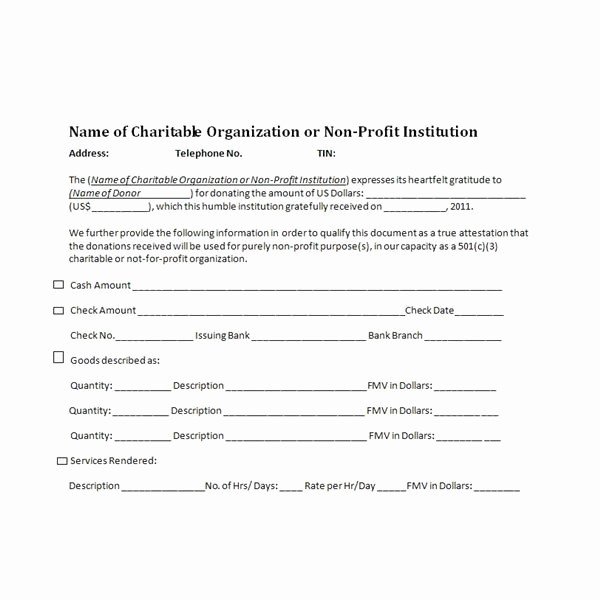

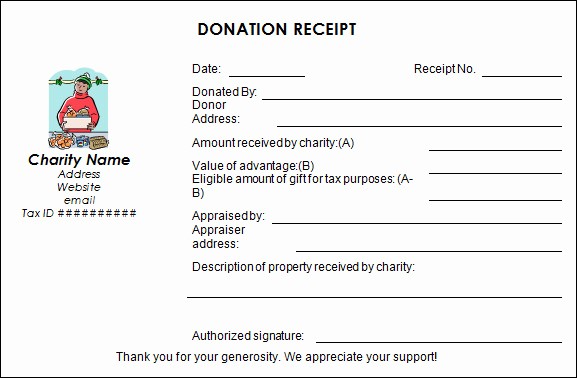

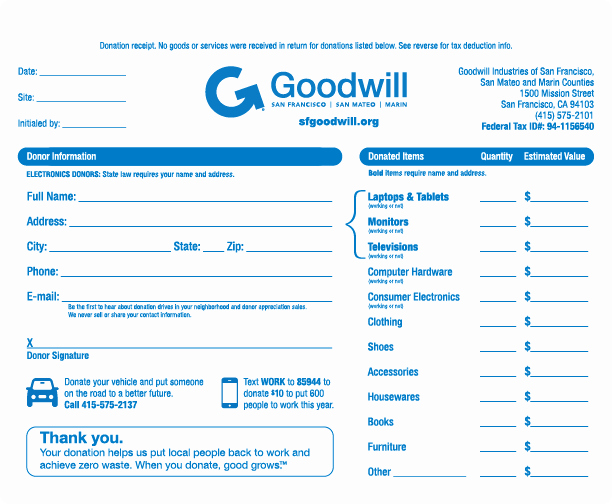

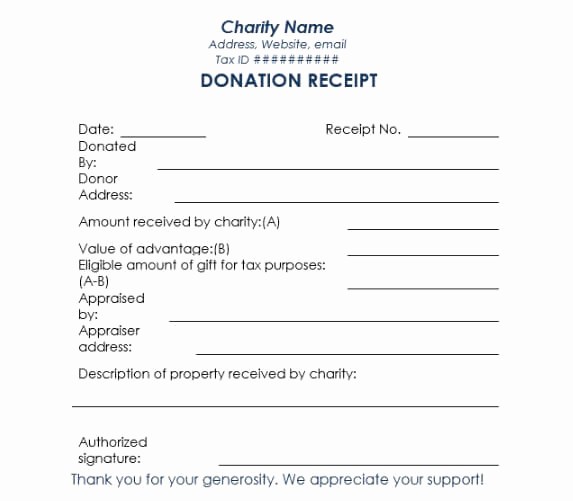

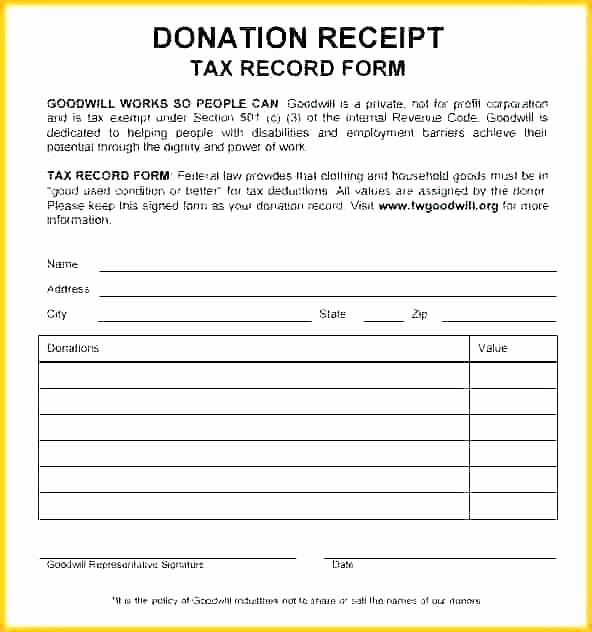

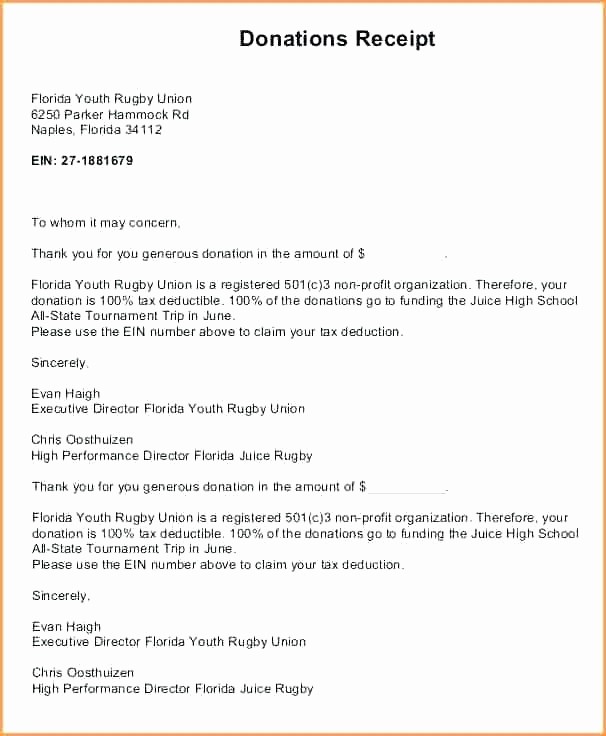

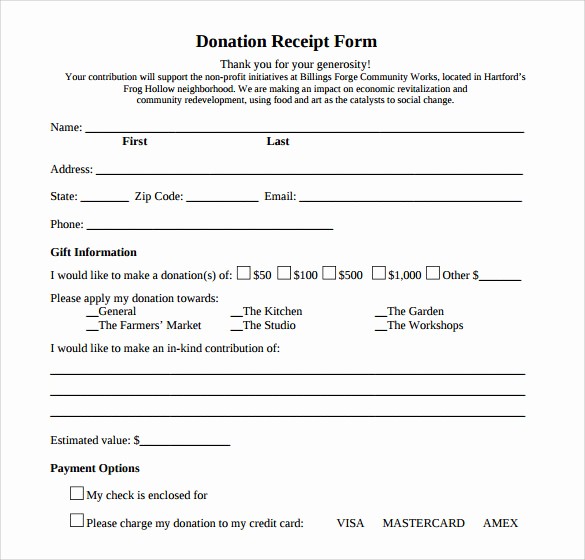

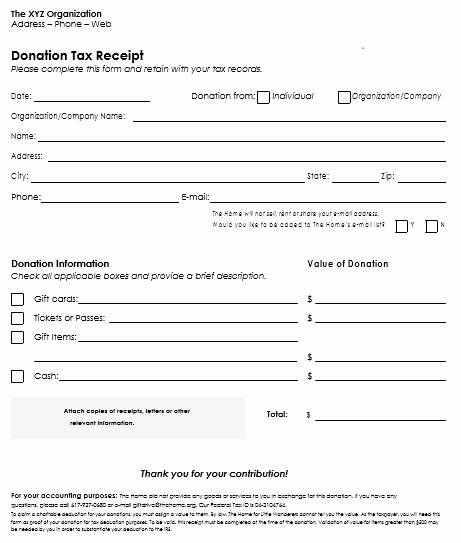

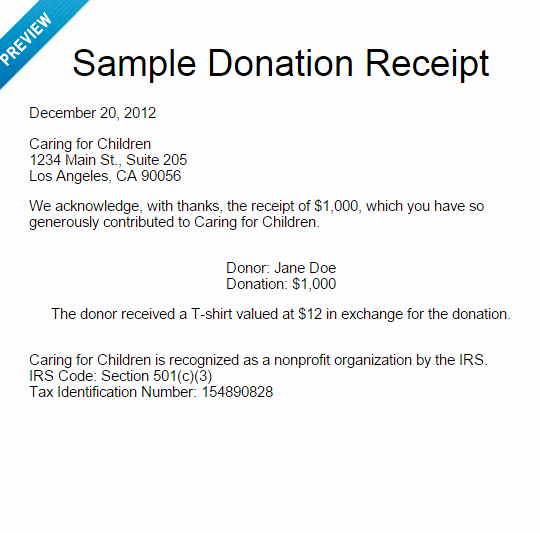

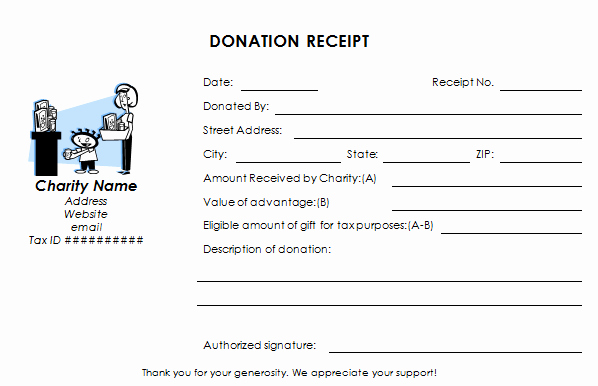

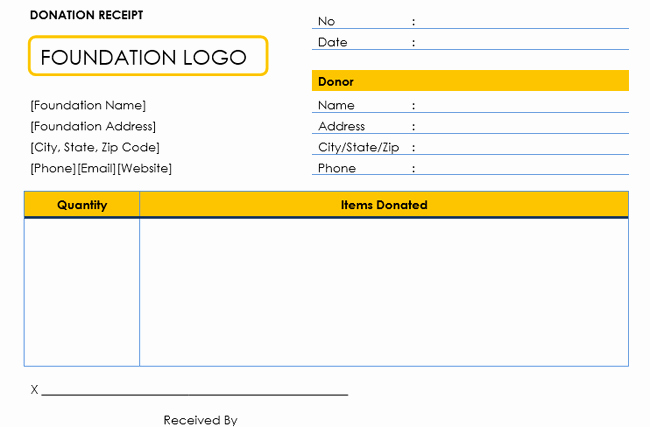

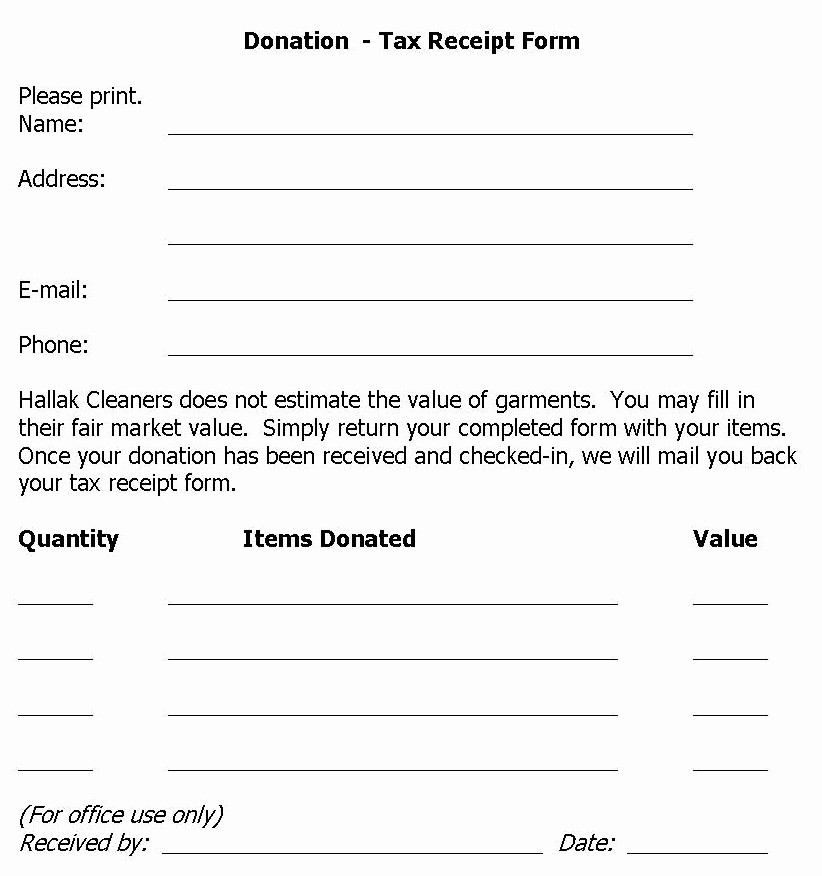

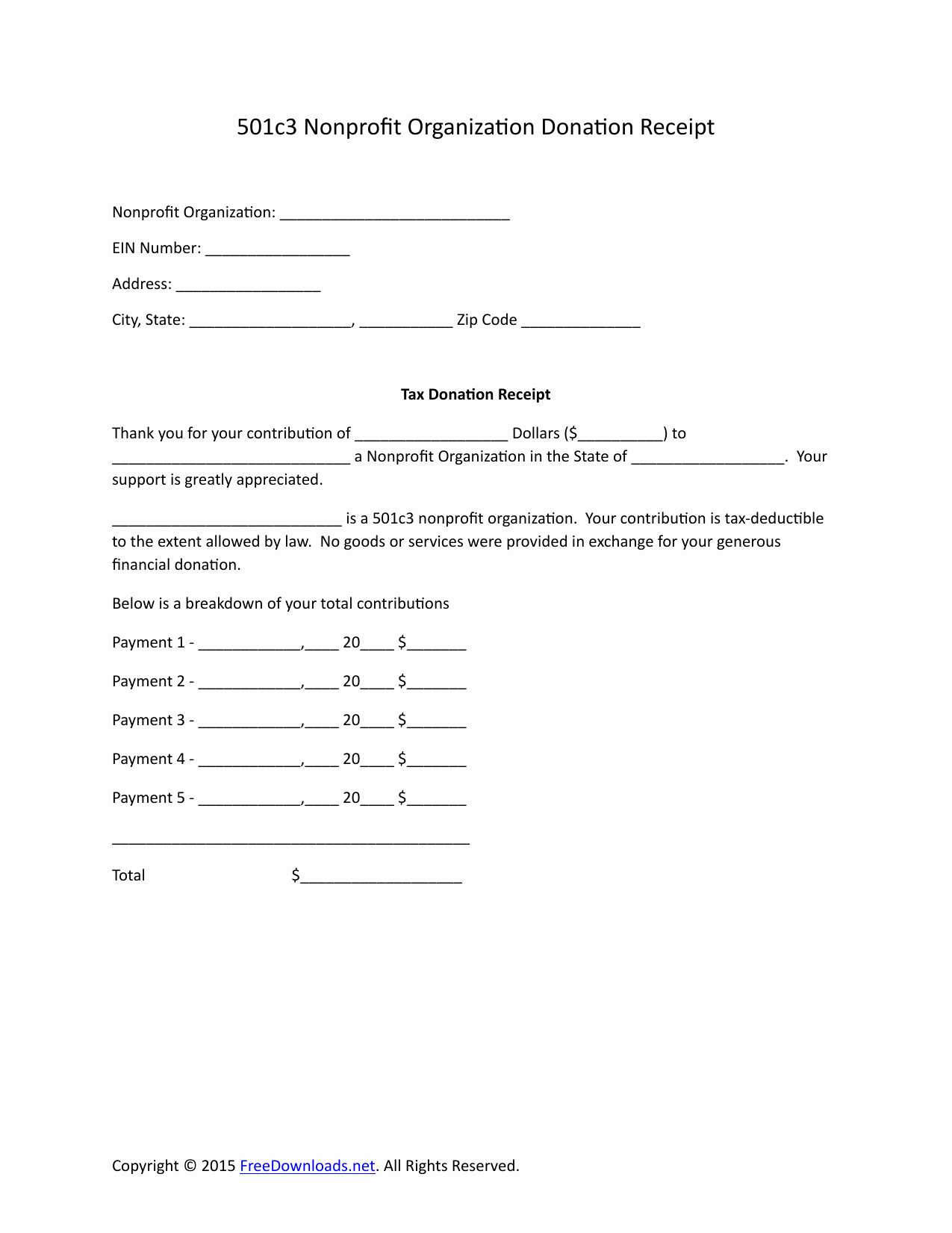

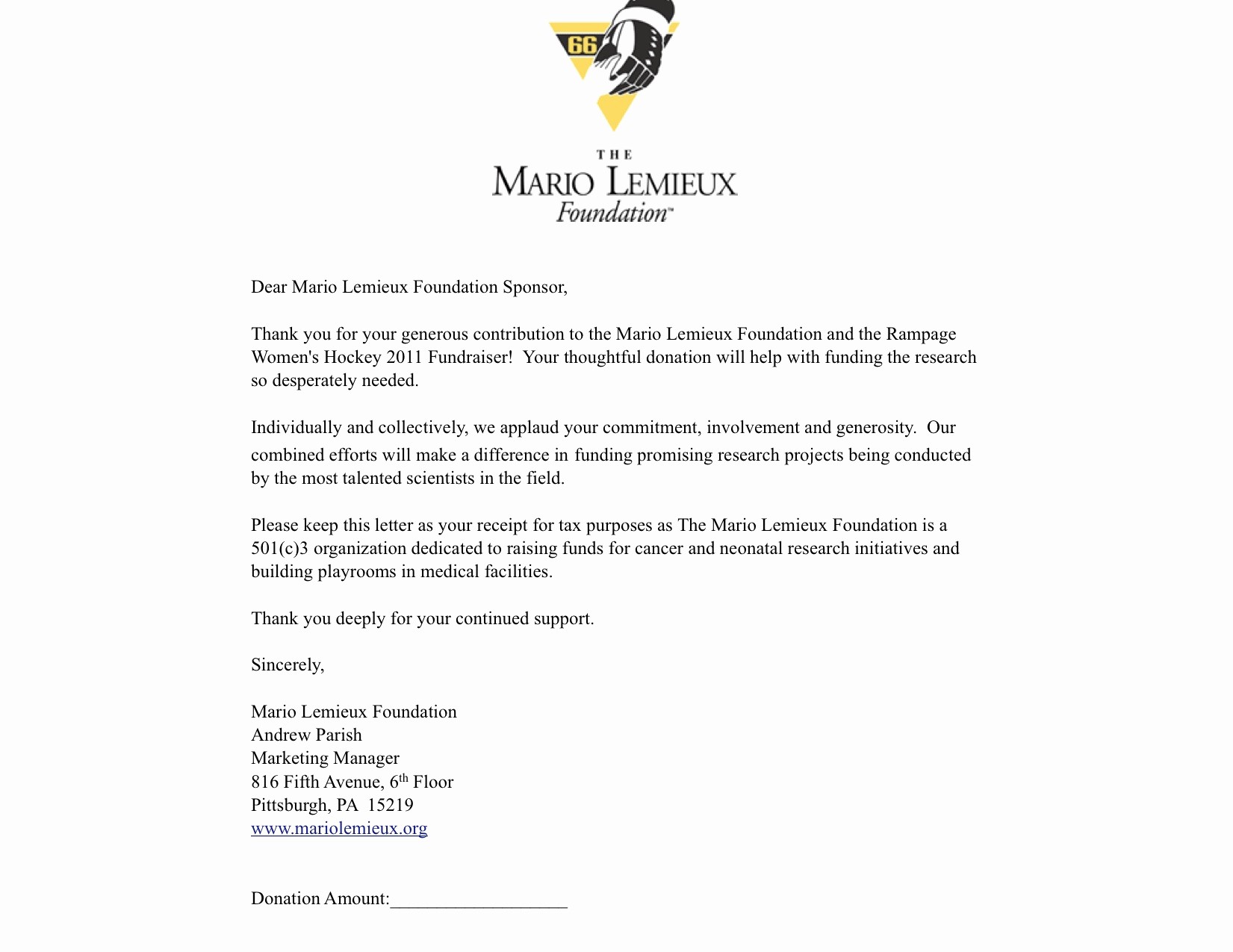

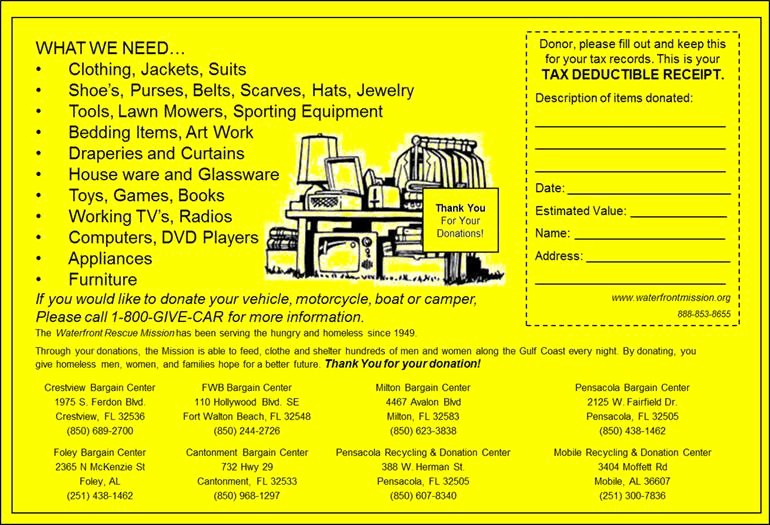

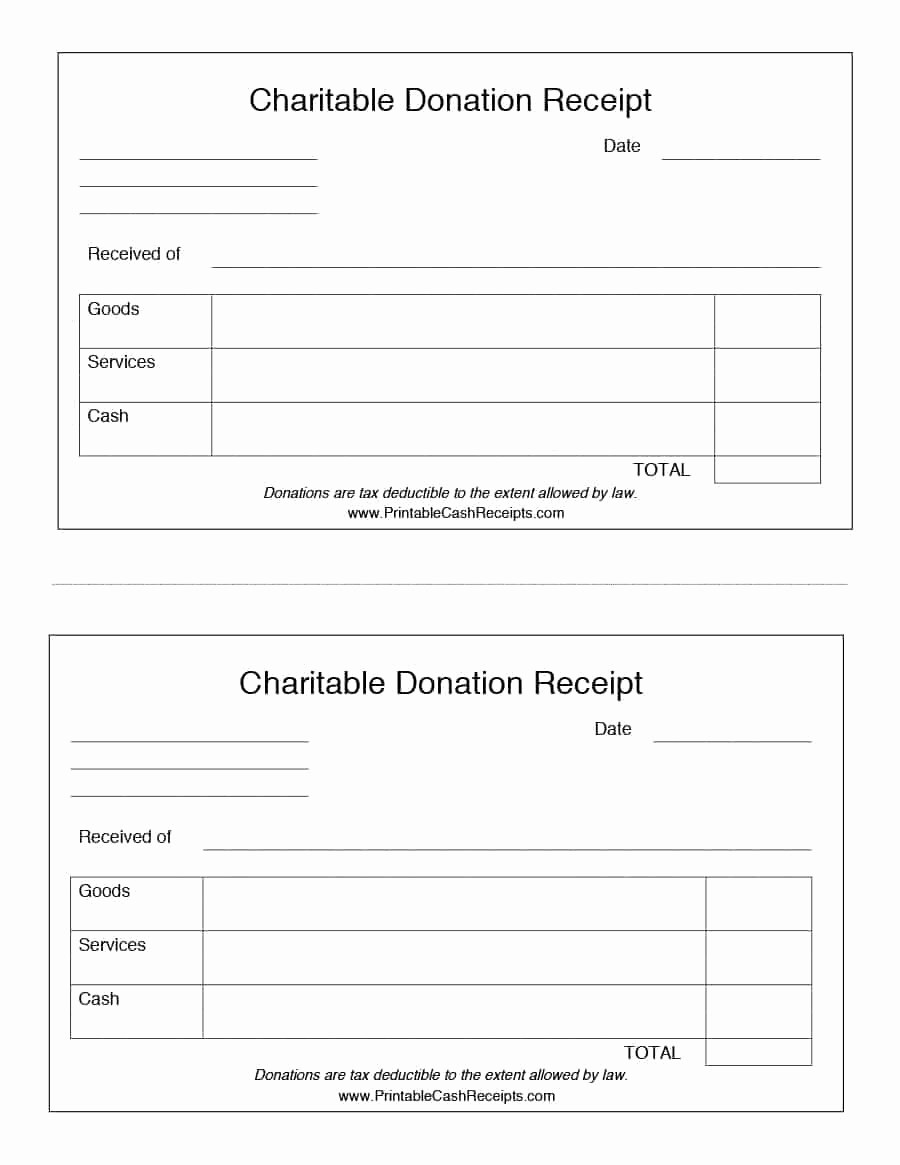

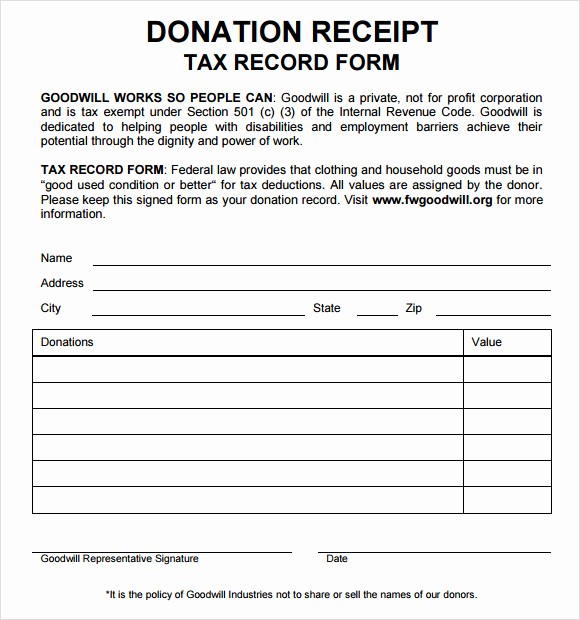

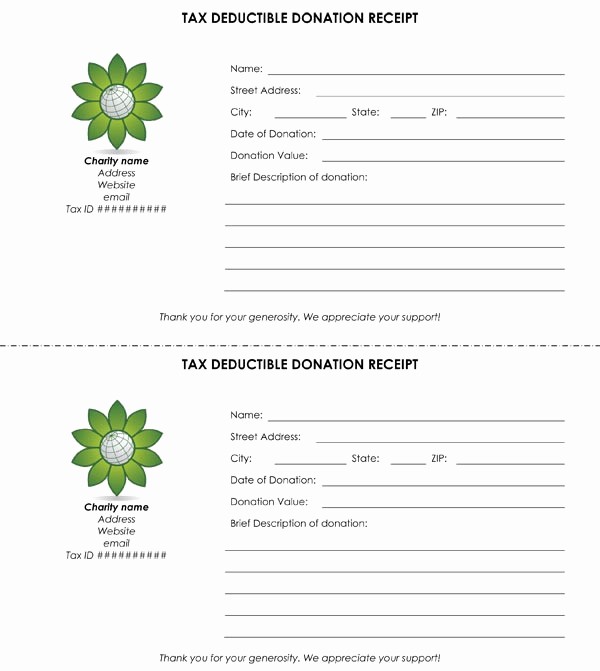

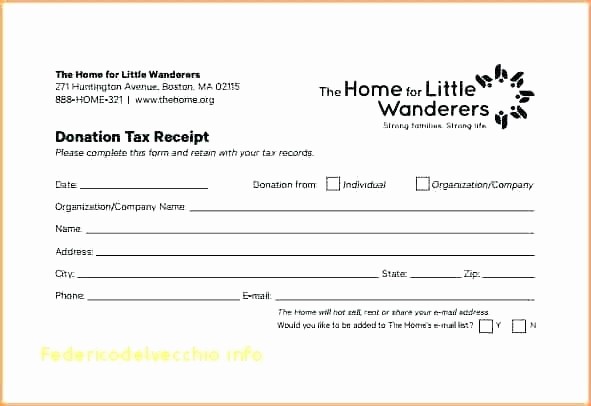

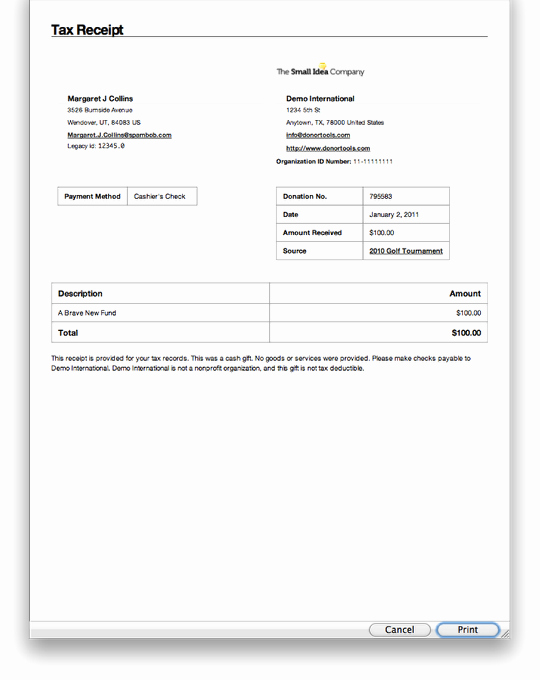

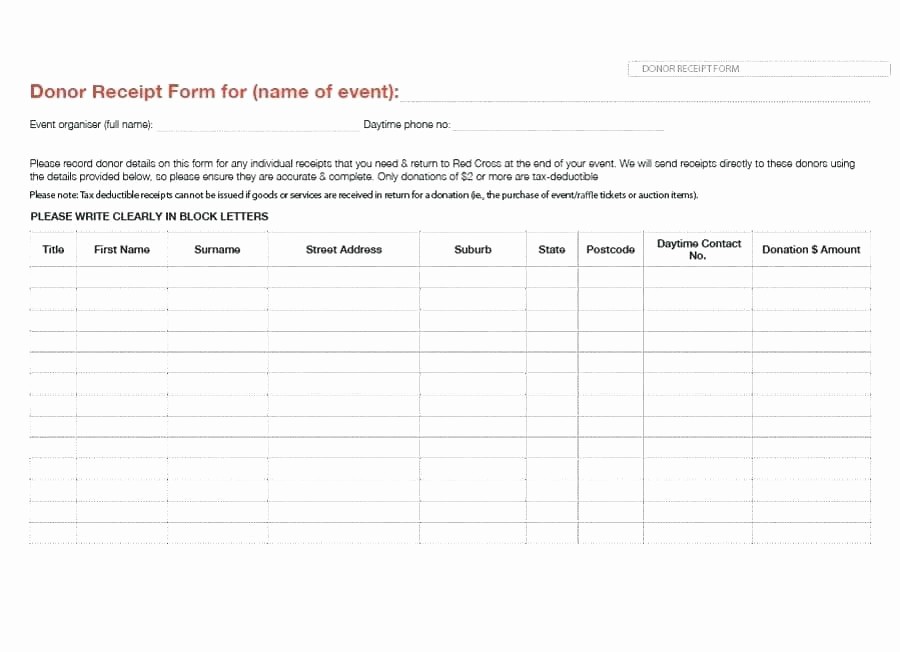

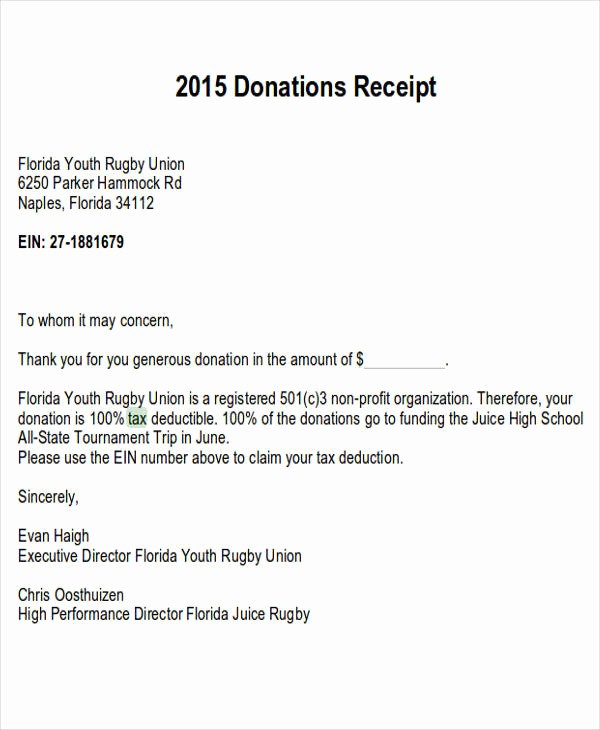

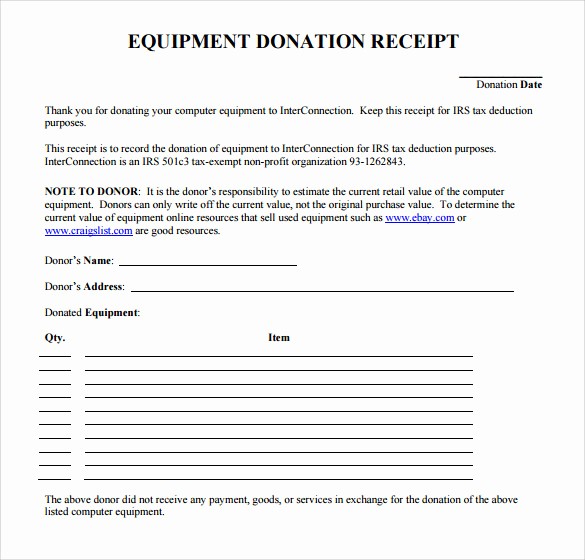

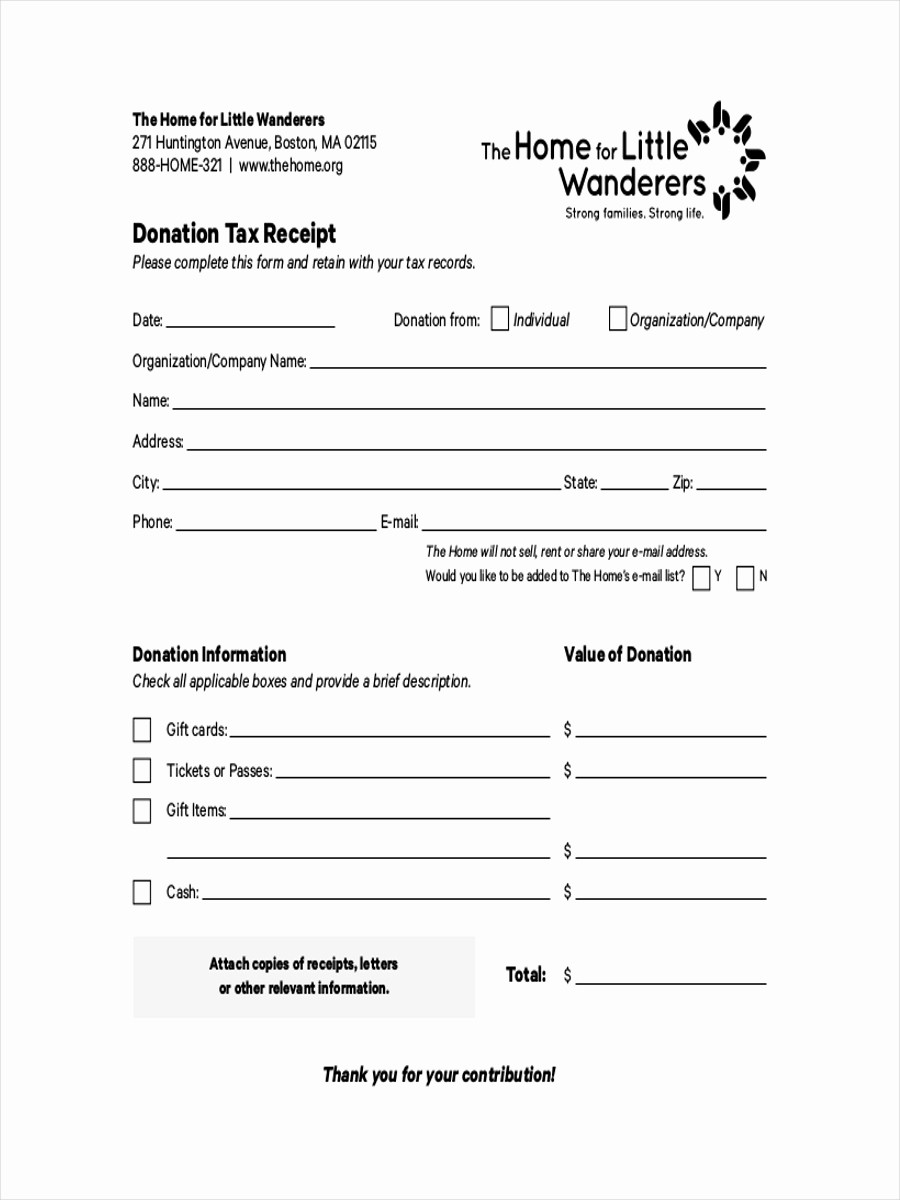

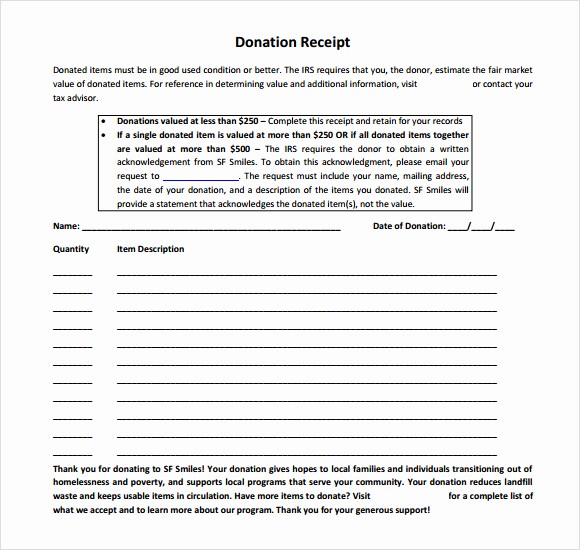

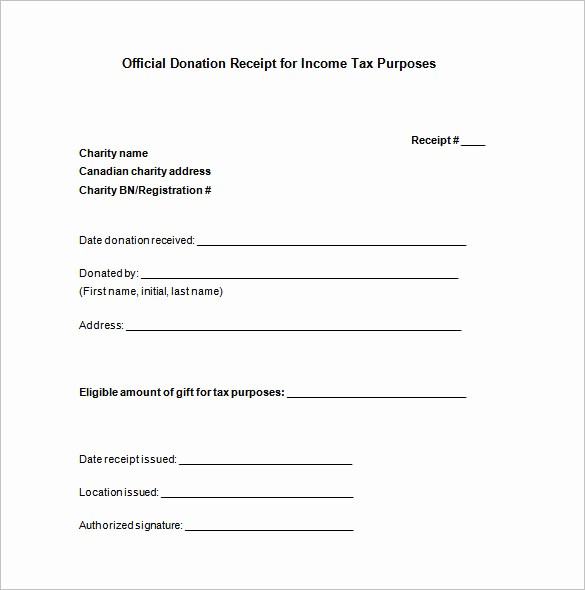

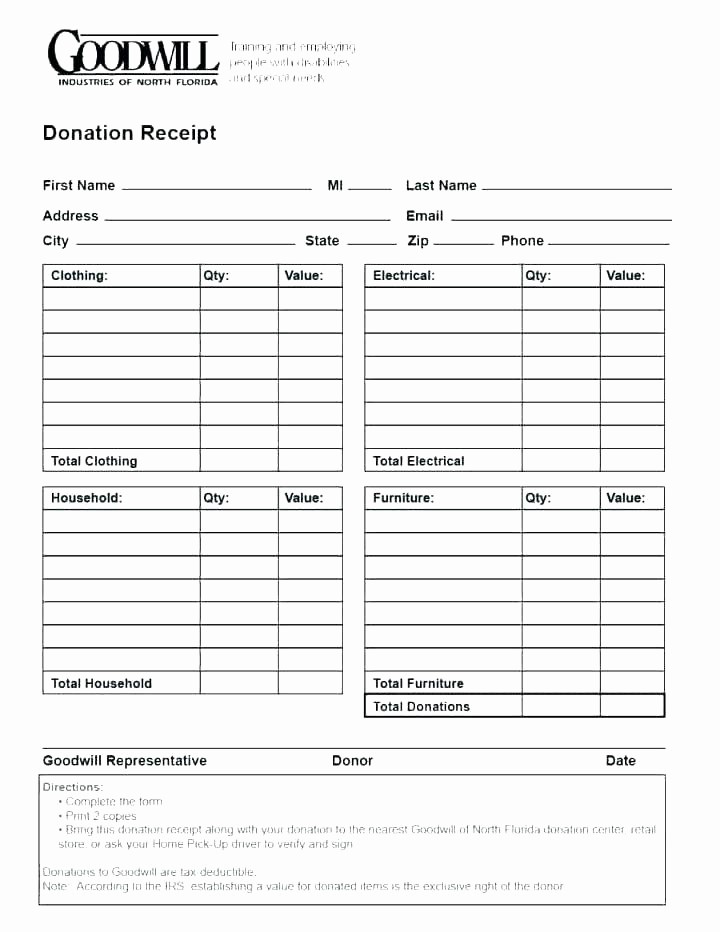

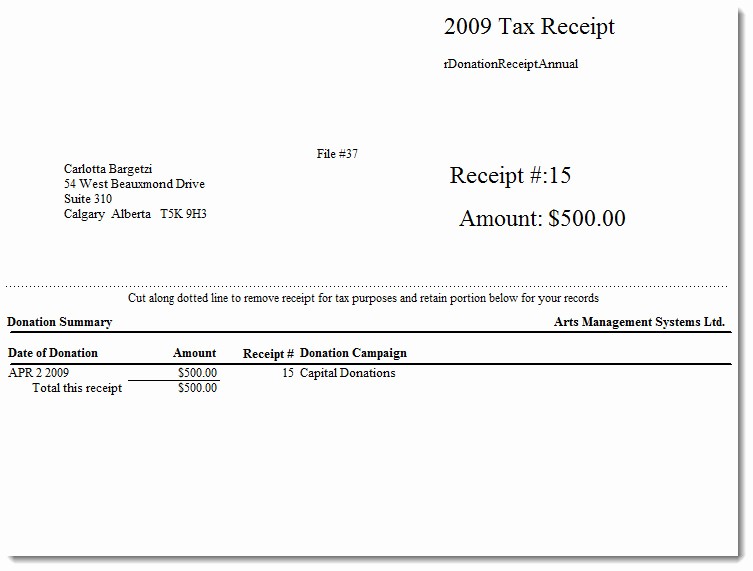

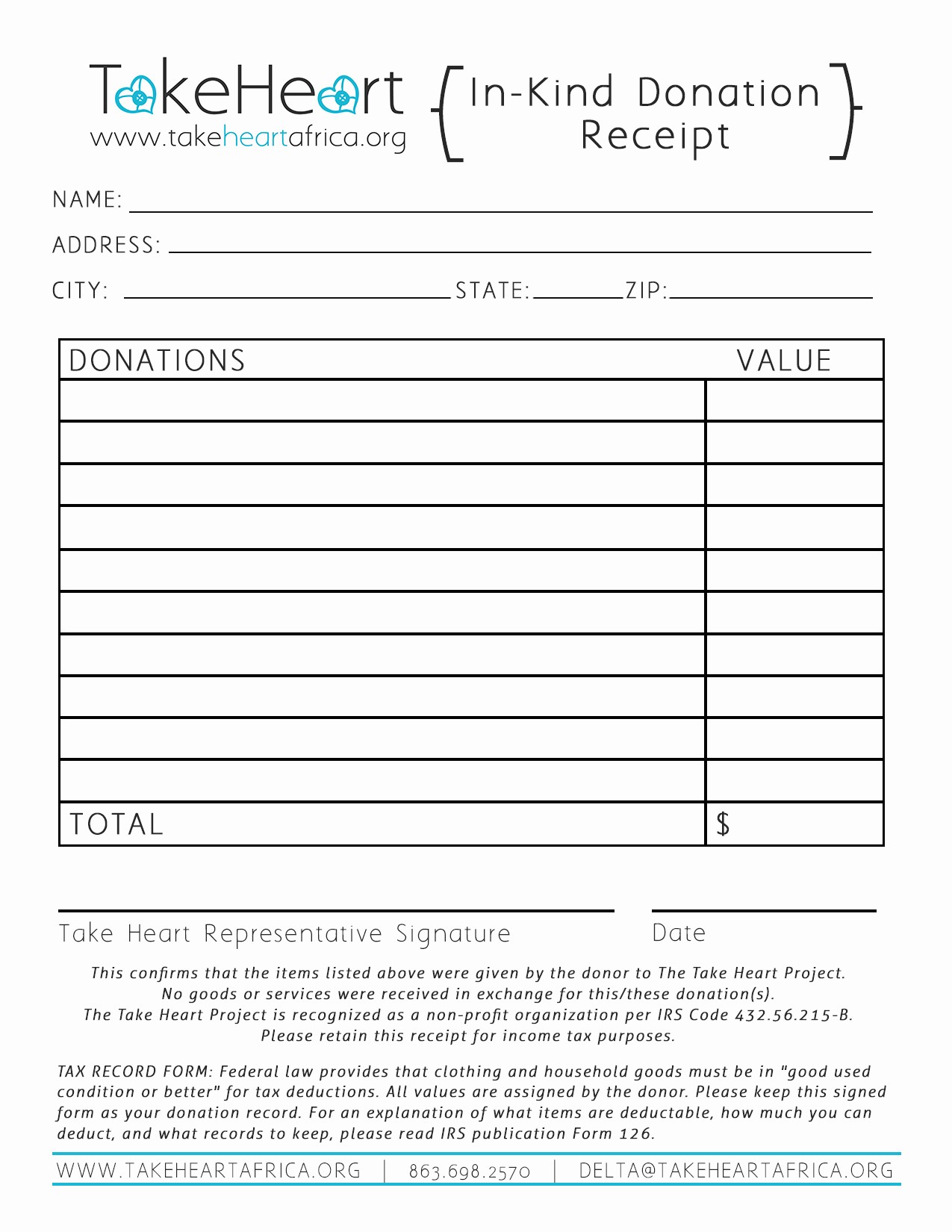

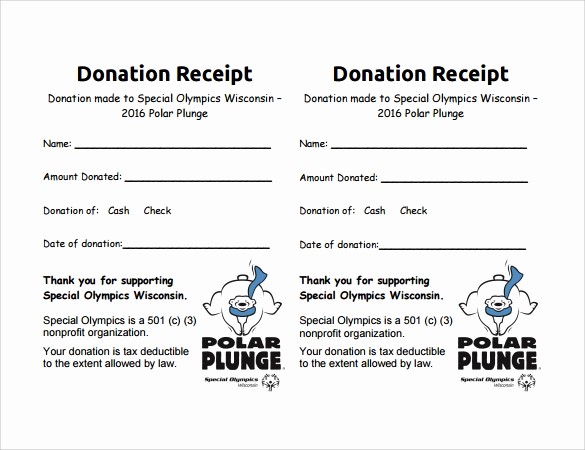

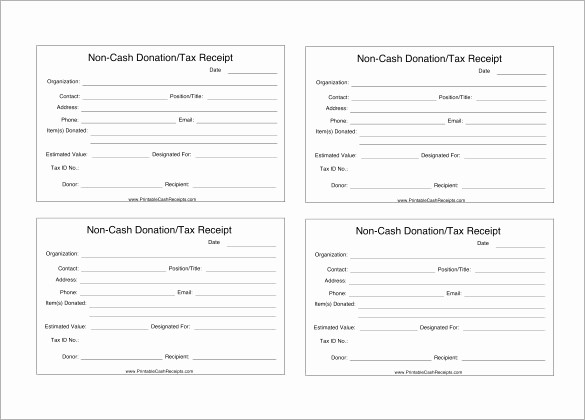

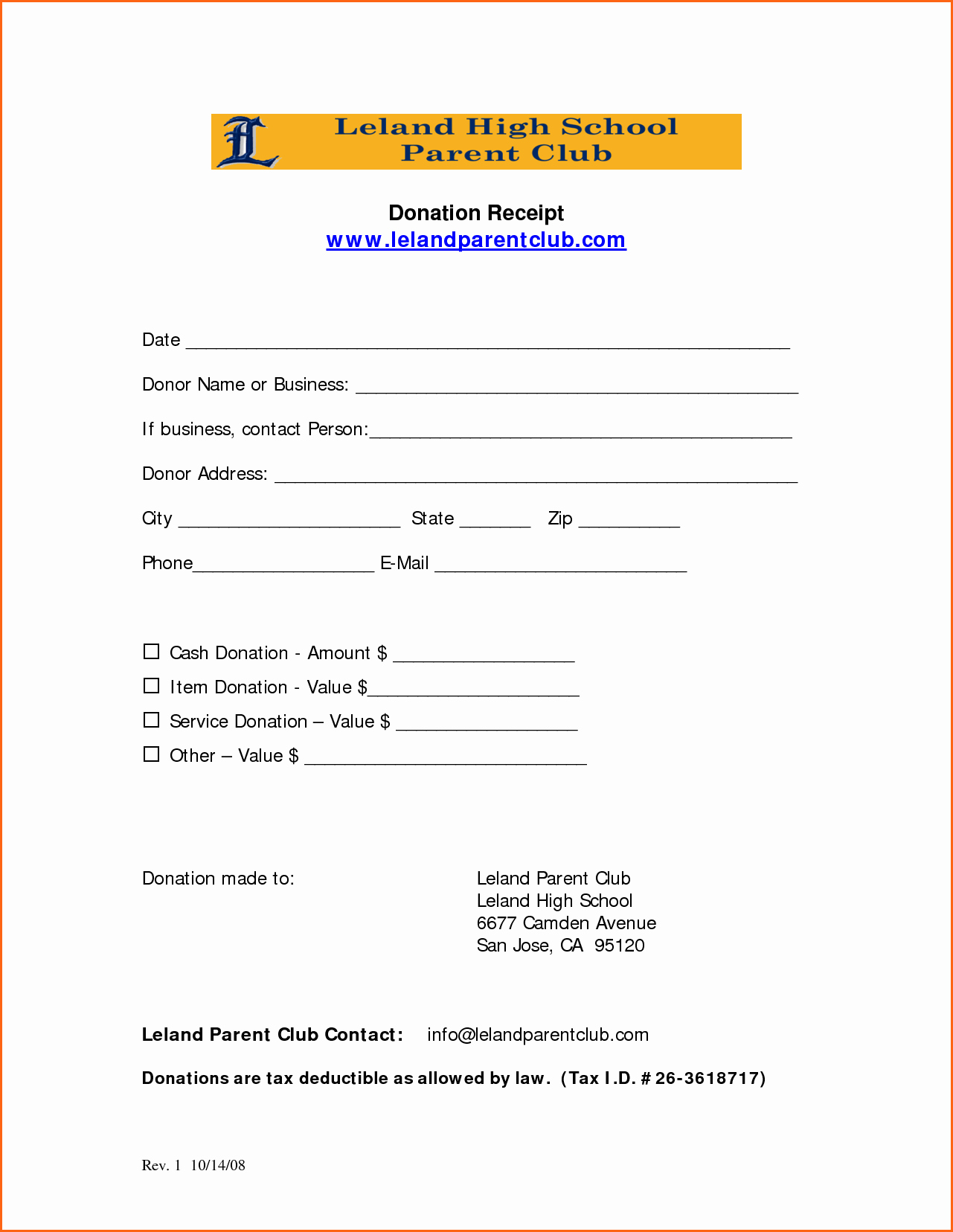

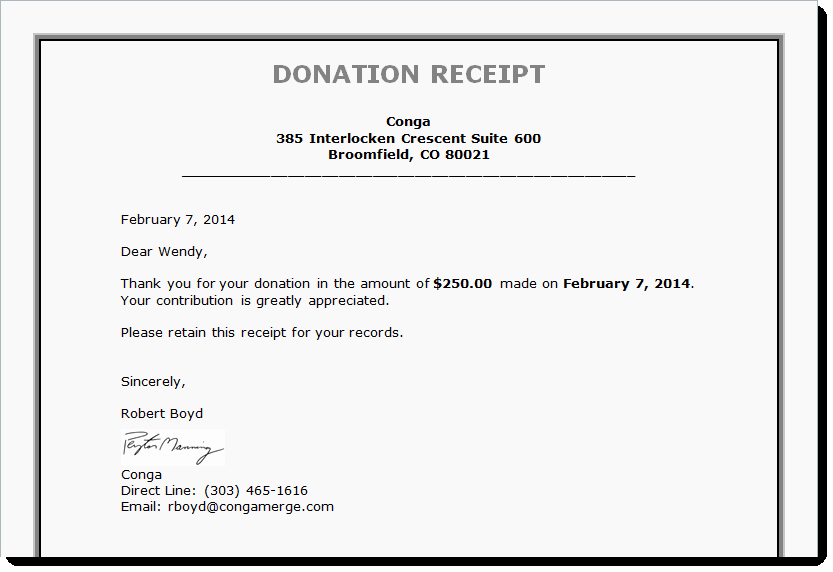

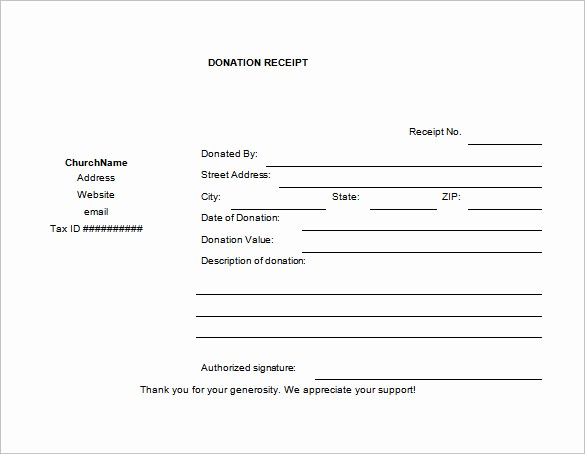

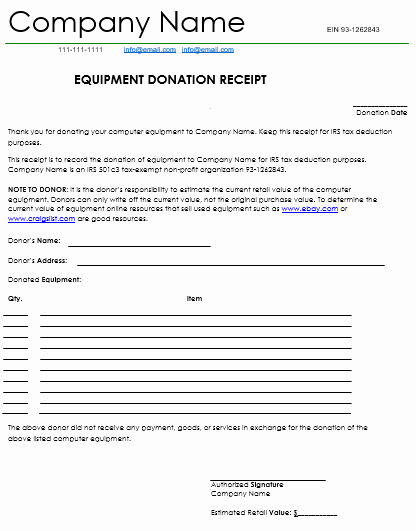

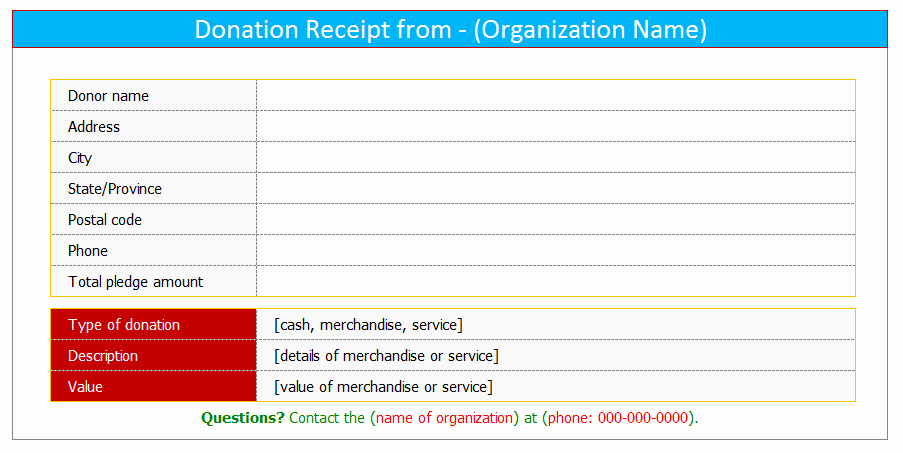

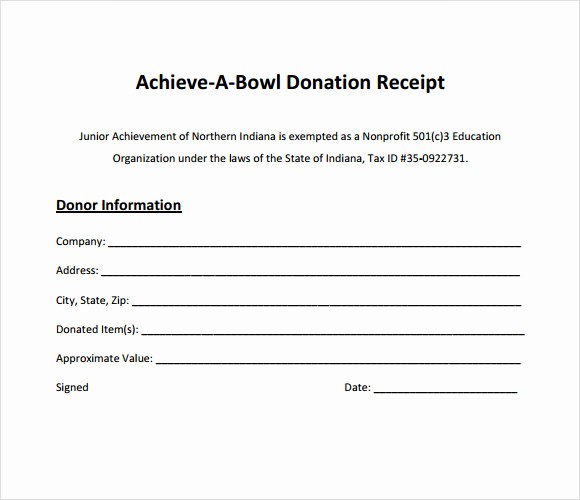

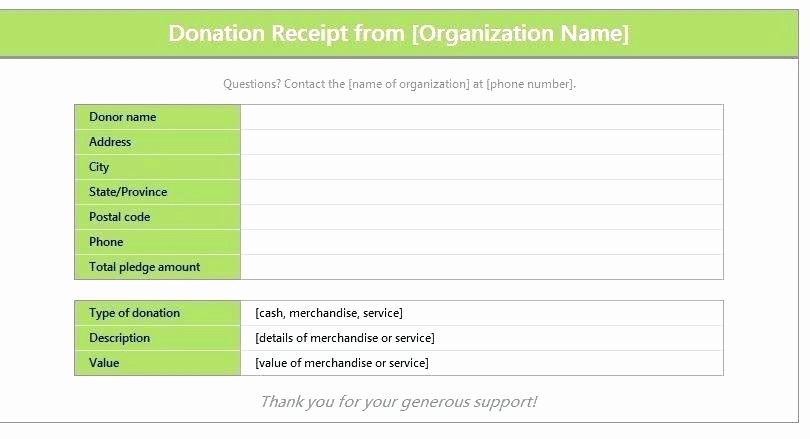

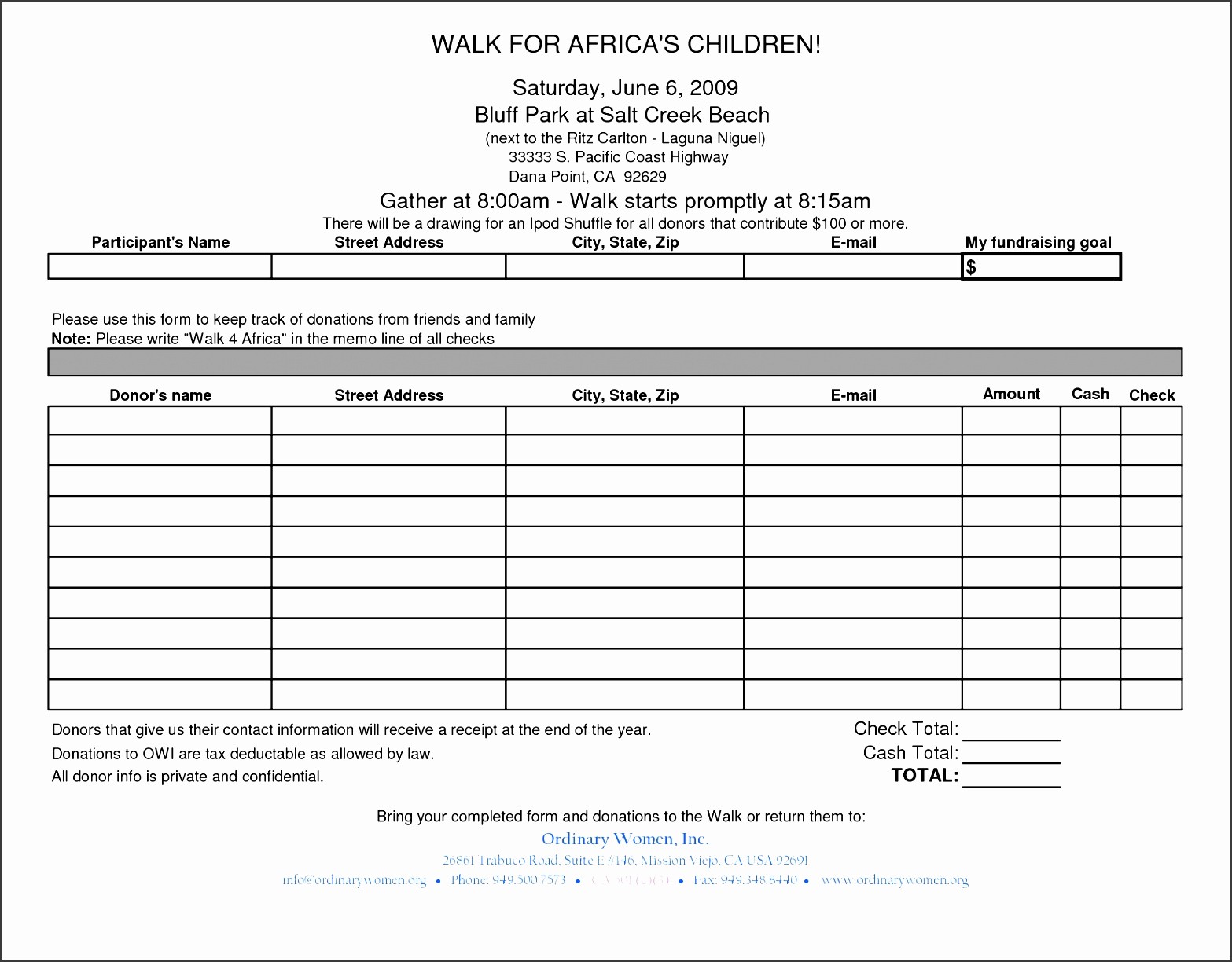

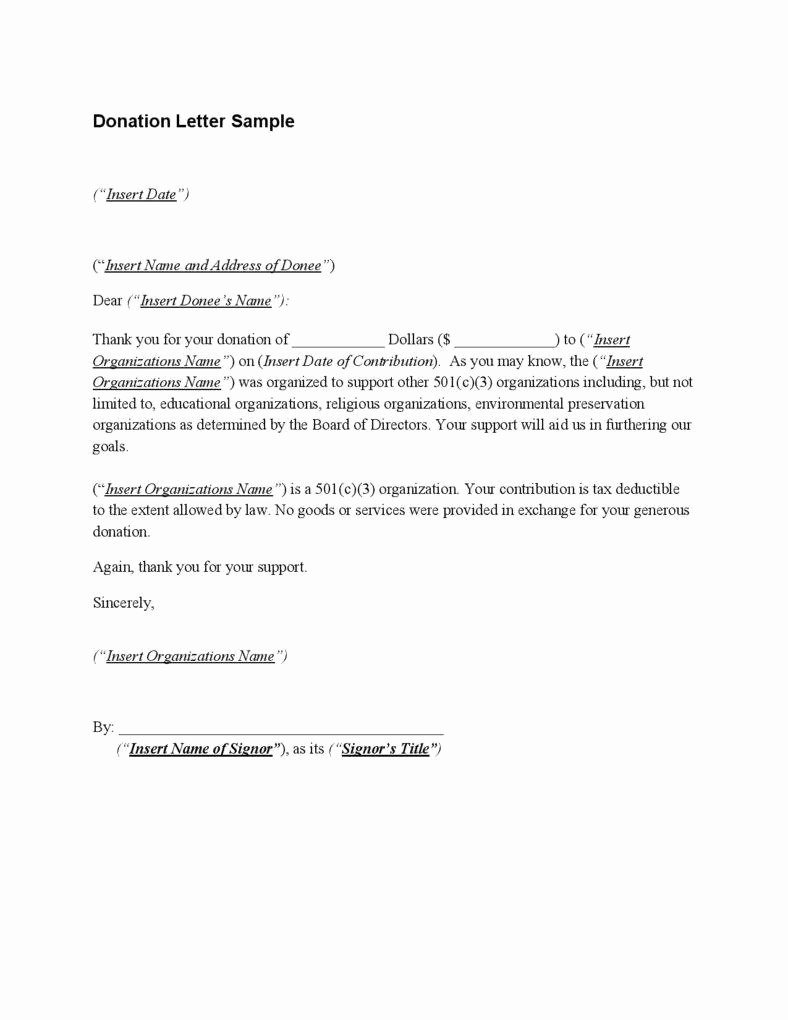

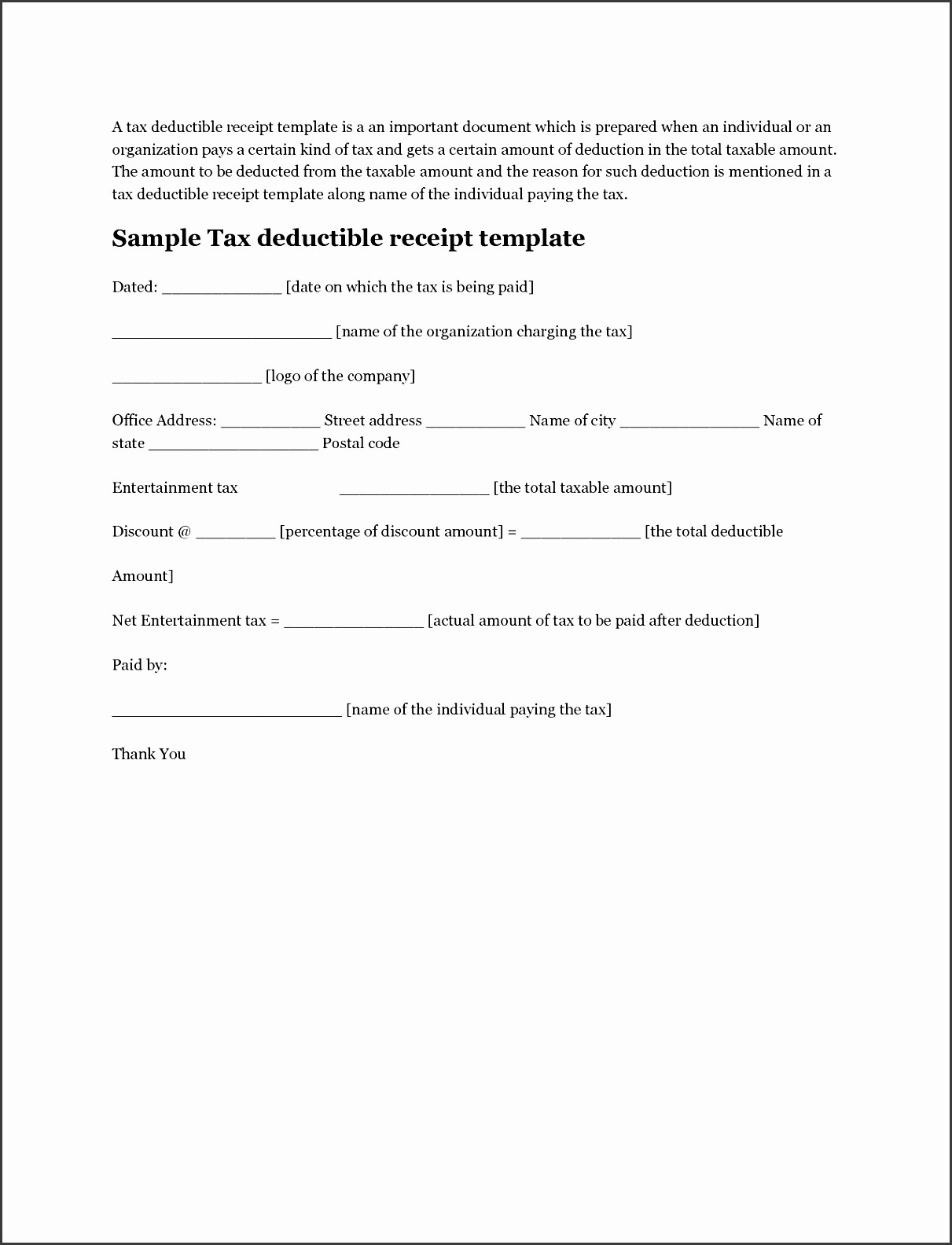

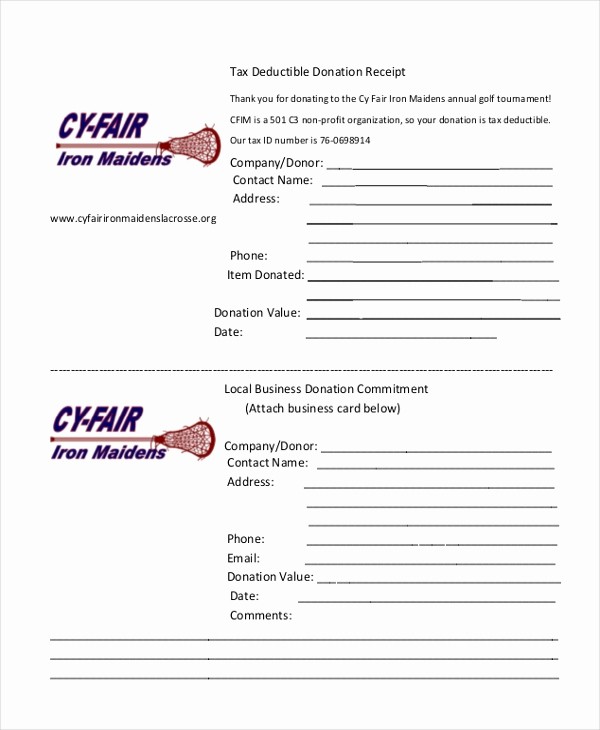

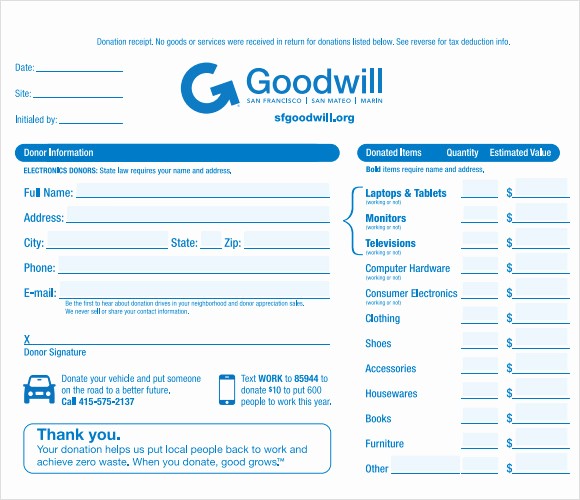

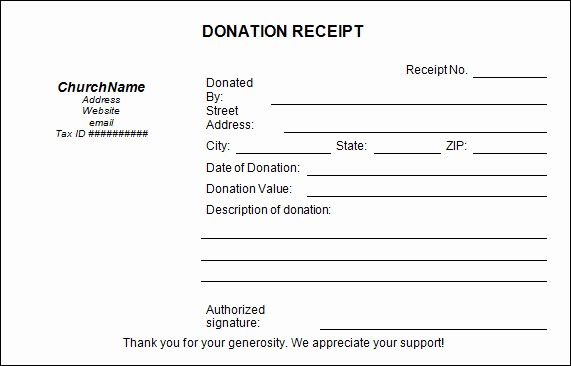

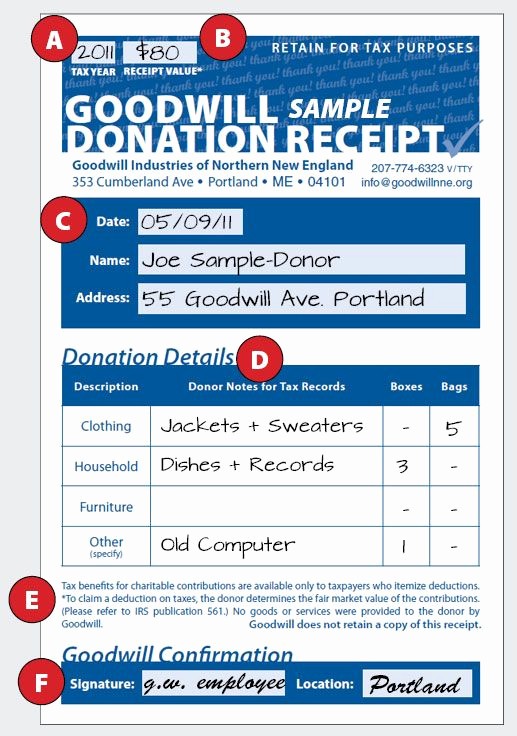

sample official donation receipts canada use these samples to help your charity or other qualified donee prepare official donation receipts that meet the requirements of the in e tax act and its regulations publication 1771 rev 3 2016 churches that receive tax deductible charitable contributions and for taxpayers who make contributions the irs imposes recordkeeping and substantiation rules on donors of charitable contributions and disclosure rules on charities that receive certain quid pro quo contributions donors must have a bank record or written munication from a charity for any monetary contribution before the how to create a donation receipt with sample receipt because charitable donations are tax deductible for the donor and reportable by the nonprofit organization a donation receipt must include specific information about the value of the donation and what the donor received in return how to fill out a goodwill donation tax receipt did you make a tax deductible donation to goodwill and need to fill out a tax receipt this step by step guide will help you fill out the donation tax receipt and things in order for tax season tax deductible donation receipt template if you are managing a charity organization you must deal with creating tax deductible donation receipts on a regular basis we provide you with a tax deductible donation receipt template to help you create tax deductible donation receipts quickly and easily

non profit donation receipt form Gallery from receipt for tax deductible donation , image source: keywordteam.net

![Receipt for Tax Deductible Donation Luxury 40 Donation Receipt Templates & Letters [goodwill Non Profit]](https://ufreeonline.net/wp-content/uploads/2019/04/receipt-for-tax-deductible-donation-luxury-40-donation-receipt-templates-amp-letters-goodwill-non-profit-of-receipt-for-tax-deductible-donation.jpg)