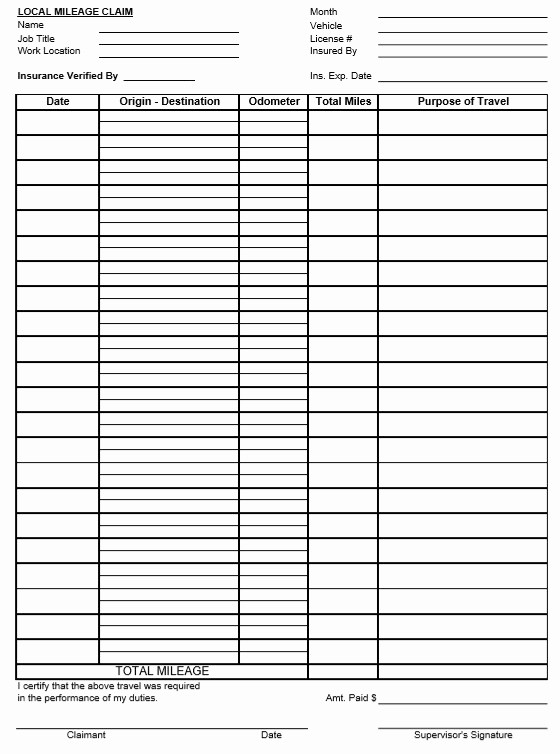

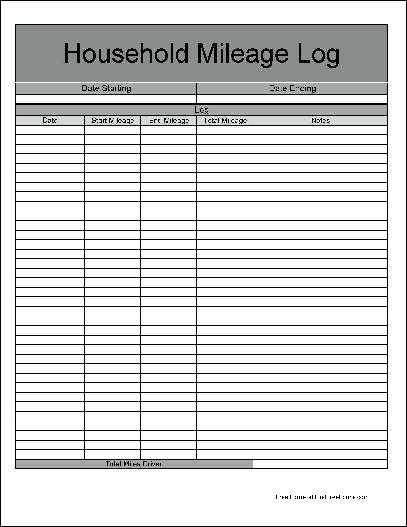

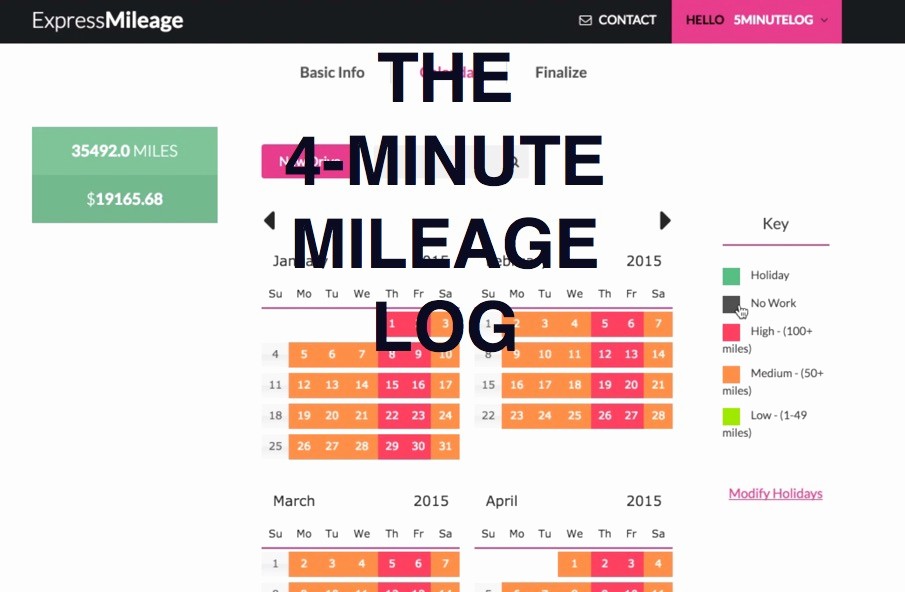

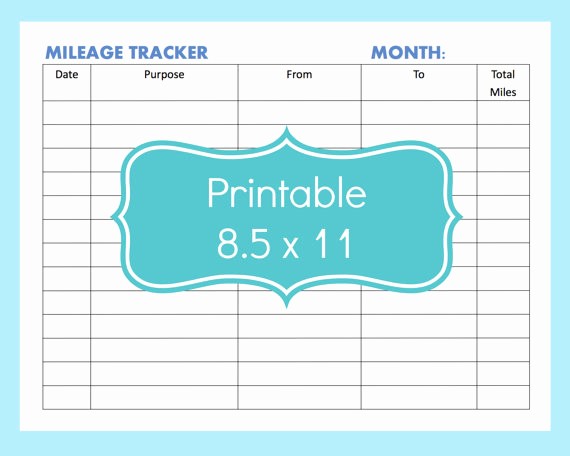

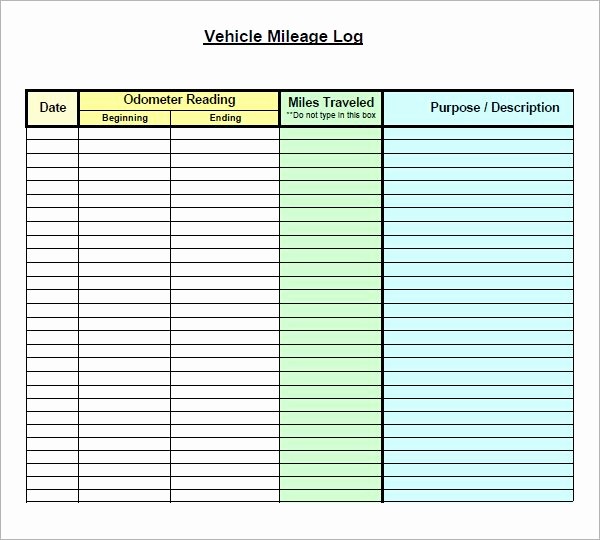

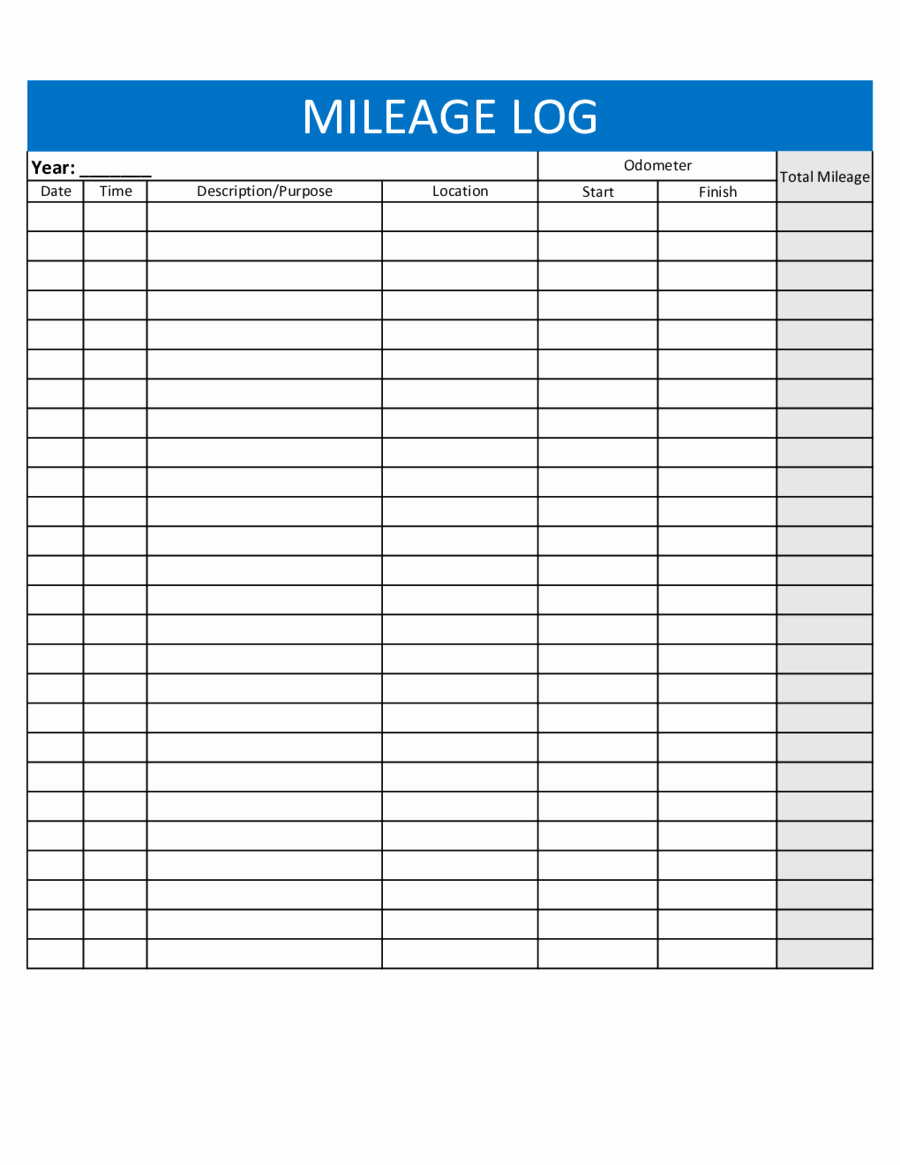

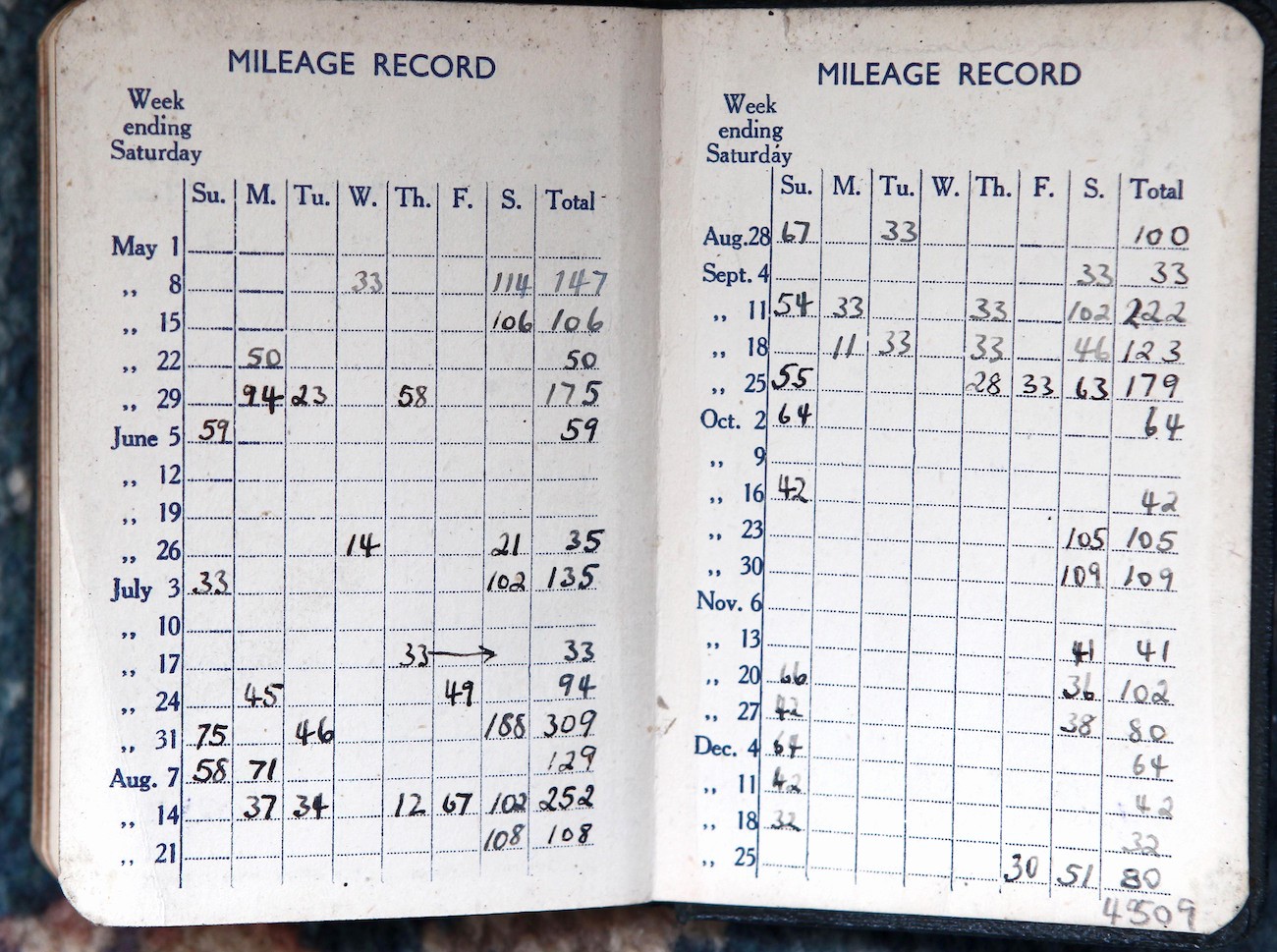

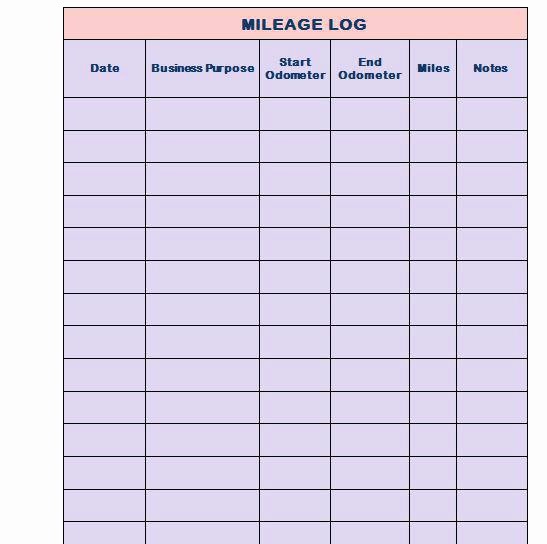

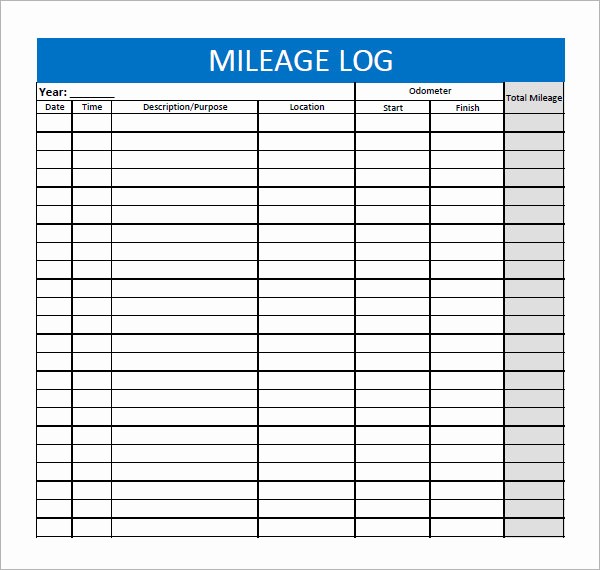

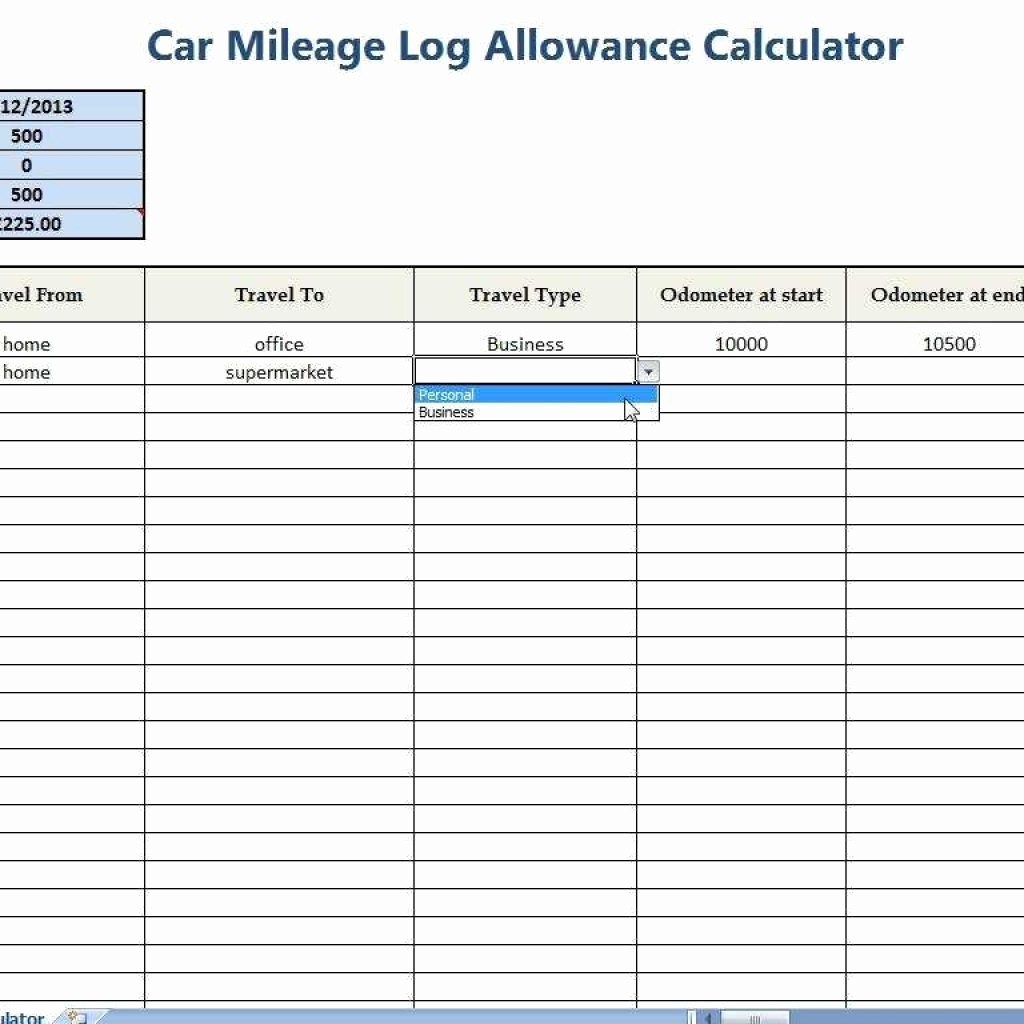

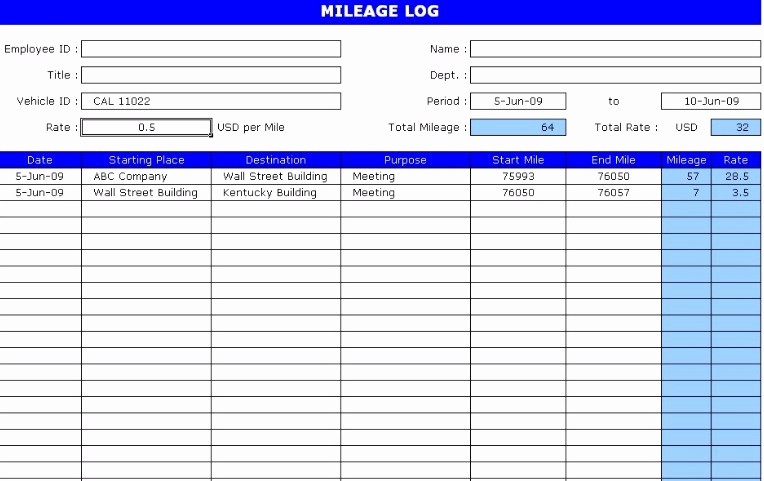

how to create an uber mileage log do you need a mileage log for reimbursement or irs tax purposes our online mileage log generator helps you make mileage logs in a matter of minutes free mileage tracking log and mileage reimbursement form mileage reimbursement download a free mileage tracking log for excel to keep good mileage records and calculate business mileage for tax purposes free mileage log template for excel track your miles free mileage log template for taxes you can use the following log as documentation for your mileage deduction the irs lets you deduct 54 5 cents per business mile the mileage deduction how to deduct miles when you re the standard mileage rate is set by the irs every year and this is the deductible rate for your drives how to calculate mileage for taxes you can claim mileage on your tax return if you kept diligent track of your drives throughout the year 30 printable mileage log templates free template lab what is a mileage log to claim deductions on your tax returns you have to keep meticulous records of your driving many people record the time weekly or monthly which will not satisfy the irs if there’s an audit of your records

![]()

IRS Uber mileage log tax deduction with TRIPLOG tracking from example mileage log for taxes , image source: www.pinterest.com.au